Japan Air Cargo Market

Japan Air Cargo Market Size, Share, and COVID-19 Impact Analysis, By Type (Air Freight, Air Mail, and Others), By Service (Express, Regular), and Japan Air Cargo Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Air Cargo Market Insights Forecasts to 2035

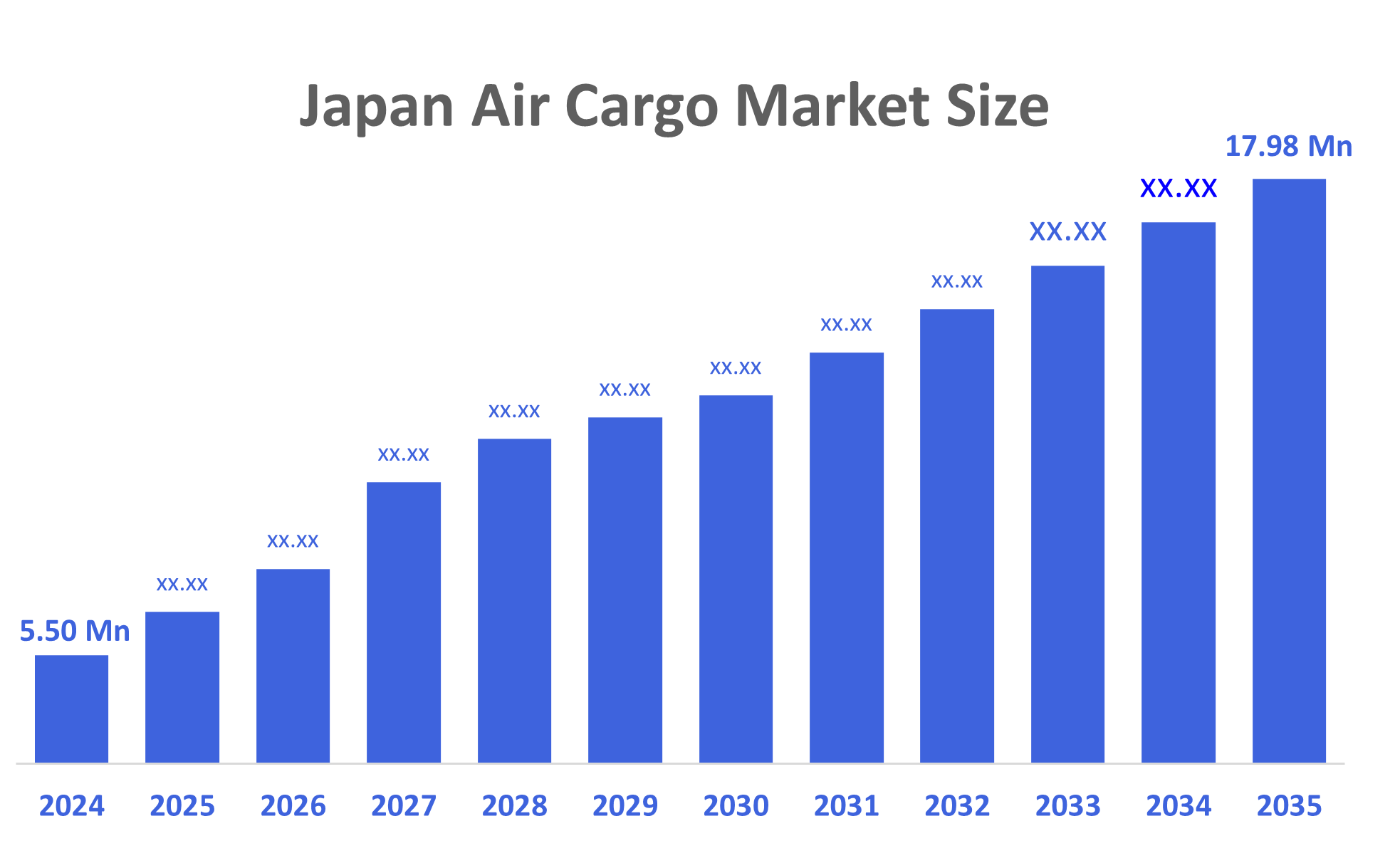

- The Japan Air Cargo Market Size Was Estimated at USD 5.50 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 11.37% from 2025 to 2035

- The Japan Air Cargo Market Size is Expected to Reach USD 17.98 Million by 2035

According to a research report published by Decisions Advisors, The Japan Air Cargo Market Size is Anticipated to Reach USD 17.98 Million by 2035, Growing at a CAGR of 11.37% from 2025 to 2035. The Japan air cargo market is driven by expanding e-commerce demand, growth in high-value electronics exports, advancements in logistics infrastructure, rising international trade flows, and increasing need for faster, reliable supply chain solutions.

Market Overview

The Japan air cargo market refers to the transportation of goods and freight by air within, to, and from Japan. It supports domestic and international trade by enabling fast, reliable shipment of electronics, automotive parts, perishables, and e-commerce products, driven by advanced logistics infrastructure and global supply chain demand. The expansion of e-commerce portals is positively influencing the market. According to PCMI's data, Japan total e-commerce volume for 2024 reached USD 380 Billion. E-commerce platforms demand faster and more reliable logistics solutions to meet user expectations for quick delivery, and air cargo is becoming a preferred mode due to its speed and efficiency. Japan retailers and e-commerce companies continue to rely on air transport to move goods quickly across domestic and international markets.

This trend is creating the need for timely, secure, and temperature-sensitive deliveries, especially for electronics, fashion, and perishables. The requirement for efficient last-mile delivery is also increasing air cargo volumes, as companies try to meet same-day or next-day delivery targets. Warehousing and distribution networks near airports are expanding to support quicker transit times. Airlines and cargo service providers are investing in digital tracking systems and logistics automation to improve service quality and capacity. Moreover, the broadening of cross-border online trade is contributing to the rising adoption of international air cargo services. Japan strong digital infrastructure, high internet penetration, and urban density are supporting e-commerce activities, thus catalysing the demand for advanced air cargo logistics.

Report Coverage

This research report categorizes the market for the Japan air cargo market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan air cargo market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan air cargo market.

Driving Factors

The air cargo markets in Japan are driven by robust international trade, expanding e-commerce operations, increasing demand for rapid shipment of high-value products, and growth in automotive, semiconductor, and electronics exports. Additional drivers include advanced airport and logistics infrastructure, technological innovation in freight handling, global supply chain integration, and rising expectations for fast, reliable delivery services across domestic and international routes.

Restraining Factors

The air cargo market in Japan is restrained by by high operational costs, limited airport capacity, strict environmental regulations, labor shortages, fluctuating fuel prices, and competition from efficient maritime and rail freight alternatives.

Market Segmentation

The Japan air cargo market share is categorized by type and service.

- The air freight segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan air cargo market is segmented by type into air freight, air mail, and others. Among these, the air freight segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by rising e-commerce demand, increased high-value goods transport, faster delivery expectations, improved logistics networks, and Japan’s strong export activity.

- The regular segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan air cargo market is segmented by service into express, regular. Among these, the regular segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to consistent shipping demand, stable scheduling, cost efficiency, strong use by manufacturers, and reliable service networks, supporting continued expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan air cargo market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ANA Cargo

- JAL Cargo

- Nippon Cargo Airlines

- Nippon Express

- Kintetsu World Express

- Yamato Transport

- Sagawa Express / SG Holdings

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, Japan Airlines (JAL) and Kalitta Air established a partnership for regular cargo services from Tokyo Narita (NRT) to Chicago O’Hare (ORD). The agreement allowed JAL to cater to the ongoing robust demand for cargo transport by offering reliable and versatile air cargo services with the inclusion of large cargo planes from a partner company. Between April 4 and April 26, cargo capacity would be available on flights run by Kalitta aboard a 747-400F, and starting May 10, the codeshare would feature flights operated by Kalitta Air using a 777-300ERSF.

- In January 2025, ANA Holdings, headquartered in Tokyo, obtained authorization from Japan’s Fair-Trade Commission (JFTC) for its intended acquisition of Nippon Cargo Airlines (NCA). The competition authority indicated that in the total cargo sector, the airlines owned by NCA and ANA Holdings, such as All Nippon Airways, would possess a market share of roughly 30% for the Los Angeles region and 35% for the Chicago region.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Air Cargo Market based on the below-mentioned segments:

Japan Air Cargo Market, By Type

- Air Freight

- Air Mail

- Others

Japan Air Cargo Market, By Service

- Express

- Regular

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |