India Medical Device Coating Market

India Medical Device Coating Market Size, Share & Trends Analysis Report By Product (Hydrophilic Coatings, Anti-microbial Coatings, Drug-eluting Coatings, Anti-thrombogenic Coatings, Others), By Application (Neurology, Orthopaedics, General Surgery, Cardiovascular, Dentistry, Gynaecology, Others), And Segment Forecasts to 2035

Report Overview

Table of Contents

India Medical Device Coating Market Insights Forecasts to 2035

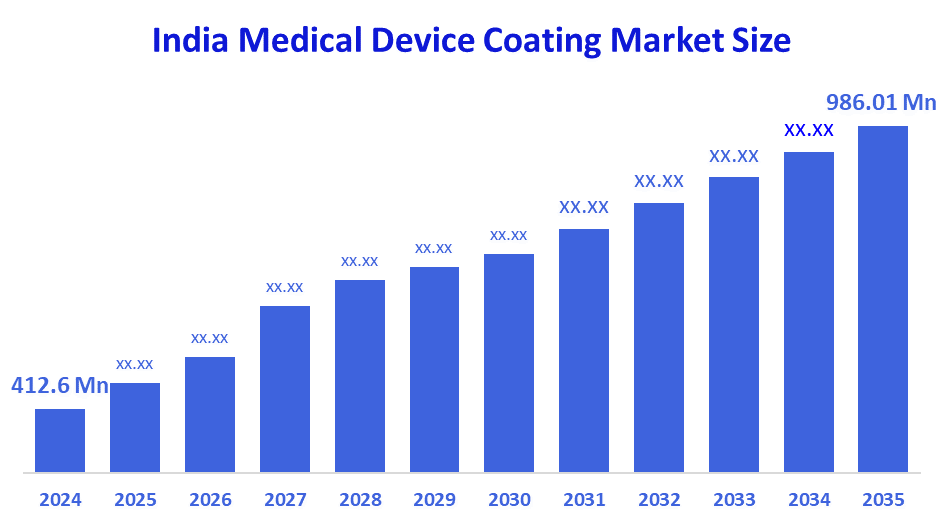

- India Medical Device Coating Market Size 2024: USD 412.6 Mn

- India Medical Device Coating Market Size 2035: USD 986.01 Mn

- India Medical Device Coating Market CAGR (2025-2035): 8.24%

- India Medical Device Coating Market Segments: Product and Application

Medical device coatings improve biocompatibility, durability, lubricity, infection resistance, and controlled drug delivery when the device is used in the clinic. In India, these coatings are extensively used on catheters, stents, guidewires, implants, and surgical instruments to improve their performance and ensure patient safety. The applications go through the cardiovascular system, neurology, orthopaedics, general surgery, dentistry, and gynaecology, in which precision and low risk of complications are paramount.

The demand for the market is influenced by the increase in the prevalence of cardiovascular diseases, the number of orthopaedic and neurological interventions, as well as the rise in the adoption of minimally invasive and catheter, based procedures. Moreover, the proliferation of tertiary care hospitals and the increased number of surgeries in both public and private healthcare facilities are further enabling the use of coatings. The technological improvements in hydrophilic, antimicrobial, anti, thrombogenic, and drug, eluting coatings are facilitating the devices to be efficient by lessening the friction, infection prevention, and enabling localized drug release.

Among other government initiatives, such as Make in India, the Production Linked Incentive (PLI) Scheme for Medical Devices, and more stringent regulatory frameworks by CDSCO, they all have the effect of promoting domestic manufacturing and technology use. The rise in medical device imports, the expansion of exports, and the increased number of partnerships between global coating providers and Indian manufacturers are some of the long, term growth possibilities that have been created.

Market Dynamics of the India Medical Device Coating Market:

The India medical device coating market is essentially driven by the increasing number of surgical procedures, the rising prevalence of cardiovascular, orthopaedic, and neurological disorders, and the growing application of minimally invasive and catheter, based interventions. The trend towards infection prevention, better device performance, and fewer procedural complications is, therefore, contributing more to the demand for advanced coated medical devices.

Market growth is limited by factors such as the high cost of advanced coating technologies, long validation and approval times, and a scarce number of specialized coating capabilities in the domestic manufacturing ecosystems. Besides that, cost sensitivity among healthcare providers and medical device pricing pressures can hinder the adoption of premium coating solutions to the full extent.

There are substantial openings mainly because of the increasing demand for coated implants, catheters, and guidewires, the rising investments in the next generation of coating materials, and the growth of tertiary and super, specialty healthcare sectors. The ties between international coating technology suppliers and Indian medical device manufacturers will likely foster innovation, enhance local capabilities, and facilitate the market extension in the long run.

Market Segmentation

The India Medical Device Coating Market share is classified into product and application.

By Product:

The India medical device coating market is divided by product into hydrophilic coatings, anti-microbial coatings, drug-eluting coatings, anti-thrombogenic coatings, and others. Among these, hydrophilic coatings dominated the share in 2024 and are expected to grow at a remarkable CAGR. Growth mainly comes from their features of reducing friction, increasing device maneuverability, making procedural precision better, and being extensively used in catheters, guidewires, and minimally invasive interventions in Indian hospitals.

By Application:

The India medical device coating market is divided by application into neurology, orthopaedics, general surgery, cardiovascular, dentistry, gynaecology, and others. Among these, the cardiovascular segment dominated the share in 2024 and is anticipated to grow at a notable CAGR. The expansion of this market is fueled by the higher volume of cardiovascular procedures, the more frequent use of coated stents and catheters, the need for a lower risk of thrombosis, and the preference for high, performance coated devices in complex interventions.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India medical device coating market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Medical Device Coating Market:

- Surmodics Inc

- DSM

- Covalon Technologies Ltd

- Materion Corp

- SONO-Tek Corporation

- Hydromer

- Infinity Biotech

Recent Developments in India Medical Device Coating Market:

In March 2024, the Department of Pharmaceuticals (Government of India) changed the Production Linked Incentive (PLI) Scheme for Medical Devices. The new scheme continues to provide incentives for the domestic production of medical device components of high value, increases the scale for coated products and, therefore, supply chains, local technology adoption and investor confidence in Indias coated device ecosystem are getting strengthened indirectly.

In October 2023, the Central Drugs Standard Control Organization (CDSCO) provided definitive guidance to the regulatory authorities concerning their oversight of medical devices that have been notified, which also includes surface treatments. The revised compliance setup essentially revolves around biocompatibility and material safety, thus, leading to a greater demand for certified hydrophilic and antimicrobial coatings that can satisfy the performance and safety requirements of surgical and implantable devices.

In July 2023, the Ministry of Health and Family Welfare (Government of India) issued the updated National Guidelines on Infection Prevention and Control for healthcare facilities. These guidelines emphasize the devices that can limit hospital, acquired infections, thus antimicrobial and anti, thrombogenic coatings on invasive and critical care devices are getting preferred more and more by the institutions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the India medical device coating market based on the following segments:

India Medical Device Coating Market, By Product

- Hydrophilic Coatings

- Anti-microbial Coatings

- Drug-eluting Coatings

- Anti-thrombogenic Coatings

- Others

India Medical Device Coating Market, By Application

- Neurology

- Orthopaedics

- General Surgery

- Cardiovascular

- Dentistry

- Gynaecology

- Others

FAQ

Q: What is the India Medical Device Coating Market size?

A: The India Medical Device Coating Market is expected to grow from USD 412.6 million in 2024 to USD 986.01 million by 2035, expanding at a CAGR of 8.24% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by increasing surgical volumes, rising prevalence of cardiovascular, orthopaedic, and neurological disorders, higher adoption of minimally invasive procedures, and growing demand for advanced coated medical devices.

Q: What factors restrain the India Medical Device Coating Market?

A: Market restraints include high costs of advanced coating technologies, long validation and approval times, limited availability of specialized coating expertise, and pricing pressures within healthcare procurement systems.

Q: What are the major opportunities in this market?

A: Significant opportunities exist from rising demand for coated implants, catheters, and guidewires, increasing investments in next-generation coating materials, growth of tertiary and super-specialty hospitals, and collaborations between international coating providers and Indian device manufacturers.

Q: How is the market segmented by product?

A: The market is segmented into hydrophilic coatings, anti-microbial coatings, drug-eluting coatings, anti-thrombogenic coatings, and others.

Q: How is the market segmented by application?

A: The market is segmented into neurology, orthopaedics, general surgery, cardiovascular, dentistry, gynaecology, and others.

Q: Who are the key players in the India Medical Device Coating Market?

A: Top companies include Surmodics Inc, DSM, Covalon Technologies Ltd, Materion Corp, SONO-Tek Corporation, Hydromer, and Infinity Biotech.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |