Japan Automotive Turbocharger Market

Japan Automotive Turbocharger Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger cars, LCVs, HCVs, Agriculture Machinery, and Construction Machinery), By Product Type (Waste Gate, VGT, and Twin Turbo), and Japan Automotive Turbocharger Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Automotive Turbocharger Market Insights Forecasts to 2035

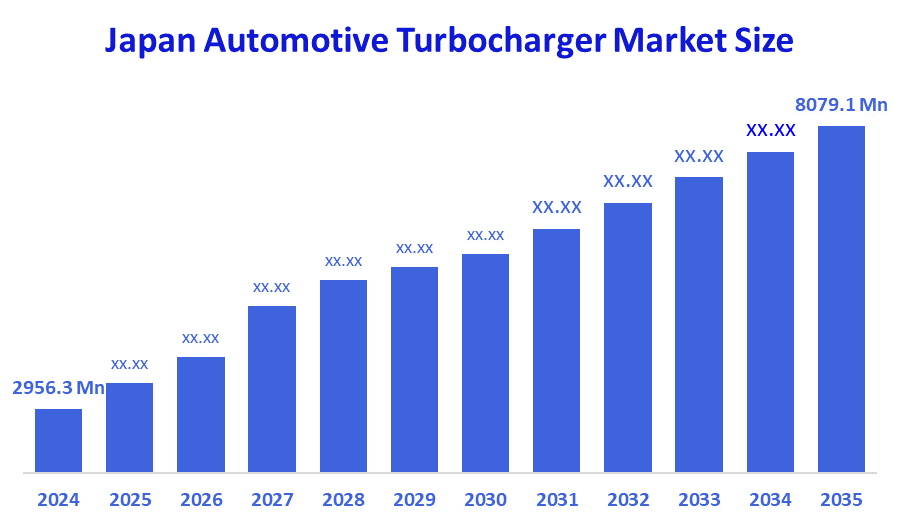

- The Japan Automotive Turbocharger Market Size Was Estimated at USD 2956.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.57% from 2025 to 2035

- The Japan Automotive Turbocharger Market Size is Expected to Reach USD 8079.1 Million by 2035

According to a research report published by Decision Advisor, the Japan automotive turbocharger market size is anticipated to reach USD 8079.1 million by 2035, growing at a CAGR of 9.57% from 2025 to 2035. The automotive turbocharger market in Japan is driven by rising fuel efficiency regulations, increased turbo adoption in gasoline engines, growth in hybridization, emissions reduction goals, and increased performance demand.

Market Overview

The automotive turbocharger market involves the design, manufacturing, and supply of turbochargers for passenger and commercial vehicles. Turbochargers are forced induction devices that increase engine efficiency and power by compressing incoming air and allowing for burning more fuel. The turbocharger market is driven by a desire to enhance vehicle performance, fuel economy, and reduce harmful emissions, particularly as manufacturers are downsizing their engines and more frequently turn to hybrid and advanced powertrains. With automakers focusing on fuel-efficient and high-power density engines, the Japan automotive turbocharger market is anticipated to keep growing. Government actions in support of carbon-neutral mobility, including subsidies for low-emission and hybrid vehicles, are also leading to higher levels of turbocharger adoption. Technology innovation around electric turbochargers, lightweight alloys, enhanced cooling systems, and improved turbine designs will strengthen competitive advantage. Moreover, opportunities are growing in hybrid and next-gen powertrains, precision turbo component export, and partnerships with global OEMs. Japan's advancement toward clean mobility continues to support steady growth in the turbocharger market.

Report Coverage

This research report categorizes the market for the Japan automotive turbocharger market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan automotive turbocharger market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan automotive turbocharger market.

Driving Factors

The automotive turbocharger market in Japan is driven by the growing acceptance of turbocharged gasoline engines and hybrid vehicles has fueled demand for high-performance, low-emission powertrains. Government incentives for clean mobility and carbon-neutrality will continue to push the integration of efficient boosting technologies larger volume. In addition, technology developments, such as electric turbochargers, lightweight turbine materials, and improved thermal management, will improve engine output and reliability and contribute to some degree of market growth for the passenger and commercial vehicle segments.

Restraining Factors

The automotive turbocharger market in Japan is mostly constrained by declining domestic vehicle production and a slow transition to fully electric vehicles, which do not require turbochargers. The increased manufacturing costs required to produce advanced turbocharger technologies and engine integration complexities put suppliers under pricing pressure. Furthermore, strict testing requirements, supply chain limitations, and weakened demand in certain compact vehicle classes may further impede the market.

Market Segmentation

The Japan automotive turbocharger market share is classified into vehicle type and product type.

- The passenger cars segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automotive turbocharger market is segmented by vehicle type into passenger cars, LCVs, HCVs, agriculture machinery, and construction machinery. Among these, the passenger cars segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is underscored by strong passenger vehicle production in Japan, increasing usage of turbocharged gasoline engines for better fuel economy, and fast-growing hybridization of sub-compact and compact cars.

- The VGT segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan automotive turbocharger market is segmented by product type into waste gate, VGT, and twin turbo. Among these, the VGT segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The VGT technology can optimize boost pressure across a wider range of engine speeds that making them ideal choices for downsized gasoline engines where mass reduction is a concern, as well as in hybrid powertrains, which are widely accepted in Japan to comply with stricter environmental regulations and to optimize vehicle efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan automotive turbocharger market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IHI Corporation

- Mitsubishi Heavy Industries Engine & Turbocharger, Ltd. (MHIET)

- Aisin Corporation

- Hitachi Automotive Systems

- Turbo Systems United Co., Ltd.

- Yanmar Power Technology Co., Ltd.

- Aikoku Alpha Corporation RH Division

- Komatsu Ltd.

- Hitachi Metals Precision, Ltd.

- GReddy (The Trust Company Ltd.)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, Mitsui E&S Co., Ltd. had a ceremony on September 19 to celebrate the roll-off of one of the first “TCT40” turbochargers manufactured under license in Japan.

- In March 2025, AISIN Corporation informed that it will participate in the Automotive Engineering Exposition with a focus on electrification products and hybrid units, indicating a shift in powertrain technologies that affects turbocharger demand.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Japan automotive turbocharger market based on the below-mentioned segments:

Japan Automotive Turbocharger Market, By Vehicle Type

- Passenger cars

- LCVs

- HCVs

- Agriculture Machinery

- Construction Machinery

Japan Automotive Turbocharger Market, By Product Type

- Waste Gate

- VGT

- Twin Turbo

FAQ’s

Q: What is the Japan automotive turbocharger market size?

A: Japan automotive turbocharger market size is expected to grow from USD 2956.3 million in 2024 to USD 8079.1 million by 2035, growing at a CAGR of 9.57% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the growing acceptance of turbocharged gasoline engines and hybrid vehicles has fueled demand for high-performance, low-emission powertrains. Government incentives for clean mobility and carbon-neutrality will continue to push the integration of efficient boosting technologies larger volume.

Q: What factors restrain the Japan automotive turbocharger market?

A: Constraints include declining domestic vehicle production and a slow transition to fully electric vehicles, which do not require turbochargers. The increased manufacturing costs required to produce advanced turbocharger technologies and engine integration complexities put suppliers under pricing pressure.

Q: How is the market segmented by vehicle type?

A: The market is segmented into passenger cars, LCVs, HCVs, agriculture machinery, and construction machinery.

Q: Who are the key players in the Japan automotive turbocharger market?

A: Key companies include IHI Corporation, Mitsubishi Heavy Industries Engine & Turbocharger, Ltd. (MHIET), Aisin Corporation, Hitachi Automotive Systems, Turbo Systems United Co., Ltd., Yanmar Power Technology Co., Ltd., Aikoku Alpha Corporation RH Division, Komatsu Ltd., Hitachi Metals Precision, Ltd., and GReddy (The Trust Company Ltd.).

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |