Global Insulated Food Containers Market

Global Insulated Food Containers Market Size, Share, and COVID-19 Impact Analysis, By Material (Stainless Steel, Plastics, Glass, Others), By Distribution Channel (Offline, Online), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Insulated Food Containers Market Summary

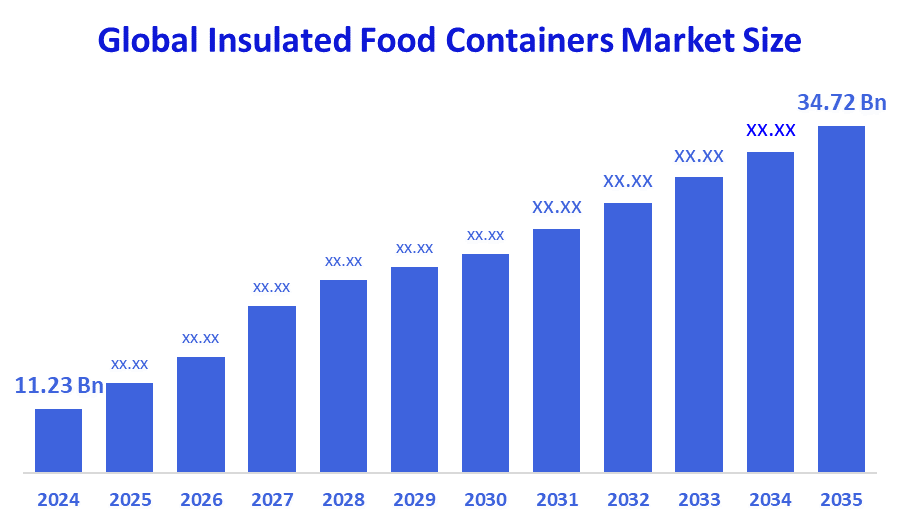

The Global Insulated Food Containers Market Size Was Estimated at USD 11.23 Billion in 2024 and is Projected to Reach USD 34.72 Billion by 2035, Growing at a CAGR of 10.81% from 2025 to 2035. The market for insulated food containers is expanding as a result of rising customer demand for fresh, healthful meals, the growth of the food delivery and e-commerce sectors, and growing environmental consciousness that favors sustainable, reusable packaging.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 39.5% and dominated the market globally.

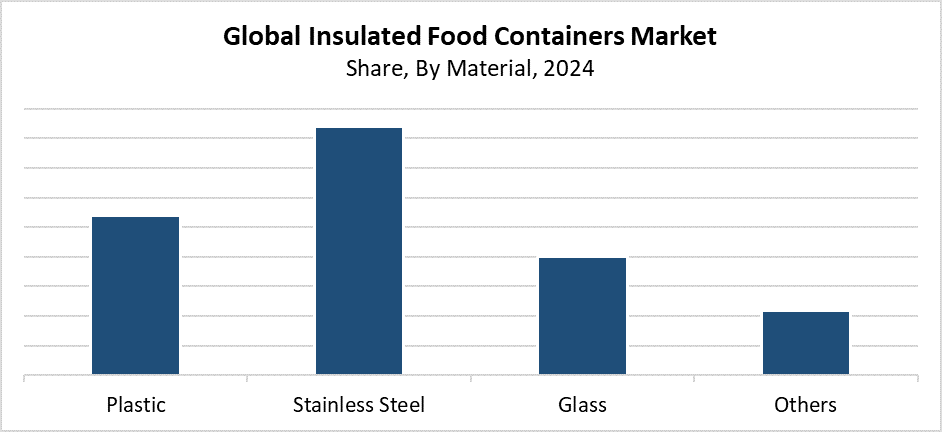

- In 2024, the stainless-steel segment had the highest market share by material, accounting for 42.4%.

- In 2024, the offline segment had the biggest market share by distribution channel, accounting for 61.4%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 11.23 Billion

- 2035 Projected Market Size: USD 34.72 Billion

- CAGR (2025-2035): 10.81%

- Asia Pacific: Largest Market in 2024

The market for insulated food containers stands as the sector of food storage products that preserve food temperatures at stable levels over extended durations. Such containers serve numerous commercial, institutional, and residential sectors, including restaurants and catering services, along with food delivery businesses and individual meal preparation. The market growth mainly stems from worldwide food delivery service expansion, together with increasing urban population density and rising demand for simple portable food storage systems. Consumers now focus more on food safety and sustainability, which drives the growing need for durable insulated containers that can be reused. Modern lifestyles, including remote work and increased travel, have driven the necessity for portable food storage containers that maintain temperature while preserving freshness.

Technological advancements have brought about substantial changes in the market for insulated food containers. Developments in phase-change materials and double-wall stainless steel construction, and vacuum insulation have substantially improved heat retention and durability. Smart containers that track and control temperature are gaining popularity among premium market consumers. The implementation of government programs focused on waste reduction and reusable products, and environmentally friendly packaging options has led manufacturers to adopt recyclable metals and BPA-free plastics. The growth of worldwide markets and innovation occurs because of advancements, together with strict regulations on single-use plastics.

Material Insights

What Factors Enabled the Stainless-Steel Segment to Capture Over 42.4% Revenue Share in the Insulated Food Containers Market in 2024?

The stainless-steel segment led the insulated food containers market in 2024 by capturing more than 42.4% of total revenue. The exceptional thermal insulation features of stainless steel, together with its durability and corrosion resistance, and non-reactive properties, make it the preferred choice for storing hot and cold food. The institutional and commercial, and residential sectors find stainless steel appealing because it lasts a long time while maintaining food safety standards. Consumers now prefer stainless steel containers because they offer BPA-free solutions and reusable designs, while sustainability and health concerns continue to rise. The food delivery industry, along with increasing stainless-steel container usage in thermal flasks and lunch boxes, drives the market segment to maintain its leading position.

The plastic sector within insulated food container markets will experience substantial growth throughout the forecast timeframe. The lightweight quality of plastic, along with its budget-friendliness and flexible design capabilities, leads to this market expansion. Plastic insulated containers serve as popular food storage solutions across schools and domestic environments because they offer simple usage and multiple sizes and design choices. The development of food-grade and BPA-free plastics has strengthened consumer confidence in using plastic containers for safe food storage. The functionality of these products continues to grow as microwave-safe materials combine with advanced insulation technologies. The worldwide plastic market continues to grow at a strong pace because people need practical food storage solutions that are both cheap and reusable.

Distribution Channel Insights

What Made the Offline Segment Lead the Insulated Food Containers Market in 2024?

The offline segment led the insulated food containers market with the largest revenue share of 61.4% throughout 2024. The widespread distribution of insulated food containers throughout department stores and hypermarkets, as well as specialty shops and supermarkets, explains why offline sales lead the market in 2024. Offline channels maintain strong sales because customers in developing nations trust and prefer the quick shopping experience that stores provide. Retailers present their customers with multiple brand options and seasonal promotions and bundle sales, which enhance their shopping convenience. Online shopping continues to gain popularity, yet numerous customers maintain their preference for offline purchasing when buying standard household items, including kitchenware.

During the forecast period, the online segment within insulated food containers is expected to grow significantly. The quick expansion of this market segment results from online browsing and comparison shopping as well as e-commerce platform growth. Brand-specific online storefronts, as well as digital marketplaces including Amazon, Flipkart, and Alibaba, have made products more accessible throughout urban and rural regions. Through online platforms, customers receive improved buying experiences because they discover extensive product choices and better prices and read customer feedback, and select delivery services. The online distribution channel's market expansion continues to grow because smartphone adoption increases and internet reach expands while digital payment systems gain popularity, especially in developing nations.

Regional Insights

During 2024, the insulated food container market in the Asia Pacific dominated global sales by securing the largest revenue share of 39.5%. The quick expansion of cities, along with rising consumer spending and population density needs for food storage solutions in China, India, and Japan, has established this market as the global leader. The market demand in this region has surged because people use insulated containers for food delivery services and school meals, and for home use. The expanding middle class, together with changing ways of life, has elevated the requirement for food storage containers that maintain portability and longevity. The Asia Pacific region dominates the global market for insulated food containers because it has domestic manufacturing facilities and inexpensive production costs alongside a rising consumer demand for sustainable reusable products.

North America Insulated Food Containers Market Trends

The North American market for insulated food containers continues to grow because customers want sustainable portable food storage solutions that are easy to use. The usage of insulated containers to maintain food temperature and freshness has grown substantially across the United States and Canada because more people are meal planning and spending time outdoors and living active lifestyles. The industry expansion is driven by meal delivery businesses and growing interest in nutritious eating habits. The North American market shows strong consumer interest in high-quality, eco-friendly containers made from stainless steel, which are free from BPA. The global market for insulated food containers receives stronger market positioning from well-established brands, combined with an extensive retail distribution network, along with growing digital sales opportunities.

Europe Insulated Food Containers Market Trends

Throughout the forecast period, the European market for insulated food containers will experience steady growth because of increased environmental awareness, together with the shift toward reusable food storage solutions. Consumers from Germany, France, and the United Kingdom are adopting insulated containers for meal preparation as well as school lunches and office meals to fulfill their need for durable, environmentally safe products. Increased travel, along with outdoor dining and health-conscious eating patterns, has started to drive market expansion. The European Union's strict regulations regarding single-use plastics encourage consumers to adopt insulated containers as an alternative. The European market for insulated food containers continues to expand because of enhanced design and materials technology, combined with growing e-commerce platform availability.

Key Insulated Food Containers Companies:

The following are the leading companies in the insulated food containers market. These companies collectively hold the largest market share and dictate industry trends.

- Sonoco ThermoSafe

- BARTH GmbH

- Klean Kanteen

- Huhtamaki

- Anchor Packaging LLC

- YETI COOLERS, LLC

- Genpak

- Inline Plastics

- Cambro

- KingStar Industries Co., Ltd

- Smurfit Westrock

- Evans Manufacturing

- MARKO FOAM PRODUCTS

- Others

Recent Developments

- In August 2025, A novel reusable bulk insulated container for the storage and distribution of dry ice and perishable items worldwide was introduced by Sonoco ThermoSafe, a division of Sonoco Products Company. With its 440-liter storage capacity and 1,200 x 800 mm dimensions, this container maximizes storage for dry ice blocks from the UK and Europe while minimizing truck cube consumption.

- In April 2025, using sturdy borosilicate glass, Caraway introduced its Glass Airtight Storage Containers, a fashionable and non-toxic kitchen storage option. These containers have a unique True Airtight Seal that seals in freshness, extending the shelf life of food while shielding it from moisture, air, pests, and aromas.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the insulated food containers market based on the below-mentioned segments:

Global Insulated Food Containers Market, By Material

- Plastic

- Stainless Steel

- Glass

- Others

Global Insulated Food Containers Market, By Distribution Channel

- Offline

- Online

Global Insulated Food Containers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |