Global Intrinsically Conductive Polymers Market

Global Intrinsically Conductive Polymers Market Size, Share, and COVID-19 Impact Analysis, By Product (Polyaniline (PANI), Polypyrrole (PPy), Poly(3,4-ethylenedioxythiophene) (PEDOT), Polythiophene (PT)), By End-use (Electronics & Electricals, Automotive, Energy Storage, Medical Devices, Coatings & Anticorrosion, Other end uses), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Intrinsically Conductive Polymers Market Summary

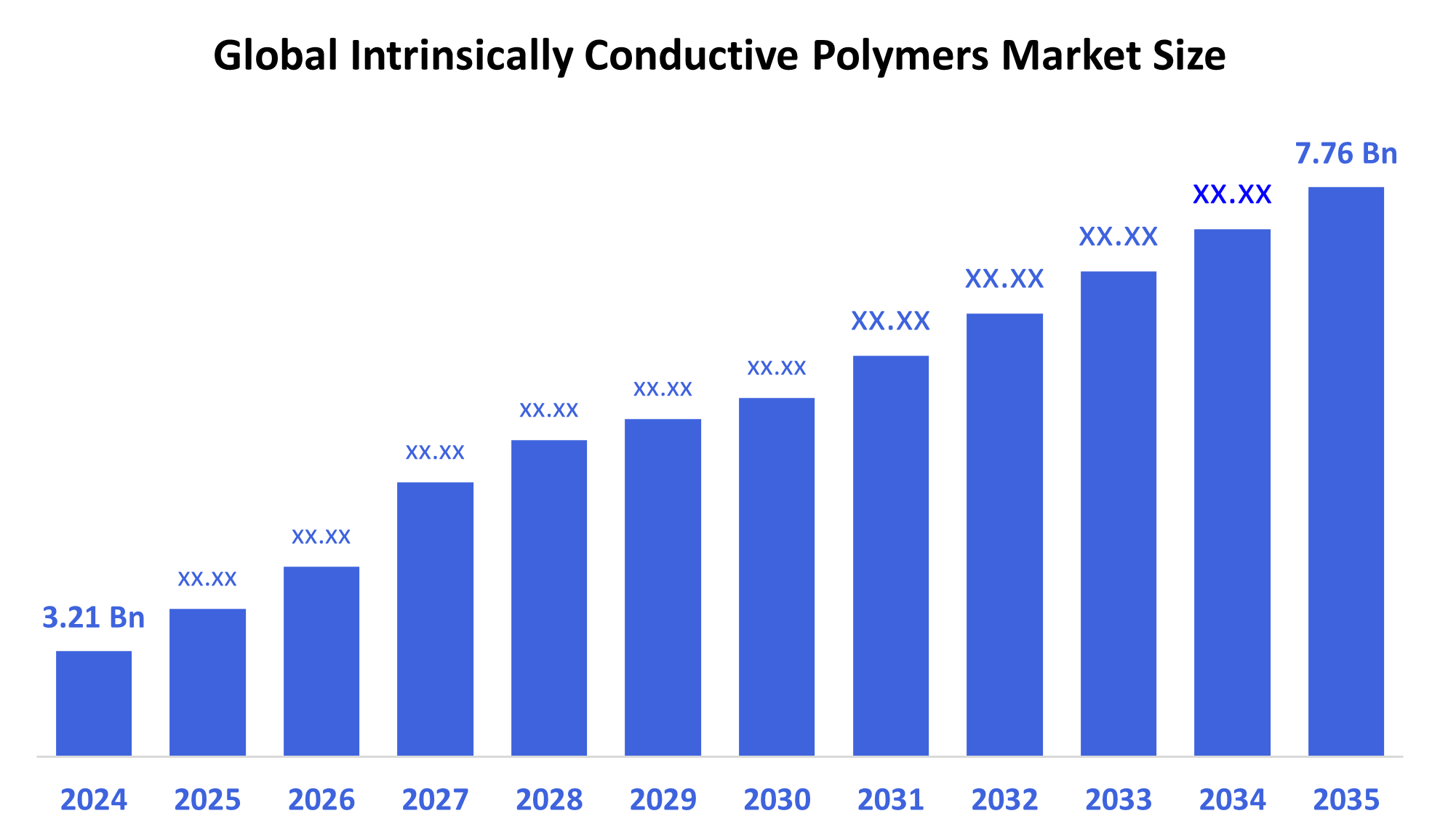

The Global Intrinsically Conductive Polymers Market Size Was Estimated at USD 3.21 Billion in 2024 and is Projected to Reach USD 7.76 Billion by 2035, Growing at a CAGR of 8.36% from 2025 to 2035. The market for intrinsically conductive polymers is expanding as a result of growing demand in sensors, energy storage, and electronics. This increase is primarily driven by their lightweight, corrosion-resistant qualities, as well as developments in material science, sustainability trends, and flexible electronics applications.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 45.72% and dominated the market globally.

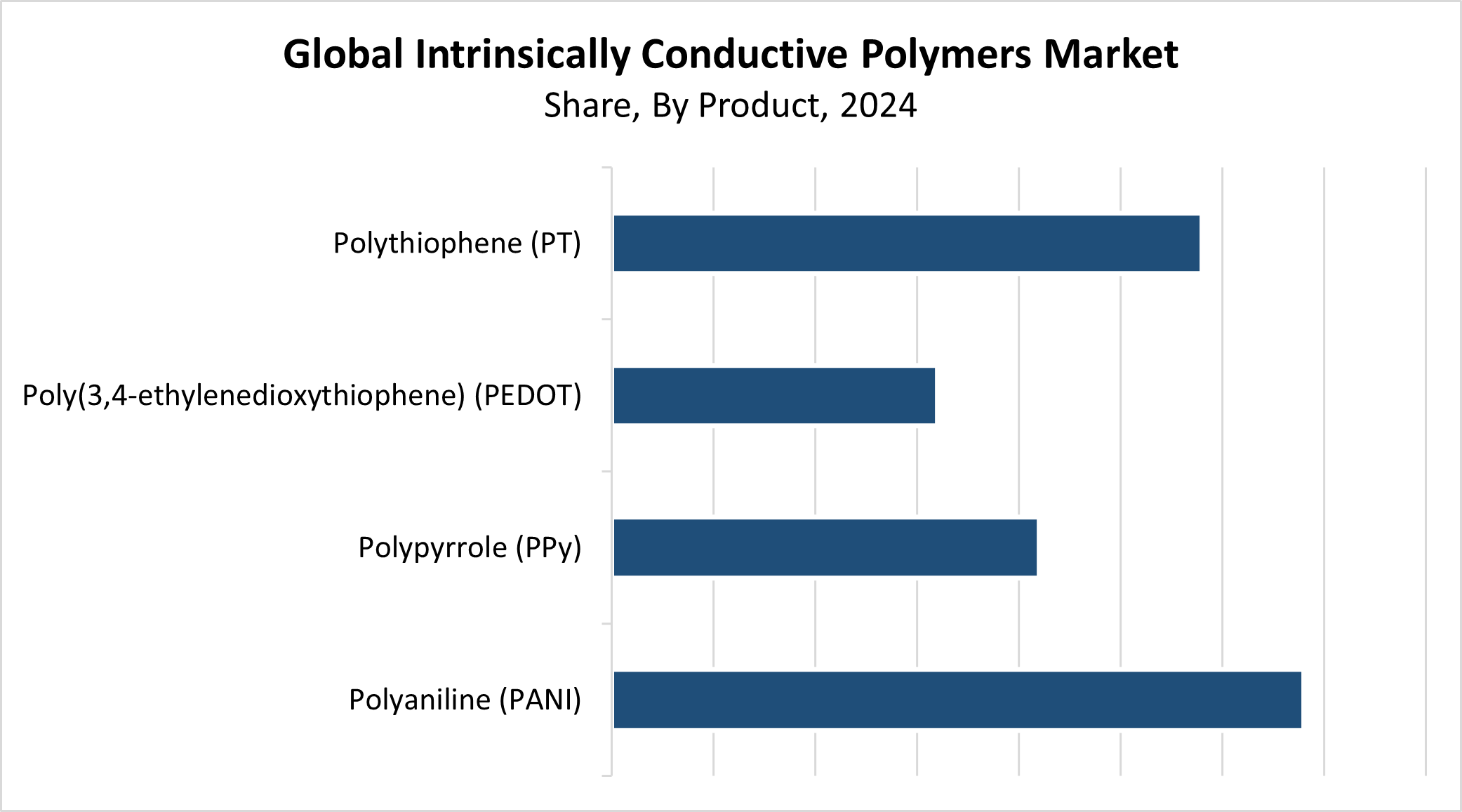

- In 2024, the Polyaniline (PANI) segment had the highest market share by product, accounting for 34.27%.

- In 2024, the electronics and electricals segment had the biggest market share by end use, accounting for 39.62%.

Market Size & Forecast

- 2024 Market Size: USD 3.21 Billion

- 2035 Projected Market Size: USD 7.76 Billion

- CAGR (2025-2035): 8.36%

- Asia Pacific: Largest market in 2024

The Intrinsically Conductive Polymers (ICP) market encompasses polymers that possess built-in electrical conductivity without requiring external conductive substances. These materials combine the flexibility of polymers with the conductivity of metals, making them ideal for use in a variety of applications, including flexible electronics, energy storage devices, sensors, and anti-static coatings. The market growth is propelled forward by essential factors, which include rising requirements for flexible and lightweight materials in the electronic, automotive, and healthcare industries. The market for ICPs experiences growth because of both increased interest in sustainable materials and energy-efficient solutions, along with electronic device miniaturization.

Technological progress has led to an expanded set of applications for ICPs. Research into wearable technology and organic electronics, and energy storage systems has enhanced the practical applications and operational capabilities of these polymers. New doping techniques and polymer blends have advanced polymer synthesis by enhancing conductivity and processability, which enables their integration into emerging technologies. Worldwide governments support ICP adoption in multiple industries by providing funding and programs that promote sustainable material development to minimize environmental impact.

Product Insights

In 2024, the Polyaniline (PANI) segment leads the Intrinsically Conductive Polymers (ICP) market by generating the largest revenue share of 34.27%. PANI achieves widespread adoption through its high electrical conductivity, together with affordable pricing and stable environmental properties. The specific characteristics of this material make it suitable for applications including conductive coatings and sensors, as well as batteries and electrochemical capacitors. The growing market for energy storage devices, combined with flexible electronics and anti-corrosion coatings, is driving increased adoption of PANI-based products. PANI exists as a material that can be easily used by various industries because producing it is straightforward, and its doping methods remain flexible. PANI maintains its market dominance because it delivers outstanding performance to both commercial and scientific users.

Throughout the forecast period, the polythiophene (PT) segment of the Intrinsically Conductive Polymers (ICP) market is expected to grow at a significant CAGR. Organic electronics, solar cells, and sensors benefit from the excellent conductivity and processing simplicity of polythiophene, which makes it a valuable material. Polythiophene allows for expanded usage because it can be produced in multiple forms, including films and coatings. The rising requirement for organic semiconductors in flexible and wearable electronics, together with advancements in renewable energy technology, drives the development of PT-based materials. PT demonstrates enhanced performance when mixed with graphene and carbon nanotubes, which establishes it as an important element in energy storage systems and upcoming electronic technologies.

End-use Insights

The electronics and electricals segment led the intrinsically conductive polymers market with the largest revenue share of 39.62% in 2024. Flexible lightweight materials, along with sophisticated requirements from the electronics industry, lead this market expansion. ICPs serve essential functions in circuit boards, conductive coatings, and sensors because they deliver superior electrical conductivity alongside excellent endurance. ICP adoption has accelerated due to the rapid advancement of wearable technology alongside smartphones, IoT devices, and miniaturized electronics. Their market value grows because they function in energy-saving devices that include batteries, capacitors, and electrochromic displays. ICPs have become essential components because consumer electronics evolve to meet performance and sustainability criteria, which will sustain the electronics and electricals segment leadership in the market.

During the forecast period, the automotive segment of the Intrinsically Conductive Polymers (ICP) market will experience growth at a substantial CAGR. The rising demand for innovative materials in autonomous driving systems and smart automotive technologies, as well as electric vehicles (EVs), drives this market growth. ICPs serve multiple automotive functions, including sensors, batteries, and electrostatic discharge protection, because of their excellent conductivity, flexibility, and environmental resistance. ICPs deliver crucial advantages to the automotive industry during its transition to automated and electric vehicles through their high-performance conductivity, lightweight design, and corrosion resistance. The upcoming intelligent and environmentally friendly automobiles will rely on ICPs as fundamental components because they integrate into infotainment systems, control units, and energy-efficient applications.

Regional Insights

The North America intrinsically conductive polymers market accounted for a substantial revenue share in 2024 because of high industrial demand from sectors such as electronics, automotive, and healthcare. The region's advanced technological infrastructure, together with its substantial research and development investments, has propelled the development of ICP applications in electronics and energy storage systems and flexible devices. The manufacturing foundation of North America enables efficient production and distribution of ICP-based products. The rising use of electric vehicles, together with the growing focus on sustainable and energy-efficient solutions, has accelerated market expansion. The regional government support for green technology and renewable energy projects will drive ICP demand, thus strengthening North America's position in the global market.

Asia Pacific Intrinsically Conductive Polymers Market Trends

The Asia Pacific intrinsically conductive polymers market led the market worldwide with the largest revenue share of 45.72% in 2024. The high industrialization, together with a strong electronics manufacturing base and innovative technology adoption in China, Japan, and South Korea, drives this market leadership. ICP growth in the region stems from strong demand for consumer electronics and automotive applications, and renewable energy solutions. Market expansion receives a boost from both electric vehicle adoption and smart device development. The Asia Pacific region hosts a large population of low-cost workers and extensive manufacturing capabilities, which enable it to become a center for ICP manufacturing and innovation. The region will sustain its global leadership position in the intrinsically conductive polymers market through persistent R&D investments and technical advancements.

Europe Intrinsically Conductive Polymers Market Trends

The European Intrinsically Conductive Polymers (ICP) market experienced consistent growth because of rising needs in electronics, alongside the automotive and energy storage industries. The European commitment to sustainability, together with green technology innovation, has caused ICP adoption to rise mainly for energy-efficient solutions in electric vehicles and renewable energy systems. The European market benefits from its leadership in advanced electronics development, which includes flexible displays, sensors, and wearable devices, thus enhancing the overall market growth. Various industries implement these polymers due to government programs that support environmental sustainability and carbon reduction efforts. Europe will continue to be a leading force within the global ICP market because of its robust industrial framework, extensive research programs, and established demand for high-performance materials.

Key Intrinsically Conductive Polymers Companies:

The following are the leading companies in the intrinsically conductive polymers market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- The Lubrizol Corporation

- Lehmann&Voss&Co.

- Solvay

- PolyOne Corporation

- Premix OY

- Sumitomo Chemical

- Parker Hannifin

- Heraeus Group

- SABIC

- RTP Company

- Covestro

- Others

Recent Developments

- In March 2024, Toray Industries announced that it had developed an ion-conductive polymer membrane with 10 times the ion conductivity of previous membranes. This revolutionary polymer uses a hopping conduction mechanism, allowing lithium ions to travel efficiently over a non-porous barrier. Using their knowledge of aramid polymers, Toray produced a polymer with more hopping sites, reaching ionic conductivity in the 10^-4 S/cm range.

- In October 2023, Solvay has announced the release of SolvaLite 716 FR, a cutting-edge fast-curing epoxy prepreg solution intended for a variety of structural components and reinforcements found in high-end battery electric vehicles (BEVs).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the intrinsically conductive polymers market based on the below-mentioned segments:

Global Intrinsically Conductive Polymers Market, By Product

- Polyaniline (PANI)

- Polypyrrole (PPy)

- Poly(3,4-ethylenedioxythiophene) (PEDOT)

- Polythiophene (PT)

Global Intrinsically Conductive Polymers Market, By End Use

- Electronics & Electricals

- Automotive

- Energy Storage

- Medical Devices

- Coatings & Anticorrosion

- Other end uses

Global Intrinsically Conductive Polymers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |