India Dairy Alternatives Market

India Dairy Alternatives Market Size, Share, And COVID 19 Impact Analysis, By Source (Soy, Almond, Coconut, Rice, Oats, and Others), By Product (Milk, Yogurt, Cheese, Ice Cream, Creamer, and Others), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online Retail, Others), and India Dairy Alternatives Market Insights, Industry Trend, Forecast to 2035

Report Overview

Table of Contents

India Dairy Alternatives Market Insights Forecasts to 2035

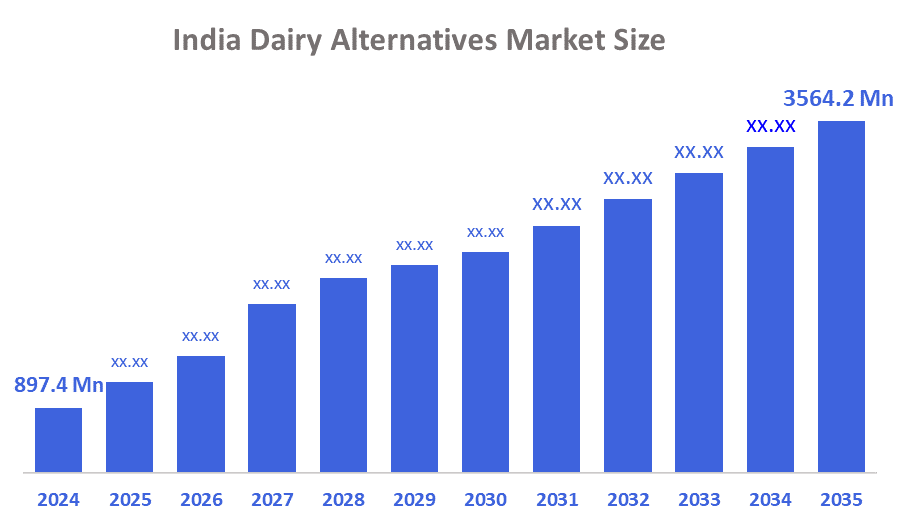

- India Dairy Alternatives Market Size 2024: USD 897.4 Mn

- India Dairy Alternatives Market Size 2035: USD 3564.2 Mn

- India Dairy Alternatives Market CAGR 2024: 13.36%

- India Dairy Alternatives Market Segments: Source, Product, and Distribution Channel

The India Dairy Alternatives Market Size comprises plant-based milks, yogurts, cheeses, butter, and cream, as well as ice creams made from soya, almonds, coconuts, oats, cashews, and rice. These have numerous uses including as beverages, teas and coffees, food and cooking, baked goods and desserts, camp and packaged foods, and foodservice. The growth of this dairy alternative market in India is driven by lactose intolerance in a large population of Indians, an increasing number of vegans and flexitarians, increasing awareness of health benefits, and demands for cholesterol-free, hormone-free, and allergen-friendly food and nutritional solutions.

Technological advancements in vanilla, plant proteins, extrusion, enzyme, emulsification, fortification, and masking have improved dairy alternative products in terms of taste, textures, nutritional profile, and longer shelf life. Advances in oat, almond, sugar-reduction, or protein fortification have aided consumer adoption. Support comes from government programs emphasizing awareness of healthy eating, consumption of clean label foods, food safety, and sustainable farming practices, supporting dairy alternatives in an indirect way. The dairy alternatives market in India will open new areas in vegan cheese and yogurt products, tier-2 and tier-3 geographic reach, growth of private labels, institutional sales, and speedy expansion on emerging e-commerce and quick-commerce channels.

Market Dynamics of the India Dairy Alternatives Market:

The dairy alternate market in India gets driven by the rise in lactose intolerance, an increase in the number of milk allergies, and a growing need for non-dairy nutrition in the urban sector. A health-conscious shift in the understanding of consumables, linked with the consumption of cholesterols, digestion, and lifestyle-related illnesses, gets fueling the usage of soy, almond, oat, and coconut dairy alternates in the Indian dairy sector.

The high pricing of the product compared to traditional dairy options, lack of cold storage infrastructure, and lesser awareness in semi-urban and rural areas are some factors that limit growth. The adaptability of taste, shelf life of certain dairy alternative products, and imports for raw material such as almonds and oats for oats-based products keep costs high and thus limit entry into cost-conscious Indian homes.

The growing demand for vegan and flexitarian lifestyles, the rising demand for fortified dairy alternatives, and innovations in functional categories such as flavored milk, yogurt, cheese, and ice cream offer robust growth opportunities. Penetration into Tier II and Tier III cities, tie-ups with hotels and restaurants, and an emphasis on eco-friendly and clean-label offerings are set to drive the long-term growth of the market.

Market Segmentation

The India dairy alternatives market share is classified into source, product, and distribution channel.

By Source:

The India dairy alternatives market is segmented by source into soy, almond, coconut, rice, oats, and others. Among these, the soy segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by cultural familiarity, as soy has been a traditional part of India diets for centuries. It is supported by established supply chains, easy availability, and the widespread use of soy-based products, making it a healthy, popular, and trusted dairy alternative.

By Product:

The India dairy alternatives market is segmented by product into milk, yogurt, cheese, ice cream, creamer, and others. Among these, the milk segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by convenience, as milk is easy to use daily and in cooking. It is supported by coffee consumption, versatility in recipes, and widespread consumer acceptance, making milk the most preferred dairy alternative in India.

By Distribution Channel:

The India dairy alternatives market is segmented by distribution channel into supermarkets & hypermarkets, convenience stores, online retail, and others. Among these, the supermarkets & hypermarkets segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth is driven by the broad reach of these stores, which makes products accessible to many consumers. Product variety attracts different customer preferences, and the convenience of shopping in one place further boosts sales of dairy alternatives.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India dairy alternatives market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Dairy Alternatives Market:

- Alpro (Danone)

- Vitasoy International Holdings Ltd.

- Valsoia S.p.A.

- The Enlightened Food Company Pvt. Ltd. (Goodmylk Co.)

- Epigamia (Danone)

- Slurrp Farm Foods Pvt.

- GoodMylk Co.

- Oziva Naturals

- Urban Platter (Vivio Foods)

- The Whole Truth Foods Pvt. Ltd.

- RiteBite Superfoods Ltd.

- Veggie Champ

- Earthling Co.

- Others

Recent Developments in India Dairy Alternatives Market:

In June 2025, Country Delight entered the Indian market with oats drinks. It entered the dairy alternatives market, specifically plant-based dairy alternatives, by launching a cost-effective and purified oats drink. It was intended by them to reach more people. It aimed at increasing its market in the dairy alternatives segment.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India dairy alternatives market based on the below-mentioned segments:

India Dairy Alternatives Market, By Source

- Soy

- Almond

- Coconut

- Rice

- Oats

- Others

India Dairy Alternatives Market, By Product

- Milk

- Yogurt

- Cheese

- Ice Cream

- Creamer

- Others

India Dairy Alternatives Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Others

FAQ

Q: What is the India dairy alternatives market size?

A: India dairy alternatives market is expected to grow from USD 897.4 million in 2024 to USD 3564.2 million by 2035, growing at a CAGR of 13.36% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: The India dairy alternatives market is driven by the rise in lactose intolerance, an increase in the number of milk allergies, and a growing need for non-dairy nutrition in the urban sector. A health-conscious shift in the understanding of consumables, linked with the consumption of cholesterols, digestion, and lifestyle-related illnesses, gets fueling the usage of soy, almond, oat, and coconut dairy alternates in the Indian dairy sector.

Q: What factors restrain the India dairy alternatives market?

A: India dairy alternatives market is restrained high pricing of the product compared to traditional dairy options, lack of cold storage infrastructure, and lesser awareness in semi-urban and rural areas. The adaptability of taste, shelf life of certain dairy alternative products, and imports for raw material such as almonds and oats for oats-based products keep costs high and thus limit entry into cost-conscious Indian homes.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |