Japan Alcoholic Beverages Market

Japan Alcoholic Beverages Market Size, Share, and COVID-19 Impact Analysis, By Category (Beer, Wine, Spirits, and Others), By Packaging Type (Glass Bottles, Tins, Plastic Bottles, and Others), By Distribution Channel (Supermarkets/Hypermarkets, On-Trade, Specialist Retailers, Online, Convenience Stores, and Others), and Japan Alcoholic Beverages Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Alcoholic Beverages Market Insights Forecasts to 2035

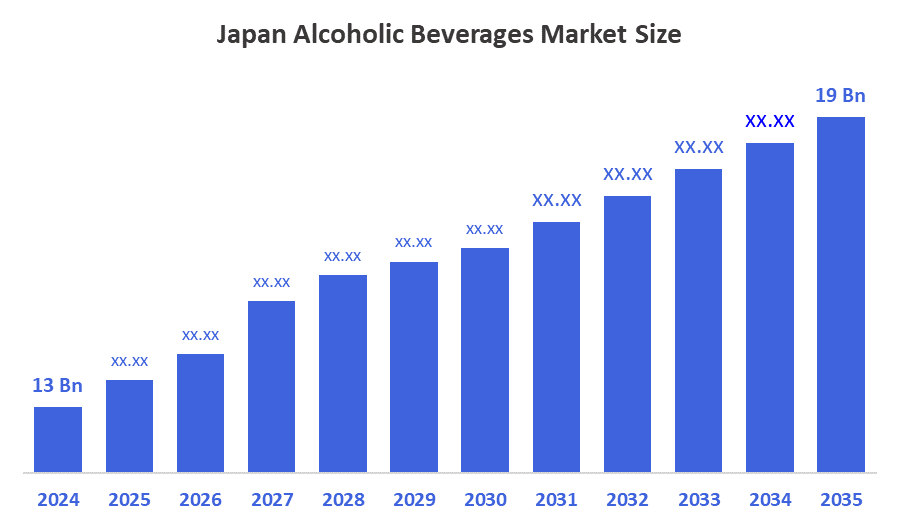

- The Japan Alcoholic Beverages Market Size Was Estimated at USD 13 Billion in 2024.

- The Market Size is Expected to Grow at a CAGR of Around 3.51% from 2025 to 2035.

- The Japan Alcoholic Beverages Market Size is Expected to Reach USD 19 Billion by 2035.

According to a research report published by Decision Advisors, the Japan Alcoholic Beverages Market Size is Anticipated to Reach USD 19 Billion by 2035, growing at a CAGR of 3.51% from 2025 to 2035. The Japan alcoholic beverages market is driven by evolving consumer preferences, rising demand for premium and craft drinks, growing influence of western drinking culture, and continuous product innovation supported by research-oriented strategies.

Market Overview

Japan alcoholic beverages market also known as alcohol or spirits, has been consumed by humans for thousands of years. They are drinks that contain ethanol, a psychoactive substance produced through the fermentation of sugars by yeast. These beverages come in various forms, including beer, wine, and distilled spirits. Beer, one of the oldest alcoholic drinks, is made from fermented grains such as barley and wheat. It has a relatively low alcohol content and is enjoyed for its diverse flavours and styles. Wine is crafted from fermented grapes, and its production dates back to ancient civilisations. It offers a wide range of flavours, aromas, and styles, from dry and light to sweet and fortified. Distilled spirits like whiskey, vodka, and rum are created through distillation, a process that increases alcohol content. They are known for their potency and can be enjoyed straight, in cocktails, or as part of various culinary traditions.

The legal age for drinking in Japan is 20 years. Social drinking holds significance in Japan, serving a means to foster social and business connections. The Japan alcoholic beverages market is driven by evolving consumer preferences, rising demand for premium and craft drinks, growing influence of western drinking culture, and continuous product innovation supported by research-oriented strategies.

Report Coverage

This research report categorizes the market for the Japan alcoholic beverages market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan alcoholic beverages market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan alcoholic beverages market.

Driving Factors

The alcoholic beverages markets in Japan are driven by changing consumer lifestyles, increasing demand for premium and craft beverages, rising influence of global and cultural drinking trends, innovation through research-oriented product development, and strategic marketing focused on quality and authenticity.

The taxation policies of Japan have experienced numerous alterations over decades, changing according to the alcohol by volume of various drinks. A recent development of 2022 was government outlined plan to implement a gradual transition in tax rates. The intention was to lower the taxes on sake and beer, but at the same time elevate taxes on low malt beers, chuhai, which is a cocktail drink with an alcohol by volume of less than 12%, and wine. Such tax changes would help create a more equitable taxation system that relates to the distinctive features of every beverage category.

Restraining Factors

The alcoholic beverages markets in Japan is restrained by strict government regulations and high taxation policies, declining alcohol consumption due to growing health consciousness, and increasing competition in a mature and saturated market.

Market Segmentation

The Japan alcoholic beverages market is share is cauterized by category, packing type and distribution channel.

- The beer segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan alcoholic beverages market is segmented by category into beer, wine, spirits, others. Among these, the beer segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by strong consumer preference for traditional and craft beers, continuous product innovation supported by research and development, increasing demand for premium and low-alcohol variants, and expanding distribution channels enhancing market accessibility.

- The plastic bottles segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan alcoholic beverages market is segmented by packaging type into glass bottles, tins, plastic bottles, and others. Among these, the plastic bottles segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to increasing demand for lightweight and cost-effective packaging solutions, advancements in sustainable and recyclable plastic materials through research-oriented innovation, rising convenience among consumers for on-the-go consumption, and expanding applications across various alcoholic beverage categories.

The supermarkets/ hypermarkets segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan alcoholic beverages market is segmented by distribution channel into supermarkets/ hypermarkets, on-trade, specialist retailers, online, convenience stores, and others. Among these, the supermarkets/ hypermarkets segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the wide availability of diverse alcoholic beverage brands under one roof, increasing consumer preference for convenient and cost-effective shopping experiences, continuous expansion of retail networks supported by research-driven inventory management and marketing strategies, and rising collaborations between beverage manufacturers and large retail chains to enhance product visibility and accessibility.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan alcoholic beverages market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Suntory Holdings Limited

- Kirin Holdings Company, Limited

- Asahi Group Holdings Limited

- Takara Holdings Inc

- Sapporo Holdings Limited

- OENON Holdings, Inc

- Gekkeikan Sake Co.Ltd

- Choya Umeshu Co.Ltd

- Ozeki Corporation

- Sanwa Shurui Co.Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2022, the Suntory group took a significant step towards streamlining its domestic liquor operations and adapting to evolving alcohol consumption patterns by establishing a new domestic liquor company. This new entity, Suntory Spirits Limited, was formed by merging five pre-existing companies.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Japan Alcoholic Beverages Market based on the below-mentioned segments:

Japan Alcoholic Beverages Market, By Category

- Beer

- Wine

- Spirits

- Others

Japan Alcoholic Beverages Market, By Packaging Type

- Glass Bottles

- Tins

- Plastic Bottles

- Others

Japan Alcoholic Beverages Market, By Distribution Channel

- Supermarkets/Hypermarkets

- On-Trade

- Specialist Retailers

- Online

- Convenience Stores

- Others

FAQs

Q. What is the base year used for analysing the Japan Alcoholic Beverages Market?

A: The base year for the Japan Alcoholic Beverages Market is 2024, with historical data covering 2020–2023.

Q. What is the projected market size of Japan’s alcoholic beverages sector by 2035?

A: The Japan Alcoholic Beverages Market size is expected to reach USD 13.04 billion litres by 2035, growing at a CAGR of 2.65% from 2025 to 2035.

Q. What key factor is driving the growth of Japan’s alcoholic beverages market?

A: The market is growing due to rising demand for low- and no-alcohol drinks, increased tourism, and strong interest in premium beverages.

Q. Which product category held the largest market share in 2024?

A: The beer segment accounted for the largest revenue market share in 2024, driven by premium, artisanal, and low-alcohol beer trends.

Q. Which distribution channel dominated Japan’s alcoholic beverages market in 2024?

A: Supermarkets and hypermarkets held the largest revenue share in 2024 due to consumer preference for convenience and one-stop shopping.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |