India Ice Cream Market

India Ice Cream Market Size, Share, and COVID-19 Impact Analysis, By Product (Cartons, Tubs, Cups, Cones, and Bars), By Flavour (Chocolate, Fruit, Vanilla, and Others), By Distribution Channel (Store-Based, and Non-Store-Based), and India Ice Cream Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

India Ice Cream Market Insights Forecasts to 2035

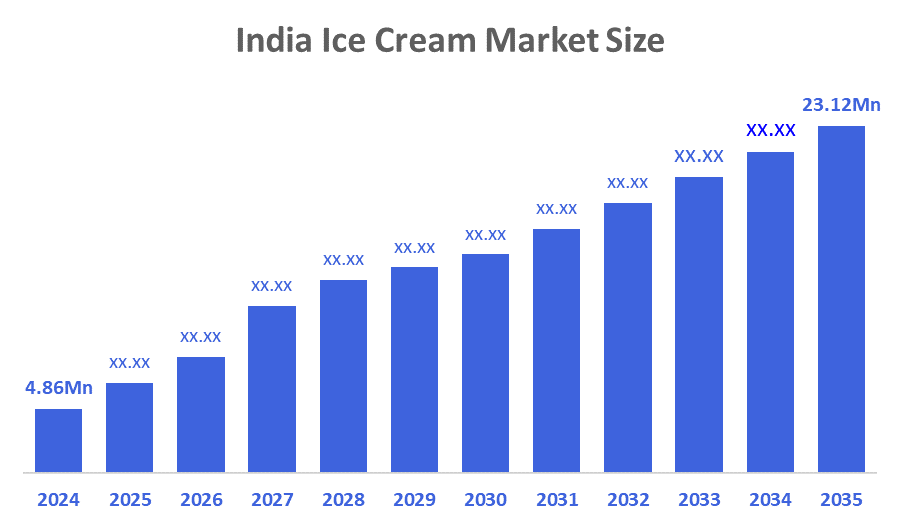

- The India Ice Cream Market Size was estimated at USD 4.86 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.23% from 2025 to 2035

- The India Ice Cream Market Size is Expected to Reach USD 23.12 Billion by 2035

According To a Research Report Published By Decision Advisors and Consulting, The India Ice Cream Market is Anticipated To Reach USD 23.12 Billion By 2035, Growing At a CAGR Of 15.23% From 2025 To 2035. The market is continuously growing with an increase in disposable incomes, increased customer preference for pampering, and new goods offered by prominent brands. Additionally, the ice cream market share in India is being influenced by the quick development of both online and offline distribution channels to cater to a wide range of consumer demographics residing in both urban and rural areas.

Market Overview

The Indian ice cream market is a subsection of the Indian dairy industry that manufactures, distributes, and sells ice cream products throughout the country. It includes impulse, take-home, and artisanal varieties, with an increase due to rising incomes, urbanisation, and changing consumer preferences. Ice cream is a frozen delicacy prepared from milk, cream, sugar, and sometimes other components. In addition to milk or cream, ice cream often adds stabilisers like gluten to help keep the texture uniform. This dessert has just recently been more readily available due to the extensive use of refrigeration. As ice cream's popularity has grown, so has the appeal of frozen custard, frozen yoghurt, and even non-dairy ice cream variations. Furthermore, the ice cream manufacturers are always innovating, producing a wide variety of flavours, textures, and formats to entice customers, including vegan, dairy-free, premium, and more options.

In 2023, India's average per capita ice cream consumption is at 1.6 litres, which is up from 400 ml in 2011, or roughly 4.4 ml per day per person across a population of over 1.4 billion.

The Indian government supports the ice cream industry through key schemes like the Pradhan Mantri Kisan Sampada Yojana (PMKSY), which offers significant financial incentives to food processing units, including ice cream manufacturers.

PMKSY provides up to 35% capital subsidy on eligible costs (limited at ?10 crore) for establishing or renovating food processing facilities. AHIDF offers a 3% APR subvention on loans up to ?50 crore for eight years, enabling firms to secure inexpensive finance for expansion and infrastructure investments.

Report Coverage

This research report categorises the market for the India ice cream market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India ice cream market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India ice cream market.

Driving Factors

The market for India Ice Cream is driven by the rising disposable incomes, fast urbanisation, and a growing middle class, all contribute to the desire for high-end, cutting-edge frozen treats. The improvement of cold chain infrastructure and the rise of organised retail, e-commerce, and quick-commerce delivery, especially in tier-2, tier-3 influence the market growth. Further, health-conscious, plant-based, and other products are becoming more popular among consumers, which is driving the market across India. Moreover, key firms and their merging policy develop and provide a wide variety of products that satisfy changing consumer preferences, which boosts the market development. Additionally, government incentives in the food processing sector and excellent climate conditions also encourage recent market expansion.

Hindustan Foods Limited (HFL), a major player in the Indian food processing business, has made an important strategic decision. The company's board approved a ?30 crore investment through its wholly owned subsidiary to buy ice cream cone and sleeve printing operations.

GCMMF, Amul's parent company, announced a Rs 10,000 crore investment to establish 10-12 new dairy, ice cream, and food plants in the next 2-3 years.

Restraining Factors

The Indian ice cream market has obstacles such as significant variability, scattered supply chains, rising input costs, and inadequate cold chain infrastructure. Further, fluctuation in raw materials price, and managing manufacturing costs hampered the market expansion.

Market Segmentation

The India ice cream market share is classified into product, flavour, and distribution channel.

The cups segment held a significant share in 2024 and is estimated to grow at a rapid pace during the forecast period.

The India ice cream market is divided by product into cartons, tubs, cups, cones, and bars. Among these, the cups segment held a significant share in 2024 and is estimated to grow at a rapid pace during the forecast period. They are easily accessible, even in distant areas of India. Additionally, cup-format ice cream remains a popular choice for customers of all ages, including those under the age of 18. Furthermore, several important firms, including Amul, Kwality Wall's, and others, have introduced new flavoured ice cream products in cup formats at competitive costs, recognising that urban consumers value both novel flavours and convenience.

- The chocolate segment held a substantial share in 2024 and is anticipated to grow at a notable CAGR during the forecast period.

The India ice cream market is segmented by flavour into chocolate, fruit, vanilla, and others. Among these, the chocolate segment held a substantial share in 2024 and is anticipated to grow at a notable CAGR during the forecast period. This is due to its ability to inspire sentiments of warmth, nostalgia, and pleasure, making it a frozen dessert classic. Furthermore, demand for chocolate-flavoured ice cream has increased as a result of the proliferation of novel flavour combinations and premium offers. Also, manufacturers are continuously experimenting with new cocoa blends, chocolate suppliers, and extra ingredients like nuts, biscuits, and caramel swirls to produce distinct and delectable flavour profiles.

- The store-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR over the forecast period.

The India ice cream market is differentiated by distribution channel into store-based, and non-store-based. Among these, the store-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR over the forecast period. Store-based channels, which include supermarkets, hypermarkets, and local grocery stores, play a vital role in providing consumers with immediate access to a wide variety of ice cream products. These establishments frequently offer a lively retail experience, promoting quick deals and brand visibility.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India ice cream market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amul

- Vadilal Industries Ltd.

- Mother Dairy Fruit & Vegetable Pvt. Ltd.

- Hindustan Unilever (Kwality Wall's)

- Havmor Ice Cream Pvt. Ltd.

- Creambell (Devyani Food Industries Ltd.)

- Naturals Ice Cream (Kamaths Ourtimes Ice Creams Pvt. Ltd.)

- Arun Ice Creams (Hatsun Agro Product Ltd.

- Dinshaw's Dairy Foods Ltd.

- Dodla Dairy Ltd.?

- other.

Recent Developments:

- In December 2025, Lotte Wellfood Co. Ltd., the South Korean confectionery giant, announced the launch of India’s first 4-layered ice cream bar, ‘Lotte Krunch’. This innovation marks Lotte’s bold entry into India’s premium frozen dessert market.

- In November 2025, Arun Icecreams, one of India’s most iconic ice cream brands, launched its latest innovation, Ice Cream Doughnuts. This playful fusion combines the indulgence of doughnuts with Arun’s creamy ice creams, creating a bite-sized treat designed to appeal to all age groups.

- In October 2025, Carvel (soft serve ice cream brand) opened its first Indian store in New Delhi. It's bringing their iconic products and new India-specific flavours to one of the world’s most vibrant dessert markets. They anticipate expanding to 100 locations around the country over the next 3-4 years with Unify Foodworks.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India ice cream market based on the below-mentioned segments:

India Ice Cream Market, By Product

- Cartons

- Tubs

- Cups

- Cones

- Bars

India Ice Cream Market, By Flavour

- Chocolate

- Fruit

- Vanilla

- Others

India Ice Cream Market, By Distribution Channel

- Store-Based

- Non-Store-Based

FAQ

Q: What is the current size of the India Ice Cream Market?

A: The India Ice Cream Market size was estimated at USD 4.86 billion in 2024.

Q: What is the expected market size by 2035?

A: The market is expected to reach USD 23.12 billion by 2035.

Q: What is the expected CAGR for the India Ice Cream Market from 2025 to 2035?

A: The market is projected to grow at a CAGR of approximately 15.23% during this period.

Q: What factors are driving the growth of India’s Ice Cream Market?

A: Key drivers include rising disposable incomes, urbanisation, a growing middle class, improved cold chain infrastructure, expansion of organised retail and e-commerce, and increasing demand for plant-based and premium ice cream options. Government subsidies and investments in food processing are also significant growth catalysts.

Q: How is the market segmented by product in India?

A: The market is segmented into cartons, tubs, cups, cones, and bars. Among these, ice cream cups held a significant market share in 2024 and are growing rapidly due to their convenience and wide availability.

Q: Which ice cream flavour dominates the market?

A: Chocolate was the dominant flavour segment in 2024, driven by its classic appeal and innovations in flavour combinations.

Q: What are the main distribution channels for ice cream in India?

A: The key distribution channels are store-based (supermarkets, hypermarkets, grocery stores) and non-store-based (online, kiosks, mobile vans). Store-based channels dominate the market.

Q: What recent innovations or product launches have taken place?

A: Notable developments include Lotte Wellfood’s 4-layered ice cream bar “Lotte Krunch,” Arun Icecreams’ Ice Cream Doughnuts, and Carvel launching its first Indian store with India-specific flavours.

Q: Which companies are key players in the India Ice Cream Market?

A: Major companies include Amul, Vadilal Industries, Mother Dairy, Hindustan Unilever (Kwality Wall’s), Havmor, Creambell, Naturals Ice Cream, Arun Ice Creams, Dinshaw's Dairy Foods, and Dodla Dairy.

Q: How does government support impact the ice cream market?

A: The government provides financial support via schemes like the Pradhan Mantri Kisan Sampada Yojana (PMKSY), offering up to 35% capital subsidies, and the Affordable Housing and Infrastructure Development Fund (AHIDF) with low-interest loans, encouraging expansion and modernisation.

Q: What is the per capita ice cream consumption in India?

A: In 2023, average per capita consumption was approximately 1.6 litres per year, a significant increase from 400 ml in 2011.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |