Global Immunotherapy Drugs Market

Global Immunotherapy Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Type (Antibody Drugs, Inhibitor Drugs, Interferons and Interleukins, Vaccines, and Others), By Route of Administration (Intravenous, Subcutaneous, Oral, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

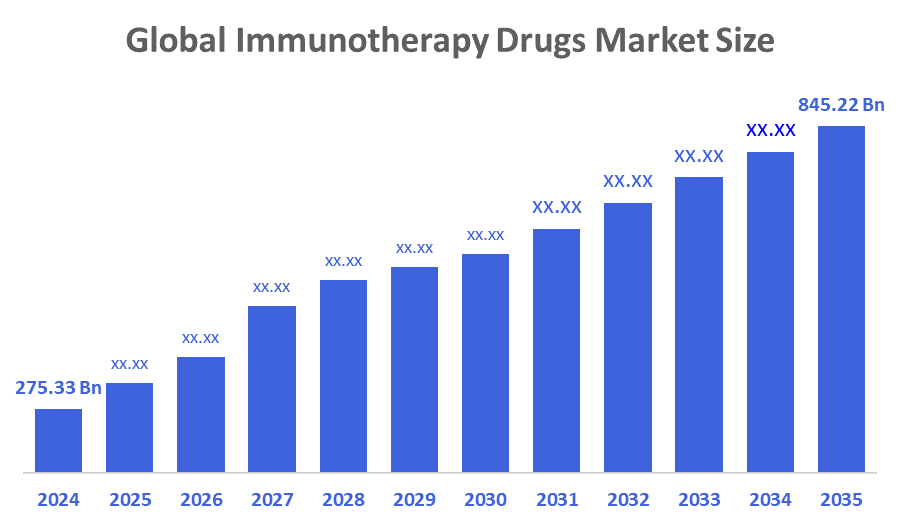

Global Immunotherapy Drugs Market Size Insights Forecasts to 2035

- The Global Immunotherapy Drugs Market Size Was Estimated at USD 275.33 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.73% from 2025 to 2035

- The Worldwide Immunotherapy Drugs Market Size is Expected to Reach USD 845.22 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Immunotherapy Drugs Market Size was worth around USD 275.33 Billion in 2024 and is predicted to Grow to around USD 845.22 Billion by 2035 with a compound annual growth rate (CAGR) of 10.73% from 2025 to 2035. This increase is linked to both the development of antibody engineering and the growing incidence of chronic illnesses like cancer, autoimmune diseases, and infectious diseases. Cancer treatment regimens are being revolutionised by technologies such as bispecific antibodies, CAR-T cell therapy, and checkpoint inhibitors. Additionally, biomarker-based patient classification and AI-driven medication discovery are speeding up clinical development and enhancing results.

Market Overview

Immunotherapy medications include a variety of medication types developed to stimulate, suppress or modify an individual's immune system for therapeutic purposes. This class of medication includes oncology therapies (i.e., cancer treatment), autoimmune treatments for diseases such as rheumatoid arthritis and multiple sclerosis, and treatments for inflammatory conditions. Generally speaking, immunotherapeutic agents cause an immune response to disease-causing cells, or they inhibit the ability of these disease-causing cells to remain hidden from the body's immune system (i.e., by blocking). Checkpoint inhibitors, monoclonal antibodies, and cancer vaccines are examples of known immunotherapy drug classes. These medications are referred to as immunomodulators and are utilised in several practice areas (i.e., Cancer Care, Rheumatology, Neurology, etc.). As the development of novel immune-based therapies is constantly on the rise, robust clinical evidence exists for immunotherapy medications and, therefore, has been sustained through ongoing investment in new clinical research through pharmaceutical biotechnology companies. In addition, the sustained development of innovative therapeutic combination approaches in the field of immunotherapy and the development of precision medicine continue to enhance and broaden the application and utilisation of immunotherapy medications throughout the globe.

In July 2025, Dispatch Bio launched with $216 million in funding and a bold plan to develop a “universal” CAR?T therapy for solid tumours. The company, co-founded by CAR?T pioneer Carl June, aims to overcome two major barriers in solid tumour immunotherapy: lack of tumour-specific targets and the immunosuppressive tumour environment.

In October 2025, Nilo Therapeutics launched with $101 million in Series A funding to pioneer drugs that harness neural circuits to regulate inflammation and restore immune balance. The biotech aims to “rewire” the immune system by targeting specific nerve cells, positioning itself at the intersection of neurobiology and immunology.

Report Coverage

This research report categorises the immunotherapy drugs market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the immunotherapy drugs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the immunotherapy drugs market.

Driving Factors

The global immunotherapy drugs market is primarily driven by the increasing prevalence of chronic diseases, increasing healthcare costs, and the increase in the use of targeted therapies by patients. Additionally, the rise of biosimilars, due to the approval of some biosimilar drugs by agencies such as the FDA and EMA, is expected to be a significant driver of growth for the immunotherapy drugs market over the next several years. Many of the factors that are likely to drive the growth of the global immunotherapy drugs market during the forecast period include increased research and development activity by biotechnology and pharmaceutical companies, an increase in the number of research laboratories, and an increase in collaborative research activities by major players in the market. The rapidly growing biopharmaceutical industry, due in part to increased governmental support and investment from the private sector, is also a contributor to the growth of the global immunotherapy drugs market. Additionally, an increase in public awareness about the advantages of using Immunotherapy Drugs, compared to traditional treatment methods, is significantly contributing to increased demand for immunotherapy drugs.

Restraining Factors

The market for immunotherapy drugs is expected to grow; however, there are many barriers to growth, such as expensive treatment costs, regulatory issues and safety concerns with immune-related adverse events (IRAEs). Limited awareness and infrastructure in emerging markets, as well as competition from low-cost conventional therapies, decrease the ability for wide-scale adoption. These barriers will hinder the rate of commercialisation of these drugs and will decrease patient access around the globe.

Market Segmentation

The immunotherapy drugs market share is classified into drug, and the route of administration.

- The antibody drugs segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the drug, the immunotherapy drugs market is differentiated into antibody drugs, inhibitor drugs, interferons and interleukins, vaccines, and others. Among these, the antibody drugs segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to its shown effectiveness in treating a range of illnesses, including autoimmune diseases and cancer, the antibody medicines segment maintained the biggest share. Monoclonal antibodies have demonstrated notable efficacy in targeting certain antigens on immunological or cancer cells, resulting in precise and efficient therapy with fewer side effects. Their widespread use in treating various malignancies and chronic illnesses, together with their efficacy, has solidified their leading position in the market.

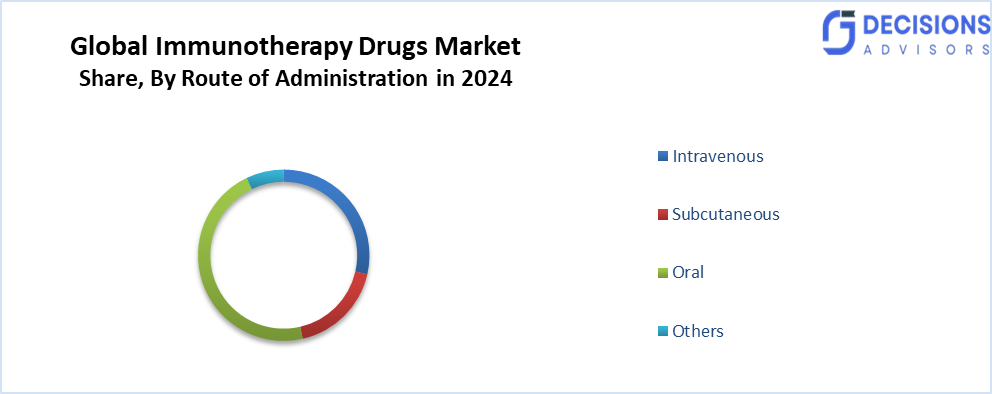

- The oral segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the route of administration, the immunotherapy drugs market is divided into intravenous, subcutaneous, oral, and others. Among these, the oral segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Oral immunotherapy medications are simple to use and do not require hospital stays or infusion facilities. This increases patient adherence, particularly in cases of chronic illnesses that call for ongoing care. Oral medicines are more appealing due to the flexibility of at-home administration, especially in areas with inadequate healthcare infrastructure.

Regional Segment Analysis of the Immunotherapy Drugs Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the immunotherapy drugs market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the immunotherapy drugs market over the predicted timeframe. The increased prevalence of various types of cancer and autoimmune diseases has created a greater demand for effective treatment options within this geographic area. With the rise in this demand, many companies are investing heavily in developing their healthcare infrastructure and engaging in R&D to create new therapies that will improve or enhance the body's immune response to these diseases. Additionally, the immuno-pharmaceutical business of Japan is already developed and innovative, and it continues to expand with new oncology therapies, advanced methods of precise diagnostic testing, and domestic pharmaceutical research and development. In addition, as Japan has an increasingly older population, this continued demand will require Continuing Growth (HCG), and thereby, Japan will remain a major contributor to the development of Asia Pacific Growth (APG).

With a rapidly improving healthcare system and an increase in the number of patients who accept the use of biopharmaceuticals, China has the potential to become a major driver of growth for the Asia Pacific Region (APR).

In March 2025, Valo Therapeutics announced that it had secured €19 million in investment funding to expand clinical trials of its lead cancer immunotherapy candidate, PeptiCRAd. The financing will accelerate the development of this innovative tumour antigen-coated oncolytic virus platform across Australia.

North America is expected to grow at a rapid CAGR in the immunotherapy drugs market during the forecast period. The expanding use of immunotherapy drugs can be attributed to the high prevalence of cancer and autoimmune diseases, creating a demand for successful treatments. Areas within an area are well-developed in terms of health-care infrastructure, and they have received considerable amounts of money invested into R&D to develop innovative treatments that improve the body’s immune responses. Furthermore, under favourable government policies related to health care and increasing expenditures on health-related services, there is an increased demand for immunotherapy products due to continued demand for safer and more effective methods of treating cancer. Therefore, the growth rate of this market will continue to reflect the need for additional treatments that utilise these methods.

In December 2025, the FDA granted fast-track designations to several oncology drugs targeting acute myeloid leukaemia, non-small cell lung cancer, colorectal cancer, liver cancer, breast cancer, and ovarian cancer. These designations accelerate development and review, reflecting the urgent need for new therapies in hard-to-treat cancers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the immunotherapy drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amgen

- AstraZeneca

- Bristol Myers Squibb

- Bluebird Bio

- F. Hoffmann La Roche

- GlaxoSmithKline

- Gilead Sciences

- Johnson & Johnson

- Kite Pharma

- Merck & Co.

- Moderna

- Novartis

- Pfizer

- Sanofi

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, a clinical trial by Novastra Therapeutics showed that its experimental cancer immunotherapy, OAP?1, was safe and demonstrated early signs of tumour control in patients with advanced, drug-resistant solid tumours who had exhausted standard treatment options.

- In August 2025, the FDA approved Papzimeos (zopapogene imadenovec?drba), the first immunotherapy for recurrent respiratory papillomatosis (RRP), a rare chronic disease caused by HPV types 6 or 11. This marks the first non-surgical treatment option for RRP patients, offering hope beyond repeated surgeries to manage airway?blocking tumours.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the immunotherapy drugs market based on the below-mentioned segments:

Global Immunotherapy Drugs Market, By Drug

- Antibody Drugs

- Inhibitor Drugs

- Interferons and Interleukins

- Vaccines

- Others

Global Immunotherapy Drugs Market, By Route of Administration

- Intravenous

- Subcutaneous

- Oral

- Others

Global Immunotherapy Drugs Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

1. What is the current size of the global immunotherapy drugs market?

The market was valued at USD 275.33 billion in 2024.

2. What is the projected market size by 2035?

It is expected to reach USD 845.22 billion by 2035.

3. What is the CAGR for the forecast period?

The market is projected to grow at a CAGR of 10.73% from 2025 to 2035.

4. Which region will hold the largest market share?

Asia Pacific is anticipated to hold the largest share over the forecast period.

5. Which drug type leads the market?

Antibody drugs accounted for the largest share in 2024 and are expected to grow significantly.

6. Which route of administration is the highest revenue generator?

The oral segment generated the highest revenue in 2024 and is set for strong growth.

7. What are the main growth drivers?

Increasing chronic diseases like cancer, R&D investments, biosimilars, and targeted therapies fuel growth.

8. What are the key restraining factors?

High costs, regulatory hurdles, safety concerns (like IRAEs), and limited access in emerging markets slow adoption.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 244 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |