Japan Anti-Infective Drug Market

Japan Anti-Infective Drug Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Antibiotics, Antivirals, Antifungals, and Others), By Route of Administration (Oral, Injectable, and Topical), and Japan Anti-Infective Drug Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Japan Anti-Infective Drug Market Insights Forecasts to 2035

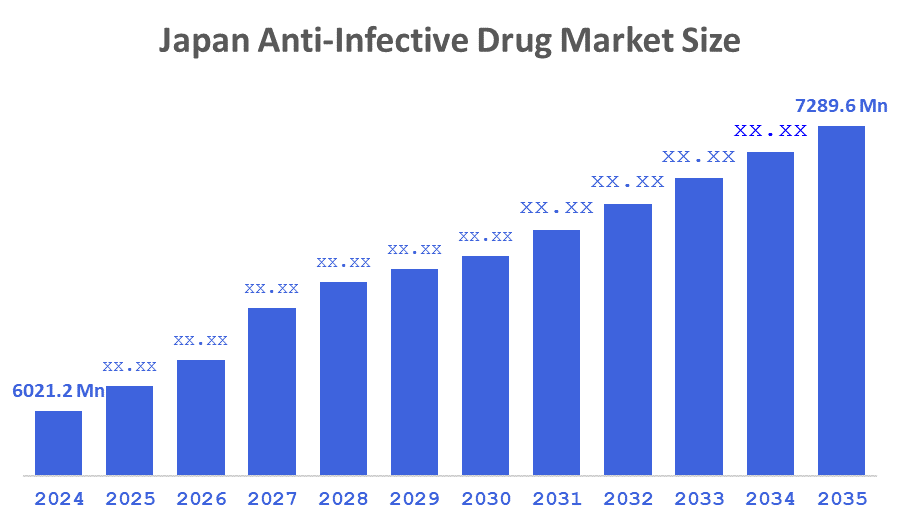

- The Japan Anti-Infective Drug Market Size Was Estimated at USD 6021.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 1.75% from 2025 to 2035

- The Japan Anti-Infective Drug Market Size is Expected to Reach USD 7289.6 Million by 2035

According to a research report published by Decision Advisior & Consulting, the Japan Anti-Infective Drug Market is projected to reach USD 7,289.6 Million by 2035, expanding at a CAGR of 1.75% during the forecast period. Growth is primarily driven by rising incidence of infectious diseases, increasing antimicrobial resistance that necessitates stronger and more advanced therapies, and continuous development of novel antivirals and broad-spectrum antibiotics. Japan’s aging population, growing hospitalization rates, and increasing government focus on infection control further accelerate demand for anti-infective medications. The expansion of pharmaceutical R&D, digital health systems, and rapid diagnostic technologies also supports market progression across the country.

Market Overview

The Japanese anti-infective drug market refers to pharmaceutical treatments used to prevent or cure infections caused by bacteria, viruses, fungi, and parasites. Anti-infective drugs are essential in managing diseases such as pneumonia, influenza, urinary tract infections, skin infections, and systemic fungal conditions. Key market trends include the rising need for next-generation antibiotics due to antimicrobial resistance (AMR), increasing development of targeted antivirals, and a growing shift toward combination therapies. Additionally, demand for broad-spectrum and hospital-grade anti-infectives continues to rise with Japan’s expanding elderly population and increased prevalence of chronic diseases, which heighten vulnerability to infections. Major market characteristics include strong government oversight, expansion of local pharmaceutical manufacturing, and high emphasis on drug safety, efficacy, and responsible antimicrobial usage.

The Ministry of Health, Labour and Welfare (MHLW), Japan’s AMR National Action Plan, PMDA fast-track approvals for essential anti-infective drugs, and infection-control reforms in hospitals all strengthen market demand. Funding support for vaccine development, rapid infection diagnostics, and antimicrobial stewardship further enhances the sector’s growth dynamics.

Report Coverage

This research report categorizes the market for the Japan anti-infective drug market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan anti-infective drug market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan anti-infective drug market.

Driving Factors

The Japanese anti-infective drug market is driven by rising infection rates in both community and hospital settings, increasing antimicrobial resistance, and the need for more advanced and effective therapeutic options. The aging population contributes significantly to higher demand for antibiotics, antivirals, and antifungals due to weakened immunity. Expanding R&D investments, introduction of innovative treatment formulations, and greater focus on infection-prevention and rapid diagnostics also support strong market growth. Government-backed AMR programs and increased public health preparedness further accelerate the adoption of anti-infective therapies.

Restraining Factors

The Japanese anti-infective drug market is restrained by strict regulatory protocols, high development costs for new antimicrobial drugs, and rising concerns over inappropriate antibiotic use. Increasing preference for preventive healthcare and vaccines may also reduce reliance on certain anti-infective categories.

Market Segmentation

The Japan anti-infective drug market share is categorized by Drug Class and Route of Administration.

• The antibiotics segment accounted for the largest revenue share in 2024 and is expected to grow significantly during the forecast period.

The Japan anti-infective drug market is segmented by drug class into antibiotics, antivirals, antifungals, and others. Among these, the antibiotics segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the high prescription volume, widespread bacterial infections, and ongoing demand for broad-spectrum and resistant-targeting therapies. Increasing hospital-acquired infections, AMR challenges, and expansion of combination-antibiotic formulations further support segment growth.

• The injectable segment dominated the market in 2024 and is projected to expand at a substantial CAGR during the forecast period.

The Japan anti-infective drug market is segmented by route of administration into oral, injectable, and topical. Among these, the injectables segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by their fast action, high efficacy in severe infections, and extensive use in hospital settings. Rising inpatient admissions and the need for rapid-treatment solutions strengthen injectable anti-infective demand across Japan’s healthcare institutions.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the Japan anti-infective drug market, along with a comparative evaluation primarily based on their product offerings, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shionogi & Co., Ltd.

- Daiichi Sankyo Company, Limited

- Takeda Pharmaceutical Company Limited

- Astellas Pharma Inc.

- Chugai Pharmaceutical Co., Ltd.

- Mitsubishi Tanabe Pharma Corporation

- Meiji Seika Pharma Co., Ltd.

- Pfizer Japan Inc.

- MSD K.K.

- GlaxoSmithKline Japan

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In February 2024, Shionogi announced the development of a next-generation antibacterial candidate targeting resistant gram-negative pathogens, supporting Japan’s national efforts to combat antimicrobial resistance (AMR).

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Japan Anti-Infective Drug Market based on the segments below:

Japan Anti-Infective Drug Market, By Drug Class

- Antibiotics

- Antivirals

- Antifungals

- Others

Japan Anti-Infective Drug Market, By Route of Administration

- Oral

- Injectable

- Topical

FAQs

Q: What are the key growth drivers of the market?

A: The market is driven by rising infection prevalence, antimicrobial resistance, growth in hospital-acquired infections, and increased investment in advanced anti-infective therapies.

Q: What factors restrain the Japan anti-infective drug market?

A: Stringent regulatory requirements, high development costs, and the shift toward preventive healthcare reduce market expansion.

Q: How is the market segmented by drug class?

A: The market is segmented into antibiotics, antivirals, antifungals, and others.

Q: Who are the key players in the Japan anti-infective drug market?

A: Major companies include Shionogi, Daiichi Sankyo, Takeda, Astellas, and Chugai Pharmaceutical

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |