Japan Cannabidiol (CBD) Market

Japan Cannabidiol (CBD) Market Size, Share, And COVID-19 Impact Analysis, By Product (CBD Oil, CBD Isolates, CBD Concentrates, And Others), By Source Type (Marijuana And Hemp), By Grade (Food Grade And Therapeutic Grade), By Sales Type (B2B And B2C), And Japan Cannabidiol Market Insights, Industry Trend, Forecast To 2035

Report Overview

Table of Contents

Japan Cannabidiol (CBD) Market Insights Forecasts to 2035

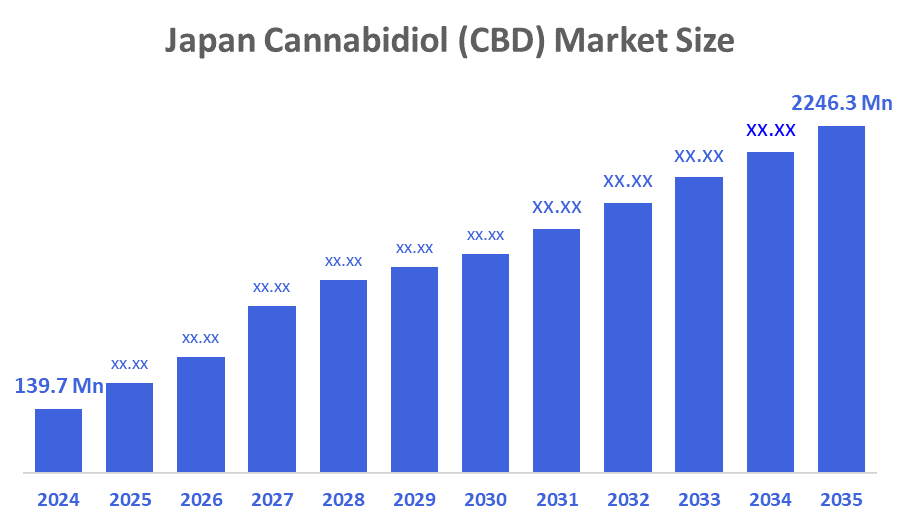

- Japan Cannabidiol (CBD) Market Size Was Estimated at USD 139.7 Million in 2024.

- The Market Size is Expected to Grow at a CAGR of Around 28.72% from 2025 to 2035.

- Japan Cannabidiol (CBD) Market Size is Expected to Reach USD 2246.3 Million by 2035.

According to a research report published by Decision Advisors & Consulting, The Japan Cannabidiol (CBD) Market size is anticipated to reach USD 2246.3 Million by 2035, Growing at a CAGR of 28.72% from 2025 to 2035. The Japan Cannabidiol (CBD) Market is driven by a growing ageing population, growing consumer awareness of CBD’s health benefits, product innovations across cosmetics, edibles, and wellness items, and easily available through pharmacies and online channels.

Market Overview

Cannabidiol is an oil derivative of cannabinoid compounds that occur naturally in the Cannabis Sativa plant. Cannabinoids are one of major active constituents of the plant, with CBD being the most important of the over 100 cannabinoids produced by this plant. In anxiety, chronic pain and many different conditions, CBD has provided some benefit and improve quality of life. As demand for natural alternatives has increased and the demand for CBD Cosmetics has exploded CBD Isolates, the Japanese are the first country to start developing this segment of the Cannabidiol market. Cannabidiol interacts with the Endocannabinoid system, which is responsible for many functions that regulate both physical and mental functions such as mood, appetite, ability to feel pain, memory and so on. CBD has many forms such as oil, tinctures, edibles and topical products.

The cannabidiol (CBD) market has been driven by increasing public awareness about the beneficial effects of cannabidiol on health, which has resulted in significant growth in Japan's CBD market. As consumers become increasingly educated about CBD's anti-inflammatory and stress-relief capabilities, the demand for CBD products has continued to increase. Changes to Japan's laws and regulations have also helped to facilitate growth in the Japanese CBD market. Additionally, consumers are moving toward natural and organic a product, which is causing a surge in demand for CBD-based wellness products as consumers search for safer, plant-based solutions to their health and wellness issues. The Japanese government has begun implementing several initiatives to regulate and support the CBD market through its Ministry of Health, Labour and Welfare; these initiatives include new laws to create a legal framework for CBD, support for medical research related to CBD, and allow for the legal cultivation of hemp for medical purposes.

Report Coverage

This research report categorizes the market for the Japan cannabidiol (CBD) market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan cannabidiol (CBD) market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan cannabidiol (CBD) market.

Driving Factors

Japan cannabidiol market is driven by an ageing population that are searching for alternative therapies for chronic conditions, increased consumer awareness around the health benefits of using CBD oil, moving towards the use of natural ingredients instead of chemicals, favourable changes in regulation allowing for CBD oil to be classified as a pharmaceutical, increased focus on quality and compliance, and many more broad offerings of products related to cosmetics, edibles, and wellness items.

Restraining Factors

High costs, complex compliance, strict and out-dated laws, lack of physician understanding, supply of unregulated products breaks consumer trust, limitations in clinical research, concerns over THC limits, and uncertainty over new regulations restrains the cannabidiol (CBD) market in Japan.

Market Segmentation

The Japan cannabidiol (CBD) market share is categorized by product, source type, grade, and sales type.

- The CBD oil segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cannabidiol (CBD) market is segmented by product into CBD oil, CBD isolates, CBD concentrates, and others. Among these, the CBD oil segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by demand for wellness and self-care applications, increase consumer preference to use natural plant-based products made in Japan, high stress culture and growing consciousness, and strict regulations for THC-free products encourage adoption, especially in urban centres.

- The hemp segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan cannabidiol (CBD) market is segmented by source type into marijuana and hemp. Among these, the hemp segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to Japan’s legal availability for various products like oils, cosmetics, and foods, high consumer acceptance, demand for accessible hemp-based wellness items, widely available in stores, and legal framework for hemp cultivation and CBD products making it the primary legal source.

- The food grade segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cannabidiol (CBD) market is segmented by grade into food grade, and therapeutic grade. Among these, the food grade segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its legal clarity and accessibility by regulatory framework, widely available in retail stores and online platforms, consumer preference for natural, plant-based products, and food grade labels supports to build consumer trust, and socially acceptable.

- The B2B segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan cannabidiol (CBD) market is segmented by sales type into B2B, and B2C. Among these, the B2B segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to growing demand for CBD as a core ingredient for manufacturers creating final products, with wholesalers facilitating the supply chain, growing consumer acceptance of hemp-based wellness products like cosmetics and supplements, despite strict regulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within The Japan cannabidiol (CBD) market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PharmaHemp

- Elixinol Japan

- Endoca

- Bluebird Botanicals

- Medterra CBD

- Charlotte’s Web

- Canopy Growth Corporation

- New Age Beverages Corporation

- Dr. Watson CBD

- AP Organics

- HealthyTOKYO

- Cannabist

- FANCL

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In August 2024, Taisho Pharmaceutical, a major Japanese pharmaceutical company, entered the CBD supplements market with products like capsules and tablets. The launch follows amendments to Japan’s Cannabis Control Law in Dec 2024 and gained traction through regulatory guidelines by 2025.

• In May 2024, the US-based brand Kanha, a top edible brand, launched its KRx by Kanha and Kanha Wellness lines of CBD tinctures, softgels, and beverages in the Japanese market through a partnership with the Tokyo-based company Lightec Co.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2025 to 2035. Decision Advisors has segmented the Japan cannabidiol (CBD) market based on the below-mentioned segments:

Japan Cannabidiol (CBD) Market, By Product

- CBD Oil

- CBD Isolates

- CBD Concentrates

- Others

Japan Cannabidiol (CBD) Market, By Source Type

- Marijuana

- Hemp

Japan Cannabidiol (CBD) Market, By Grade

- Food Grade

- Therapeutic Grade

Japan Cannabidiol (CBD) Market, By Sales Type

- B2B

- B2C

FAQ’s

Q. What is the projected market size & growth rate of the Japan cannabidiol (CBD) market?

A. Japan cannabidiol (CBD) market was valued at USD 139.7 million in 2024 and is projected to reach USD 2246.3 million by 2035, growing at a CAGR of 28.72% from 2025 to 2035.

Q. What are the key driving factors for the growth of the Japan cannabidiol (CBD) market?

A. The Japan cannabidiol (CBD) market in Japan are driven by a growing ageing population seeking natural relief for chronic issues, rising consumer awareness of CBD’s wellness benefits, a shift towards natural plant-based products, and favourable regulatory shifts allowing CBD pharmaceuticals, focus on quality and compliance, and broader products availability, leading to diverse product offerings in cosmetics, edibles, and wellness items.

Q. What are the top players operating in the Japan cannabidiol (CBD) market?

A. PharmaHemp, Elixinol Japan, Endoca, Bluebird Botanicals, Medterra CBD, Charlotte’s Web, Canopy Growth Corporation, New Age Beverages Corporation, Dr. Watson CBD, AP Organics, HealthyTOKYO, Cannabist, FANCL, and Others.

Q. What segments are covered in the Japan cannabidiol (CBD) market report?

A. Japan cannabidiol (CBD) market is segmented based on Product, Source Type, Grade, and Sales Type.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 185 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |