Global HER2 Negative Breast Cancer Market

Global HER2 Negative Breast Cancer Market Size, Share, and COVID-19 Impact Analysis, By Treatment Type (Chemotherapy, Hormone Therapy, Targeted Therapy, and Immunotherapy), By Patient Age (Age Group 30-40, Age Group 41-50, Age Group 51-60, and Age Group 61 and above), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global HER2 Negative Breast Cancer Market Size Insights Forecasts to 2035

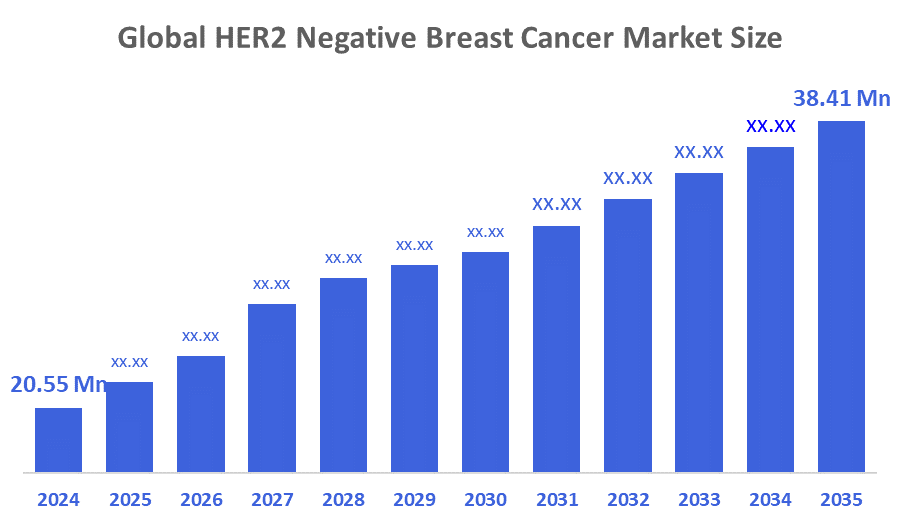

- The Global HER2 Negative Breast Cancer Market Size Was Estimated at USD 20.55 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.85% from 2025 to 2035

- The Worldwide HER2 Negative Breast Cancer Market Size is Expected to Reach USD 38.41 Million by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global HER2 Negative Breast Cancer Market Size was worth around USD 20.55 Million in 2024 and is Predicted to Grow to around USD 38.41 Million by 2035 with a compound annual growth rate (CAGR) of 5.85% from 2025 to 2035. The recent development of immunotherapies and targeted medicines seems to be changing the therapeutic paradigm and giving patients new hope. Moreover, the development of successful interventions and improving patient care, cooperation among researchers, doctors, and industry participants will be crucial for market growth.

Market Overview

The global healthcare and pharmaceutical industry segment devoted to the diagnosis, therapy, and management of breast cancers, HER2 (human epidermal growth factor receptor 2) protein is known as the HER2-negative breast cancer industry. HER2-negative breast cancer is defined as having low amounts of the HER2 protein in the malignant cells. HER2-negative cancer cells may grow more slowly and have a lower chance of recurring or spreading to other parts of the body than HER2-positive cancer cells. Breast cancer that is HER2-negative, or human epidermal growth factor receptor type 2, is the most prevalent type of cancer in the world and the most common among women. HER2-, estrogen receptor (ER)+ and/or progesterone receptor (PR)+ and HER2-, ER-, and PR- (triple-negative breast cancer, or TNBC) are the two main subgroups of HER2-negative breast cancer. Hormone treatments have historically been the mainstay of treatment for individuals with HR+ breast cancer, whereas doctors have traditionally depended on chemotherapy.

In October 2025, Dana-Farber/Harvard Cancer Centre was awarded a $12 million NCI SPORE grant renewal to further translational breast cancer research, including studies on triple-negative breast cancer immunomodulation and resistance to antibody-drug conjugates pertinent to HER2-negative subtypes.

In December 2022, Carrick Therapeutics raised $60 million to develop samuraciclib for CDK4/6 inhibitor-resistant HR+, HER2-negative metastatic breast cancer, including a $35 million investment from Pfizer and a $25 million Series C round.

Report Coverage

This research report categorises the HER2 negative breast cancer market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the HER2 negative breast cancer market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the HER2 negative breast cancer market.

Driving Factors

The market for HER2 negative breast cancer is growing swiftly, driven by increasing case rates associated with lifestyle shifts, environmental elements, and greater awareness of symptoms and screenings. The expanding patient population fuels the need for novel treatments, with HER2 negative cases making up a considerable portion of recent diagnoses. Notable trends encompass the rise of targeted therapies that focus on particular molecular targets for more effective and less toxic alternatives, alongside the progress in research into genetic profiles for individualised treatment plans. Immunotherapy is becoming increasingly prominent by utilising the immune system to target cancer cells, providing hope for patients who do not respond to standard therapies and indicating a significant change in treatment approaches. Moreover, the focus on early identification via enhanced screening and awareness initiatives suggests improved results, increased survival rates, and diminished healthcare costs.

Restraining Factors

High treatment costs, restricted therapeutic efficacy in advanced stages, regulatory obstacles, and unequal access to novel medicines are some of the major problems limiting the market for HER2-negative breast cancer.

Market Segmentation

The HER2 negative breast cancer market share is classified into treatment type and patient age.

- The chemotherapy segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

Based on the treatment type, the HER2 negative breast cancer market is segmented into chemotherapy, hormone therapy, targeted therapy, and immunotherapy. Among these, the chemotherapy segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to its capacity to deliver strong treatment outcomes for a variety of patient types. Its strengths are a thorough grasp of tumour biology and a variety of regimens that can be tailored to the specific requirements of each patient. Further, its main resource for clinical use is considered as primary therapy option for many patients.

- The age group 51-60 segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the patient age, the HER2-negative breast cancer market is divided into age group 30-40, age group 41-50, age group 51-60, and age group 61 and above. Among these, the age group 51-60 segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because a higher incidence of breast cancer has historically been linked to this demographic. Patients in this group frequently deal with the challenges of diagnosis and therapy because they usually have busy personal and professional lives that affect their treatment choices and compliance. This age group has a significant role in the industry, as evidenced by their high levels of medical involvement and treatment initiation.

Regional Segment Analysis of the HER2 Negative Breast Cancer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the HER2 negative breast cancer market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the HER2 negative breast cancer market over the predicted timeframe. The growing patient numbers, increased healthcare investment, and more awareness of breast cancer are the main drivers of the region's growth. Besides, improving access to cutting-edge treatments and healthcare infrastructure are top priority across the region. Additionally, regulatory agencies are improving their systems to speed up drug approvals, which is propelling industry expansion. China is the biggest market in the area, with Japan and India coming in second and third. Companies like Novartis and GSK are at the forefront of the competitive environment, which includes both local and multinational businesses.

In March 2025, Daiichi Sankyo launched DATROWAY (datopotamab deruxtecan) in Japan as the first TROP2-directed therapy for patients with previously treated unresectable or recurrent HR-positive, HER2-negative breast cancer.

North America is expected to grow at a rapid CAGR in the HER2 negative breast cancer market during the forecast period. The region has advantages, including substantial R&D investments, cutting-edge healthcare facilities, and an increasing incidence of breast cancer. The FDA and other regulatory bodies' cooperation speeds up the approval of novel treatments, which propels market expansion. Canada makes substantial contributions, although the United States is the main player in the market. Prominent companies, including Pfizer, Merck & Co., and Eli Lilly, are heavily engaged in the development of targeted treatments. The competitive environment is defined by an emphasis on immunotherapy and personalised medicine.

In January 2025, Enhertu (trastuzumab deruxtecan) from AstraZeneca and Daiichi Sankyo was approved in the United States for the treatment of adult patients with hormone receptor (HR)-positive, HER2-low (IHC 1+ or IHC 2+/ISH-) or HER2-ultralow (IHC 0 with membrane staining) breast cancer that has progressed on one or more endocrine therapies in the metastatic setting.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the HER2 negative breast cancer market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arvinas

- AstraZeneca

- BeiGene

- CytomX Therapeutics

- Eli Lilly

- Merck & Co.

- Novartis

- Olema Pharmaceuticals

- Pfizer Inc.

- Roche/Genentech

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, in the phase III ASCENT-07 trial, sacituzumab govitecan-hziy (Trodelvy) showed similar progression-free survival (PFS) compared to standard-of-care chemotherapy in patients with hormone receptor (HR)-positive, HER2-negative advanced breast cancers that had become refractory to endocrine therapy. Patients treated with sacituzumab govitecan-hziy had numerically greater treatment response rates than patients treated with chemotherapy, with 37% of patients responding to sacituzumab govitecan-hziy and 33% to chemotherapy.

- In September 2025, Olema Oncology and Pfizer entered a new clinical trial collaboration to test palazestrant (a novel oral SERD) in combination with atirmociclib (a CDK4 inhibitor) for patients with ER+/HER2- metastatic breast cancer. The study will enrol ~35 patients starting in the second half of 2025, with results intended to guide a potential pivotal Phase 3 trial.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the HER2 negative breast cancer market based on the below-mentioned segments:

Global HER2 Negative Breast Cancer Market, By Treatment Type

- Chemotherapy

- Hormone Therapy

- Targeted Therapy

- Immunotherapy

Global HER2 Negative Breast Cancer Market, By Patient Age

- Age Group 30-40

- Age Group 41-50

- Age Group 51-60,

- Age Group 61 and above

Global HER2 Negative Breast Cancer Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the projected market size and growth rate for the Global HER2 Negative Breast Cancer Market?

The market was valued at USD 20.55 million in 2024 and is expected to reach USD 38.41 million by 2035, growing at a CAGR of 5.85% from 2025 to 2035.

- What are the main treatment types segmented in the market?

The market segments by treatment type into Chemotherapy, Hormone Therapy, Targeted Therapy, and Immunotherapy. Chemotherapy held the largest share in 2024 and is projected to grow at a substantial CAGR due to its versatility across patient types.

- Which patient age group dominates the market?

The age group 51-60 accounted for the highest revenue in 2024 and is expected to grow at a significant CAGR, linked to higher incidence rates and active treatment engagement in this demographic.

- Which region holds the largest market share, and which is growing fastest?

Asia-Pacific is anticipated to hold the largest share, driven by rising patient numbers, healthcare investments, and improved access to treatments. North America is expected to grow at the fastest CAGR, fueled by R&D investments and regulatory support.

- What are the key driving factors for market growth?

Growth stems from rising incidence due to lifestyle and environmental factors, demand for novel treatments like targeted therapies and immunotherapy, genetic profiling for personalised care, and early detection via screenings.

- What challenges or restraining factors affect the market?

High treatment costs, limited efficacy in advanced stages, regulatory hurdles, and unequal access to innovative therapies pose major restraints.

- Who are the major companies in the competitive landscape?

Key players include Arvinas, AstraZeneca, BeiGene, CytomX Therapeutics, Eli Lilly, Merck & Co., Novartis, Olema Pharmaceuticals, Pfizer Inc., and Roche/Genentech.

- What does the report cover in terms of data and analysis?

It includes base year 2024, historical data from 2020-2023, forecasts to 2035, segment analysis by treatment and age, regional breakdowns, drivers/restraints, competitive strategies, and recent news like grants and partnerships (e.g., Dana-Farber's $12M NCI grant in October 2025).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 268 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |