India Petrochemicals Market

India Petrochemicals Market Size, Share, and COVID-19 Impact Analysis, By Product (Methanol, Propylene, Benzene, Ethylene, Butadiene, Xylene, Toluene, Styrene, Vinyls, and Others), By End Use (Aerospace, Agriculture, Automotive, Building & Construction, Consumer & Industrial Goods, and Others), and India Petrochemicals Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

India Petrochemicals Market Insights Forecasts to 2035

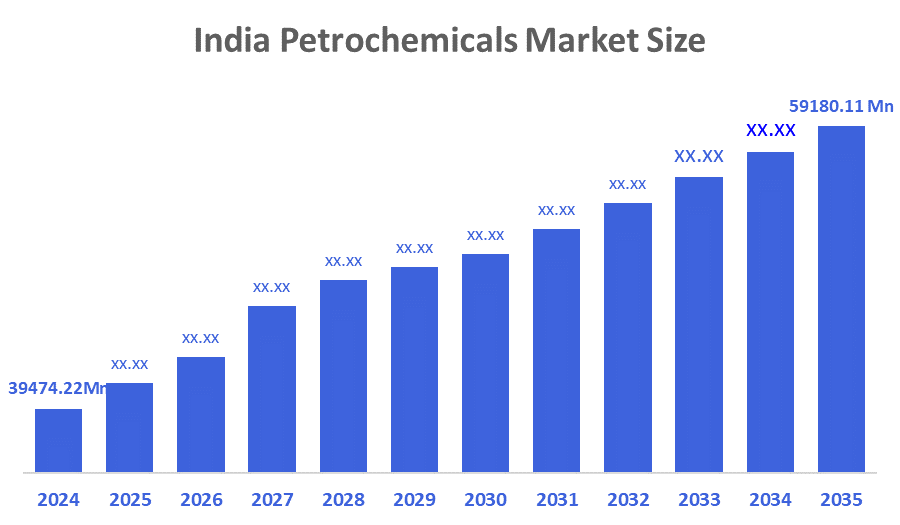

- The India Petrochemicals Market Size was estimated at USD 39474.22 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.75% from 2025 to 2035

- The India Petrochemicals Market Size is Expected to Reach USD 59180.11 Million by 2035

According To a Research Report Published By Decisions Advisors and Consulting, The India Petrochemicals Market Size Is Anticipated To Reach USD 59180.11 Million By 2035, Growing At a CAGR Of 3.75% from 2025 to 2035. The market development is being accelerated by increased demand for plastics and polymers in the packaging, automotive, and construction industries, as well as government programs such as the PLI plan. Moreover, the growing urbanisation, rising disposable income, and a shift toward sustainable bio-based chemicals all contribute to India's petrochemical market share. Export prospects and refinery expansions both contribute to industry growth.

Market Overview

The Indian petrochemicals market refers to the industry focused on the manufacture, transport, and consumption of chemical-related products made primarily from natural gas and petroleum are all covered in the petrochemical sector. These substances, which include butadiene, methanol, ethylene, propylene, benzene, toluene, and xylene, serve as vital building blocks for a variety of downstream goods. Further, its extensive integration with the global manufacturing, transportation, infrastructure, and consumer products sectors, the market vital to the larger chemical industry. Petrochemicals are essential to today's economy since they serve as the foundation for a wide range of products, including plastics, synthetic rubber, fertilisers, solvents, textiles, detergents, and pharmaceuticals. They are essential for promoting industrialisation, technological development, and urban growth due to their adaptability and affordability. India's petrochemical industry is on a solid growth path, aided by large-scale investments, government policies, and continued private-sector participation, to build a strong and self-sufficient petrochemical sector in the future.

India ranks fourth in the world (after the USA, China, and Japan) in terms of refining capacity, with a refining representation of roughly 256.816 MMTPA among 23 refineries and a robust petrochemical environment.

The government's Petroleum, Chemicals & Petrochemicals Investment Regions (PCPIRs) policy, which aims to draw investments totalling $142 billion by 2025, and the National Petrochemical Policy, which promotes capacity expansion, downstream industry development, and improvements in supply chain efficiency, are two major initiatives propelling this growth. Haldia Petrochemicals, Reliance Industries, ONGC, BPCL, Indian Oil Corporation, and other major Indian corporations are making significant investments in large-scale refinery and petrochemical complexes.

India's initiative, the Oilfields Amendment Bill 2025 and the Hydrocarbon Exploration and Licensing Policy (HELP), aims to increase the exploration area to one million square kilometres by 2030 to increase its reserves to 651.8 million metric tonnes (MMT) of crude oil and 1,138.6 billion cubic meters (BCM) of natural gas.

Report Coverage

This research report categorises the market for the India petrochemicals market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India petrochemicals market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India petrochemicals market.

Driving Factors

The shift toward sustainable, bio-based petrochemical products, spurred by increased environmental consciousness and stringent government regulations, is mainly driving the growth of the Indian petrochemicals market. Companies are investing in bio-based alternatives to traditional plastics, such as biodegradable polymers and bio-polyethene, to decrease their carbon footprints, which opens up wide market opportunities. Moreover, this trend is being accelerated by government measures like the Plastic Waste Management Rules and the Extended Producer Responsibility (EPR) framework that boost the market expansion. In line with global sustainability objectives, major businesses such as Reliance Industries and Indian Oil Corporation are expanding their portfolios of bio-based products that assist the market development. The requirement for petrochemical derivatives is further fueled by the increased emphasis on lightweight and high-performance materials, which supports steady market expansion. Furthermore, digitisation and Industry 4.0 adoption within petrochemical manufacturing offer pathways to enhance operational efficiency, cut costs, and improve environmental performance, hence unleashing new opportunities.

According to S&P Global Commodity Insights (2025), India is set to become a petrochemicals powerhouse with a planned capital expenditure (capex) push of ?3,28,227 crore (USD $37 billion) over the next decade. This investment will significantly expand India’s petrochemical capacity, reduce import dependence, and strengthen its position in the global chemicals market.

Restraining Factors

Despite enormous market growth, the petrochemicals industry in India suffers from several problems, including high feedstock dependency, environmental regulations, and infrastructure deficiencies. Furthermore, established petrochemical companies are facing fierce rivalry due to the emergence of bio-based substitutes and a growing focus on sustainable economic approaches, which may restrict market growth.

Market Segmentation

The India petrochemicals market share is classified into product and end use.

The ethylene segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The India petrochemicals market is segmented by product into methanol, propylene, benzene, ethylene, butadiene, xylene, toluene, styrene, vinyls and others. Among these, the ethylene segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. This is because of its versatility with a wide range of applications and large volume consumption in various end-use industries. Ethylene is a crucial feedstock for the synthesis of ethylene oxide, ethylene dichloride, polyethene (HDPE, LDPE, and LLDPE), and other necessary chemicals used in consumer products, packaging, building materials, automotive components, and textiles. The increasing global demand for lightweight, durable, and cost-effective packaging materials, particularly in the food and e-commerce sectors, continues to boost the segment revenue.

- The consumer & industrial goods segment held a substantial share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The India petrochemicals market is segmented by end use into aerospace, agriculture, automotive, building & construction, consumer & industrial goods, and others. Among these, the consumer & industrial goods segment held a substantial share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment growth is driven by high demand in the packaging industry, which is expanding due to the consumer goods rapid growth with e-commerce, and the need for robust, lightweight packing materials. Moreover, the food industry is also a main driver of the rising demand for packaging materials, which could result in segment expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India petrochemicals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Reliance Industries Limited (RIL)

- Indian Oil Corporation Limited (IOCL)

- Haldia Petrochemicals Limited

- GAIL Petrochemicals

- Kothari Petrochemicals Limited

- BASF India Limited

- SRF Limited

- UPL Limited

- Aarti Industries Limited

- Deepak Nitrite Limited

- Godrej Industries Limited

- Linde India Limited

- Tata Chemicals Limited

- other

Recent Developments:

- In July 2025, Manali Petrochemicals Ltd. (MPL) expanded its propylene glycol (PG) production capacity in India to support the government’s Make in India initiative. This move strengthens domestic supply, reduces import dependence, and positions MPL as a key player in India’s petrochemical sector.

- In April 2025, Indian Oil Corporation Ltd. (IOC) signed an MoU with the Government of Odisha to invest ?61,077 crore in a world-class petrochemical complex at Paradip, marking IOC’s largest single-location investment. Supports India’s push for self-reliance in petrochemicals and reduces import dependence. Boosts Odisha’s industrial ecosystem, leveraging its coastal advantage for exports.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the India petrochemicals market based on the below-mentioned segments:

India Petrochemicals Market, By Product

- Methanol

- Propylene

- Benzene

- Ethylene

- Butadiene

- Xylene

- Toluene

- Styrene

- Vinyls

- Others

India Petrochemicals Market, By End Use

- Aerospace

- Agriculture

- Automotive

- Building & Construction

- Consumer & Industrial Goods

- Others

FAQ

- What is the market size and growth forecast?

The market was valued at USD 39,474.22 million in 2024 and is expected to reach USD 59,180.11 million by 2035, driven by a 3.75% CAGR, fueled by demand in the packaging, automotive, and construction sectors.?

- What are the main drivers?

Growth stems from rising plastics and polymers demand, urbanisation, disposable income increases, government PLI schemes, refinery expansions, and a shift to sustainable bio-based chemicals.?

- Which product segment leads?

Ethylene dominated in 2024 due to its versatility in producing polyethene, ethylene oxide, and other chemicals for packaging, construction, and textiles, with a strong projected CAGR.?

- What end-use segment is prominent?

Building & construction held a substantial share in 2024, growing rapidly from demand for plastics in pipes, insulation, roofing, adhesives, and sealants.?

- What are the key government initiatives?

Policies include PCPIRs targeting $142 billion investments by 2025, the National Petrochemical Policy for capacity expansion, the Oilfields Amendment Bill 2025, and HELP to boost reserves.?

- Who are the major companies?

Key players: Reliance Industries Limited, Indian Oil Corporation Limited, Haldia Petrochemicals, GAIL Petrochemicals, BASF India, SRF Limited, UPL Limited, and others.?

- What recent developments occurred?

IOC signed an MoU for ?61,077 crore Paradip complex (April 2025); Manali Petrochemicals expanded propylene glycol capacity (July 2025).?

- What challenges exist?

High feedstock dependency, environmental regulations, infrastructure gaps, and competition from bio-based alternatives restrain growth.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |