India Spectacles Market

India Spectacles Market Size, Share, And COVID-19 Impact Analysis, By Product Type (Prescription Spectacles, Sunglasses), By Lens Type (Single Vision, Bifocal, Progressive), By Distribution Channel (Retail Optical Stores, Online Platforms), By End User (Adults, Children) And India Spectacles Market Insights, Industry Trend, Forecast To 2035

Report Overview

Table of Contents

India Spectacles Market Insights Forecast to 2035

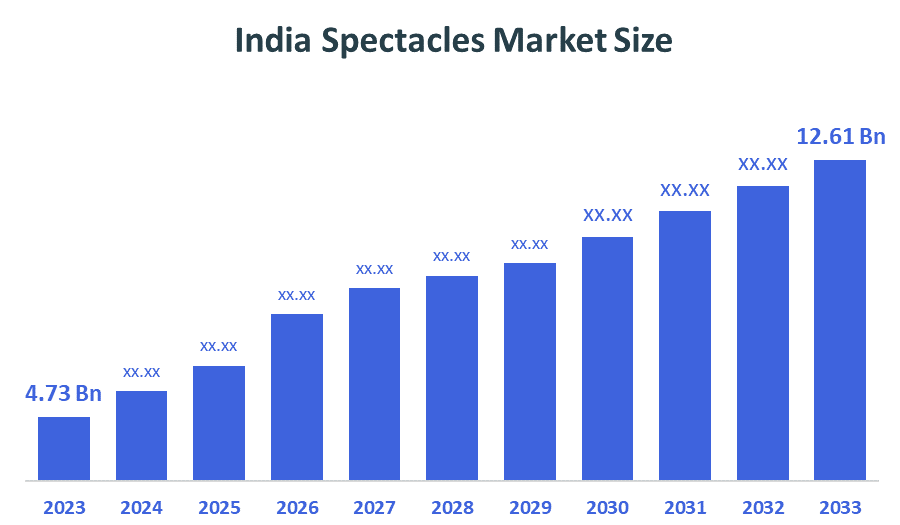

- India Spectacles Market Size Was Estimated at USD 4.73 Billion in 2024.

- The Market Size is Expected to Grow at a CAGR of 9.32% from 2025 to 2035.

- India Spectacles Market Size is Expected to Reach USD 12.61 Billion by 2035.

According to Industry Research, the Decision Advisior Market Size is projected to reach USD 12.61 Billion by 2035, growing at a CAGR of 9.32% from 2025 to 2035. The India spectacles market is growing due to rising digital screen usage that is increasing vision problems, alongside a shift toward fashionable eyewear, expanding organised optical retail presence, and the rapid acceptance of online eyewear platforms that make products more accessible nationwide.

Market Overview

Spectacles are eyewear used to correct vision problems like myopia, hyperopia, and astigmatism and to protect eyes from digital strain and environmental stress. They include prescription glasses, sunglasses, and protective eyewear with features like UV protection, anti-glare coating, blue-light filters, and scratch-resistant lenses. Moreover, the Indian market is growing due to rising screen time across all age groups, increased early vision screening, and higher awareness of eye health. Organised optical retail expansion, adoption of digital eye-testing technologies, and online eyewear platforms are shaping consumer buying preferences. Innovations such as lightweight frames, advanced lens coatings, and AI-driven virtual try-on tools are enhancing user convenience and experience. Government support through the National Programme for Control of Blindness and Visual Impairment (NPCBVI) includes over 98 lakh cataract surgeries in FY 2024-25 and free spectacles for 12 lakh school children. With technology, retail expansion, and strong government backing, the market is set for robust growth.

Report Coverage

This research report categorizes the market for the India spectacles market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India spectacles market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India spectacles market.

Driving Factors

The India spectacles market growth is driven by rising digital screen usage, which has increased the prevalence of refractive errors and eye strain. Growing awareness about vision care and corrective eyewear adoption is supporting market expansion. Additionally, the rising demand for fashionable and premium frames, rapid expansion of organised optical retail chains, and increasing penetration of online eyewear platforms are enhancing accessibility and convenience, further fueling the overall market growth.

Restraining Factors

The India spectacles market is restrained by high price sensitivity in rural areas, limiting adoption of branded eyewear. Additionally, unorganised sellers and counterfeit products reduce consumer trust, while limited awareness of routine eye check-ups restricts consistent demand growth.

Market Segmentation

The India spectacles market share is categorized by product type, lens type, distribution channel, and end user

- The prescription spectacles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India spectacles market is segmented by product type into prescription spectacles and sunglasses. Among these, the prescription spectacles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth is driven by rising prevalence of refractive errors, increasing adoption of corrective eyewear, government-supported vision screening initiatives, and growing awareness of eye health across both urban and semi-urban populations.

- The single-vision lenses segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The India spectacles market is segmented by lens type into single-vision, bifocal, and progressive lenses. Among these, the single-vision lenses segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Growth is fueled by increasing myopia and hyperopia cases among students and working adults, demand for affordable lens solutions, and adoption of lenses with blue-light and anti-glare features to reduce digital eye strain.

- The retail optical stores segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India spectacles market is segmented by distribution channel into retail optical stores and online platforms. Among these, the retail optical stores segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Growth is driven by strong consumer trust in in-store eye testing, personalised frame fittings, availability of premium and branded eyewear, and the continuous expansion of organised optical retail chains in urban and semi-urban regions.

- The adults segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The India spectacles market is segmented by end user into adults and children. Among these, the adults segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of this segment is due to higher digital screen exposure, rising occupational eye strain, preference for stylish and premium eyewear, and increasing awareness of vision care and corrective solutions among working-age populations.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within The India spectacles market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lenskart

- Titan Eyeplus

- GKB Opticals

- Vision Express

- Specsmakers

- Lawrence & Mayo

- Ben Franklin

- Coolwinks

- EssilorLuxottica India

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, less than three months after signing an MoU with the Telangana government to invest ?1,500 crore in eyewear manufacturing, Lenskart has commenced construction of the world’s largest eyewear facility at Tukkuguda, located on the outskirts of Hyderabad

- In October 2025, With Lenskart’s IPO scheduled for listing on 31 October 2025, India’s rapidly growing eyewear market has come into sharp focus. Rising screen time, increasing visual health issues, and demand for fashion-driven eyewear are propelling industry growth, making the timing of Lenskart’s IPO particularly significant.

- Market Segment

- This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Decision Advisior has segmented The India Spectacles Market based on the below-mentioned segments:

India Spectacles Market, By Product Type

- Prescription Spectacles

- Sunglasses

India Spectacles Market, By Lens Type

- Single Vision

- Bifocal

- Progressive

India Spectacles Market, By Distribution Channel

- Retail Optical Stores

- Online Platforms

India Spectacles Market, By End User

- Adults

- Children

FAQ’s

Q. What is the projected market size & growth rate of the India spectacles market?

A. India spectacles market was valued at USD 4.73 billion in 2024 and is projected to reach USD 12.61 billion by 2035, growing at a CAGR of 9.32% from 2025 to 2035.

Q. What are the key driving factors for the growth of the India spectacles market?

A. The India spectacles market is driven by rising digital screen usage, increasing prevalence of refractive errors, growing demand for fashionable eyewear, expansion of organised optical retail chains, and rising adoption of online eyewear platforms.

Q. What are the top players operating in the India spectacles market?

A. Lenskart, Titan Eyeplus, GKB Opticals, Vision Express, Specsmakers, Lawrence & Mayo, Ben Franklin, Coolwinks, EssilorLuxottica India, Others.

Q. What segments are covered in the India spectacles market report?

A. The India spectacles market is segmented based on Product Type, Lens Type, Distribution Channel, and End User.

Q. Which product type dominates the India spectacles market?

A. Prescription spectacles hold the largest share due to higher adoption for vision correction, government-supported vision screening initiatives, and increasing awareness of eye health.

Q. Which lens type is most popular in the India spectacles market?

A. Single-vision lenses dominate, driven by affordability, rising cases of myopia and hyperopia, and demand for anti-glare and blue-light protective features.

Q. Which end user contributes most to the India spectacles market growth?

A. Adults dominate due to high digital screen exposure, occupational eye strain, and preference for stylish and premium eyewear solutions.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 170 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |