Global Injection Molding Market

Global Injection Molding Market Size, Share, and COVID-19 Impact Analysis, By Material (Plastics, Metals, Others), By Application (Packaging, Consumables & Electronics, Automotive & Transportation, Building & Construction, Medical, Other), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Injection Molding Market Size Summary

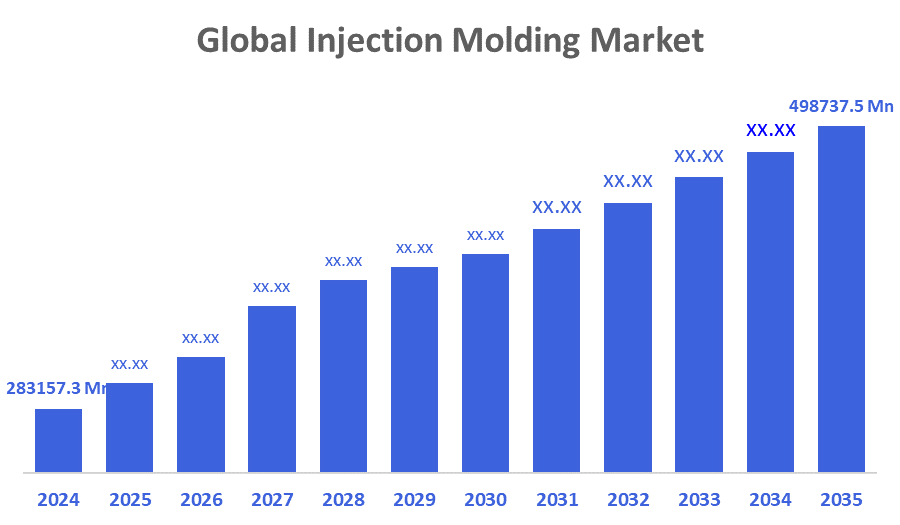

The Global Injection Molding Market Size Was Estimated at USD 283157.3 Million in 2024 and is Projected to Reach USD 498737.5 Million by 2035, Growing at a CAGR of 5.28% from 2025 to 2035. The market for injection molding is expanding because of the growing need for complicated plastic components to be produced in large quantities, cost-effective manufacturing, developing applications in the packaging and automotive industries, improvements in materials and automation, and the growth of the consumer goods and medical industries.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the largest revenue share of over 40.4% and dominated the market globally.

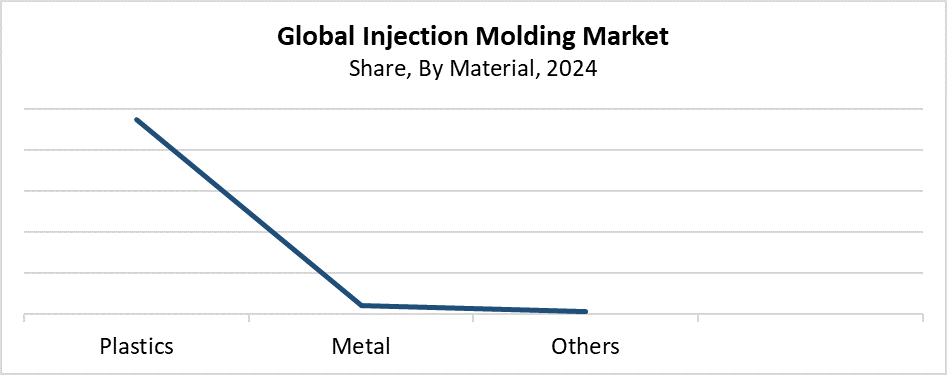

- In 2024, the plastics segment had the highest market share by material, accounting for 97.4%.

- In 2024, the packaging segment had the biggest market share by application, accounting for 31.5%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 283157.3 Million

- 2035 Projected Market Size: USD 498737.5 Million

- CAGR (2025-2035): 5.28%

- Asia Pacific: Largest market in 2024

The injection molding industry specializes in making plastic, metal, or ceramic components through the process of injecting molten material into molds to create detailed and accurate parts. This production technique serves industries including consumer goods, electronics and medical devices and automotive, and packaging because it delivers effective and scalable solutions at an affordable cost. The primary forces behind this industry growth include fast industrial growth, together with demands for cost-efficient mass production and the rising need for durable yet light components. Market growth continues to accelerate because of expanding e-commerce-driven packaging development and the rising application of plastic components in the aerospace and automotive sectors to improve fuel efficiency.

Technological progress serves as the main driving force that determines the future direction of the injection molding market. Modern injection molding technologies, including multi-material processing and 3D printing, along with AI-driven robot automation, enable companies to achieve better operational efficiency while cutting down production duration and enhancing precision. The industry addresses environmental problems through the development of biodegradable and sustainable material solutions. Global governments support manufacturing development through incentives combined with supportive laws and investments in intelligent factories and Industry 4.0 adoption, which drives market expansion by encouraging businesses to implement advanced injection molding technologies.

Material Insights

During 2024, the plastics segment dominated the injection molding market with the largest revenue share of 95.1%. The widespread use of plastic materials across different sectors, including consumer products, electronics, medical devices, automotive, and packaging, leads to this significant market dominance. The adaptability of plastics makes them ideal for injection molding mass production since these materials are lightweight, cost-effective, and able to form complex shapes. The materials polypropylene, polyethylene, ABS, and polystyrene stand out as top choices because of their robust properties and versatile nature. The increasing requirement of plastic components for lightweight car manufacturing and single-use medical devices drives market growth. The market maintains its upward trajectory because of the industry shift toward using recyclable and biodegradable plastics.

The metal segment of the injection molding market is anticipated to grow at the fastest CAGR during the forecast period because precision-engineered high-strength components for automotive, aerospace, electronics, and medical devices require this manufacturing approach. Metal injection molding (MIM) enables the production of detailed miniature components with exact dimensions by uniting metal strength with plastic injection molding design flexibility. The rising need for electronic medical device components that are lighter and smaller continues to drive this market growth. The MIM process benefits from enhanced efficiency and cost reduction through ongoing developments in sintering technology and metal powder development, and binder system innovation. Growing awareness of sustainable practices as well as material performance characteristics serves as an additional factor that drives widespread adoption.

Application Insights

The packaging segment led the injection molding market with the largest revenue share of 31.5% in 2024. The main driver for this market dominance stems from the rising demand for strong yet affordable packaging solutions across consumer goods and food and beverage sectors, as well as pharmaceutical and cosmetics industries. The combination of injection molding's fast production rate and its capacity to create precise, reliable shapes makes it the preferred method for manufacturing caps, containers, lids, and closures. The need for high-quality molded packaging has risen because of e-commerce growth and product preservation and shelf-life extension initiatives. Modern injection molding methods have become attractive to businesses because sustainable packaging materials alongside recyclable plastics lead the way toward environmentally friendly packaging solutions.

The medical segment of the injection molding market will experience the fastest growth during the forecast period because of the increasing demand for precise single-use components that can be sterilized. The production of items with strict quality and hygienic standards, such as syringes and surgical tools, along with diagnostic devices, implants, and drug delivery systems, requires injection molding methods. The demand continues to grow because of the worldwide increase in healthcare expenses and the expanding elderly population, and the need for advanced medical solutions. The medical device industry quickly adopted injection molding methods after the COVID-19 pandemic brought awareness to efficient, scalable manufacturing of medical devices. Medical-grade and biocompatible materials continue to evolve, which strengthens the growth opportunities for this particular segment.

Regional Insights

The injection molding market in North America grows at a significant CAGR because various key sectors, including automotive, healthcare, packaging, and consumer electronics, maintain high demand. The region benefits from a solid manufacturing network, together with advanced technological infrastructure and increasing adoption of Industry 4.0 automation systems. Market expansion occurs because healthcare organizations need more precise medical equipment along with precision-molded medical components. Modern automotive production requires plastic injection molding because manufacturers move toward lightweight vehicles with enhanced fuel efficiency. Companies receive funding from government initiatives and investments in sustainable materials, which drives sector innovation. The presence of top injection molding companies facilitates the continuous expansion of the regional market.

Europe Injection Molding Market Trends

The injection molding market in Europe is growing significantly because it receives strong demand from consumer goods, automotive, packaging, and healthcare industries. The region's sustainability focus, together with circular economy principles, motivates injection molding processes to adopt recyclable and biodegradable materials. Manufacturers must adopt advanced energy-saving molding procedures because of stringent requirements regarding product quality alongside environmental impact regulations. The automotive sector in France and Germany maintains its importance by utilizing injection molding to produce lightweight, high-quality plastic components. Medical components and devices produced through injection molding are receiving increasing adoption within the healthcare industry. The EU's supportive policies, together with its highly qualified workforce and continuous R&D investment, drive commercial growth across Europe and innovation activities.

Asia Pacific Injection Molding Market Trends

Asia Pacific dominated the worldwide injection molding market with 40.4% revenue share in 2024. The supremacy of this region stems from widespread industrial requirements spanning consumer products and electronics, together with automobiles, packaging, and fast-paced industrial expansion and solid manufacturing capabilities. The market growth of China, India, Japan, and South Korea stems from their low-cost manufacturing expenses and plentiful material sources, as well as their highly skilled workforce. The middle-class expansion of Asia Pacific nations, together with increased consumer product and packaged goods consumption, drives additional market expansion. Foreign investment, along with infrastructure development and state support for the domestic industry, enables production capacity expansion. The advancement of injection molding technology and rising automation rates continue to establish the Asia Pacific as the dominant global market leader.

Key Injection Molding Companies:

The following are the leading companies in the injection molding market. These companies collectively hold the largest market share and dictate industry trends.

- C&J Industries

- Majors Plastics, INC

- All-Plastics

- Tessy Plastics

- The Rodon Group

- EVCO Plastics

- Formplast GmbH

- Proto Labs

- Currier Plastics, Inc.

- Hehnke GmbH & Co KG

- HTI Plastics

- D&M Plastics, LLC

- Others

Recent Developments

- In May 2025, at CPHI North America 2025, HTI Plastics will demonstrate its proficiency in pharmaceutical injection molding. High-precision, high-quality components for pharmaceutical applications are the company's area of expertise. Important drug delivery and medical device components are designed, prototyped, and manufactured by them. To learn more about HTI Plastics' cutting-edge capabilities, attendees can stop by Booth 1741.

- In April 2025, C&J Industries added a 12,000-square-foot Class 8 cleanroom to expand its capacity for medical-grade plastic injection molding. For effective production and inspection, the facility has automated 3-axis robots and Toshiba molding machines that run entirely on electricity. The company's capacity to provide premium medical components to satisfy rising demand is greatly increased by this development.

- In October 2024, Biomerics began providing precision metal parts for medical devices through Metal Injection Molding (MIM) services. From design and prototype to full-scale production, the organization offers comprehensive solutions. This growth improves quality, shortens lead times, and fortifies Biomerics' capacity to serve the medical sector.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the injection molding market based on the below-mentioned segments:

Global Injection Molding Market, By Material

- Plastics

- Metal

- Others

Global Injection Molding Market, By Application

- Packaging

- Consumables & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Other

Global Injection Molding Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 160 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |