Japan Biocomposites Market

Japan Biocomposites Market Size, Share, By Product (Wood Plastic Composites, Natural Fiber Composites, and Hybrid Biocomposites), By End Use (Automotive and Transportation, Building and Construction, Consumer Goods, Aerospace, Medical, and Others), Japan Biocomposites Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Biocomposites Market Insights Forecasts to 2035

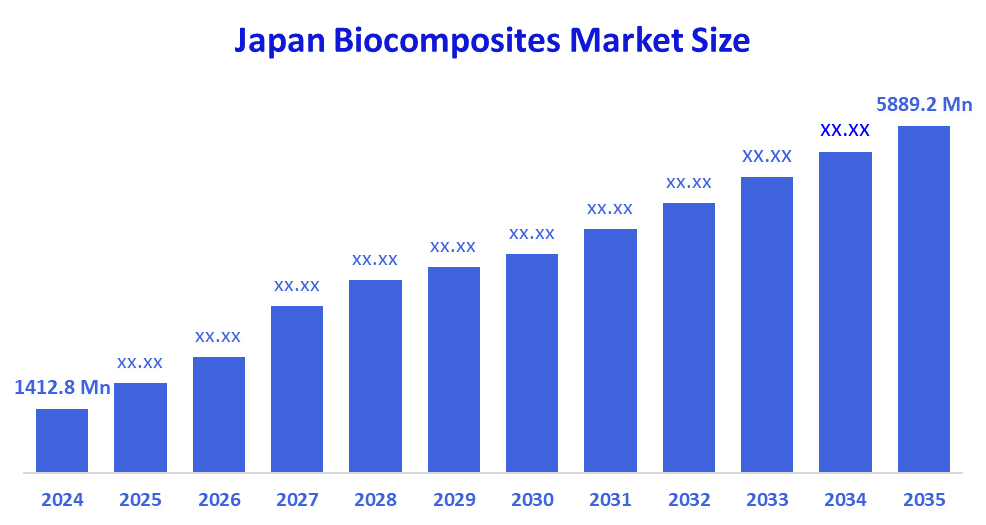

- Japan Biocomposites Market Size 2024: USD 1412.8 Million

- Japan Biocomposites Market Size 2035: USD 5889.2 Million

- Japan Biocomposites Market CAGR 2024: 13.86%

- Japan Biocomposites Market Segments: Product and End Use.

The Japanese market for biocomposites deals in producing biocomposite materials by mixing natural fibres such as wood, hemp, and flax with polymers or plastic resins made from renewable or biological sources. These composite materials are viewed as a more eco-friendly option to traditional carbon or glass fibre composites due to their superior strength-to-weight ratio, lighter weight, and ability to biodegrade. A major emphasis in the biocomposites market is the development of wood fiber composites as well as the growth of hybrid composites that incorporate various types of fiber, including natural and synthetic. In addition, an increasing number of industries are integrating biocomposite materials into their products and manufacturing processes, especially in the automotive, construction, and packaging sectors, due to a growing desire for environmentally friendly practices and the development of the circular economy.

Japan's progress with social and private sector initiatives is of utmost importance when it comes to the development of the biocomposite sector in Japan. The Japanese government's objective is to have 25% of all plastic products replaced with renewable resources by the year 2030, and this effort will be supported by the Ministry of Environment's announcement of their "transition strategies toward nature positive economy" programme in March 2024. The Ministry of Economy, Trade and Industry (METI)'s Green Growth Strategy provides incentives to industries involved in the reduction of greenhouse gas emissions through the use of lightweight and sustainable materials to achieve carbon neutrality by the year 2050.

Technological advances in material performance and, in some cases, manufacturing efficiency for biocomposites in Japan are attributable to the increased application of artificial intelligence and machine learning technologies. These new technological applications are allowing for quicker development of new material designs and the ability to predict how long a new formulation will last without the need for extensive physical testing. Also, improvements in the resins used to manufacture biocomposite materials are coming from the development of new plant-derived resins made from agricultural crop waste.

Market Dynamics of the Japan Biocomposites Market:

The Japanese biocomposites market is driven by the increase is an increase in demand for lightweight construction materials for fuel-efficient vehicles, both in the automobile and aerospace industries. The demand for eco-friendly products will continue to increase because consumers are aware of the advantages of biocomposites compared to other types of plastics and composites. Biocomposites offer higher specific strength than traditional composite and plastic materials, which will drive their use in many different industries, including construction and consumer goods.

The Japanese biocomposites market is restrained by the high production costs, complexity of the manufacturing process, and the high cost of raw materials, which make biocomposite products much more expensive than most conventional plastics. Another challenge to the broader use of biocomposites in many industries is a general lack of knowledge among the small- and medium-sized enterprises regarding biocomposite applications and the advantages of biocomposite materials.

The recent growth of sustainable packaging solutions and the resulting development of high-performance, bio-based materials have opened up numerous growth opportunities. For example, the creation of bio-based honeycomb structures and the pending introduction of bio-based transport packaging will greatly enhance Japan's position as a supplier of advanced materials.

Market Segmentation

The Japan Biocomposites market share is classified into product and end use.

By Product:

The Japanese biocomposites market is divided by product into wood plastic composites, natural fiber composites, and hybrid biocomposites. Among these, the hybrid biocomposites segment is expected to grow at the fastest CAGR during the forecast period. These composites achieve this by integrating the characteristics of both natural and synthetic fibers, thus enhancing their mechanical, thermal, and environmental capabilities, and creating materials that are quickly becoming the new standard in demanding industries such as aerospace, automotive, and consumer electronics, where mechanical and thermal performance, weight-to-strength ratio, impact resistance, and longevity are paramount.

By End Use:

The Japanese biocomposites market is divided by end use into automotive and transportation, building and construction, consumer goods, aerospace, medical, and others. Among these, the automotive and transportation segment held the highest revenue market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The use of biocomposite products in an automobile has expanded into the interior of the vehicle, including the door panels, dash, and shields under the vehicle, to lower the overall weight of the car, thus providing better fuel economy.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Biocomposites market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Biocomposites Market:

- Toray Industries, Inc.

- Teijin Limited

- Mitsubishi Chemical Group

- Nippon Paper Industries Co., Ltd.

- Mitsui Chemicals, Inc.

- Daiken Corporation

- Sumitomo Forestry Co., Ltd.

- Asahi Kasei Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan biocomposites market based on the below-mentioned segments:

Japan Biocomposites Market, By Product

- Wood Plastic Composites

- Natural Fiber Composites

- Hybrid Biocomposites

Japan Biocomposites Market, By End Use

- Automotive and Transportation

- Building and Construction

- Consumer Goods

- Aerospace

- Medical

- Others

FAQ

Q: What is the market size and growth outlook for Japan biocomposites?

A: The Japan biocomposites market was valued at USD 1,412.8 million in 2024 and is projected to reach USD 5,889.2 million by 2035, growing at a strong CAGR of 13.86% during the forecast period from 2025 to 2035.

Q: What are the key drivers of the Japan biocomposites market?

A: Major growth drivers include rising demand for lightweight and fuel-efficient materials in automotive and aerospace industries, increasing consumer preference for eco-friendly products, and growing adoption of circular economy practices across manufacturing sectors.

Q: How is the Japanese government supporting the biocomposites market?

A: The Japanese government promotes biocomposites through sustainability initiatives such as targeting 25% replacement of plastic products with renewable materials by 2030 and implementing METI’s Green Growth Strategy to achieve carbon neutrality by 2050.

Q: Which product segment is expected to grow the fastest in Japan?

A: The hybrid biocomposites segment is expected to grow at the fastest CAGR, as these materials combine natural and synthetic fibers to deliver superior mechanical strength, thermal stability, and durability for high-performance applications.

Q: Who are the key companies operating in the Japanese biocomposites market?

A: Prominent players include Toray Industries, Inc., Teijin Limited, Mitsubishi Chemical Group, Nippon Paper Industries Co., Ltd., Mitsui Chemicals, Inc., Daiken Corporation, Sumitomo Forestry Co., Ltd., and Asahi Kasei Corporation.

Q: Who are the target audiences for the Japan biocomposites market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |