India Q-Commerce Market

India Q-Commerce Market Size, Share, By Product Category (Grocery and Staples, Fresh Produce and Dairy, and Others), By Delivery Time Promise (? 10 Minutes, 11?30 Minutes, 31?60 Minutes), By City Tier (Tier I Metros, Tier II Cities, and Tier III & Below), India Q-Commerce Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

India Q-Commerce Market Size Insights Forecasts to 2035

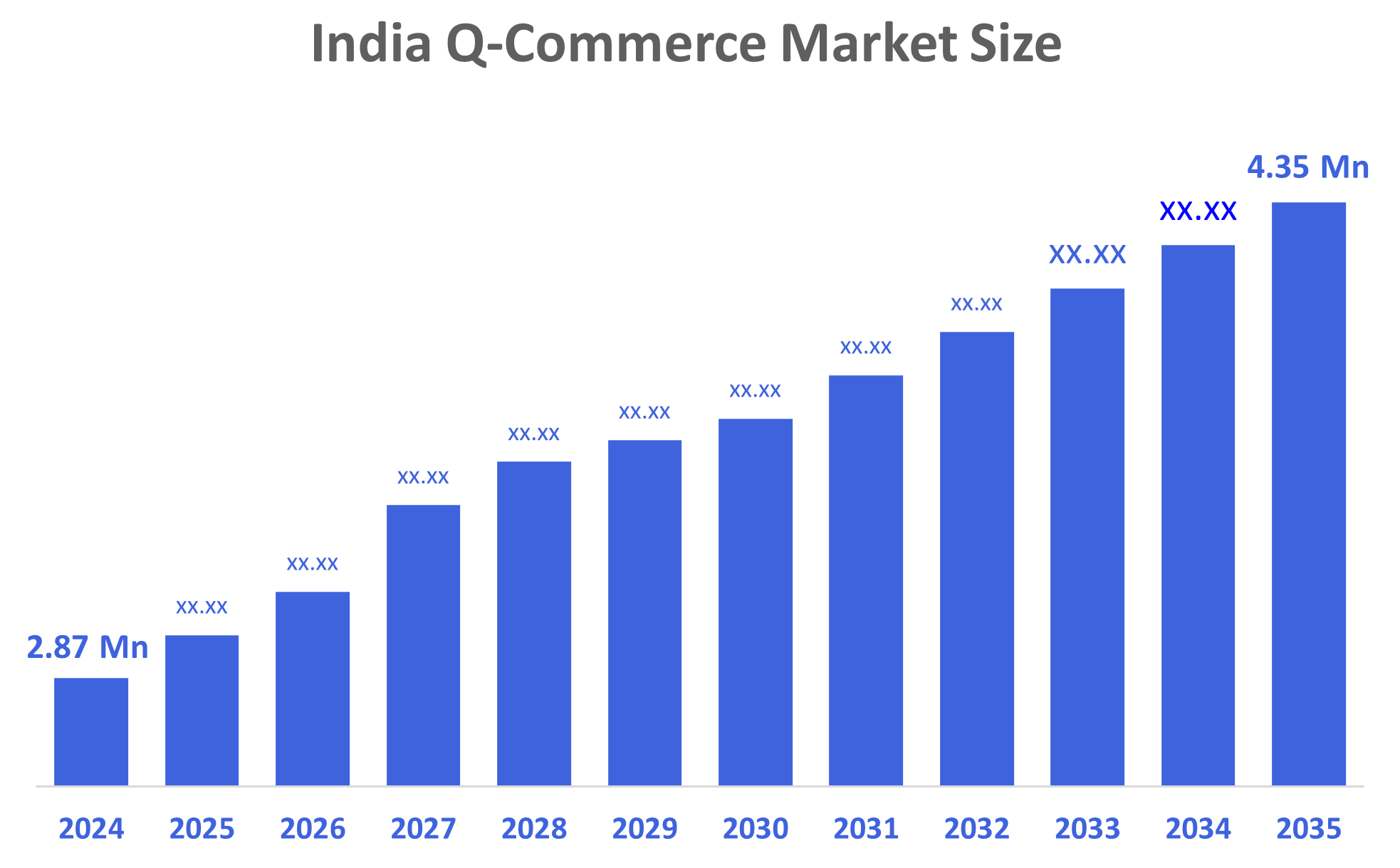

- India Q-Commerce Market Size 2024: USD 2.87 Bn

- India Q-Commerce Market Size 2035: USD 4.35 Bn

- India Q-Commerce Market CAGR 2024: 3.9%

- India Q-Commerce Market Segments: Product Category, Delivery Time Promise, and City Tier

The India Q-Commerce Market Size consists of ultra, fast online delivery services that allow consumers to get daily essentials and convenience products within minutes of placing an order. These platforms primarily deal with groceries, fresh produce, dairy products, personal care products, and household necessities, and they operate through dark stores and hyper, local fulfillment centers. The market is getting popular due to increasing smartphone penetration, growing digital payment adoption, and rising consumer demand for speed and convenience in urban lifestyles.

Market growth is also fueled by rapid urbanization, increasing working population, and time, constrained consumers in metropolitan and emerging cities. Investments in dark store infrastructure, sophisticated logistics, route optimization technologies, and AI, driven demand forecasting are helping delivery efficiency to increase. Besides that, the quick commerce platforms' presence in tier II and tier III cities is creating a larger consumer base, while the customers' loyalty is getting strengthened through competitive pricing and subscription, based benefits.

Market Dynamics of the India Q- commerce market:

The India Q-Commerce Market Size is primarily influenced by the changing behaviour of consumers who demand instant gratification, the increasing use of app, based grocery and essential delivery, and the internet penetration that is spreading in both urban and semi, urban areas. The rise of organized retail, the availability of venture capital funding, and the technological advancements in last, mile delivery solutions are, therefore, the few factors that are further accelerating the expansion of the market. The strong demand for quick access to essentials during emergencies and for daily consumption needs is, thus, the main reason for the continuous market growth.

The India Q-Commerce Market Size is constrained with issues such as high operational costs, thin profit margins, logistics inefficiencies, limited scalability in low, density areas, and severe competition among key players. Besides, the high dependence on dark store economics and the availability of delivery personnel also affects the sustainability of operations.

The India market for Q-commerce has significant potentials for growth by extending to the tier II and tier III cities, launching more private, label products, streamlining delivery timelines, and implementing AI, based inventory management systems. The collaborations with FMCG brands, local suppliers, and digital payment platforms will thus facilitate the profitability and expansion of the market.

Market Segmentation

The India Q-Commerce Market share is classified into product category, delivery time promise, and city tier.

By Product Category:

The India Q-Commerce Market Size is divided by product category into grocery and staples, fresh produce and dairy, and others. Among these, the grocery and staples segment dominated the share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. Growth is mainly driven by daily consumption necessities, a very high number of repeat purchases, price sensitivity, and consumers preference for the immediate replenishment of their essential household items, which makes grocery and staples the most stable and highest, volume categories for Q, commerce platforms.

By Delivery Time Promise:

The India Q-Commerce Market Size is divided by delivery time promise into ≤ 10 minutes, 11-30 minutes, and 31-60 minutes. Among these, the ≤ 10 minutes segment dominated the share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This segment increases due to consumer demand for instant gratification, availability of nearby dark stores, an efficient rider network, and AI, based route optimization, which makes ultra, fast delivery a powerful differentiating factor in densely populated urban markets.

By City Tier:

The India Q-Commerce Market Size is divided by city tier into tier I metros, tier II cities, and tier III & below. Among these, tier I metros dominated the share in 2024 and are expected to grow at a remarkable CAGR during the forecast period. Tier I metros are the main contributors to growth due to dense populations, higher disposable incomes, strong smartphone penetration, digital payment adoption, and a well, developed logistics infrastructure that enables cost, effective and rapid Q, commerce operations. The Japan Clinical Trials Support Services Market share is classified into phase type and service.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Q-commerce market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Q-commerce market:

- Swiggy Limited

- Zepto Marketplace Private Limited

- JioMart (Reliance Retail Ltd.)

- Blinkit (Blink Commerce Private Limited)

- Flipkart Minutes (Flipkart.com)

- bigbasket.com (Supermarket Grocery Supplies Pvt Ltd)

- Amazon Fresh (Amazon.com, Inc.)

- Licious (Delightful Gourmet Pvt Ltd.)

- Nature's Basket

- Freshtohome

- Jiffy (Spencers)

- PharmEasy

- Tata 1mg

- Apollo 24|7

- Milkbasket

Recent Developments in India Q-commerce market:

In May 2025, Zomato pumped INR 1, 500 crores into Blinkit to fuel rapid expansion and scale up dark stores. With this funding, Blinkit is able to open more dark stores closer to customers, thus reducing delivery times and increasing order volumes, which in turn, elevates their competitive advantage in ultra, fast grocery and essentials delivery.

In May 2025, Flipkart Minutes has laid out a major plan to invest significantly in the expansion of its dark store network, initially aiming at ~800 stores and then further scaling toward ~1, 000 stores by 2026. The expansion of dark stores leads to a higher store density in urban areas, which makes the fulfillment faster, inventory availability can be improved, and service penetration can get deeper, thus customer satisfaction can increase and customer loyalty can be retained.

In April 2025, Reliance Retail has achieved ~2.4 order growth and made sub-30-minute delivery possible across 4, 000+ pin codes through Jio Marts hyperlocal network. Fast delivery in more pin codes enables JioMart to reach a greater number of customers outside metro cores, thus having the opportunity to capture a bigger market share and also be able to respond to the increasing demand for quick delivery of groceries and essentials.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the India Q-Commerce Market Size based on the below-mentioned segments:

India Q-Commerce Market, By Product Category

- Grocery and Staples

- Fresh Produce and Dairy

- Others

India Q-Commerce Market, By Delivery Time Promise

- ≤ 10 Minutes

- 11–30 Minutes

- 31–60 Minutes

India Q-Commerce Market, By City Tier

- Tier I Metros

- Tier II Cities

- Tier III & Below

FAQ

Q: What is the India Q-Commerce market size?

A: India Q-Commerce market size is expected to grow from USD 2.87 billion in 2024 to USD 4.35 billion by 2035, growing at a CAGR of 3.9% during the forecast period 2025-2035.

Q: What are the key growth drivers of the India Q-Commerce market?

A: Market growth is driven by increasing smartphone penetration, growing digital payment adoption, rising consumer demand for speed and convenience, rapid urbanization, expanding working population, and investments in dark store infrastructure and AI-driven logistics.

Q: What factors restrain the India Q-Commerce market?

A: Constraints include high operational costs, thin profit margins, logistics inefficiencies, limited scalability in low-density areas, severe competition among key players, dependence on dark store economics, and availability of delivery personnel.

Q: How is the India Q-Commerce market segmented by product category?

A: The market is segmented into Grocery and Staples, Fresh Produce and Dairy, and Others.

Q: How is the India Q-Commerce market segmented by delivery time promise?

A: The market is segmented into ≤ 10 Minutes, 11-30 Minutes, and 31-60 Minutes.

Q: How is the India Q-Commerce market segmented by city tier?

A: The market is segmented into Tier I Metros, Tier II Cities, and Tier III & Below.

Q: Who are the key players in the India Q-Commerce market?

A: Key companies include Swiggy Limited, Zepto Marketplace Private Limited, JioMart (Reliance Retail Ltd.), Blinkit (Blink Commerce Private Limited), Flipkart Minutes (Flipkart.com), bigbasket.com (Supermarket Grocery Supplies Pvt Ltd), Amazon Fresh (Amazon.com, Inc.), Licious (Delightful Gourmet Pvt Ltd.), Nature's Basket, Freshtohome, Jiffy (Spencers), PharmEasy, Tata 1mg, Apollo 24|7, and Milkbasket.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |