Global Industrial Rollers Market

Global Industrial Rollers Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Roller Type (Conveyor Rollers / Drive & Idler Rollers, Printing Rollers, Guide Rollers, and Flat Rollers / Cylinder Rollers), By Material (Metal, Rubber, Composite, and Plastic), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Industrial Rollers Market Summary, Size & Emerging Trends

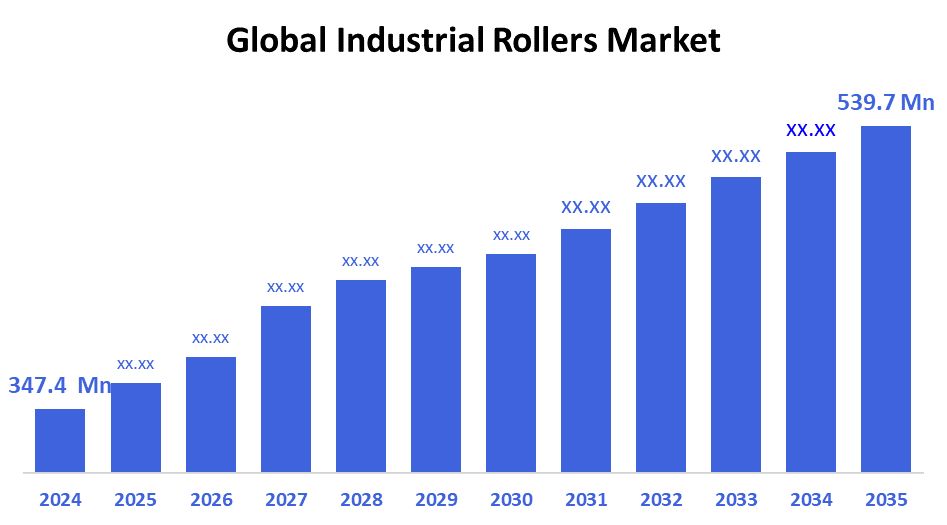

According to Decision Advisors, The Global Industrial Rollers Market Size is expected to grow from USD 347.4 Million in 2024 to USD 539.7 Million by 2035, at a CAGR of 4.09% during the forecast period 2025-2035. Emerging trends include increasing automation, demand for precision rollers with longer lifespans (lower maintenance), and growth in composite and rubber rollers for special applications (e.g. printing, textile). Sustainability and energy efficiency are also pushing material and design innovation.

Key Market Insights

- Asia Pacific is expected to dominate the market during the forecast period.

- Within roller types, conveyor rollers and drive/idler rollers are likely to have largest shares.

- Among materials, metal rollers still hold major share, but composites and specialty rubbers are growing fastest.

- Manufacturing, paper & pulp, and automotive remain key end?use sectors.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 347.4 Million

- 2035 Projected Market Size: USD 539.7 Million

- CAGR (2025-2035): 4.09%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Industrial Rollers Market

The industrial rollers market involves the production and use of cylindrical components designed to support and move materials in various industrial processes. These rollers are essential in applications such as conveying systems, printing, textile processing, material handling, and compaction. Depending on usage, they are made from materials like rubber, metal, composites, or plastics, offering different levels of durability, flexibility, and resistance to environmental factors. Industrial rollers play a critical role in improving operational efficiency, product quality, energy usage, and equipment longevity. Market growth is fueled by expanding manufacturing activities, rising demand in logistics and packaging, and automation across industries. Additionally, evolving environmental regulations, fluctuating raw material prices, and international trade dynamics influence manufacturing costs and global supply chains, shaping the strategic focus of roller producers and users worldwide.

Industrial Rollers Market Trends

- Increasing use of composite and hybrid materials (lighter, corrosion resistant).

- Roller surfaces with improved coatings or specialized treatments (abrasion, wear, hygiene) for food, pharma.

- Integration of sensors / monitoring (vibration, temperature) for predictive maintenance.

- Demand for rollers designed for high?speed, low friction, and energy efficiency.

- Growing preference for local manufacture / regional supply chains to avoid long lead times and import costs.

Industrial Rollers Market Dynamics

Driving Factors: E-commerce growth and rising logistics infrastructure globally

The industrial rollers market is driven by rapid industrialization and expanding manufacturing activities, especially in the Asia Pacific. E-commerce growth and rising logistics infrastructure globally have fueled demand for efficient material handling systems, where rollers play a critical role. Companies seek high-performance rollers that reduce energy consumption, improve throughput, and lower maintenance costs. Additionally, evolving safety and environmental regulations push manufacturers to adopt low-friction, durable, and eco-friendly roller designs. These trends are accelerating the shift toward engineered solutions that enhance productivity, reduce downtime, and meet compliance standards, making rollers a key component in modern industrial systems.

Restrain Factors: Volatility in raw material prices, especially steel, rubber, and polymers

Despite growing demand, several restraints hinder market growth. Specialized rollers made from advanced composites or engineered rubbers are expensive, limiting adoption in cost-sensitive industries. Manufacturing custom-designed rollers with tight tolerances often requires long lead times and advanced capabilities. Volatility in raw material prices, especially steel, rubber, and polymers, impacts margins and planning. Furthermore, many regions lack the technical awareness or skilled labor needed for high-end roller installation and maintenance, leading customers to opt for low-cost, less durable alternatives. These challenges slow modernization and prevent full-scale adoption of innovative roller technologies across emerging and mid-tier industrial segments.

Opportunity: Shift toward smart manufacturing and Industry 4.0 creates major opportunities for roller innovation

The shift toward smart manufacturing and Industry 4.0 creates major opportunities for roller innovation. Integration of sensors for predictive maintenance and performance monitoring can transform rollers into intelligent system components. Demand is rising for sustainable, low-impact materials like recycled composites and bio-based rubbers, which appeal to environmentally conscious industries. Emerging economies in Southeast Asia, Africa, and Latin America are heavily investing in infrastructure and new manufacturing plants, opening large new markets for rollers. Additionally, the global installed base of aging rollers presents a huge opportunity for aftermarket upgrades and replacements, especially as companies focus on reducing downtime and improving efficiency.

Challenges: Combined with intense price competition from low-cost imports

The market faces several persistent challenges. Supply chain disruptions, including raw material shortages, port delays, and transport issues, can delay production and increase costs. Geopolitical instability and trade tensions, such as tariffs on steel or cross-border shipping restrictions, further complicate global sourcing. Stricter environmental regulations also impact the industry, requiring manufacturers to limit emissions and manage hazardous substances used in coatings or adhesives. Moreover, new technologies like magnetic or beltless conveyors present a threat by offering alternative solutions to rollers. Combined with intense price competition from low-cost imports, these factors demand strategic innovation and risk mitigation from industry players.

Global Industrial Rollers Market Ecosystem Analysis

The ecosystem includes raw material suppliers (steel, rubber, polymers, resins), roller manufacturers, OEMs (conveyor/system integrators, printing machines, textile machines), distributors, end?users (manufacturing plants, pulp & paper, food processing, mines). Regulatory bodies impose safety, emissions, hygiene standards (especially for food and pharma). R&D centers focus on new materials and smart technologies. Transformation in supply chain logistics and duty/tariff regimes also play roles.

Global Industrial Rollers Market, By Roller Type

Conveyor rollers/drive & idler rollers are the largest segment in the industrial rollers market, capturing about 35% of the global revenue and volume share. Their dominance is due to their critical role in material handling systems across industries such as manufacturing, warehousing, logistics, and distribution centers. These rollers facilitate the smooth and efficient movement of goods, reducing downtime and increasing throughput. Their wide applicability in conveyor belts and automation systems makes them indispensable, especially with the rise of e-commerce and automated warehouses globally.

Printing rollers account for roughly 20% of the market share and hold significant importance in sectors like printing, packaging, and paper manufacturing. These rollers are engineered for precision, ensuring high-quality printing and coating, which is vital for the packaging and publishing industries. Although smaller than conveyor rollers in volume, they are crucial for specialized applications where quality and detail matter.

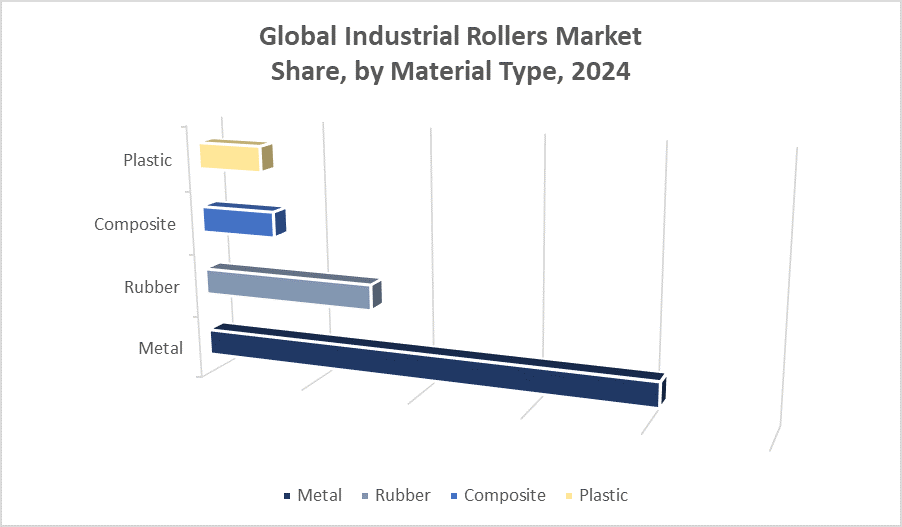

Global Industrial Rollers Market, By Material Type

Metal rollers hold the largest share in the industrial rollers market, accounting for approximately 40-50% of the total revenue. Their dominance is attributed to exceptional durability, high load-bearing capacity, and resistance to wear and tear, making them ideal for heavy-duty industrial applications. Steel and alloy rollers are widely used in manufacturing, mining, and material handling industries where robust performance under harsh conditions is essential. Their strength and reliability ensure long service life, which reduces maintenance costs and downtime, reinforcing their leading position in the market.

Rubber rollers represent about 20-25% of the market share. These rollers are preferred for applications requiring superior grip, vibration absorption, and specific surface properties. Industries such as printing, packaging, and textiles often use rubber rollers because of their flexibility and ability to handle delicate materials without damage. The material’s natural cushioning properties also protect equipment and improve product quality. This segment benefits from consistent demand where controlled friction and smooth operation are critical.

Asia Pacific holds the largest share of the industrial rollers market, accounting for approximately 45% in 2024.

This dominance is driven by rapid industrialization, expanding manufacturing output, and massive infrastructure development across countries like China and India. China, in particular, stands out as a key market due to its vast manufacturing base, booming e-commerce, and growing logistics sectors, which heavily rely on material handling equipment using industrial rollers. Government investments in industrial parks, smart factories, and transportation infrastructure further fuel demand. The region’s cost advantages and availability of raw materials also attract manufacturers, ensuring Asia Pacific remains the global leader in industrial rollers.

North America holds about 25% of the market share and is witnessing strong growth.

primarily fueled by rising automation and replacement demand. The U.S. leads this growth, with its advanced manufacturing sector embracing Industry 4.0 technologies that require high-precision rollers equipped with IoT and monitoring capabilities. Aging industrial equipment also drives steady replacement and maintenance markets. Additionally, strict safety and environmental regulations push for durable, eco-friendly rollers, contributing to market expansion. Investments in warehousing and logistics, supported by the growing e-commerce industry, further bolster demand in this region.

WORLDWIDE TOP KEY PLAYERS IN THE INDUSTRIAL ROLLERS MARKET INCLUDE

- SKF Group

- Siemens AG

- ABB Ltd.

- Schaeffler Group

- Timken Company

- NSK Ltd.

- Rexnord Corporation

- Parker Hannifin Corporation

- Emerson Electric Co.

- Koyo Bearings

- Tsubaki

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the industrial rollers market based on the below-mentioned segments:

Global Industrial Rollers Market, By Roller Type

- Conveyor Rollers / Drive & Idler Rollers

- Printing Rollers

- Guide Rollers

- Flat Rollers / Cylinder Rollers

Global Industrial Rollers Market, By Material Type

- Metal

- Rubber / Synthetic Rubber

- Composite

- Plastic

Global Industrial Rollers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: Which roller type holds the largest share in the market?

A: Conveyor rollers and drive/idler rollers hold the largest market share, capturing around 35% of the global revenue.

Q: What materials are commonly used in industrial rollers?

A: Industrial rollers are commonly made from metal, rubber, composite, and plastic materials.

Q: Which material type dominates the Industrial Rollers Market?

A: Metal rollers dominate the market, accounting for approximately 40-50% of total revenue.

Q: What industries primarily use industrial rollers?

A: Manufacturing, paper & pulp, automotive, logistics, and packaging are key end-use sectors.

Q: What are the major factors driving the growth of the Industrial Rollers Market?

A: Growth drivers include rapid industrialization, expansion of manufacturing activities, growth in e-commerce and logistics infrastructure, and increasing automation.

Q: What challenges are impacting the Industrial Rollers Market?

A: Challenges include volatility in raw material prices, supply chain disruptions, intense price competition from low-cost imports, and the need for skilled labor.

Q: What opportunities exist in the Industrial Rollers Market?

A: Opportunities arise from Industry 4.0 integration with smart sensors, innovations in composite and eco-friendly materials, and expansion in emerging markets.

Q: Which companies are leading the Global Industrial Rollers Market?

A: Leading companies include SKF Group, Siemens AG, ABB Ltd., Schaeffler Group, Timken Company, NSK Ltd., Rexnord Corporation, Parker Hannifin Corporation, Emerson Electric Co., and Koyo Bearings.

Q: How is sustainability influencing the Industrial Rollers Market?

A: There is a growing demand for sustainable materials like recycled composites and bio-based rubbers, driven by environmental regulations and customer preferences.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |