Japan Cell Culture Vessels Market

Japan Cell Culture Vessels Market Size, Share, and COVID-19 Impact Analysis, By Product (Bags, Flasks, Plates, Bottles, Dishes, and Tubes), By End Use (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, and CMOs & CROs), and Japan Cell Culture Vessels Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Cell Culture Vessels Market Insights Forecasts to 2035

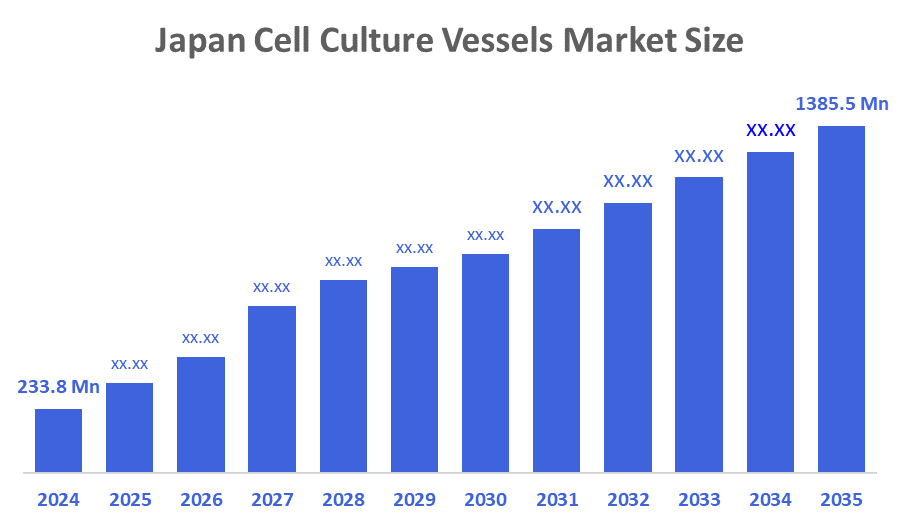

- The Japan Cell Culture Vessels Market Size Was Estimated at USD 233.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 17.56% from 2025 to 2035

- The Japan Cell Culture Vessels Market Size is Expected to Reach USD 1385.5 Million by 2035

According to a research report published by Decision Advisors & Consulting, the Japan Cell Culture Vessels Market size is anticipated to reach USD 1385.5 million by 2035, growing at a CAGR of 17.56% from 2025 to 2035. The cell culture vessels market in Japan is driven by the rising prevalence of chronic diseases, increased investments in research and development, and a growing number of clinical trials for cell-based therapies are driving the market growth.

Market Overview

Cell culture vessels sold in Japan are basically laboratory containers used to grow cells in carefully controlled laboratory environments. These vessels are vital to supporting the rapidly growing biotech/pharma R&D in Japan, the growing importance of regenerative medicine and vaccine production, all of which are driven by the growing demand for biologics, personalised therapies, and increased investment in cell-based research, especially for therapies. Also, pharmaceutical companies and contract research organisations (CROs) continue to place a strong demand for new and innovative single-use and high-throughput systems. In addition, Japan’s strong pharmaceutical industry is committed to developing biologics and vaccines, and creating personalised medicines, therefore, there is a strong demand for cell culture technologies. The Japan Agency for Medical Research and Development (AMED) has developed multiple types of programs that support the translation of regenerative medicine and iPS cell projects from basic laboratory work into clinical practice; and the regulatory system in Japan, including the Regenerative Medicine Act and the accelerated regulatory pathways created by the Medical Products and Devices Act (PMDA), was explicitly designed to facilitate the clinical use of products that are derived from cells. Therefore, there will continue to be high demand for clinical-grade and GMP-compatible cell culture/processing vessels and closed systems.

Report Coverage

This research report categorizes the market for the Japan cell culture vessels market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan cell culture vessels market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan cell culture vessels market.

Driving Factors

The cell culture vessels markets in Japan are driven by the demand for sophisticated cell culture containers is greatly increased by the growing regenerative medicine ecosystem, robust AMED/MEXT research funding, and the quick expansion of biomanufacturing. Consumption throughout R&D, clinical manufacturing, and commercial-scale production is further accelerated by the growing usage of single-use, GMP-compliant systems in pharmaceutical and biotech facilities, as well as by increased investments in stem-cell therapy, IPS-cell research, and automation.

Restraining Factors

The cell culture vessels market in Japan is mostly restrained by the high cost of high-grade vessels, strict PMDA regulations, and reliance on imported single-use equipment. Market expansion is further slowed by limited domestic production capacity, supply-chain volatility, and the requirement for specialised handling facilities, especially for smaller research labs and up-and-coming biotech companies.

Market Segmentation

The Japan cell culture vessels market share is classified into product and end use.

- The bags segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japanese cell culture vessels market is segmented by product into bags, flasks, plates, bottles, dishes, and tubes. Among these, the bags segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is due to flexible, single-use bags are becoming more and more popular in cell culture applications because of their affordability, convenience of use, and lower danger of contamination.

- The pharmaceutical & biotechnology segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cell culture vessels market is segmented by end-use into pharmaceutical & biotechnology companies, academic & research institutes, and CMOs & CROs. Among these, the pharmaceutical & biotechnology segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The broad adoption of cell culture containers in drug development, manufacture, and discovery is the main cause of this. Additionally, there is a significant investment in R&D and an increasing emphasis on personalised medicine and sophisticated medicines.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan cell culture vessels market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Merck KGaA

- Thermo Fisher

- Corning

- Sartorius

- FUJIFILM Holdings

- Takara Bio

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Japan Cell Culture Vessels Market based on the below-mentioned segments:Japan Cell Culture Vessels Market, By Product

- Bags

- Flasks

- Plates

- Bottles

- Dishes

- Tubes

Japan Cell Culture Vessels Market, By End Use

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- CMOs & CROs

FAQ’s

Q: What is the size of the Japan cell culture vessels market in 2024?

A: The Japan cell culture vessels market size was estimated at USD 233.8 million in 2024, supported by rising biologics production, regenerative medicine advancements, and increasing cell-based research activities.

Q: What is the growth outlook for the Japan cell culture vessels market?

A: The market is projected to grow at a CAGR of 17.56% from 2025 to 2035, reaching USD 1385.5 million by 2035, driven by strong R&D funding, expanding biomanufacturing, and increasing clinical adoption of cell-based therapies.

Q: Which product segment dominates the Japan cell culture vessels market?

A: Bags dominate the product segment, owing to their cost-effectiveness, ease of use, flexibility, and reduced contamination risk compared to reusable or rigid culture vessels.

Q: Which end-use segment accounts for the largest market share?

A: Pharmaceutical and biotechnology companies hold the largest market share due to extensive adoption of vessels in drug discovery, biologics production, and personalized medicine research.

Q: Who are the major players in the Japanese cell culture vessels market?

A: Key companies include Merck KGaA, Thermo Fisher, Corning, Sartorius, FUJIFILM Holdings, and Takara Bio, along with several other regional and international manufacturers supplying cell culture containers and single-use systems.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 185 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |