Japan Alcohol Packaging Market

Japan Alcohol Packaging Market Size, Share, and COVID-19 Impact Analysis, By Packaging Type (Bottles, Cans, Cartons, Pouches, and Others), By Material (Glass, Metal, Plastic, Paper & Paperboard, and Others), By Application (Beer, Wine, Spirits, RTD Alcoholic Beverages, and Others), and Japan Alcohol Packaging Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Alcohol Packaging Market Size Insights Forecasts to 2035

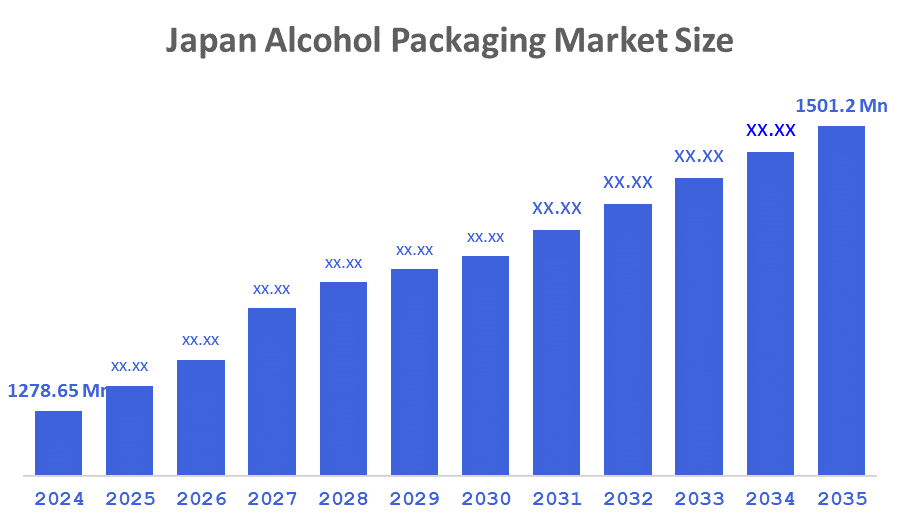

- The Japan Alcohol Packaging Market Size Was Estimated at USD 1278.65 Million in 2024

- The Market Size is Expected to Grow at a CAGR of 1.47% from 2025 to 2035

- The Japan Alcohol Packaging Market Size is Expected to Reach USD 1501.2 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Japan Alcohol Packaging Market Size is anticipated to Reach USD 1501.2 Million by 2035, Growing at a CAGR of 1.47% from 2025–2035. The Japan Alcohol Packaging Market is driven by rising consumption of premium alcohol, increasing demand for sustainable and recyclable packaging, and product innovations in bottles, cans, and lightweight packaging formats. The growing popularity of craft beer, specialty spirits, and ready-to-drink (RTD) beverages has further accelerated the need for attractive, durable, and eco-friendly packaging solutions.

Market Overview

The Japanese alcohol packaging market refers to the production and supply of packaging materials and formats used for alcoholic beverages such as beer, wine, spirits, and RTD drinks. Alcohol packaging includes bottles, cans, cartons, labels, closures, and protective materials designed to preserve product quality, provide safe storage, and enhance brand appeal. Trends in this market include rapid adoption of lightweight glass bottles, the rise of aluminium cans for beer and RTD beverages, increased use of paper-based packaging, and a growing shift toward eco-friendly packaging driven by Japan's environmental policies. Key market characteristics include high demand for premium packaging designs, strong presence of established packaging manufacturers, rapid expansion of craft beverage brands, and widespread use of recycled materials. Drivers such as rising alcoholic beverage consumption, increasing demand for sustainable packaging, and the premiumization of spirits and wine are supporting robust market growth.

Japanese government initiatives related to recycling, reduced plastic consumption, and circular economy programs have further strengthened the transition toward environmentally friendly alcohol packaging solutions.

Report Coverage

This research report categorizes the market for the Japan alcohol packaging market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan alcohol packaging market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan alcohol packaging market.

Driving Factor

The Japanese alcohol packaging market is driven by rising demand for premium alcohol beverages, such as craft beer, artisan spirits, and high-end wine, which require well-designed and durable packaging. Additionally, the growing adoption of sustainable and recyclable materials, especially aluminium cans and lightweight glass, supports market expansion. Rapid growth in ready-to-drink alcoholic beverages and increased consumer preference for convenient, portable packaging formats further fuel the demand for advanced alcohol packaging solutions.

Restraining Factor

The Japanese alcohol packaging market faces restraints such as high production costs for premium and eco-friendly packaging, limited availability of certain sustainable raw materials, and strict regulations related to waste disposal and recycling. Fluctuations in glass and aluminium prices may also create cost pressures, affecting small and mid-sized alcohol producers.

Market Segmentation

The Japan alcohol packaging market share is categorized by packaging type, material, and application.

- The bottles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japanese alcohol packaging market is segmented by packaging type into bottles, cans, cartons, pouches, and others. Among these, the bottles segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by the strong preference for glass bottles in premium alcohol categories such as wine, craft beer, and spirits. Bottles provide durability, superior product preservation, and strong visual appeal, which resonates with Japanese consumers’ preference for heritage, luxury, and authenticity in alcoholic beverages. Additionally, the increasing adoption of lightweight and recycled-glass bottles supports the continued dominance of this segment.

- The glass segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japanese alcohol packaging market is segmented by material into glass, metal, plastic, paper & paperboard, and others. Among these, the glass segment accounted for the largest revenue share in 2024 and is projected to maintain its leading position. The growth of this segment is fueled by the rising demand for premium sake, whisky, wine, and craft spirits beverages that rely on glass for quality preservation and brand identity. Government initiatives promoting recyclability and reduced environmental impact, along with consumer preference for eco-friendly materials, further support the adoption of glass packaging across all major alcohol categories.

- The beer segment accounted for the largest revenue share in 2024 and is expected to grow at a notable CAGR during the forecast period.

The Japanese alcohol packaging market is segmented by application into beer, wine, spirits, RTD alcoholic beverages, and others. Among these, the beer segment held the largest revenue share in 2024 and is expected to grow significantly during the forecast period. The segment’s growth is driven by Japan’s strong beer culture, rising consumption of craft beer, and the expanding preference for canned beer formats. Alcohol brands are increasingly adopting innovative packaging designs such as slim cans, matte-finish bottles, and visually appealing labels to stand out in a competitive market. The rapid expansion of RTD alcoholic beverages through convenience stores is also contributing to strong performance across beer packaging formats.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the Japan alcohol packaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nihon Glass Co., Ltd.

- Toyo Seikan Group Holdings

- O-I Glass Japan

- Toppan Printing Co., Ltd.

- Nippon Paper Industries

- Ball Corporation Japan

- Can-Pack Japan

- Sidel Japan

- YFY Packaging

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2025, Toyo Seikan Group launched a new eco-friendly lightweight aluminium can designed specifically for Japanese craft beer and RTD beverage brands, reducing material usage by 15% without compromising durability.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Alcohol Packaging Market based on the segments below:

Japan Alcohol Packaging Market, By Packaging Type

- Bottles

- Cans

- Cartons

- Pouches

- Others

Japan Alcohol Packaging Market, By Material

- Glass

- Metal

- Plastic

- Paper & Paperboard

- Others

Japan Alcohol Packaging Market, By Application

- Beer

- Wine

- Spirits

- RTD Alcoholic Beverages

- Others

Frequently Asked Questions (FAQs)

Q: What is the Japan Alcohol Packaging Market size?

A: The market is expected to grow from USD 1278.65 million in 2024 to USD 1501.2 million by 2035, at a CAGR of 1.47% during 2025–2035.

Q: What factors restrain the Japan Alcohol Packaging Market?

A: High production costs, raw material price volatility, and strict recycling regulations.

Q: How is the market segmented by packaging type?

A: Bottles, Cans, Cartons, Pouches, and Others.

Q: Who are the key players in the Japan Alcohol Packaging Market?

A: Major players include Toyo Seikan, Nihon Glass, Nippon Paper Industries, Ball Corporation Japan, and others.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 193 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |