Global Hydro Distillers Market

Global Hydro Distillers Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Capacity (Below 10 liters, 10-50 liters, 50-100 liters, and Above 100 liters), By Application (Essential Oils, Pharmaceuticals, Food & Beverages, and Cosmetics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Hydro Distillers Market Summary, Size & Emerging Trends

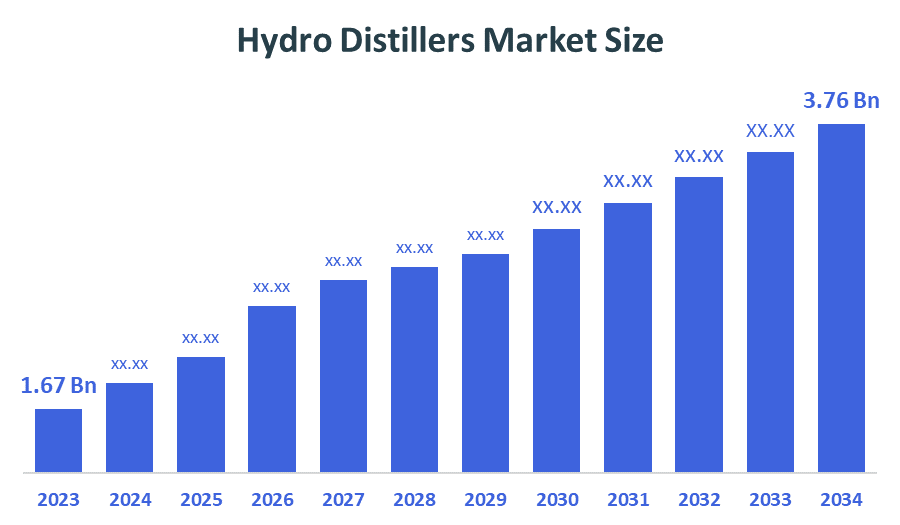

According to Decision Advisor, the Global Hydro Distillers Market Size is Expected to Grow from USD 1.67 Billion in 2024 to USD 3.76 Billion by 2035, at a CAGR of 7.66% during the forecast period 2025-2035. The expanding demand for natural and pure extracts in pharmaceuticals, cosmetics, and food industries is a key factor driving the hydro distillers market.

Key Market Insights

- Asia Pacific is projected to lead the hydro distillers market with the largest share due to rapid industrialization and growth in herbal and essential oil production.

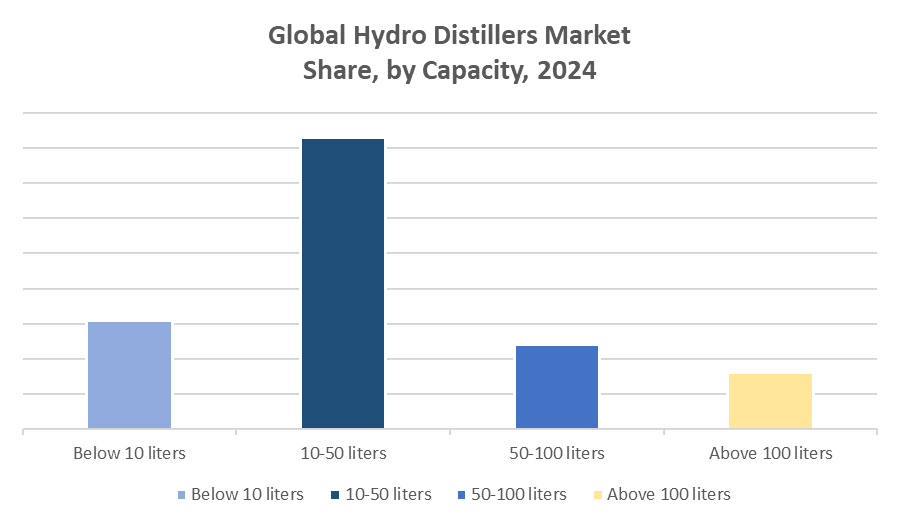

- By capacity, the 10-50 liters segment is expected to dominate in terms of revenue, favored for its balance of efficiency and scalability.

- The essential oils application segment holds the largest revenue share, driven by rising consumer preference for natural products.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.67 Billion

- 2035 Projected Market Size: USD 3.76 Billion

- CAGR (2025-2035): 7.66%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Hydro Distillers Market

The hydro distillers market centers on equipment used to extract essential oils, flavors, and active pharmaceutical ingredients through steam or water distillation. These distillers play a vital role in pharmaceuticals, cosmetics, and food & beverage industries, where natural and pure extraction methods are essential. Growing consumer preference for organic and chemical-free products is driving demand for hydro distillation. Additionally, government initiatives supporting herbal medicine and organic farming contribute to market growth. Technological advancements, such as energy-efficient systems and automation, further enhance the efficiency and yield of hydro distillers. These improvements reduce operational costs and improve product quality, making hydro distillation a preferred method for producing high-purity extracts. Overall, the market is expanding steadily due to rising demand for natural extracts and ongoing innovation in distillation technologies.

Hydro Distillers Market Trends

- Growing consumer preference for natural and organic extracts is driving demand.

- Technological innovations are leading to more energy-efficient and automated hydro distillers.

- Strategic collaborations among manufacturers and herbal product companies are expanding product reach.

Hydro Distillers Market Dynamics

Driving Factors: Increasing demand from pharmaceutical and cosmetic sectors

The growing preference for natural and organic products is significantly boosting demand for hydro distillers, especially in the pharmaceutical and cosmetic industries. These sectors rely heavily on pure and high-quality extracts, which hydro distillation efficiently provides. Additionally, expanding applications in food flavoring and aromatherapy further drive market growth. Government support through policies promoting herbal medicines and essential oils enhances industry confidence and investment. Together, these factors create a strong and sustained demand for hydro distillation equipment worldwide, fueling market expansion across various sectors focused on health, wellness, and natural product formulations.

Restrain Factors: High initial investment and maintenance costs

Hydro distillation equipment often requires substantial upfront capital investment, making it less accessible for small and medium-sized enterprises. The maintenance of these systems can also be costly due to the need for specialized components and regular servicing to ensure optimal performance. Moreover, the presence of alternative extraction methods like solvent extraction and supercritical CO? extraction offers competitive options that might be more cost-effective or suitable for specific applications. These factors can discourage adoption and slow market penetration, particularly in price-sensitive or resource-constrained environments, limiting overall growth potential.

Opportunity: Technological advancements and expansion in emerging markets

Technological innovations such as energy-efficient distillation units and automated control systems are improving operational efficiency and reducing costs, creating new opportunities in the hydro distillers market. These advancements help optimize extraction yields and simplify processes, making hydro distillation more appealing. Meanwhile, emerging markets rich in herbal and botanical resources, especially in Asia-Pacific and Latin America, provide vast untapped potential for industry players. Growing awareness about natural products and increasing investments in organic farming in these regions further bolster market expansion, offering companies lucrative avenues for growth and product diversification.

Challenges: Complex operation and regulatory compliance

Operating hydro distillation equipment requires skilled technicians to manage the intricate processes and ensure consistent product quality. This need for specialized labor can increase operational costs and create barriers for new entrants. Additionally, manufacturers must comply with strict environmental and quality regulations, which vary by region but often impose rigorous standards for emissions, waste management, and product safety. Navigating these regulatory frameworks can be challenging and costly, potentially delaying production and increasing overhead. Together, these operational complexities and compliance demands present significant challenges that the hydro distillers market must address to sustain growth.

Global Hydro Distillers Market Ecosystem Analysis

The ecosystem includes raw material suppliers (herbal and plant extract producers), equipment manufacturers, and end-users in pharmaceuticals, cosmetics, and food industries. Key players focus on R&D to enhance product performance and sustainability. Regulatory agencies enforce quality standards ensuring safety and efficacy of extracts produced via hydro distillation. Collaborations between growers, manufacturers, and research institutions further stimulate innovation and market expansion.

Global Hydro Distillers Market, By Capacity

The 10-50 liters capacity segment dominated the hydro distillers market in terms of revenue during the forecast period, accounting for approximately 55% of the global market share. This capacity range is ideal for small to medium-sized industrial applications, including pharmaceuticals, cosmetics, and food flavoring production. It offers a balanced combination of efficiency, scalability, and cost-effectiveness, making it the preferred choice for many manufacturers. The versatility and higher throughput of these distillers allow for consistent output, meeting growing demand while maintaining product quality, which significantly contributes to their dominant revenue share.

The below 10 liters capacity segment holds around 20% of the market share and primarily serves laboratory and research purposes. These smaller units are used extensively in R&D settings, universities, and small-scale herbal extract production where precision and control over the distillation process are critical. Although this segment contributes less to overall revenue compared to larger capacities, it is essential for innovation, formulation development, and testing new products, supporting the broader hydro distillers market’s growth and technological advancements.

Global Hydro Distillers Market, By Application

The essential oils segment holds the largest revenue share in the hydro distillers market, accounting for approximately 50% of the total market revenue during the forecast period. This dominance is driven by the growing demand for essential oils in aromatherapy, perfumery, and natural personal care products. Consumers increasingly prefer natural and organic ingredients, boosting the use of hydro distillation for extracting high-purity oils. The versatility and wide application of essential oils across wellness and beauty industries continue to fuel strong market growth in this segment.

The pharmaceuticals segment is rapidly expanding, capturing around 30% of the market share. This growth is attributed to the rising incorporation of herbal extracts and plant-based compounds in drug formulations. Increasing awareness of natural and alternative medicines, along with government support for herbal healthcare products, is driving the demand for hydro distillation equipment in pharmaceutical production. As herbal drugs gain acceptance globally, this segment offers significant growth potential within the hydro distillers market.

Asia Pacific dominates the hydro distillers market, accounting for approximately 42% of the global revenue, driven by major investments from countries like China, India, and Indonesia, which are rapidly expanding their herbal extraction industries and manufacturing of wellness products. The region benefits from abundant natural resources, growing consumer demand for organic and herbal products, and supportive government policies that encourage sustainable agriculture and herbal medicine production. These factors collectively position Asia Pacific as the largest and fastest-growing market for hydro distillation equipment worldwide.

India is projected to grow at a robust CAGR of around 9.3% during the forecast period, fueled by government initiatives such as promoting herbal medicine and organic farming under programs like the National AYUSH Mission. Increased production capacity and rising domestic and export demand for herbal extracts further accelerate market expansion. India’s strategic focus on natural health products and traditional medicine supports the growing adoption of hydro distillation technologies, making it a key growth market within Asia Pacific.

North America is expected to register a steady CAGR of approximately 6.5%, supported by a strong pharmaceutical sector and a booming organic cosmetics industry that prioritizes natural and pure ingredients. The region’s advanced technological infrastructure facilitates the adoption of state-of-the-art hydro distillation equipment, enhancing efficiency and product quality. Additionally, stringent regulatory frameworks ensure high standards in product safety, which further drives demand for reliable and innovative distillation systems in North America.

Europe maintains a steady market share, due to its strict quality standards and environmental regulations. These policies encourage the use of efficient, eco-friendly hydro distillation equipment that meets sustainability goals while ensuring product purity. The region’s mature market benefits from widespread adoption of advanced extraction technologies in pharmaceuticals, cosmetics, and food sectors. As a result, Europe continues to be a significant contributor to the global hydro distillers market, with steady demand driven by regulatory compliance and consumer preference for high-quality natural extracts.

WORLDWIDE TOP KEY PLAYERS IN THE HYDRO DISTILLERS MARKET INCLUDE

-

- Alfa Laval AB

- GEA Group AG

- Buchi Corporation

- Flavourtech

- PerkinElmer Inc.

- Anderson International Corp.

- LabTech Engineering Co.

- Others

Product Launches in Hydro Distillers Market

- In 2024, Alfa Laval AB introduced an energy-efficient hydro distiller model featuring automated temperature and pressure controls to optimize extraction yield. Similarly, Buchi Corporation launched compact, user-friendly hydro distillation units designed for small-scale pharmaceutical and cosmetic manufacturers, addressing growing demand for scalable solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the hydro distillers market based on the below-mentioned segments:

Global Hydro Distillers Market, By Capacity

- Below 10 liters

- 10-50 liters

- 50-100 liters

- Above 100 liters

Global Hydro Distillers Market, By Application

- Essential Oils

- Pharmaceuticals

- Food & Beverages

- Cosmetics

Global Hydro Distillers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: Which capacity segment dominates the Global Hydro Distillers Market?

A: The 10-50 liters capacity segment dominates the market, accounting for approximately 55% of global revenue due to its balance of efficiency and scalability.

Q: Which application segment holds the largest revenue share in the Hydro Distillers Market?

A: The essential oils application segment holds the largest revenue share, driven by rising consumer preference for natural and organic products.

Q: What are the main drivers of growth in the Hydro Distillers Market?

A: Increasing demand from pharmaceutical, cosmetic, and food industries for natural and pure extracts, government support for herbal medicines, and technological advancements in distillation equipment are major growth drivers.

Q: What are the key challenges limiting market growth?

A: High initial investment and maintenance costs, complex operation requiring skilled labor, and stringent regulatory compliance requirements are significant challenges.

Q: Which regions are witnessing the fastest growth in the Hydro Distillers Market?

A: North America is expected to be the fastest-growing market due to a strong pharmaceutical sector and increasing demand in the organic cosmetics industry.

Q: Who are the top companies operating in the Global Hydro Distillers Market?

A: Key players include Alfa Laval AB, GEA Group AG, Buchi Corporation, Flavourtech, PerkinElmer Inc., Anderson International Corp., and LabTech Engineering Co.

Q: What recent product launches have occurred in the Hydro Distillers Market?

A: In 2024, Alfa Laval AB launched an energy-efficient hydro distiller with automated controls, while Buchi Corporation introduced compact units targeting small-scale pharmaceutical and cosmetic manufacturers.

Q: What are the latest trends in the Hydro Distillers Market?

A: Growing consumer preference for natural extracts, technological innovations such as energy-efficient and automated systems, and strategic collaborations among manufacturers and herbal product companies.

Q: What opportunities are emerging in the Hydro Distillers Market?

A: Technological advancements improving efficiency, automation, and emerging markets rich in herbal resources, especially in Asia-Pacific and Latin America, present significant growth opportunities.

Q: How do capacity segments below 10 liters and above 100 liters contribute to the market?

A: Below 10 liters capacity is primarily used for laboratory and research purposes, while larger capacities above 100 liters serve large-scale industrial applications but have smaller market shares compared to 10-50 liters.

Q: What is the long-term outlook for the Hydro Distillers Market from 2025 to 2035?

A: The market is expected to grow steadily, driven by increasing demand for natural extracts, expansion of herbal product industries, and ongoing innovations in distillation technologies

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |