Italy Car Rental Market

Italy Car Rental Market Size, Share, and COVID-19 Impact Analysis, By Booking Type (Online Booking and Offline Booking), By Rental Length (Short Term and Long Term), By Car Type (Hatchback, Sedan, and Utility Vehicle), and Italy Car Rental Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Italy Car Rental Market Insights Forecasts to 2035

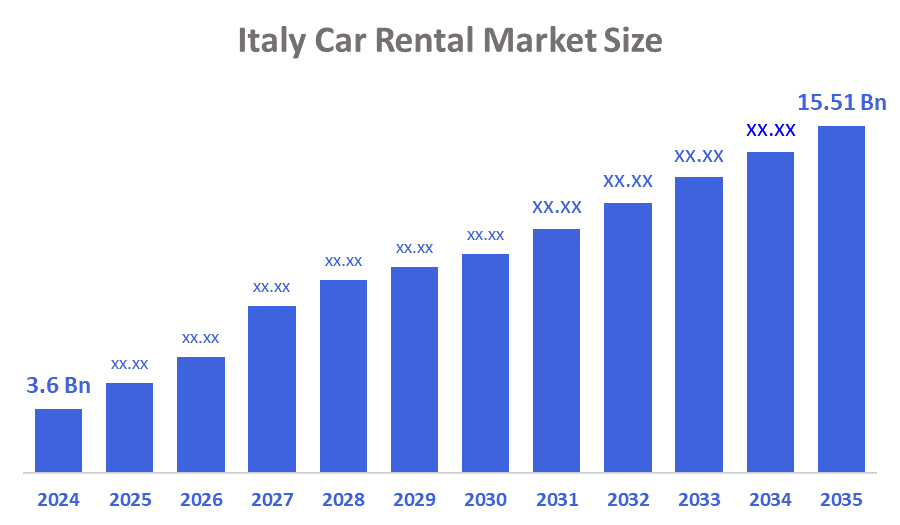

- The Italy Car Rental Market Size Was Estimated at USD 3.6 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 14.2% from 2025 to 2035

- The Italy Car Rental Market Size is Expected to Reach USD 15.51 Billion by 2035

According to a research report published by Decision Advisor & Consulting, the Italy car rental market size is anticipated to reach USD 15.51 billion by 2035, growing at a CAGR of 14.2% from 2025 to 2035. The Italy car rental market is driven by strong tourism demand, growing domestic and international travel, rising preference for flexible mobility, expansion of online booking platforms, increasing urbanization, limited private car ownership in cities, and corporate travel requirements supporting short-term and long-term rentals.

Market Overview

The Italy car rental market is mainly service providers who offer vehicle rental for short-term and long-term to tourists, corporate users, and residents. It incorporates economy, luxury, and commercial vehicles available through airports, cities, and online platforms, thus enabling travel, business mobility, and temporary transportation needs while lessening the need for private vehicle ownership throughout Italy. Besides that, the growth in the Italy car rental market is influenced by increased tourism, higher air passenger traffic, more online booking platforms, demand for flexible and affordable mobility, business travel expansion, and city regulations that restrict private car ownership and encourage rental and shared transportation services.

The Italy car rental market is experiencing several major trends that are helping to grow the market. One of the most notable is that the increasing availability of electric vehicle (EV) rentals is being driven by government incentives and a focus on sustainability, with travelers and businesses increasingly preferring eco-friendly options in cities and tourist destinations. Digitalization has resulted in the introduction of contactless rental services, such as app-based bookings, keyless entry, and automated check-ins, which not only improve convenience but also reduce the reliance on physical counters. The share of short-term and hourly rentals has gone up as a result of urban mobility reforms and changing consumer preferences, thus providing flexible options for tourists and business travelers. Additionally, AI and telematics integration optimize fleet management, enable predictive maintenance, improve customer experience, and provide data-driven insights for efficient operations and pricing strategies.

the italy car rental market is driven by technological advancements in fleet management, real-time tracking, automated booking, and mobile apps, enhancing efficiency and customer experience. By 2025, around 60% of rentals are online, reflecting digitalization. These innovations optimize fleet utilization, simplify bookings, and increase profitability. continued adoption of technology is expected to further transform the industry, making operations more efficient, customer-centric, and supporting sustained growth in Italy’s car rental market.

Report Coverage

This research report categorizes the market for the Italy car rental market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy car rental market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy car rental market.

Driving Factors

the Italy car rental market is primarily driven by rising tourism, increasing domestic and international travel, and growing demand for flexible mobility solutions. technological advancements, including online booking platforms, mobile apps, and fleet management systems, enhance convenience and efficiency. Additionally, government support for electric vehicles encourages eco-friendly rentals, while urbanization and limited private car ownership in cities boost short-term and on-demand rentals. corporate travel, business mobility needs, and evolving consumer preferences for contactless services further propel market growth, making Italy’s car rental sector increasingly dynamic and competitive.

Restraining Factors

the Italy car rental market faces restraints from high operational and maintenance costs, stringent government regulations, and fluctuating fuel prices. Seasonal demand variations, intense competition, and rising insurance expenses also limit profitability. Additionally, economic uncertainties and the increasing adoption of alternative mobility options, such as ride-sharing and public transportation, may reduce reliance on car rentals, slowing market growth.

Market Segmentation

The Italy car rental market share is classified into booking type, rental length, and car type.

- The online booking segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy car rental market is segmented by booking type into online booking and offline booking. Among these, the online booking segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of online booking in Italy’s car rental market is driven by convenience, speed, and accessibility. Customers can easily compare prices, choose vehicles, and receive instant confirmations from anywhere, without visiting rental offices. mobile apps and websites support contactless transactions, flexible cancellations, and personalized offers, enhancing user experience. Rising smartphone usage, growing internet penetration, and changing consumer preferences toward digital solutions have further accelerated the shift from offline to online bookings, making online the preferred segment.

- The short-term segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy car rental market is segmented by rental length into short-term and long-term. Among these, the short-term segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The short-term rental segment dominates the market due to high demand from tourists and business travelers seeking flexible and temporary mobility. Short-term rentals offer convenience for daily or hourly use, airport transfers, and city travel, without the commitment of long-term leases. Urban residents also prefer short-term options to avoid the costs and hassles of car ownership. Additionally, the growth of digital and app-based rental platforms has made short-term bookings easier, faster, and more accessible, reinforcing this segment’s dominance.

- The hatchback segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy car rental market is segmented by car type into hatchback, sedan, and utility vehicle. Among these, the hatchback segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hatchback segment dominates the market because of its practicality, affordability, and convenience. Hatchbacks are compact, making them ideal for navigating narrow streets and crowded urban areas common in Italian cities. They offer fuel efficiency, lower rental costs, and easy parking, which appeals to both tourists and local renters. Their versatility for short trips, sightseeing, and small groups makes them more popular than sedans and utility vehicles, establishing hatchbacks as the preferred choice in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy car rental market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Europcar Italia

- Hertz Italy

- Avis / Budget Group

- Sixt Italy

- Enterprise Holdings

- Sicily by Car

- Locauto Rent

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the Italy car rental market based on the below-mentioned segments:

Italy Car Rental Market, By Booking Type

- Online Booking

- Offline Booking

Italy Car Rental Market, By Rental Length

- Short Term

- Long Term

Italy Car Rental Market, By Car Type

- Hatchback

- Sedan

- Utility Vehicle

FAQ’s

Q1: How is the Italy car rental market defined?

It comprises companies offering vehicles for short-term and long-term use to tourists, businesses, and residents, through airports, urban centers, and online platforms, providing flexible mobility without owning a car.

Q2: What factors are driving the Italy car rental market?

Growing tourism, digital booking platforms, demand for eco-friendly EV rentals, urbanization, and corporate travel needs are key growth drivers.

Q3: Which car type is most in demand?

Hatchbacks are preferred for their compact size, fuel efficiency, easy parking, and suitability for city travel.

Q4: What type of booking is most used by customers?

Online bookings dominate due to convenience, app-based reservations, instant confirmations, and contactless services.

Q5: What challenges are slowing market growth?

High operational and insurance costs, seasonal fluctuations, intense competition, and alternatives like ride-sharing or public transport act as restraints.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |