Global Hyperscale Data Center Market

Global Hyperscale Data Center Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, Services), By Power Capacity (20 MW to 50 MW, 50 MW to 100 MW, 100 MW to 150 MW, 150 MW and above), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Hyperscale Data Center Market Summary

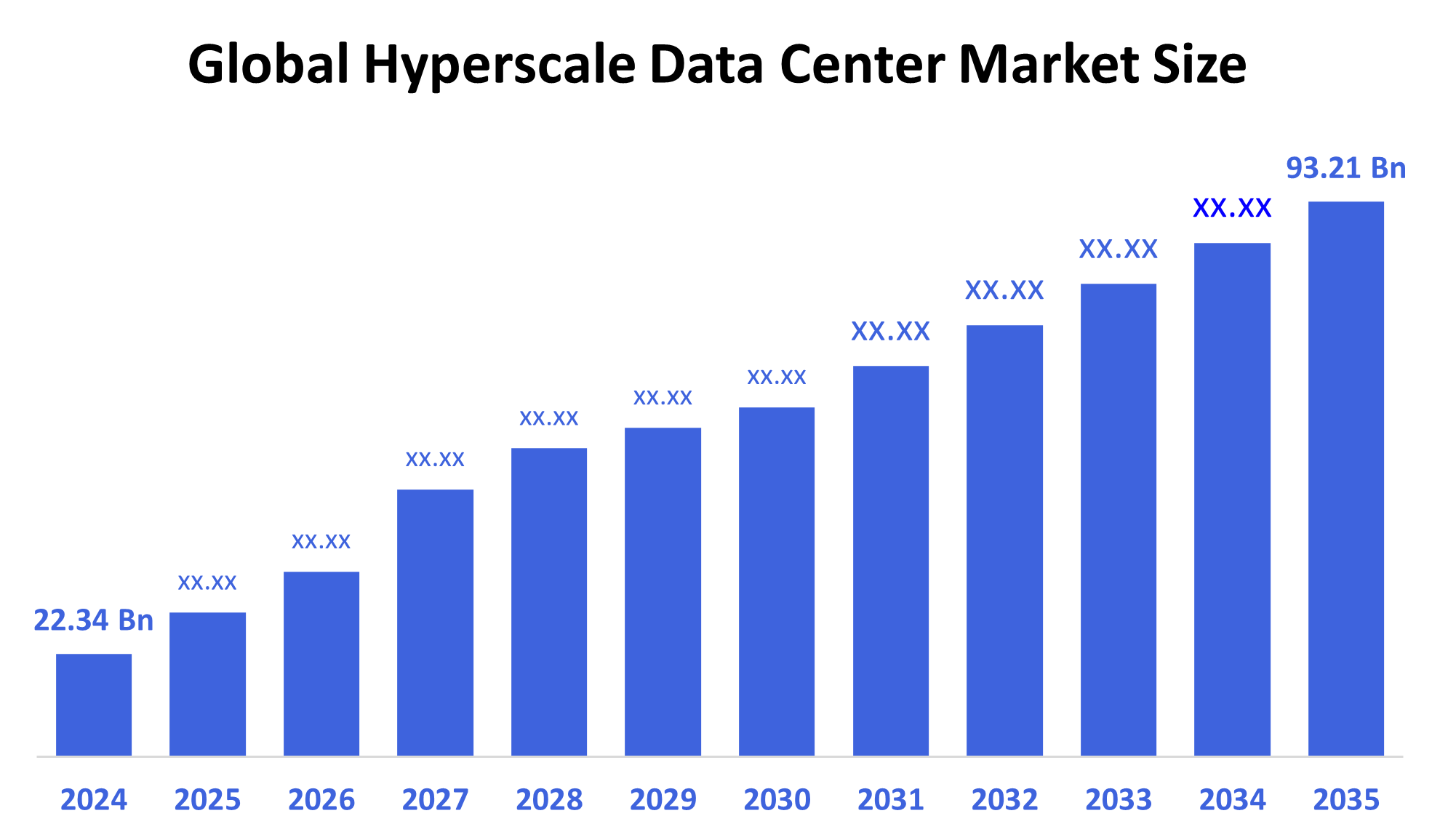

- The Global Hyperscale Data Center Market Size Was Estimated at USD 22.34 Billion in 2024 and is Projected to Reach USD 93.21 Billion by 2035, Growing at a CAGR of 13.87% from 2025 to 2035.

- Rising cloud usage, big data analytics, IoT expansion, demand for scalable infrastructure, growing digital transformation, and an increasing requirement for high-performance, energy-efficient computing solutions are the main factors propelling the growth of the hyperscale data center market.

Key Regional and Segment-Wise Insights

- In 2024, the North American hyperscale data center market held a 37.4% global share, dominating the market.

- With a revenue share of more than 49.3% in 2024, the hardware sector led the market by component.

- The 50 MW to 100 MW power capacity segment led the market in 2024 with a revenue share of more than 32.7%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 22.34 Billion

- 2035 Projected Market Size: USD 93.21 Billion

- CAGR (2025-2035): 13.87%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market for hyperscale data centers is the sector devoted to the planning, building, and management of extraordinarily large data centers that can accommodate enormous amounts of workloads related to cloud computing, processing, and data storage. These data centers, which serve huge organizations, internet companies, and major cloud service providers, are designed for maximum performance, scalability, and efficiency. The swift expansion of digital data, the growing use of cloud services, and the growing applications of IoT, AI, and big data analytics are the main factors propelling the market. Furthermore, the rise in e-commerce, remote work, and online streaming is increasing the need for scalable and reliable infrastructure, which is driving large investments in hyperscale data centers around the world.

Technological innovations that improve efficiency and lower energy use, like liquid cooling, AI-powered automation, and edge computing integration, are completely changing the way hyperscale data centers operate. The development of sustainable data centers is also being encouraged by governments throughout the world through laws and incentives that support the use of renewable energy sources and the reduction of carbon emissions. Together with continuous advancements in software and hardware, these endeavours are propelling the global hyperscale data center market's expansion and development.

Component Insights

What Factors Enabled the Hardware Segment to Capture a 49.3% Revenue Share in 2024?

The hardware category led the hyperscale data center market with a revenue share of more than 49.3% in 2024. The crucial role that hardware components play in sustaining the high-performance infrastructure needed for hyperscale operations is the reason for this supremacy. Servers, networking devices, storage systems, and power and cooling systems are examples of essential hardware components. Investments in cutting-edge hardware are rising in tandem with the demand for larger storage, faster data processing, and high-speed communication. The segment's growth is further aided by the growing demand for specialized and high-performance computing hardware, driven by the increasing deployment of AI and machine learning workloads in hyperscale environments. The market is expanding due to ongoing advancements in modular and energy-efficient hardware solutions.

Over the course of the forecast period, the software segment of the hyperscale data center market is expected to grow at a significant CAGR. The growing demand for automation, real-time monitoring, and intelligent data center management is the factor driving the growth of the segment. Large-scale infrastructures can benefit from improved security, task orchestration, energy efficiency, and resource optimization made possible by software solutions. The development of AI, big data, and virtualization technologies further fuels the need for advanced software platforms that can manage complex computer systems. The use of software-defined data centers (SDDC) and sophisticated management tools is also anticipated to increase as hyperscale operators concentrate on lowering operating costs and enhancing scalability, making the software segment a major contributor to future market expansion.

Power Capacity Insights

How did the 50 MW to 100 MW Segment lead in the Hyperscale Data Center Market in 2024?

The 50 MW to 100 MW segment led the hyperscale data center market with a revenue share of more than 32.7% in 2024. The increasing number of large-scale data centers needed to serve cloud services, AI workloads, and big data analytics is primarily responsible for this segment's supremacy. For hyperscale operators like cloud providers and IT giants, data centers in this power range are perfect because they strike a compromise between scalability and operating efficiency. These facilities are built to withstand the demands of high-performance computing while preserving resilience and energy efficiency. The demand for mid-to-large capacity data centers is increasing due to the global acceleration of digital transformation, which has cemented the market leadership of the 50 MW to 100 MW category.

The 150 MW and above segment in the hyperscale data center market is expected to grow at a significant CAGR over the forecast period. This growth is primarily driven by the rising demand for ultra-large data centers capable of supporting next-generation technologies such as artificial intelligence (AI), machine learning, and high-volume cloud computing. Hyperscale operators, including major cloud service providers and tech giants, are increasingly investing in mega data center campuses that require power capacities exceeding 150 MW to meet future scalability and performance needs. Additionally, the expansion of data-intensive applications, real-time analytics, and 5G infrastructure is further accelerating the need for high-capacity, energy-efficient data centers, positioning this segment for robust growth.

Regional Insights

North America held the largest revenue share of 37.4% in 2024, dominating the global hyperscale data center market. The existence of significant cloud service providers, a strong digital infrastructure, and the growing need for sophisticated data processing capabilities across industries are the main drivers of this dominant market position. Many hyperscale facilities run by tech behemoths like Amazon Web Services (AWS), Microsoft, Google, and Meta are located in the United States in particular. The need for massive data centers is also being fueled by rising investments in AI, IoT, and 5G technologies. North America leads the hyperscale data center industry in part because of favorable government regulations, easy access to renewable energy sources, and a developed IT ecosystem.

Europe Hyperscale Data Center Market Trends

Over the course of the projection period, the European hyperscale data center market is expected to grow at a significant CAGR. Strong government support for the construction of green and sustainable data centers, growing demand for cloud computing, and increased digitization across industries are the main drivers of this expansion. Because of their advantageous laws, cutting-edge infrastructure, and availability of renewable energy, nations like Germany, the Netherlands, Ireland, and Sweden are emerging as important hubs. Furthermore, big data, AI, and IoT technologies, all of which call for high-performance computer infrastructure, are being adopted by European businesses at an accelerating rate. In the upcoming years, Europe's hyperscale data center footprint is anticipated to grow dramatically due to continued investments from both local data center operators and international IT businesses.

Asia Pacific Hyperscale Data Center Market Trends

Over the course of the forecast period, the Asia Pacific hyperscale data center market is anticipated to expand at the fastest CAGR. The rise of cloud services, growing internet penetration, and the growing uptake of digital technology in emerging economies like China, India, and Southeast Asia are the main drivers of this quick growth. In order to satisfy the region's increasing need for data processing, storage, and real-time services, major cloud providers are making significant investments in the construction of new hyperscale facilities. Government programs supporting data localization, smart cities, and digital infrastructure are also speeding up industry expansion. The region's status as the world's fastest-growing hyperscale data center industry is also a result of the rise in e-commerce, mobile usage, and AI-driven applications.

Key Hyperscale Data Center Companies:

The following are the leading companies in the hyperscale data center market. These companies collectively hold the largest market share and dictate industry trends.

- Alibaba

- Tencent Cloud

- NVIDIA Corporation

- Amazon Web Services, Inc.

- NTT Ltd.

- Digital Realty Trust

- Ericsson, Inc.

- Google, Inc.

- Equinix, Inc.

- IBM Cloud

- Microsoft

- Oracle

- Intel Corporation

- Arista Networks, Inc.

- Vertiv Group Corp.

- Others

Recent Development

- In January 2025, Oracle's latest version of the Exadata platform, the Exadata X11M, offers significant performance improvements for workloads involving AI, analytics, and online transaction processing (OLTP). With intelligent power management and optimum performance, the X11M system is designed to manage mission-critical operations more effectively, allowing enterprises to process data more quickly while utilizing fewer systems.

- In December 2024, Amazon Web Services, Inc. revealed cutting-edge data center improvements to improve sustainability and energy efficiency while satisfying growing AI demands. Software-driven rack optimization to cut down on energy waste, liquid and multimodal cooling for high-density AI hardware, and simpler power and cooling systems are some of the major improvements. In order to improve monitoring and diagnostics, AWS also unveiled improved control systems and a redesigned power shelf. These enhancements help both performance and environmental goals by increasing processing power per site and lowering the requirement for additional data centers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the hyperscale data center market based on the below-mentioned segments:

Global Hyperscale Data Center Market, By Component

- Hardware

- Software

- Services

Global Hyperscale Data Center Market, By Power Capacity

- 20 MW to 50 MW

- 50 MW to 100 MW

- 100 MW to 150 MW

- 150 MW and above

Global Hyperscale Data Center Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 235 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |