Global Hibiscus Calyx Powder Market

Global Hibiscus Calyx Powder Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Type (Organic Hibiscus Powder and Conventional Hibiscus Powder), By Processing Method (Spray Dried, Air Dried, Freeze Dried, and Sun Dried), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Hibiscus Calyx Powder Market Summary, Size & Emerging Trends

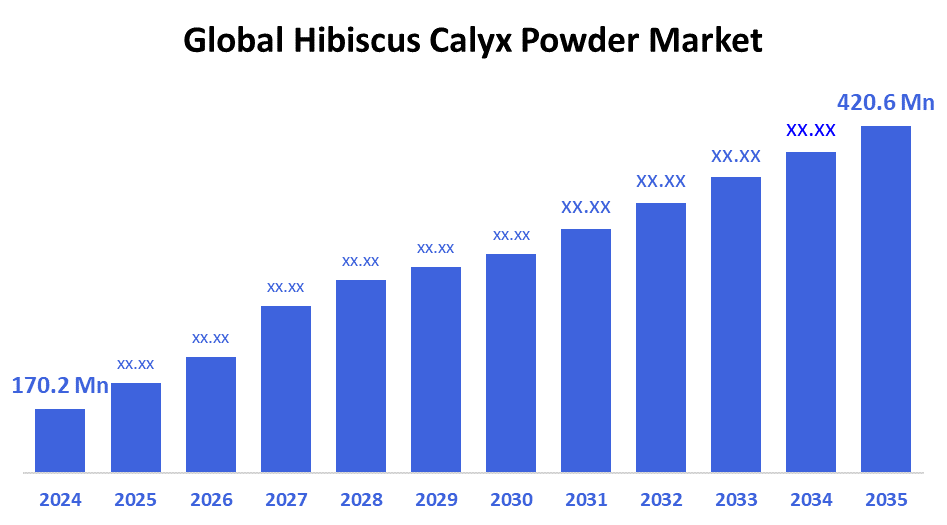

According to Decision Advisor, The Global Hibiscus Calyx Powder Market Size is expected to grow from USD 170.2 Million in 2024 to USD 420.6 Million by 2035, at a CAGR of 8.57% during the forecast period 2025-2035. The rising demand for natural and functional ingredients in the food, beverage, and cosmetics sectors is driving the hibiscus calyx powder market globally.

Key Market Insights

- Asia Pacific is projected to dominate the hibiscus calyx powder market during the forecast period.

- By product type, the organic hibiscus powder segment held the largest revenue share in 2024.

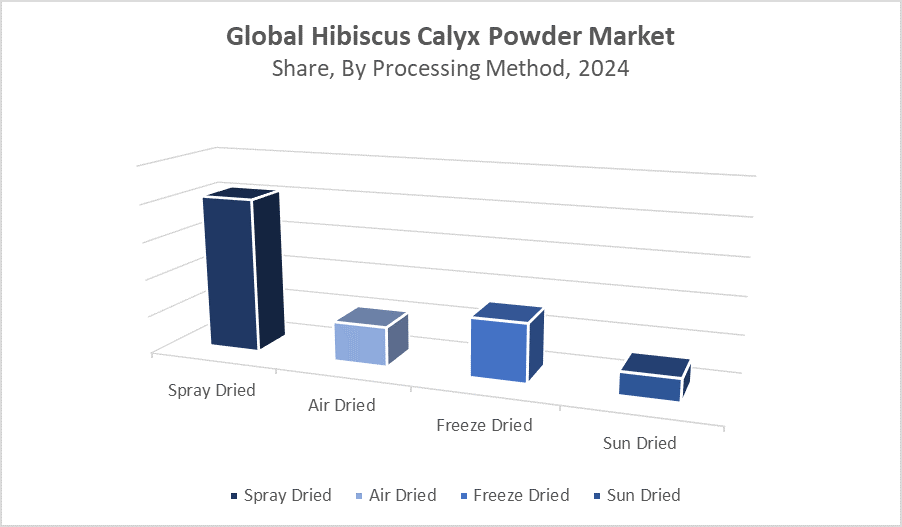

- Among processing methods, spray dried hibiscus powder was the top segment in terms of revenue contribution.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 170.2 Million

- 2035 Projected Market Size: USD 420.6 Million

- CAGR (2025-2035): 8.57%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Hibiscus Calyx Powder Market

The hibiscus calyx powder market revolves around the processing and commercialization of dried hibiscus flower petals, primarily Hibiscus sabdariffa, which are rich in antioxidants, anthocyanins, and flavonoids. The powder is widely used across functional foods, herbal teas, beverages, cosmetics, and pharmaceuticals due to its health benefits, including blood pressure regulation, liver health, and anti-inflammatory properties. Increasing consumer awareness of clean-label and plant-based products, coupled with rising trends in organic and herbal supplementation, are driving the market forward. Moreover, government support for organic farming and sustainable agriculture practices is encouraging the cultivation of hibiscus, particularly in African, Asian, and Latin American regions.

Hibiscus Calyx Powder Market Trends

- Surge in demand for plant-based colorants and flavoring agents in the food and beverage industry.

- Growth in the nutricosmetics sector using hibiscus for skin and hair health.

- Increasing preference for organic and clean-label herbal ingredients.

- Technological advancements in low-temperature drying techniques to retain nutritional value and color.

Hibiscus Calyx Powder Market Dynamics

Driving Factors: Rising demand for functional food ingredients and clean-label beauty products

Growing global health consciousness is pushing demand for natural and organic supplements. Hibiscus calyx powder’s versatility across food, cosmetics, and pharma makes it highly sought after. The increasing popularity of hibiscus tea and herbal infusions, along with its anti-hypertensive and antioxidant properties, are key growth drivers. Furthermore, organic farming initiatives and exports from African countries such as Nigeria and Sudan are contributing to global supply.

Restrain Factors: Seasonal availability and lack of standardized processing

Despite rising demand, limited awareness in some markets, inconsistent quality, and seasonal harvesting present key challenges. Inadequate infrastructure in major producing countries can also affect supply chain efficiency. Moreover, the high cost of organic certification and limited mechanization in processing affect scalability and consistency.

Opportunity: Expansion into nutraceuticals, cosmetics, and functional beverages

The growing application of hibiscus calyx powder in high-margin industries like cosmeceuticals, dietary supplements, and functional beverages offers significant opportunities. Product innovation such as hibiscus-infused energy drinks, herbal skincare, and organic hair treatments is expected to open new revenue streams. Additionally, increasing e-commerce penetration is boosting direct-to-consumer sales of herbal powders globally.

Challenges: Price volatility and regulatory complexities

Fluctuations in hibiscus raw material prices due to climate conditions and export limitations can disrupt market stability. Regulatory complexities surrounding food-grade, pharmaceutical-grade, and cosmetic-grade powders also pose hurdles for global manufacturers. Furthermore, maintaining product consistency, especially in color and taste, remains a challenge for producers relying on traditional drying methods.

Global Hibiscus Calyx Powder Market Ecosystem Analysis

The ecosystem comprises raw hibiscus flower suppliers, powder processors, packaging companies, exporters, and end-use industries. Key processing players operate in Africa, Southeast Asia, and Latin America. Exporters and global distributors serve major demand centers like the U.S., Europe, and Japan. Increasing vertical integration and strategic partnerships with organic farms are emerging trends to ensure traceability and consistent quality.

Global Hibiscus Calyx Powder Market, By Product Type

What factors enabled the organic hibiscus powder segment to lead the hibiscus calyx powder market in 2024?

The organic hibiscus powder segment accounted for the largest market share in the hibiscus calyx powder market in 2024 due to increasing consumer preference for natural and chemical-free products, driven by growing health awareness and demand for organic ingredients. Its superior quality, sustainable cultivation practices, and higher nutrient content compared to non-organic alternatives contributed significantly to its market dominance. Additionally, rising applications in the food, beverage, and cosmetics industries further boosted the segment’s appeal, giving it a competitive edge and establishing it as the preferred choice among consumers and manufacturers alike.

Why did the conventional hibiscus powder segment maintain a strong presence in the global hibiscus calyx powder market in 2024?

The conventional hibiscus powder segment held a significant share in the hibiscus calyx powder market in 2024 due to its cost-effectiveness and widespread availability, which appealed to price-sensitive consumers and manufacturers. Despite the growing demand for organic products, conventional hibiscus powder remained popular because of established cultivation methods and consistent supply chains. Additionally, it continued to be favored in applications where organic certification was less critical, helping it sustain a competitive position alongside organic alternatives.

Global Hibiscus Calyx Powder Market, By Processing Method

How did the spray dried segment gain a competitive edge in generating the highest revenue in the hibiscus calyx powder market in 2024?

The spray dried segment dominated the hibiscus calyx powder market in terms of revenue in 2024 due to its ability to preserve the powder’s quality, flavor, and nutritional properties more effectively than other drying methods. This resulted in a higher-value product that appealed to premium markets such as food and beverage, nutraceuticals, and cosmetics. Additionally, the spray drying process offers improved shelf life, better solubility, and consistent product quality, which attracted more customers and enabled manufacturers to command higher prices. These factors combined to give the spray dried segment a strong competitive edge and made it the leading revenue contributor in the market.

What made the freeze dried hibiscus powder segment a growing choice among consumers in 2024?

The freeze dried hibiscus powder segment, though costlier, gained traction in 2024 due to its superior ability to retain the natural flavor, color, and nutritional content of hibiscus compared to other drying methods. This high-quality preservation appeals particularly to premium food, beverage, and cosmetic manufacturers looking for the best raw materials. Furthermore, freeze drying offers extended shelf life and better rehydration properties, making it ideal for specialized applications despite the higher price. These advantages contributed to its growing popularity among quality-conscious consumers and industries, enabling it to carve out a significant niche in the market.

Asia Pacific held the largest market share of approximately 38% in 2024

driven by strong demand in countries such as India, China, and Japan. The widespread use of hibiscus calyx powder in traditional medicine plays a significant role in this region. Additionally, the growing popularity of herbal cosmetics and natural beverages further fuels the market growth. Consumers in these countries increasingly prefer natural and plant-based products, which supports the steady expansion of the hibiscus calyx powder market in Asia Pacific.

North America is expected to register the fastes CAGR of around 9.5% during the forecast period.

This rapid growth is largely attributed to rising consumption of herbal supplements, clean-label foods, and functional beverages that promote health and wellness. Increasing consumer awareness about the benefits of natural ingredients is driving demand for hibiscus calyx powder in the region, particularly in products that offer antioxidant and other health-enhancing properties.

Europe remains a mature and stable market for hibiscus calyx powder

characterized by steady demand and high adoption rates. The use of hibiscus in herbal teas is well established, especially in countries like Germany, the UK, and France. Moreover, the organic skincare segment in Europe increasingly incorporates hibiscus powder due to its antioxidant and soothing properties. Although growth in Europe is slower compared to Asia Pacific and North America, the region maintains a consistent market presence driven by a preference for natural and organic wellness products.

WORLDWIDE TOP KEY PLAYERS IN THE HIBISCUS CALYX POWDER MARKET INCLUDE

- Starwest Botanicals

- MOUNTAIN ROSE HERBS

- Nature's Way Products, LLC

- MB-Holding GmbH & Co. KG

- Organic India Pvt. Ltd.

- Afriplex Pty Ltd

- Wild Hibiscus Flower Company

- Indus Valley Organic

- Herbeno Herbals

- Hibiscus World

- Others

Product Launches in Hibiscus Calyx Powder Market

- In May 2024, Organic India launched a new product line featuring instant hibiscus wellness teas. These teas are designed specifically for the U.S. and European markets, catering to consumers seeking convenient, healthy, and natural beverage options. The launch highlights growing demand in these regions for herbal wellness products that support overall health and well-being.

- In August 2023, Afriplex introduced a freeze-dried hibiscus extract. This product targets the premium segment of functional beverages and cosmeceuticals, where high-quality, potent natural ingredients are highly valued. Freeze-drying preserves the bioactive compounds in hibiscus, making it an ideal ingredient for manufacturers aiming to develop advanced health-focused drinks and skincare products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the hibiscus calyx powder market based on the below-mentioned segments:

Global Hibiscus Calyx Powder Market, By Product Type

- Organic Hibiscus Powder

- Conventional Hibiscus Powder

Global Hibiscus Calyx Powder Market, By Processing Method

- Spray Dried

- Air Dried

- Freeze Dried

- Sun Dried

Global Hibiscus Calyx Powder Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the market size of the Global Hibiscus Calyx Powder Market in 2024?

A: The Global Hibiscus Calyx Powder Market size was estimated at USD 170.2 million in 2024.

Q: What is the forecasted CAGR of the Global Hibiscus Calyx Powder Market from 2025 to 2035?

A: The market is expected to grow at a CAGR of approximately 8.57% during the forecast period 2025–2035.

Q: What is the projected market size of the Global Hibiscus Calyx Powder Market by 2035?

A: The market is projected to reach USD 420.6 million by 2035.

Q: Which region is expected to dominate the hibiscus calyx powder market during the forecast period?

A: Asia Pacific is projected to dominate the hibiscus calyx powder market during the forecast period.

Q: Which product type held the largest revenue share in the hibiscus calyx powder market in 2024?

A: The organic hibiscus powder segment held the largest revenue share in 2024 due to increasing consumer preference for natural and chemical-free products.

Q: Among processing methods, which segment generated the highest revenue in 2024?

A: The spray dried hibiscus powder segment generated the highest revenue in 2024 owing to better preservation of quality, flavor, and nutritional properties.

Q: Which regional market is expected to grow the fastest during the forecast period?

A: North America is expected to register the fastest CAGR of around 9.5% during the forecast period, driven by rising consumption of herbal supplements and clean-label products.

Q: What are the key drivers for growth in the hibiscus calyx powder market?

A: Rising demand for natural, functional ingredients in food, beverage, and cosmetics sectors; growing global health consciousness; and government support for organic farming are major growth drivers.

Q: What challenges are limiting the growth of the hibiscus calyx powder market?

A: Seasonal availability, inconsistent quality due to lack of standardized processing, high organic certification costs, price volatility, and regulatory complexities are key challenges.

Q: What are the emerging trends in the hibiscus calyx powder market?

A: Increasing use of hibiscus as a plant-based colorant and flavoring agent, growth in nutricosmetics, demand for organic and clean-label ingredients, and advancements in low-temperature drying techniques.

Q: Who are the top companies operating in the Global Hibiscus Calyx Powder Market?

A: Leading players include Starwest Botanicals, Mountain Rose Herbs, Nature's Way Products LLC, MB-Holding GmbH & Co. KG, Organic India Pvt. Ltd., Afriplex Pty Ltd, Wild Hibiscus Flower Company, Indus Valley Organic, Herbeno Herbals, and Hibiscus World.

Q: Can you provide examples of recent product launches in the hibiscus calyx powder market?

A: Yes. In May 2024, Organic India launched instant hibiscus wellness teas targeting the U.S. and European markets. In August 2023, Afriplex introduced a freeze-dried hibiscus extract aimed at the premium functional beverage and cosmeceutical segments.

Q: Which applications offer the best growth opportunities for hibiscus calyx powder?

A: Expansion into nutraceuticals, cosmetics, dietary supplements, and functional beverages provides significant revenue opportunities.

Q: How do Asia Pacific and North America compare in terms of market growth?

A: Asia Pacific holds the largest market share driven by traditional use and demand for natural products, while North America is growing faster due to increasing health awareness and consumption of herbal supplements.

Q: What is the long-term outlook (2025–2035) for the Global Hibiscus Calyx Powder Market?

A: The market is expected to experience sustained growth driven by increasing consumer demand for natural and organic products, expansion into high-margin industries, and technological advancements in processing methods.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |