Global International Express Delivery Market

Global International Express Delivery Market Size, Share, and COVID-19 Impact Analysis, By Mode of Transport (Roadways, Airways, Railways, Waterways), By End-user (B2B, B2C), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

International Express Delivery Market Summary

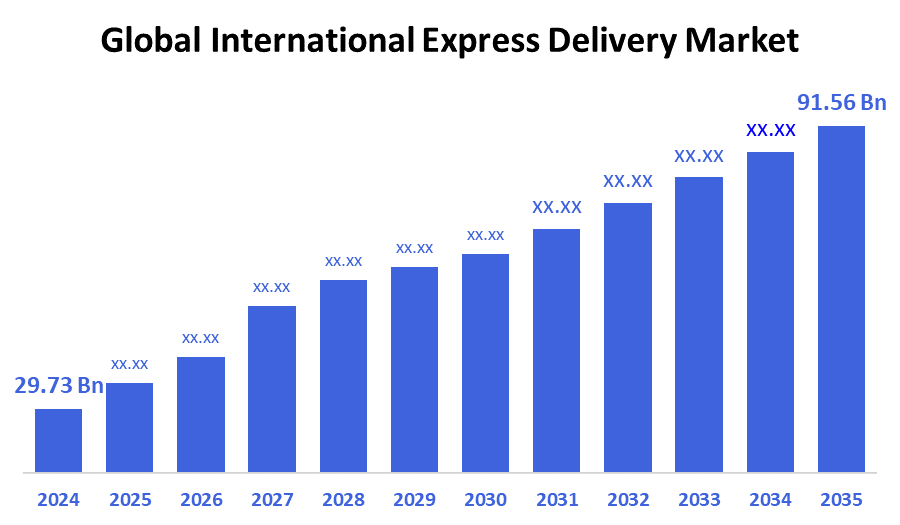

The Global International Express Delivery Market Size Was Estimated at USD 29.73 Billion in 2024 and is Projected to Reach USD 91.56 Billion by 2035, Growing at a CAGR of 10.77% from 2025 to 2035. The expansion of international e-commerce, more cross-border trade, growing consumer demand for expedited shipping, improvements in international trade agreements that facilitate smoother deliveries, and advances in logistics technology are the main factors propelling the growth of the international express delivery market.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 43.52% and dominated the market globally.

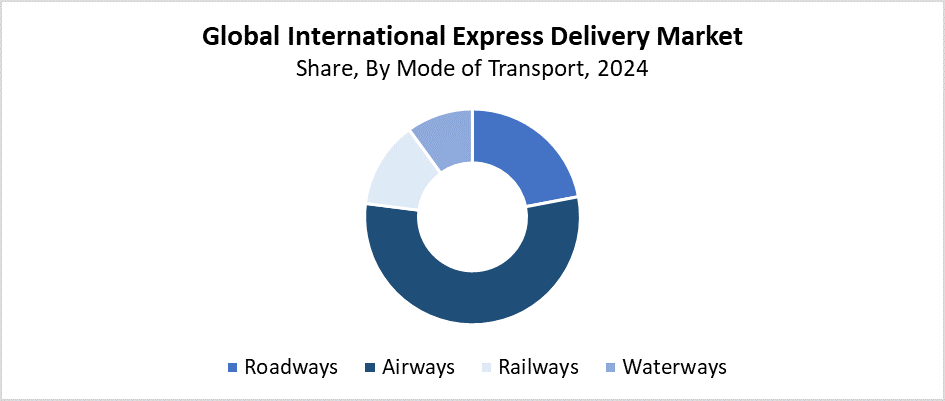

- In 2024, the airways segment had the highest market share by mode of transport, accounting for 55.3%.

- In 2024, the B2B segment had the biggest market share by end user.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 29.73 Billion

- 2035 Projected Market Size: USD 91.56 Billion

- CAGR (2025-2035): 10.77%

- Asia Pacific: Largest market in 2024

The international express delivery market defines the fast-paced international package and freight transport system, which provides delivery within three days at most. This market serves both businesses along consumers who need fast, secure shipping for their international trade operations and online shopping needs. The main factors that drive this market include the fast growth of global e-commerce, together with increasing customer delivery speed expectations and expanding worldwide supply chains. The development of small and medium-sized enterprises that handle international trade, along with improvements in air and road freight infrastructure, drives the industry growth. The market expansion continues due to its ability to provide secure package handling and efficient customs processes, along with real-time shipment monitoring.

The international express delivery industry experiences a transformation through technological developments that improve speed and transparency, and operational efficiency. The combination of blockchain-based tracking technology and AI-driven route optimization, and automated sorting systems enhances both shipment security and accuracy. Emerging technology, such as drones and driverless cars, is changing the last-mile delivery process. The industry receives market expansion support from government initiatives, which include trade facilitation programs alongside expedited customs procedures and bilateral trade agreements that reduce expenses and wait times.

Mode of Transport Insights

Why did the Airways Segment Hold the Largest Market Share of 55.3% in the International Express Delivery Market in 2024?

The airways segment held the largest market share of 55.3% and led the international express delivery market in 2024. The speed and efficiency of air transport make it the best choice for transporting high-value and time-sensitive products such as electronics, along with pharmaceuticals and e-commerce packages. Airlines offer quick worldwide connectivity, which enables both businesses and consumers to receive fast international deliveries. Modern aircraft payload capacity growth, together with established cargo airline networks and continuous advancement of air freight infrastructure, support the industry's development. The continuous growth of international trade alongside rising customer demands for swift delivery services will keep air transport dominating the express delivery market throughout the forecast period.

The roadways segment of the international express delivery market is expected to grow at a significant CAGR during the projected period. The market expansion results from rising requirements for flexible and cost-effective delivery services that focus on short-distance and medium-distance international shipments. Road transportation delivers more affordable costs and simpler access to distant regions and direct service to customers than air transport does. The use of roadways for international express delivery receives support from growing, well-developed highways and improved customs clearance processes in particular strategic locations. The combination of trade agreements easing cross-border road freight operations and rising e-commerce activity in adjacent nations drives the segment's projected growth throughout the forecast period.

End User Insights

What Factors Enabled the B2B Segment to Dominate the International Express Delivery Market in 2024?

The B2B segment dominated the International Express Delivery Market in 2024 by holding the highest market share. The dominating position stems from the need for quick, reliable delivery solutions because of the huge shipment volume that manufacturers and suppliers, and retailers exchange. To achieve efficient supply chain operations and production timeline control, B2B clients handle large volumes of component shipments together with finished products and unprocessed materials. Businesses require express delivery services strongly in their supply chain operations because global supply chains expand and international trade increases. The B2B segment leads the market because businesses demand secure handling along with real-time tracking and punctual delivery services, which logistics providers effectively provide.

The International Express Delivery Market's B2C segment is expected to experience a substantial CAGR in the upcoming projected year. The rapid expansion of worldwide e-commerce and altering customer purchasing patterns, which need faster and reliable home delivery services, drive this quick growth. Rising smartphone adoption, alongside internet expansion and growing online retail platforms, drives cross-border direct-to-consumer shipments. Business providers must enhance their express delivery services because customers want fast delivery and effortless return processes along with immediate package tracking information. The international express delivery market's B2C segment experiences rapid growth because customers increasingly select same-day and next-day international shipping services.

Regional Insights

In 2024, the Asia Pacific region dominated the international express delivery market with the largest revenue share of 43.52%. The region leads the international express delivery market because of its expanding middle class and rising e-commerce sector, and growing international commercial exchanges. The industrially developed nations with superior logistics facilities in the Asia Pacific, including China, India, Japan, and South Korea, make up the major market contributors. The industry expands because online shopping platforms keep growing, while customers now require fast, reliable delivery services across international borders. The market gains extra strength because governments back trade facilitation programs while investing in transport systems and streamlining customs procedures. This region functions as a worldwide manufacturing and trade hub, which ensures ongoing industry dominance and bright market prospects.

North America International Express Delivery Market Trends

The international express delivery market across North America grows significantly because of expanding e-commerce operations and increasing requirements for fast, reliable cross-border shipment services. The area benefits from sophisticated logistical infrastructure, such as vast air and road networks that facilitate effective worldwide delivery. Large companies and service providers invest continuously in technology such as AI automation and real-time tracking to enhance delivery speed and customer satisfaction. The strong trade relationships between North America and Europe, along with Asia Pacific, drive increased express shipment volumes. The government supports better logistics operations through programs that aim to make customs procedures simpler and improve trade facilitation. Rising consumer demand for quick deliveries and expanding international trade between small and medium-sized enterprises will sustain the market's robust growth throughout the forecast period.

Europe International Express Delivery Market Trends

The European international express delivery market continues to grow because of strong e-commerce business growth, together with increasing needs for reliable, fast international shipping solutions. Europe's advanced air and road transport systems, together with its developed logistics infrastructure, enable effective international delivery operations. Multiple international logistics companies and hubs throughout the continent enable broad service coverage across Europe. Businesses now implement sustainable delivery solutions because new delivery standards legislation and growing environmental awareness push them to adopt more efficient delivery practices. Government initiatives that support trade between EU member states and simplify customs operations help drive market expansion. European international express delivery market growth results from both expanding online retail business and growing consumer demands for rapid delivery services.

Key International Express Delivery Companies:

The following are the leading companies in the international express delivery market. These companies collectively hold the largest market share and dictate industry trends.

- DHL Group

- Blue Dart Express Ltd.

- La Poste Group

- FedEx

- US Postal Service

- SF Express

- CJ Logistics Corporation

- Correos Express

- United Parcel Service, Inc. (UPS)

- Aramex

- Others

Recent Developments

- In February 2025, by acquiring a minority position in AJEX Logistics Services, a Saudi Arabian package transportation company, DHL eCommerce announced a strategic investment. By combining AJEX's local presence with DHL's worldwide experience in international parcel logistics, the alliance seeks to increase the supply of reliable, affordable, and ecologically friendly delivery options in the Saudi Arabian market.

- In October 2024, in the Asia Pacific, United Parcel Service, Inc. (UPS) upgraded its infrastructure and network. Shipments from mainland China and South Korea can now be delivered to important markets, including Nigeria, Pakistan, Saudi Arabia, and South Africa, in two business days, due to a new air route via Sharjah International Airport (SHJ) in the United Arab Emirates. Additionally, UPS has increased the scope of its regional express services, providing next-day delivery from major Asia Pacific markets to Seoul, South Korea, and Bangkok, among other locations throughout the region.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the international express delivery market based on the below-mentioned segments:

Global International Express Delivery Market, By Mode of Transport

- Roadways

- Airways

- Railways

- Waterways

Global International Express Delivery Market, By End User

- B2B

- B2C

Global International Express Delivery Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |