Global Home Furnishing Market

Global Home Furnishing Market Size, Share, and COVID-19 Impact Analysis, By Product (Home Furnishing, Home Textile, Home Flooring, Wall Décor, Others), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Store, Online, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Home Furnishing Market Summary

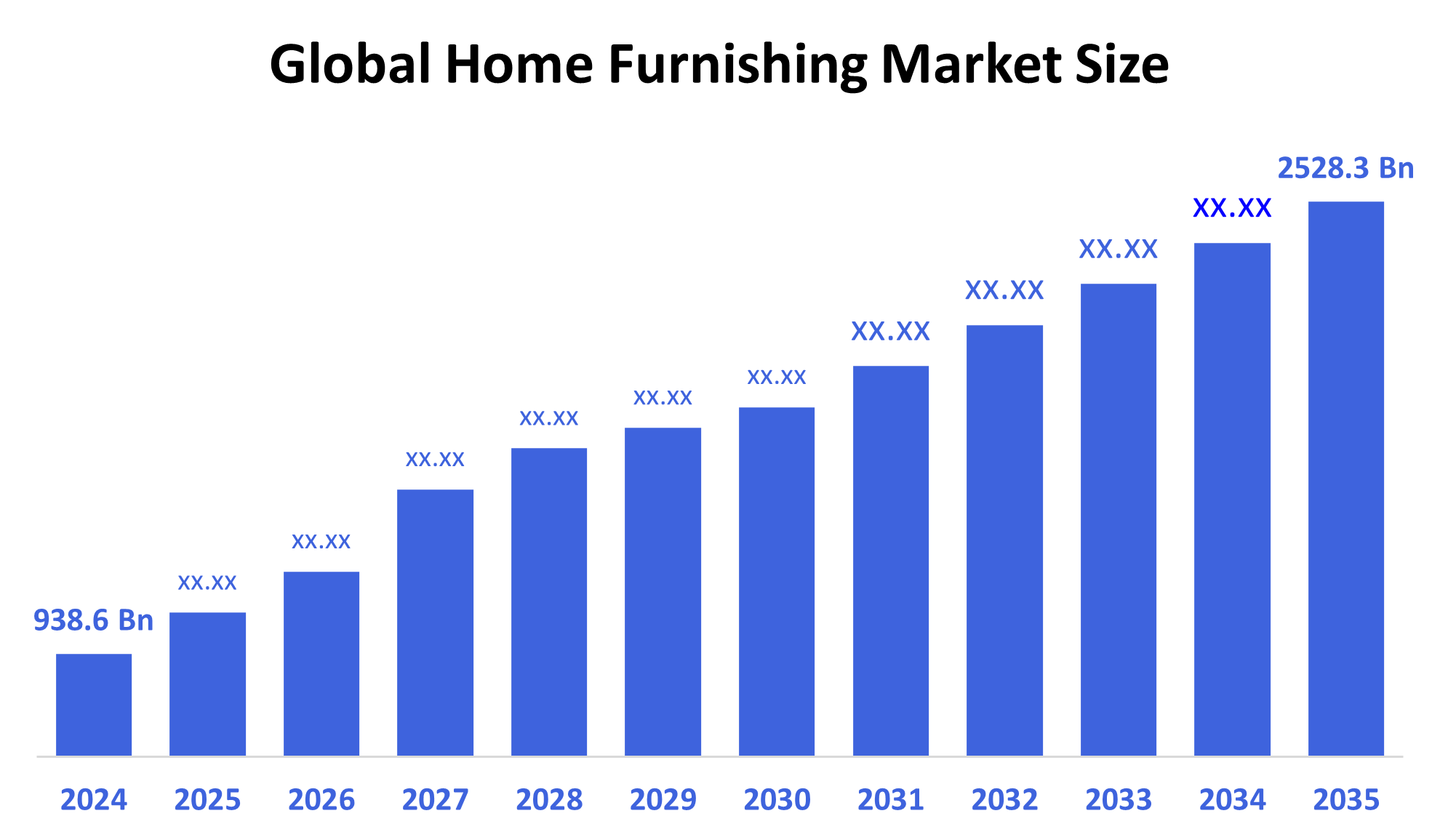

- The Global Home Furnishing Market Size Was Estimated at USD 938.6 Billion in 2024 and is Projected to Reach USD 2528.3 Billion by 2035, Growing at a CAGR of 9.43% from 2025 to 2035.

- Rising disposable incomes, urbanization, changing lifestyle trends, home ownership, e-commerce growth, and expanding consumer attention to comfort and interior design are the main factors propelling the home furnishings market.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 36.67% and dominated the market globally.

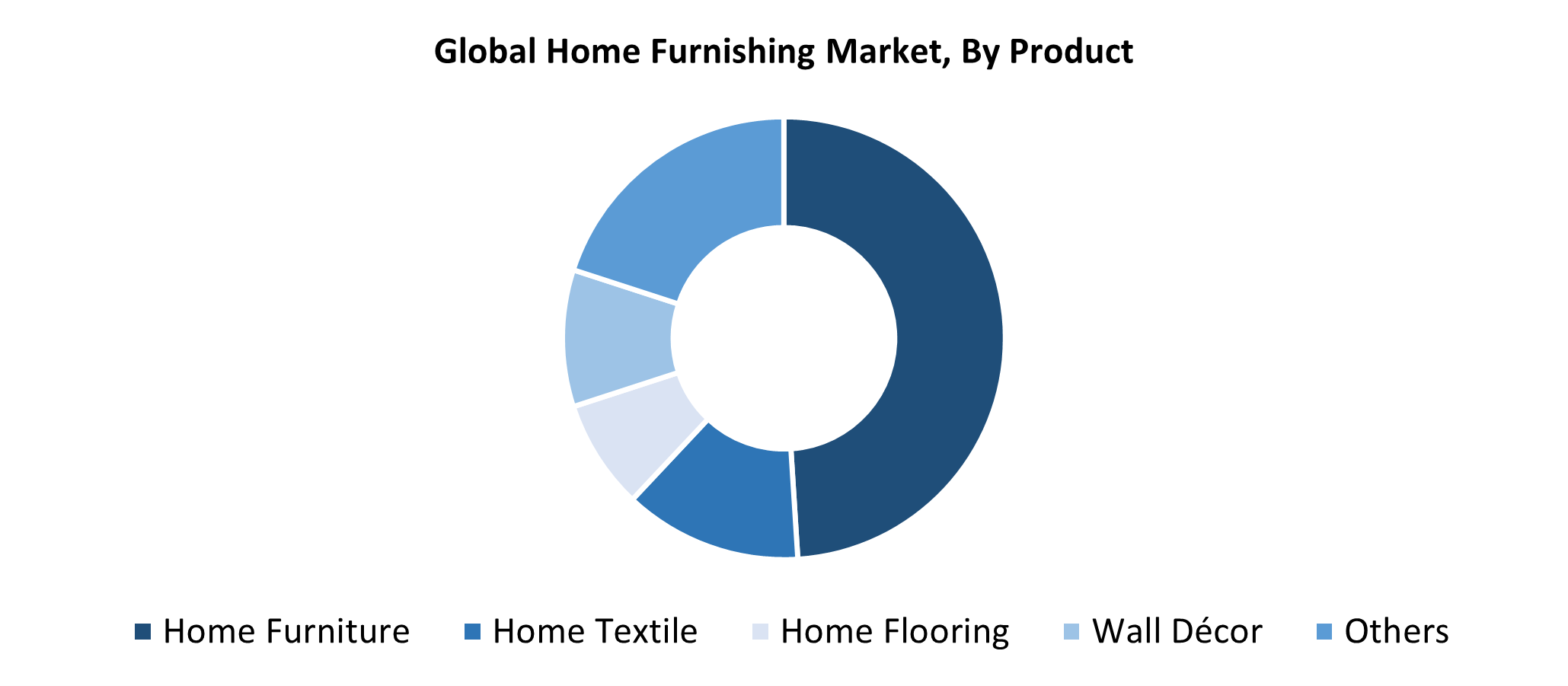

- In 2024, the home furniture segment had the highest market share by product, accounting for 49.32%.

- In 2024, the online segment had the biggest market share by distribution channel, accounting for 33.52%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 938.6 Billion

- 2035 Projected Market Size: USD 2528.3 Billion

- CAGR (2025-2035): 9.43%

- North America: Largest market in 2024

The Home Furnishing Market covers various products, which include furniture, textiles, together with lighting and decorative items that enhance both functional and aesthetic aspects of residential spaces. The market grows due to three main factors, which include increasing disposable income along with rapid urbanization, and the rising popularity of home renovation projects and interior design. The market growth receives support from both the real estate development sector and the increasing home property acquisition rates, particularly in developing countries. Consumer spending on customized, fashionable home furnishings has increased because of social media platforms and home decor trends alongside evolving lifestyle choices.

Technological advancements are fundamentally transforming the home furnishings industry. The adoption of sustainable materials and modular designs, together with smart furniture, has transformed how people select their home furnishings. Through e-commerce platforms and virtual reality applications, customers can now preview home items before they decide to purchase. The sector's expansion receives additional support from government initiatives that fund sustainable manufacturing and affordable housing projects and urban development programs. Home furnishings companies will experience substantial market growth in future years because of environmental manufacturing incentives, together with regional artisan support and market innovation opportunities.

Product Insights

What Factors Enabled the Home Furniture Segment to Lead the Market in 2024?

The home furniture segment emerged as the dominant segment of the home furnishing market in 2024 by generating the largest revenue share of 49.32%. Urban home residents lead this market because they require furniture that combines style with practicality while saving space. The combination of increased property acquisition, frequent home renovations, and rising interior design interest has driven substantial growth in living room, bedroom, and dining furniture sales. Consumers now select modular and multipurpose furniture more frequently because they want to maximize space utilization in their compact living areas. Online furniture sales combined with customizable design options have expanded the available choices for customers. The home furnishings sector emerged as the market leader due to these elements, together with rising disposable income and evolving consumer lifestyles.

Throughout the forecasted period, the home furnishings market's other segment is anticipated to grow at a significant CAGR. This market segment includes wall art, along with lighting, rugs and decorative accessories, and home storage solutions, on which customers focus on customizing their spaces. The expanding popularity of social media and home décor platforms has driven consumers to seek unique and appealing accessories. Changing consumer buying patterns, along with rising disposable incomes, drive customers to spend more money on essential yet non-urgent home furnishings. The anticipated strong market expansion for the segment in the future years stems from both its wide product variety found in e-commerce stores and the rising interest in home DIY decoration.

Distribution Channel Insights

Why Did the Online Segment Dominate the Global Home Furnishings Market in 2024?

The online segment dominated the home furnishings market in 2024 with the largest revenue share of 33.52%. The market expansion stems from consumers who want faster shopping options along with broader product availability. Through their platforms, E-commerce businesses help customers make well-informed choices by offering extensive product choices at affordable rates, together with detailed customer ratings. Virtual room planners together with augmented reality (AR) technology enable customers to preview furniture items in their living spaces before making purchases, thus enhancing the digital shopping experience. The online home furnishings market maintains its dominant position because of reasonable return policies and dependable logistics networks that enhance customer trust when purchasing furniture and décor items.

The specialty stores category within the home furnishings market is anticipated to experience strong growth throughout the forecast period. Specialty retailers benefit from the rising consumer demand for tailored shopping experiences and expert guidance, which drives their market expansion. These specialty stores offer select product collections along with exclusive designs and luxury furniture that meet specific buyer needs. The increasing popularity of specialty stores comes from their ability to deliver bespoke products alongside expert consultations to design-focused customers who seek original home decoration solutions. The home furnishings market experiences the growing popularity of specialty shops because experiential retail enables customers to interact with products inside showrooms.

Regional Insights

The home furnishings market is dominated by the North America region with the largest revenue share of 36.67% in 2024. The market growth stems mainly from strong consumer spending along with high home ownership rates and established real estate markets. The area benefits from its developed retail foundation and its growing demand for luxurious and functional home furnishings and decorations. Home office furniture alongside comfortable furnishings have become more essential because of remote work and people staying at home more frequently. Online sales in the region have expanded because residents use the internet extensively while trusting internet shopping. The global home furnishings market continues to be dominated by North America because of its innovative products and lifestyle trends and its widespread brand presence throughout major retail outlets, where customers choose customized and sustainable products.

Asia Pacific Home Furnishing Market Trends

The home furnishings market in the Asia Pacific is expected to grow notably during the forecast period because of fast urbanization alongside a rising middle-class population and increasing disposable income in China, India, and Southeast Asian countries. More people buying new homes and moving to cities means that fashionable, affordable, space-saving furniture demand continues to rise. The furniture and home decor market has experienced growth through online sales because of increased internet accessibility, combined with rising awareness of worldwide design styles. The strong manufacturing capabilities of this region enable producers to create cost-effective products and deliver them to markets with speed. A strong market growth in the Asia Pacific emerges from these elements, combined with evolving consumer tastes and government housing and infrastructure backing.

Europe Home Furnishing Market Trends

The European home furnishings market maintains consistent growth because customers show increasing preference for upscale home decorations, together with sustainable living practices and interior design trends. The market expands because homeowners actively choose to transform their properties while placing equal value on functional and attractive design elements. The environmental standards of Europe have prompted customers to prioritize sustainable products that last and come from nearby sources. E-commerce platforms and digital showrooms now provide greater accessibility to furniture products, while modular and minimalist designs continue to attract increasing attention. The market receives additional support through government initiatives that promote energy-efficient urban construction and sustainable housing practices.

Key Home Furnishing Companies:

The following are the leading companies in the home furnishing market. These companies collectively hold the largest market share and dictate industry trends.

- Wayfair Inc.

- Oppein Home Group Inc.

- Raymour & Flanigan

- Ashley Furniture Industries Inc.

- Williams-Sonoma, Inc.

- La-Z-Boy Inc.

- RH (Restoration Hardware)

- Jason Furniture (Hangzhou) Co., Ltd

- IKEA

- American Signature

- Steelcase Inc.

- Others

Recent Developments

- In March 2025, Wayfair Inc., a one-stop source for everything home, announced the debut of Wayfair Verified, a program that gives users quick access to the greatest products in the Wayfair catalog in every style and price range, setting a new benchmark in home buying. This reputable badge of approval draws attention to the company's best-selling items, which have been meticulously assessed and chosen by Wayfair product experts for their quality and affordability, making it simpler than ever for customers to furnish their homes with assurance.

- In March 2024, Ashley Home, Inc., a subsidiary of Ashley Global Retail, LLC (collectively, "Ashley"), and Resident Home Inc. announced the signing of an agreement whereby Ashley Home, Inc. will purchase Resident Home Inc. ("Resident"). Resident, a well-known online retailer and wholesaler of mattresses and bedding accessories, has the chance to increase its selection of home furnishings and global presence due to the deal, which was unanimously authorized by the boards of directors of both businesses. Ashley Furniture Industries, LLC ("AFI"), an affiliate of Ashley, will provide the Resident with enhanced sourcing and efficiency to support further expansion of its wholesale and direct-to-consumer businesses.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the home furnishing market based on the below-mentioned segments:

Global Home Furnishing Market, By Product

- Home Furniture

- Home Textile

- Home Flooring

- Wall Decor

- Others

Global Home Furnishing Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online

- Others

Global Home Furnishing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |