India Steel Market

India Steel Market Size, Share, And COVID-19 Impact Analysis, By Product (Bar, Wire Rod, Hot Rolled Sheets, Cold Rolled Sheets, And Others), By Type (Flat And Long), By Technology (Blast Furnace-Basic Oxygen Furnace, Electric Arc Furnace, And Other Technologies), By Application (Building & Construction, Automotive, Consumer Goods, Heavy Industry, And Others), And India Steel Market Insights, Industry Trend, Forecast To 2035

Report Overview

Table of Contents

India Steel Market Insights Forecasts to 2035

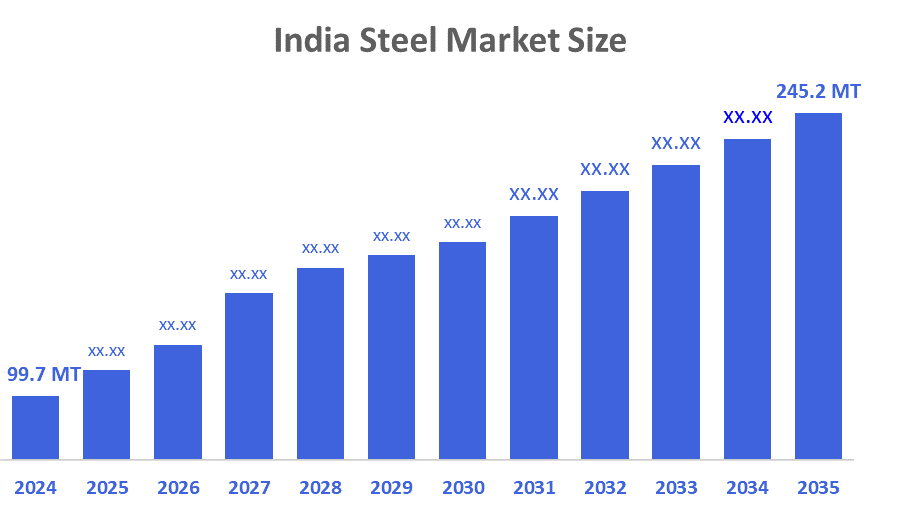

- India Steel Market Size 2024: 99.7 million tons

- India Steel Market Size 2035: 245.2 million tons

- India Steel Market CAGR 2024: 8.52%

- India Steel Market Segments: Product, Type, Technology, and Application

The India steel market encompasses all activities related to the production, consumption, trade, and economic activity associated with steel manufacturing and consumption in India, from the production of raw steel to that of finished steel. As one of the largest producers of crude steel in the world, India has seen a tremendous increase in domestic steel consumption driven primarily by the rapid expansion of capacity an increase in automotive manufacturing and automotive production, increased installation of renewable energy, and strong support from the Indian government through policy measures designed to promote capacity expansion, support domestic production of steel, and increase the overall consumption of steel.

The steel in India are backed by government support, based on the latest figures, India's steel consumption is 136 million tonnes; there is strong domestic demand for steel. Demand for steel in India is expected to grow from 136 million tonnes now to roughly 230 million tonnes by the year 2030–31, primarily because of the growth of the construction and infrastructure industries. The National Steel Policy (NSP) 2017 aims to boost crude steel capacity to 300 million tonnes by 2030–31 and significantly increase per capita steel consumption that encourage investment, modernization, and supports self-reliance in steel production propelling the steel market in India

As technology advances, Industry 4.0 is enabling the advancement of Indian steel manufacturers via the incorporation of technologies such as artificial intelligence, automation, data analytics, predictive analytics for better quality control, energy efficiency, etc. Additionally, there has been an increased emphasis placed on the use of electric arc furnaces (EAF) and hydrogen direct reduction iron as a means for decarbonization due to government support and large investments to modernise these operations to improve operational efficiency within the steel industry.

Market Dynamics of the India Steel Market:

The India steel market is driven by rapid growth in urbanization, impact of new infrastructure developments currently, large number of skilled workforces, ever-growing construction/housing development opportunities, increased automotive and manufacturing activities, large increases in renewable-friendly power generation technologies, and government support through policies designed to promote increased levels of steel use.

The India steel market is restrained by the high costs associated with raw materials & energy, fluctuations in prices of iron ore and coal, rising costs of complying with environmental regulations, reliance on imported coking coal, and changing global demand levels affecting prices and profitability of steel.

The future of India steel market is bright and promising, with versatile opportunities emerging from the massive infrastructure growth, huge government spending for construction steel, urbanization, self-reliance policies promote domestic production and use of Indian steel, increasing demand for automotive and machinery, and India’s cost competitiveness and quality steel products are in global demand.

Market Segmentation

The India Steel Market share is classified into product, type, technology, and application.

By Product:

The India steel market is divided by product into bar, wire rod, hot rolled sheets, cold rolled sheets, and others. Among these, the hot rolled sheets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Urbanization, massive demand from booming construction and automotive sectors, its cost effectiveness, high availability, inherent strength for structural uses, and versatility for applications like pipelines, heavy machinery, and railways all contribute to the hot rolled sheets segment's dominance and higher spending on steel when compared to other product.

By Type:

The India steel market is divided by type into flat and long. Among these, the flat segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The flat segment dominates because of massive demand from booming sectors like automotive, construction, and consumer goods, rapid urbanization, rise in disposable incomes, widely used in structural elements, and government support for development.

By Technology:

The India steel market is divided by technology into blast furnace-basic oxygen furnace, electric arc furnace, and other technologies. Among these, the blast furnace-basic oxygen furnace segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. by India’s abundant iron ore making it economically viable, established integrated steel plants leverage existing assets, and offering cost efficiency for massive production volumes, all contribute to the blast furnace-basic oxygen furnace segment's dominance and higher spending on steel when compared to other technology.

By Application:

The India steel market is divided by application into building & construction, automotive, consumer goods, heavy industry, and others. Among these, the building & construction segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The building & construction segment dominates because of massive government investment in highways, metro rail, housing, and urban projects, driving demand for structural steel, rebar, and other building materials, fueled by urbanization, and government development initiatives program.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India steel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Steel Market:

- Tata Steel Ltd.

- JSW Steel Ltd

- Steel Authority of India Ltd.

- Jindal Steel & Power Ltd.

- ArcelorMittal Nippon Steel India

- Jindal Stainless Ltd.

- Godawari Power and Ispat Ltd.

- Rashtriya Ispat Nigam Ltd.

- Shyam Steel Industries Ltd.

- Electrotherm (India) Ltd.

- Jai Balaji Group

- VISA Steel Limited

- Essar Steel India Ltd.

- ESL Steel Ltd

- Mukand Ltd.

- Others

Recent Developments in India Steel Market:

In May 2025, ArcelorMittal Nippon Steel India launched its new Optigal Prime and Optigal Pinnacle colors-coated steel products for construction and infrastructure, introducing European-standard, highly corrosion-resistant steel for major projects like airports, railways, and highways to support India’s “Viksit Bharat” initiative.

In January 2025, Tata Steel became the first Indian steel company to demonstrate end-to-end capabilities for developing steel pipes suitable for the transportation of pure hydrogen. This was the significant move towards enabling sustainable energy infrastructure in India.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan clinical trials support services market based on the below-mentioned segments:

India Steel Market, By Product

- Bar

- Wire Rod

- Hot Rolled Sheets

- Cold Rolled Sheets

- Others

India Steel Market, By Type

- Flat

- Long

India Steel Market, By Technology

- Blast Furnace-Basic Oxygen Furnace

- Electric Arc Furnace

- Other Technologies

India Steel Market, By Application

- Building & Construction

- Automotive

- Consumer Goods

- Heavy Industry

- Others

FAQ

Q: What is the India steel market size?

A: India steel market is expected to grow from 99.7 million tons in 2024 to 245.2 million tons by 2035, growing at a CAGR of 8.52% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the rapid growth in urbanization, impact of new infrastructure developments currently, large number of skilled workforces, ever-growing construction/housing development opportunities, increased automotive and manufacturing activities, large increases in renewable-friendly power generation technologies, and government support through policies designed to promote increased levels of steel use.

Q: What factors restrain the India steel market?

A: Constraints include the high costs associated with raw materials & energy, fluctuations in prices of iron ore and coal, rising costs of complying with environmental regulations, reliance on imported coking coal, and changing global demand levels affecting prices and profitability of steel.

Q: How is the market segmented by product?

A: The market is segmented into bar, wire rod, hot rolled sheets, cold rolled sheets, and others.

Q: Who are the key players in the India steel market?

A: Key companies include Tata Steel Ltd., JSW Steel Ltd, Steel Authority of India Ltd., Jindal Steel & Power Ltd., ArcelorMittal Nippon Steel India, Jindal Stainless Ltd., Godawari Power and Ispat Ltd., Rashtriya Ispat Nigam Ltd., Shyam Steel Industries Ltd., Electrotherm (India) Ltd., Jai Balaji Group, VISA Steel Limited, Essar Steel India Ltd., ESL Steel Ltd, Mukand Ltd., and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |