Japan Business Travel Market

Japan Business Travel Market Size, Share, and COVID-19 Impact Analysis, By Type (Managed Business Travel, Unmanaged Business Travel), By Purpose Type (Marketing, Internal Meetings, Trade Shows, Product Launch, and Others), By End User (Government, Corporate, and Others), and Japan Business Travel Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Business Travel Market Size Insights Forecasts to 2035

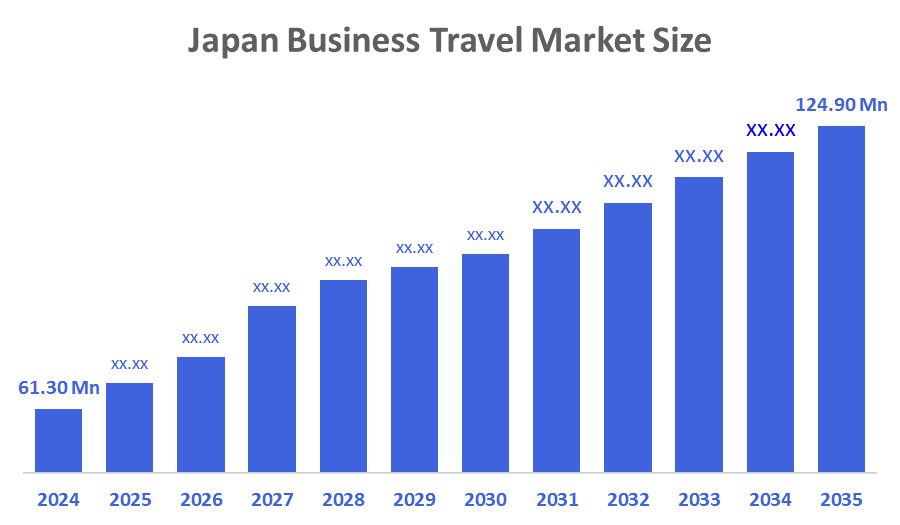

- The Japan Business Travel Market Size Was Estimated at USD 61.30 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.68% from 2025 to 2035

- The Japan Business Travel Market Size is Expected to Reach USD 124.90 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Japan Business Travel Market Size is anticipated to Reach USD 124.90 Billion by 2035, Growing at a CAGR of 6.68% from 2025 to 2035. The Japan business travel market is driven by corporate expansion, technological innovation, strong international trade relations, growing MICE activities, improved transportation infrastructure, and rising demand for efficient travel management solutions.

Market Overview

The Japan business travel market refers to the industry that supports corporate-related travel within and to Japan, including transportation, accommodation, meetings, incentives, conferences, and events. It encompasses services provided to business travellers, multinational companies, and domestic enterprises. This market is shaped by Japan strong economic activity, global trade connections, advanced infrastructure, and the growing need for efficient, technology-driven travel management solutions that enhance productivity and corporate mobility.

Business-related travel is experiencing a steady revival as international operations, client engagements, and inter-regional coordination continue to expand. Growing demand for face-to-face meetings, regional conferences, and corporate events is contributing to increased travel activity. For Japan, a country deeply integrated with global supply chains and multilateral trade partnerships, this shift is reflected in higher inbound and outbound corporate travel movement. Companies are resuming in-person negotiations, site visits, and collaboration sessions, viewing physical presence as key to building trust and maintaining business continuity. Improvements in airline connectivity, travel infrastructure, and digital booking systems further support this uptick. At the same time, flexible travel policies and expanded loyalty programs are enhancing mobility across business tiers, from executive leadership to field-level staff. The shift underscores a broader return to direct interaction, where strategic coordination, investment exploration, and market expansion activities are increasingly conducted in person, reinforcing Japan role as a hub for high-value corporate engagement

Report Coverage

This research report categorizes the market for the Japan business travel market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan business travel market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan business travel market.

Driving Factors

The business travel markets in Japan are driven by increased integration of digital platforms designed to streamline planning, booking, and expense management. New solutions are being introduced to support enterprise clients with customizable tools that improve efficiency and control over travel logistics. Regional partnerships are playing a key role in adapting these systems to local needs, ensuring compliance and service personalization. As Japan companies continue to expand operations, the demand for agile, tech-enabled travel support is growing. Local collaborations are helping bridge cultural and operational expectations while elevating the standard of business travel experiences. These developments reflect a broader shift toward automation, transparency, and centralized management in business mobility, especially for companies seeking to optimize budgets and ensure seamless regional coordination.

For instance, in October 2024, Trip Biz introduced its Product Matrix during the Trip Biz Transform 2024' conference in Singapore. The platform aims to enhance corporate travel management. Tokyo Masters, Trip Biz local partner in Japan, joined the event, signaling efforts to expand digital travel solutions tailored for Japan business travelers.

Restraining Factors

The business travel market in Japan is restrained high travel and accommodation costs, strict visa regulations, labor shortages, economic uncertainties, and the growing adoption of virtual meetings, which reduce corporate travel demand.

Market Segmentation

The Japan business travel market share is categorized by type, purpose type and end user.

- The unmanaged business travel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan business travel market is segmented by type into managed business travel, unmanaged business travel. Among these, the unmanaged business travel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by flexible booking preferences, cost-saving choices by small firms, rising use of online travel platforms, limited reliance on travel management companies, and increased autonomy for employees arranging their own business trips.

- The marketing segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan business travel market is segmented by purpose type into marketing, internal meetings, trade shows, product launch, and others. Among these, the marketing segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to increasing promotional activities, rising competition among firms, expansion of product outreach strategies, greater client engagement needs, and the ongoing emphasis on face-to-face marketing to strengthen brand visibility and market presence.

- The unmanaged business travel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan business travel market is segmented by end user into government, corporate, and others. Among these, the unmanaged business travel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by expanding business operations, rising intercompany collaboration, frequent client meetings, and continued investment in travel to support sales growth, partnerships, and operational efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan business travel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- JTB Business Travel Solutions

- NTA Corporate Solutions

- Tokudaw Inc

- M.O. Tourist Co., Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, the UK and Japan launched a new economic partnership to strengthen trade and investment across sectors, including technology, finance, and clean energy. The agreement supports increased cross-border business activity, which is expected to drive corporate travel between the two nations. This collaboration reflects both governments' commitment to fostering international business engagement and growth.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Business Travel Market based on the below-mentioned segments:

Japan Business Travel Market, By Type

- Managed Business Travel

- Unmanaged Business Travel

Japan Business Travel Market, By Purpose Type

- Marketing

- Internal Meetings

- Trade Shows

- Product Launch

- Others

Japan Business Travel Market, By End User

- Government

- Corporate

- Others

FAQ’s

Q: What is the size of the Japan business travel market in 2024?

A: The market was estimated at USD 61.30 billion in 2024.

Q: What is the expected market size by 2035?

A: It is expected to reach USD 124.90 billion by 2035, growing at a CAGR of 6.68%.

Q: Which type segment dominates the market?

A: The unmanaged business travel segment accounted for the largest revenue share in 2024.

Q: Which purpose type drives the market growth?

A: The marketing segment dominates, driven by increasing promotional activities and face-to-face client engagements.

Q: Who are the major end users?

A: The corporate segment leads, supported by expanding business operations and frequent client meetings.

Q: What factors restrain the market?

A: High travel costs, strict visa regulations, labor shortages, economic uncertainties, and rising adoption of virtual meetings.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 151 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |