Global Hydraulics Market

Global Hydraulics Market Size, Share, and COVID-19 Impact Analysis,†By Type (Mobile Hydraulics, Industrial Hydraulics), By Component (Cylinders, Motors, Pumps, Control Valves, Filters, Accumulators, Transmissions, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Hydraulics Market Summary

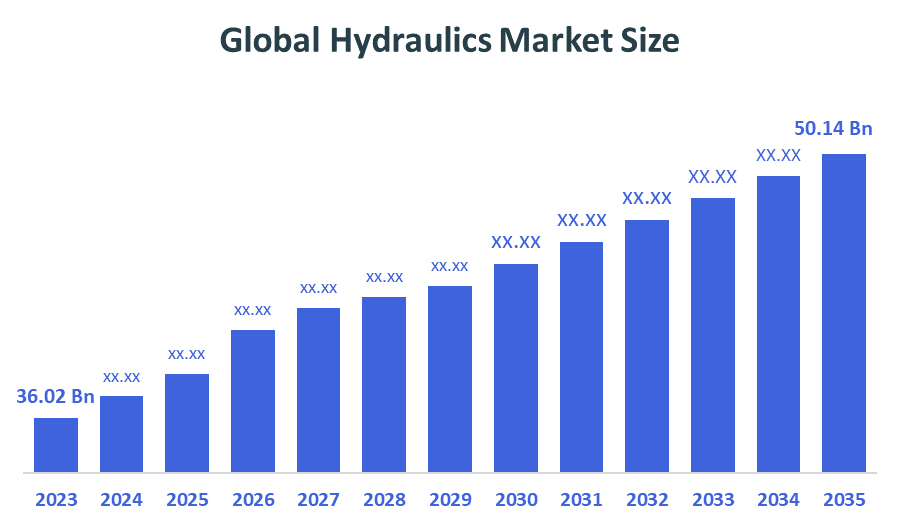

The Global Hydraulics Market Size Was Estimated at USD 36.02 Billion in 2024 and is Projected to Reach USD 50.14 Billion by 2035, Growing at a CAGR of 3.05% from 2025 to 2035. The market for hydraulics is expanding due to several factors, including increased industrial automation, the need for more efficient power transmission systems worldwide, the expansion of infrastructure, the growing need for construction and agricultural equipment, and breakthroughs in hydraulic technology.

????

????

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the greatest revenue share of 33.7%, dominating the worldwide hydraulics market.

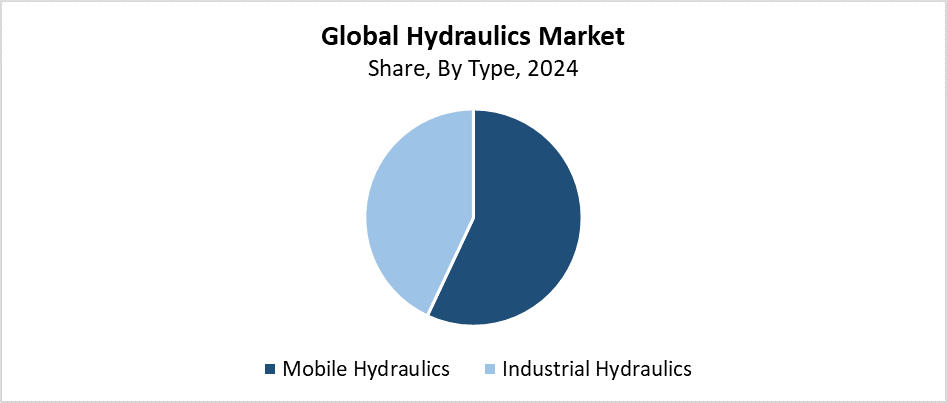

- In 2024, the mobile hydraulics segment had the biggest revenue share of 57.5% and led the market by type.

- In 2024, the market was dominated by the cylinders segment, with the largest revenue share of 29.6% based on component.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 36.02 Billion

- 2035 Projected Market Size: USD 50.14 Billion

- CAGR (2025-2035): 3.05%

- Asia Pacific: Largest market in 2024

The hydraulics market operates as a sector that deals with components and devices for power generation and control through fluid pressure in different operational environments. The high-power density combined with precision and reliability of these systems makes them essential for multiple industries, from manufacturing to mining and construction, and agricultural to aerospace and automotive. The market shows continuous growth because of increasing heavy machinery requirements, mainly from developing countries that are building their industrial base and infrastructure. The demand for advanced hydraulic systems continues to increase because of automation trends and material handling requirements across multiple industrial sectors. The market expands because organizations focus on hydraulic equipment that delivers both cost savings and reduced energy consumption.

The hydraulics market faces substantial transformation because of advancing technological developments. Electro-hydraulic systems, together with smart sensors and IoT and AI integration, enhance predictive maintenance, system control, and operational efficiency. The next-generation hydraulic technology gains support through government initiatives that promote industrial automation alongside sustainable manufacturing and infrastructure modernization. Financial support for environmentally friendly development and intelligent manufacturing facilities creates expanded market possibilities throughout Europe and the Asia-Pacific regions. The hydraulics market will speed up its evolution because of these technological advancements during the forecast period.

Type Insights

Why Did the Mobile Hydraulics Segment Hold the Largest Revenue Share of 57.5% in the Hydraulics Market in 2024?

The mobile hydraulics segment held the largest revenue share of 57.5% and led the hydraulics market in 2024. This segment dominates because it delivers essential power and performance stability to mobile equipment across mining, construction, agricultural, and material handling sectors. Mobile hydraulics development has experienced rapid growth due to rising demands for tractors and loaders, cranes, and earthmoving machinery across advanced and developing markets. The market growth receives additional support from hydraulic component advancements, which enhance system durability and efficiency through actuators, valves, and small pumps. The hydraulics industry maintains its leadership position through the rising demand for automated smart machinery in both off-road and mobile applications.

Throughout the forecast period, the industrial hydraulics segment of the hydraulics market is anticipated to grow at a significant CAGR. The manufacturing sector's automation expansion and production process precision requirements, together with industrial machinery hydraulic system usage growth drive this market development. The expanding industrial operations in metallurgy and aerospace, automotive, and food processing require hydraulic systems that deliver reliable and energy-efficient solutions. Electro-hydraulic systems, together with smart industrial framework integration, represent technical developments that enhance system efficiency and monitoring capabilities. Industrial hydraulics systems will see gradual market growth because businesses focus on operational efficiency alongside security and downtime reduction.

Component Insights

What Factors Enabled the Cylinders Segment to Capture the Largest Revenue Share in the Hydraulics Market in 2024?

The cylinders segment led the hydraulics market with the largest revenue share of 29.6% in 2024. A hydraulic cylinder functions as a critical component that produces both linear force and motion across manufacturing machines and construction vehicles, and agricultural equipment. Their dominance stems from their extensive load-handling capabilities, wide usage applications, and vital role in heavy-duty operations. The rising demand for efficient lifting and material handling systems, together with movement solutions in mining and construction, and the automobile sectors, has driven the rapid adoption of hydraulic cylinders. Improved cylinder durability, along with enhanced energy efficiency and design advancements, has solidified their market leadership position while making this category a driving force behind the hydraulics industry growth.

During the forecast period, the transmissions segment within the hydraulics market is expected to grow at a significant rate. The expanding requirement for superior power transmission solutions across the construction and agricultural sectors and the automotive industry propels this market development. For heavy-duty and precise applications, hydraulic gearboxes are the best option due to their exceptional torque control, efficiency, and dependability. Advanced hydraulic transmission systems are gaining popularity because modern industry is shifting toward automated machinery and energy-efficient operations. Smart sensors together with electronic controls enhance hydraulic transmissions' performance and their swift system responses. The hydraulics market's transmissions sector will experience strong growth because businesses are upgrading their operations and enhancing their operational efficiency focus.

Regional Insights

The Asia Pacific region held the largest revenue share of 33.7% and led the global hydraulics market in 2024. The leadership position emerged from the combination of quick industrial development and increasing construction and manufacturing operations throughout China, India, Japan, and South Korea. The demand for hydraulic systems continues to grow because of the region's substantial requirements for construction equipment, industrial automation solutions, and agricultural machinery. The market growth accelerated due to government initiatives that support industrial progress and infrastructure improvement, as well as intelligent manufacturing systems. The regional market leadership results from both major OEMs operating in the area and the inexpensive workforce availability. The hydraulics market will maintain its Asia Pacific leadership position since industries in the region evolve.

North America Hydraulics Market Trends

The North American hydraulics market secured a substantial market share during 2024 due to its advanced industrial systems combined with widespread automation technology implementation, along with strong industrial demand from manufacturing, construction, aerospace, and agricultural sectors. The United States stands out in particular because of its well-established industrial framework and continuous defense and infrastructure investment. The region demonstrates growing adoption of electro-hydraulic and smart hydraulic systems as it focuses on improving productivity and energy efficiency, together with sophisticated mechanical equipment. The market expands due to the presence of leading hydraulic component manufacturers and favorable government policies that drive technological progress in industrial sectors. North America maintains its position as a vital area in the worldwide hydraulics market because of its consistent expansion possibilities.

Europe Hydraulics Market Trends

The European hydraulics market is anticipated to grow significantly through the forecast period because high-performance energy-efficient hydraulic systems find increasing demand across manufacturing, construction, automotive, and aerospace sectors. The region adopts advanced hydraulic technologies like electro-hydraulic systems and IoT-enabled components at an increasing rate because it focuses on automation, sustainable industrial practices, and smart manufacturing. The leading nations that have established industrial sectors and maintain continuous technological innovation investments are Germany along with France and Italy. The transition toward more efficient hydraulic solutions receives momentum from both stringent environmental regulations and European Union initiatives dedicated to industrial modernization and green technology adoption.

Key Hydraulics Companies:

The following are the leading companies in the hydraulics market. These companies collectively hold the largest market share and dictate industry trends.

- Bosch Rexroth AG

- LHY Powertrain GmbH & Co. KG.

- PARKER HANNIFIN CORP

- Kawasaki Heavy Industries, Ltd.

- Danfoss

- YUKEN KOGYO CO., LTD.

- HYDAC International GmbH.

- Eaton.

- KYB Corporation.

- Wipro Infrastructure Engineering

- Others

Recent Developments

- In February 2025, Eaton's mobile hydraulics product range was expanded to include a variable-flow load-sensing pump and a new Bezares dump pump. Designed for high-efficiency performance, the dump pump supports pressures up to 3,200 psi and features selectable rotation and compact PTO mounting. Energy economy and dependability in the hydraulics industry are greatly enhanced by Eaton's innovative products, which meet important performance requirements in mobile machinery.

- In February 2025, to revolutionize the hydraulics industry, Bosch Rexroth AG launched a full range of digital and electric hydraulic solutions. The launch included the modular eLION electrification kits, which included the EML1 inverter and motors, as well as the scalable BODAS ecosystem with Collision Avoidance System hardware and software. These developments are intended to improve system integration, safety, and energy efficiency in both stationary and mobile hydraulic applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the hydraulics market based on the below-mentioned segments:

Global Hydraulics Market, By Type

- Mobile Hydraulics

- Industrial Hydraulics

Global Hydraulics Market, By Component

- Cylinders

- Motors

- Pumps

- Control Valves

- Filters

- Accumulators

- Transmissions

- Others

Global Hydraulics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |