Japan 4K TV Market

Japan 4K TV Market Size, Share, and COVID-19 Impact Analysis, By Technology (OLED (Organic Light Emitting Diode) Display, and Quantum Dot), By End User (Residential, and Commercial), Japan 4K TV Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan 4K TV Market Insights Forecasts to 2035

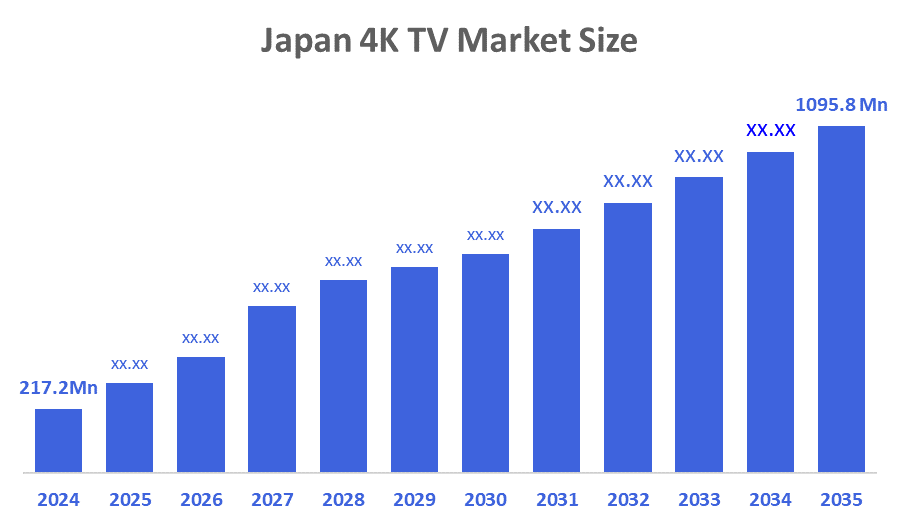

- The Japan 4K TV Market Size Was Estimated at USD 217.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 15.85% from 2025 to 2035

- The Japan 4K TV Market Size is Expected to Reach USD 1095.8 Million by 2035

According To a Research Report Published By Decisions Advisors & Consulting, The Japan 4K TV Market Size Is Anticipated To Reach USD 1095.8 Million By 2035, Growing At a CAGR of 15.85% From 2025 To 2035. The 4K TV market in Japan is driven by rising customer demand for high-resolution content, growing streaming platforms, technology advancements like OLED and HDR, competitive pricing, and a rise in the use of large-screen smart televisions.

Market Overview

The industry that manufactures, distributes, and sells 4K TV is referred to as the 4K television industry. 4K TV is defined as a television with a resolution of approximately 3840 × 2160 or "Ultra High Definition". They provide significantly improved image quality, enhanced color representation, and an immersive experience while watching. The Japan 4K TV market is experiencing a steady increase in growth as a result of increased demand for high-definition entertainment by consumers, increased use of smart home products, and increased preference for high-end display technologies like OLED and QLED products. Additionally, Japanese government programs support the 4K TV market through initiatives promoting digital broadcasting, energy-efficient appliances, and next-generation display production. METI’s “Top-Runner” standard targets a 32% reduction in TV power consumption by 2026, while local subsidies, such as Tokyo’s “Zero Emission Point,” offer rebates up to ¥80,000 for replacing old TVs, encouraging adoption of energy-efficient, advanced 4K models.

Innovations such as AI-powered upscaling, mini-LED backlighting, and easier integration of streaming platforms are increasing the attractiveness of these products. New opportunities are opening due to the increase in OTT subscriptions, gaming, and the replacement of older HD products. Also, some of the latest developments in the Japanese 4K TV market are ultra-thin 4K smart TVs from Japanese brands, increasing domestic panel production capabilities, and the creation of partnerships with content providers to enhance 4K broadcast availability.

Report Coverage

This research report categorizes the market for the Japan 4K TV market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan 4K TV market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan 4K TV market.

Driving Factors

The 4K TV market in Japan is driven by increased consumer demand for high-resolution viewing, smart TV capabilities, and advanced display technology like OLED and QLED. Other contributors to the 4K market's growth include falling prices, increased adoption rates for OTT streaming services, and consumers replacing their old HD televisions. In addition to advancements in display technology, government programs that encourage the use of digital broadcasting and energy-efficient appliances will facilitate the transition to 4K televisions. Furthermore, new technologies, including artificial intelligence upscaling, mini-LED backlighting, and enhanced connectivity to the internet, will offer consumers enhanced experiences when viewing entertainment in home or business settings.

Restraining Factors

The 4K TV market in Japan is mostly constrained by high costs associated with producing advanced display technology, intense competition between domestic and international brands, and reluctance among consumers to upgrade from their existing HD models. In addition, there is limited awareness of the smart functionality and energy-efficient capabilities available with many popular brands, which limits growth potential in this market segment.

Market Segmentation

The Japan 4K TV market share is classified into technology and end user.

- The OLED (Organic Light Emitting Diode) display segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan 4K TV market is segmented by technology into OLED (Organic Light Emitting Diode) display and quantum dot. Among these, the OLED (Organic Light Emitting Diode) display segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The OLED category dominates Japan’s 4K TV industry due to its outstanding picture quality, deep blacks, bright colors, broad viewing angles, energy efficiency, and thin design.

- The residential segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan 4K TV market is segmented by end user into residential and commercial. Among these, the residential segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Rising consumer demand for home entertainment, streaming services, gaming, and smart home integration promotes residential adoption. Households frequently replace older HD TVs with 4K OLED and QLED ones. Additionally, government incentives for energy-efficient appliances and the growing popularity of large-screen TVs further raise home market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan 4K TV market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sony (BRAVIA)

- Panasonic (VIERA)

- Sharp (AQUOS)

- Toshiba

- Hitachi

- JVC (Japan Victor Company)

- Funai Electric Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In March 2025, Sony announced its new display technology, which has separately controlled, ultra-high density RGB LED illumination on a large screen for higher quality color reproduction, wider color range, and finer brightness degradation. This product will be manufactured at a large scale in 2025 and is specifically designed to improve both filmmaking and home viewing experiences by providing the capability to create movie-like images with extremely accurate color reproduction and complete control over brightness levels.

- In January 2025, the majority of 4K televisions sold came from the 4k product line but accounted for approximately 78.7% of the TV sales revenue, suggesting a growing market for these pricier televisions. Unfortunately, the total number of TV shipments has decreased due to their relatively high pricing.

- In January 2025, Panasonic launched its flagship Z95B OLED TV, featuring a new RGB LED backlight, 40% higher brightness, Thermal Flow cooling, CALMAN and Prime Video calibration modes, 144Hz gaming support, Technics-tuned audio, Dolby Vision IQ, ultra-low latency, 360° sound, AirPlay, and smart home compatibility.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan 4K TV market based on the below-mentioned segments:

Japan 4K TV Market, By Technology

- OLED (Organic Light Emitting Diode) Display

- Quantum Dot

Japan 4K TV Market, By End User

- Residential

- Commercial

FAQ’s

Q: What is the Japan 4K TV market size?

A: Japan 4K TV market size is expected to grow from USD 217.2 million in 2024 to USD 1095.8 million by 2035, growing at a CAGR of 15.85% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by increased consumer demand for high-resolution viewing, smart TV capabilities, and advanced display technology like OLED and QLED. Other contributors to the 4K market's growth include falling prices, increased adoption rates for OTT streaming services, and consumers replacing their old HD televisions. In addition to advancements in display technology, government programs that encourage the use of digital broadcasting and energy-efficient appliances will facilitate the transition to 4K televisions.

Q: What factors restrain the Japan 4K TV market?

A: Constraints include high costs associated with producing advanced display technology, intense competition between domestic and international brands, and reluctance among consumers to upgrade from their existing HD models.

Q: How is the market segmented by technology?

A: The market is segmented into OLED (Organic Light Emitting Diode) display and quantum dot.

Q: Who are the key players in the Japan 4K TV market?

A: Key companies include Sony (BRAVIA), Panasonic (VIERA), Sharp (AQUOS), Toshiba, Hitachi, JVC (Japan Victor Company), Funai Electric Co., Ltd., and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |