Japan Antidiabetic Market

Japan Antidiabetic Market Size, Share, and COVID-19 Impact Analysis, By Type (Insulins, Oral Anti-diabetic Drugs, Non-Insulin Injectable Drugs, Combination Drugs), By Distribution Channel (Online Pharmacies, Hospital Pharmacies, Retail Pharmacies), and Japan Antidiabetic Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Antidiabetic Market Size Insights Forecasts to 2035

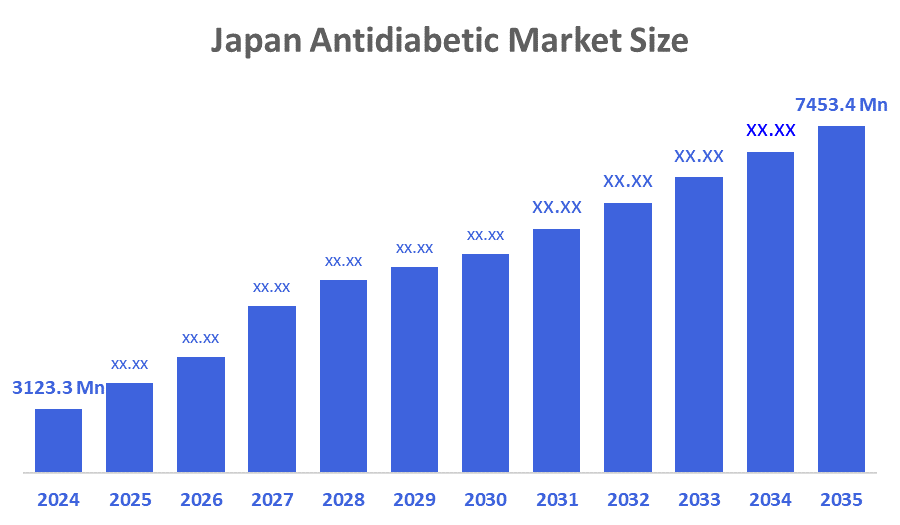

- The Japan Antidiabetic Market Size Was Estimated at USD 3123.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.23% from 2025 to 2035

- The Japan Antidiabetic Market Size is Expected to Reach USD 7453.4 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Japan Antidiabetic Market Size is anticipated to Reach USD 7453.4 Million by 2035, Growing at a CAGR of 8.23% from 2025 to 2035. Japan's Antidiabetic Market is growing due to its aging population; more people are being diagnosed with diabetes due to changes in lifestyle factors & increased availability of diabetes-related treatment and screening resulting from government programs and a growing sector of the healthcare industry.

Market Overview

In Japan, the antidiabetic sector pertains to the area involving drugs and medical instruments designed for controlling and treating diabetes. This industry is growing, primarily driven by the nation’s trends and the increasing occurrence of type 2 diabetes. Antidiabetic medications assist in reducing blood glucose by enhancing insulin utilization and increasing the body’s insulin effectiveness. These treatments include drugs such as metformin, insulin injections, and natural substances, along with lifestyle changes proven to be effective. This includes drugs that control blood sugar levels, such as sulfonylureas or biguanides, which typically work by increasing insulin secretion and/or improving the cells' responsiveness to insulin.

Japan runs a health insurance system that covers expenses related to the diagnosis, treatment, and management of diabetes. This includes support for medications, insulin therapies, and devices like glucose monitors (CGMs) and insulin pumps, significantly alleviating the burden on patients and improving access to healthcare.

Report Coverage

This research report categorizes the market for the Japan antidiabetic market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan antidiabetic market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan antidiabetic market.

Driving Factor

The antidiabetic market in Japan is driven by the growing prevalence of Type 2 diabetes, which is increasing due to an aging population and the adoption of a westernized lifestyle. Additional elements affecting diabetes risk consist of government-supported programs for diabetes screening and management, rising healthcare spending, access to medications, substantial costs associated with diabetes treatment, a robust healthcare infrastructure for diabetes care, and a growing patient base using therapies, including injectables.

Restraining Factor

The antidiabetic industry in Japan faces difficulties because of the growing availability of medications combined with their pricing approaches, alongside the prolonged drug approval process and the implementation of pharmaceutical regulations.

Market Segmentation

The Japan Antidiabetic Market share is categorized into type and distribution channel.

• In 2024, the oral anti-diabetic medications segment dominated the market revenue share. It is projected to undergo CAGR expansion throughout the forecast period.

The Japanese antidiabetic market is divided by type into insulin antidiabetic drugs, non-insulin injectable, and combination therapies. Among these, the oral antidiabetic drugs segment held the revenue share in 2024. It is projected to witness CAGR growth during the forecast period. The expansion of this segment is fueled by the prevalence of type 2 diabetes in Japan, where oral medications remain the favored treatment. These drugs are simple to use, enhance treatment adherence, and cause discomfort compared to injections. Their reduced price renders them affordable for patients. Moreover, Japan’s aging population encourages dosing schedules that increase demand. The wide range of medication types, such as DPP-4 inhibitors and SGLT-2 inhibitors, also enhances their standing in the market.

• In 2024, the retail pharmacies sector dominated the market. It is projected to achieve CAGR growth over the forecast period.

The antidiabetic market in Japan is categorized by distribution channels into pharmacies, hospital pharmacies, and retail pharmacies. Among these, the retail pharmacies segment held the revenue share in 2024. This segment is anticipated to experience CAGR growth throughout the forecast period. The development of this segment is driven by its availability to patients needing refills for ailments such as type 2 diabetes. Its widespread reach across regions guarantees convenience, swift service, and reliable access to medication. Japanese consumers also prefer in-person pharmacist guidance, especially for long-term therapies such as oral antidiabetics and insulin. Hospital pharmacies mainly support inpatient or specialized care, while online pharmacies are growing but remain limited due to regulatory controls and patient preference for face-to-face consultation, keeping retail pharmacies in the leading position.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan antidiabetic market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Takeda Pharmaceutical Co. Ltd.

- Astellas Pharma Inc.

- Daiichi Sankyo Company, Limited

- Ono Pharmaceutical Co., Ltd.

- Chugai Pharmaceutical Co., Ltd.

- Terumo Corporation

- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi

- Boehringer Ingelheim

- AstraZeneca

- other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2021, Takeda Pharmaceutical Company Limited announced an agreement to transfer the assets, marketing rights, and eventual marketing authorization for a portfolio of select non-core products in Japan to Teijin Pharma Limited for JPY 133 billion, pending standard legal and regulatory approvals.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan antidiabetic market based on the below-mentioned segments:

Japan Antidiabetic Market, By Type

- Insulins

- Oral Anti-diabetic Drugs

- Non-Insulin Injectable Drugs

- Combination Drugs

Japan Antidiabetic Market, By Distribution Channel

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

FAQ’s

1. What is driving the growth of Japan’s antidiabetic market?

A: Rising type-2 diabetes prevalence, an aging population, adoption of advanced drugs like DPP-4 and SGLT-2 inhibitors, and strong healthcare access are key drivers.

2. Which drug type dominates the market?

A: Oral anti-diabetic drugs dominate because they are easy to use, affordable, and widely prescribed for type-2 diabetes.

3. Which distribution channel leads the market?

A: Retail pharmacies dominate due to wide availability, convenience, and patient preference for in-person pharmacist guidance.

4. Are advanced therapies like GLP-1 receptor agonists growing in Japan?

A: Yes. Non-insulin injectables, especially GLP-1 agonists, are rapidly growing due to weight-loss benefits and strong clinical outcomes.

5. What challenges does the market face?

A: High treatment costs for advanced therapies, slow adoption of injectables, and regulatory requirements for new drug approvals.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 255 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |