Global Industrial Copilot Market

Global Industrial Copilot Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Source of Scrap (Individual, Small & Medium Enterprises (SMEs), Large Enterprises, and Educational & Research Institutions), By Deployment Mode (Cloud-Based, On-Premises, and Edge Deployment), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Industrial Copilot Market Summary, Size & Emerging Trends

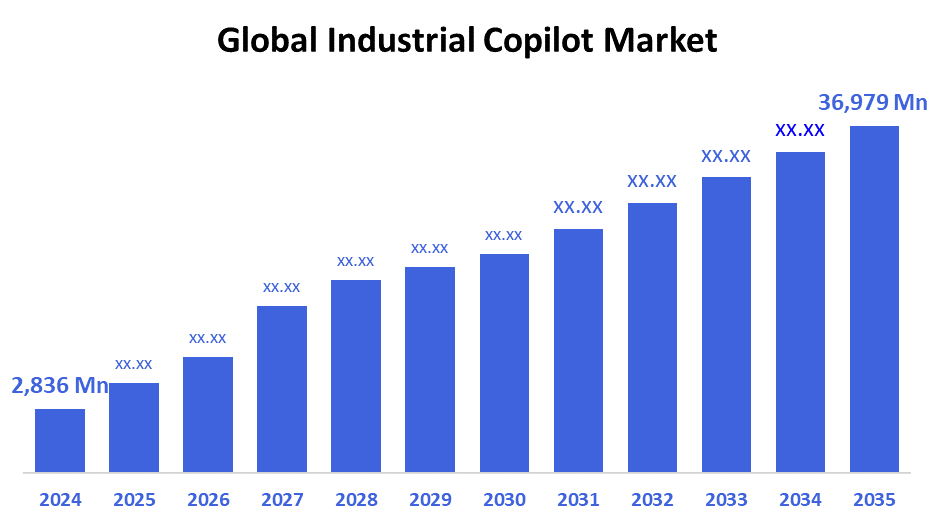

According to Decision Advisor, The Global Industrial Copilot Market Size is expected to grow from USD 2,836 Million in 2024 to USD 36,979 Million by 2035, at a CAGR of 26.3% during the forecast period 2025-2035. Increasing demand for lightweight, corrosion-resistant materials in packaging and electronics sectors is a key factor driving the industrial copilot market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the industrial copilot market during the forecast period.

- In terms of source of scrap, the small & medium enterprises (SMEs) segment dominated in terms of revenue during the forecast period.

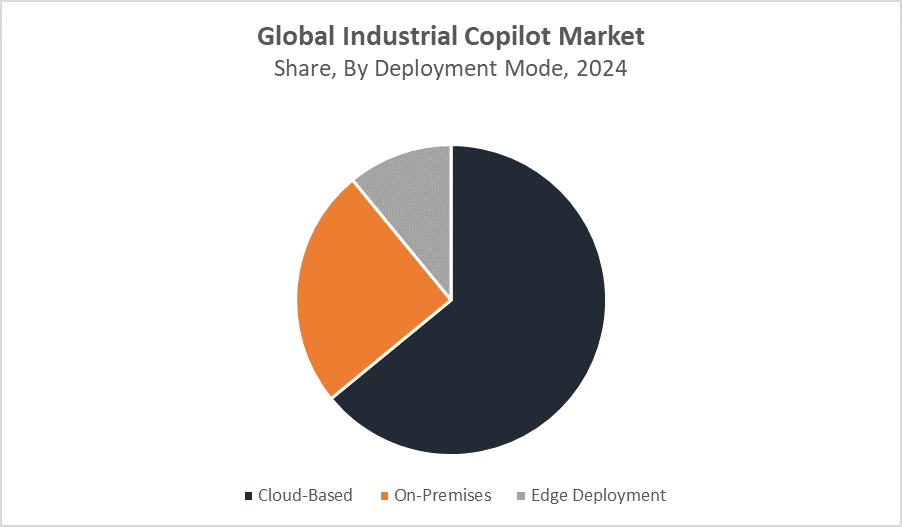

- In terms of deployment mode, the cloud-based segment accounted for the largest revenue share in the global industrial copilot market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2,836 Million

- 2035 Projected Market Size: USD 36,979 Million

- CAGR (2025-2035): 26.3%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Industrial Copilot Market

The industrial copilot market centers on AI-driven assistant systems that enhance industrial operations through real-time analytics, predictive maintenance, and automation. These solutions improve decision-making, reduce downtime, and boost safety and efficiency across manufacturing, logistics, and supply chain sectors. Growing adoption of Industry 4.0 and smart factory technologies is driving demand for industrial copilots. Governments globally support digital transformation by offering subsidies and incentives to integrate AI in industries. The rising emphasis on operational excellence and cost efficiency further fuels market growth. Industrial copilots enable companies to optimize processes, prevent failures before they occur, and respond swiftly to operational challenges. As industries increasingly embrace automation and data-driven strategies, the industrial copilot market is poised for steady expansion, becoming a critical component in modern industrial ecosystems focused on innovation and competitiveness.

Industrial Copilot Market Trends

- Growing integration of AI and machine learning to enhance predictive analytics and operational automation.

- Increasing deployment of cloud-based solutions to enable remote monitoring and management.

- Expansion of edge deployment to reduce latency and improve real-time decision-making capabilities.

Industrial Copilot Market Dynamics

Driving Factors: Growing demand for AI-driven process automation

The industrial copilot market is fueled by a growing demand for AI-driven process automation that enhances operational efficiency. Industries are increasingly adopting smart manufacturing technologies to optimize workflows, reduce costs, and minimise downtime through predictive maintenance identifying potential equipment failures before they occur. Government initiatives promoting digital transformation and Industry 4.0 adoption globally accelerate market growth by encouraging AI integration. Additionally, advancements in cloud computing and edge technologies make it easier to deploy industrial copilot solutions across diverse sectors, enabling real-time data processing and improved decision-making.

Restrain Factors: Cybersecurity risks can make industries cautious about adopting AI-driven systems

Market growth faces hurdles due to concerns around data security and integration complexities. Cybersecurity risks can make industries cautious about adopting AI-driven systems, especially when integrating with existing legacy infrastructure, which can be technically challenging and costly. The high initial investment required for AI solutions and limited skilled workforce further restrict adoption. Moreover, regulatory uncertainties surrounding AI applications create additional compliance challenges, slowing market expansion.

Opportunity: Advancements in AI and edge computing open new avenues for industrial copilots

Advancements in AI and edge computing open new avenues for industrial copilots, enabling more efficient operations with autonomous capabilities and enhanced predictive analytics. The demand for low-latency edge deployments is rising, especially in critical industrial environments. Emerging economies’ growing focus on Industry 4.0 and smart factory initiatives offers substantial market potential. Strategic collaborations between AI developers and industrial firms can drive innovation, broaden solution offerings, and accelerate market penetration.

Challenges: Data privacy remains a significant concern

Data privacy remains a significant concern, requiring stringent management and protection protocols. Uneven digital infrastructure across regions, especially in developing countries, hinders widespread adoption. Lack of standardization and interoperability among AI systems complicates integration efforts. Additionally, economic uncertainties and fluctuating investments in industrial sectors may impact the stability and growth of the market.

Global Industrial Copilot Market Ecosystem Analysis

The global industrial copilot market ecosystem consists of AI software developers, industrial hardware providers, system integrators, and end-users across manufacturing, logistics, and energy sectors. Key players focus on enhancing AI algorithms, developing user-friendly interfaces, and improving deployment flexibility through cloud and edge solutions. Collaboration among technology vendors, industry stakeholders, and regulatory bodies is vital to drive innovation and adoption while ensuring compliance and security.

Global Industrial Copilot Market, By Source of Scrap

The small & medium enterprises (SMEs) segment dominated the industrial copilot market in terms of revenue during the forecast period, capturing approximately 55% of the total market share. This dominance is attributed to SMEs increasingly adopting AI-driven solutions to enhance operational efficiency and stay competitive. SMEs benefit from the scalability and cost-effectiveness of industrial copilot systems, which help optimize processes and reduce downtime without requiring extensive infrastructure investments.

The large enterprises segment accounted for around 40% of the market revenue. Large enterprises are investing heavily in Industry 4.0 initiatives and comprehensive digital transformation strategies, driving demand for advanced AI-powered copilots. Their substantial capital resources and focus on innovation enable them to implement sophisticated systems that improve predictive maintenance and automation at scale. This segment is expected to maintain steady growth due to ongoing modernization efforts.

Global Industrial Copilot Market, By Deployment Mode

The cloud-based deployment segment accounted for the largest revenue share in the global industrial copilot market during the forecast period, holding approximately 60% of the market. This preference is driven by the flexibility, scalability, and cost-efficiency offered by cloud solutions. Cloud-based industrial copilots enable real-time data access and seamless updates, making them ideal for industries seeking quick deployment and remote monitoring capabilities. Additionally, the rise of cloud infrastructure providers and improved internet connectivity support broader adoption.

The on-premises deployment segment remains significant, capturing about 30% of the market share. It is favored by sectors with stringent data security and privacy requirements, such as defense, aerospace, and certain manufacturing industries. On-premises solutions offer greater control over sensitive data and system configurations, making them essential for organizations prioritizing compliance and internal governance. Despite the rise of cloud computing, this segment maintains steady demand due to these critical security considerations.

Asia Pacific is expected to dominate the industrial copilot market during the forecast period, accounting for approximately 45% of the global revenue.

This dominance is driven by rapid industrialization, increasing adoption of Industry 4.0 technologies, and government initiatives promoting digital transformation in countries like China, India, Japan, and South Korea. The region's expanding manufacturing base and growing emphasis on smart factory solutions further boost demand for industrial copilots.

North America holds a significant market share of around 30%

propelled by advanced technological infrastructure, strong industrial automation adoption, and robust investments in AI and machine learning. The United States and Canada are leading the way with extensive Industry 4.0 initiatives and digital transformation strategies in manufacturing, automotive, and aerospace sectors, fueling growth in industrial copilot solutions.

Europe accounts for roughly 20% of the market revenue

driven by the presence of well-established manufacturing hubs in Germany, the UK, France, and Italy. The region benefits from stringent regulations promoting energy efficiency and sustainability, encouraging companies to adopt AI-driven industrial copilots to optimize operations and reduce environmental impact.

WORLDWIDE TOP KEY PLAYERS IN THE INDUSTRIAL COPILOT MARKET INCLUDE

- Siemens

- ABB

- Microsoft

- NVIDIA

- Fujitsu

- thyssenkrupp Automation Engineering

- Siasun Robotics

- Stellantis

- Mistral AI

- Mitsubishi Electric

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the industrial copilot market based on the below-mentioned segments:

Global Industrial Copilot Market, By Source of Scrap

- Individual

- Small & Medium Enterprises (SMEs)

- Large Enterprises

- Educational & Research Institutions

Global Industrial Copilot Market, By Deployment Mode

- Cloud-Based

- On-Premises

- Edge Deployment

Global Industrial Copilot Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the revenue potential of Industrial Copilot solutions in the Asia–Pacific region by 2035?

A: Asia–Pacific is projected to dominate the global market, contributing over 45% of the global revenue by 2035 due to rapid industrialization and strong adoption of smart factory solutions.

Q: Who are the top 10 companies operating in the Global Industrial Copilot Market?

A: Key players include Siemens, ABB, Microsoft, NVIDIA, Fujitsu, thyssenkrupp Automation Engineering, Siasun Robotics, Stellantis, Mistral AI, and Mitsubishi Electric.

Q: Which startups are disrupting the Industrial Copilot market?

A: Emerging players such as Mistral AI and other AI-native startups are disrupting the market by offering lightweight, flexible copilots with advanced edge processing and predictive analytics.

Q: Can you provide company profiles for leading Industrial Copilot solution providers?

A: Yes. For example, Siemens offers AI-driven industrial copilots integrated into its automation platforms, while Microsoft provides industrial AI solutions through Azure and partners with OEMs to enhance industrial productivity.

Q: What are the main drivers of growth in the Industrial Copilot market?

A: The primary growth drivers include increasing demand for AI-driven process automation, predictive maintenance, operational efficiency, and government incentives for Industry 4.0 adoption.

Q: What challenges are limiting the adoption of Industrial Copilot systems?

A: Key challenges include cybersecurity risks, integration complexity with legacy systems, high initial costs, regulatory uncertainties, and a shortage of skilled professionals.

Q: Which regulations are affecting this market?

A: Data privacy laws such as GDPR in Europe, AI compliance standards, and cybersecurity regulations play a major role in shaping market practices and deployment models.

Q: Which deployment segment is expected to dominate over the next 10 years?

A: The cloud-based deployment segment is expected to dominate, due to its scalability, remote monitoring capabilities, and lower upfront infrastructure costs.

Q: Which industries are adopting Industrial Copilot technologies most extensively?

A: Manufacturing, logistics, automotive, energy, and aerospace industries are leading adopters, driven by the need for automation, predictive maintenance, and real-time analytics.

Q: How do Asia–Pacific and North America compare in terms of market growth?

A: Asia–Pacific leads in overall market share due to industrial expansion, while North America is the fastest-growing region due to high investment in AI technologies and a mature industrial base.

Q: What are the latest trends in the Industrial Copilot market?

A: Key trends include the shift to edge computing for low-latency operations, cloud-based monitoring platforms, and enhanced AI for predictive analytics and autonomous decision-making.

Q: What are the top investment opportunities in the Global Industrial Copilot Market?

A: Investments in edge computing, AI-based process automation, SME-specific AI tools, and strategic partnerships between tech firms and manufacturers present major growth opportunities.

Q: What is the long-term outlook (2025–2035) for the Industrial Copilot market?

A: The market is expected to witness exponential growth, becoming a cornerstone of smart manufacturing, driven by automation, digital transformation, and real-time decision intelligence.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |