Japan Cell Therapy Market

Japan Cell Therapy Market Size, Share, and COVID-19 Impact Analysis, By Therapy Type (Autologous, Allogeneic, Others), By Application (Oncology, Immunology, Rare Diseases, and Other Therapeutic Areas), and Japan Cell Therapy Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Cell Therapy Market Insights Forecasts to 2035

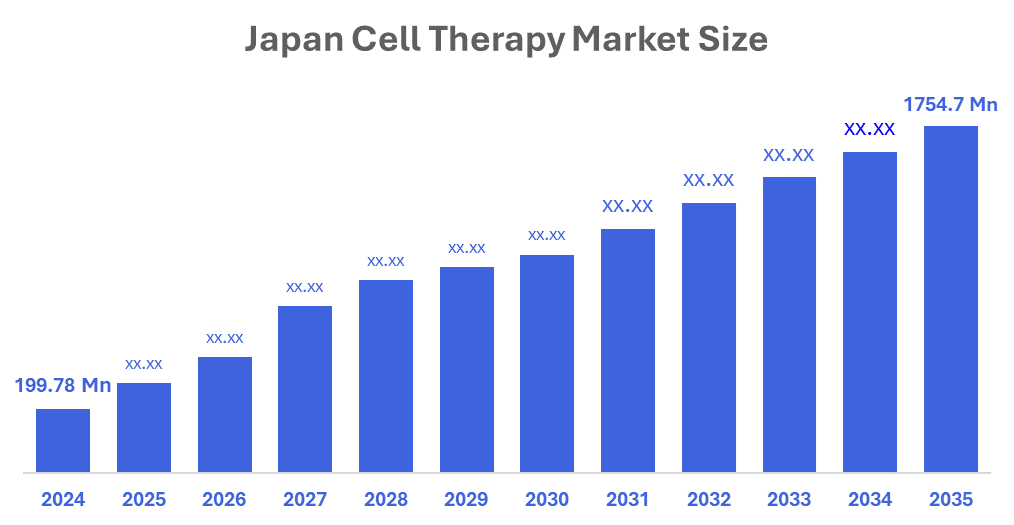

- The Japan Cell Therapy Market Size Was Estimated at USD 199.78 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 21.84% from 2025 to 2035

- The Japan Cell Therapy Market Size is Expected to Reach USD 1754.7 Million by 2035

According to a research report published by Decision Advisors & Consulting, The Japan Cell Therapy Market Size is Anticipated to reach USD 1754.7 Million by 2035, Growing at a CAGR of 21.84% from 2025 to 2035. The market is driven by increasing acceptance and utilisation of sophisticated regeneration therapies, increased occurrence of cancer as well as chronic disease, and an increase in financial investment into source and donated cells. Increased collaboration between international and local companies within the biotechnology sector, government support of research and development related to regenerative medicine, and scientific breakthroughs in establishing and creating cell products will help to stimulate growth in the cell therapy market.

Market Overview

The Japanese cell therapy market refers to the R&D, manufacturing, and marketing of Cellular therapies being implemented in the areas of cancer, autoimmune disease, cardiovascular disease, neurodegenerative diseases, and rare diseases. Cell therapy is the introduction of, by ingesting, transplanting, or engineering living cells into a patient to restore, replace, or modify functions that occur naturally. There have been very rapid developments towards the production and marketing of CAR T, Stem cell-based Regenerative therapy, IPSC-generated therapy, AI driven biometric devices, and the combination of AI with automatically produced cellular platforms is indicative of this growth. Additionally, there are distinct characteristics of this market, such as its high level of research and development intensity, its reliance on specially designed manufacturing facilities, its need for extensive regulatory compliance, its complex supply chain needs, and an increased emphasis on personalized medicine as an overall method of treating patients. Key drivers of growth within the market include the increased incidence of chronic and rare diseases and technological advancements related to new gene editing techniques.

The PMDA offers expedited review pathways for innovative cell therapy products through conditional and time-limited approvals. Other initiatives include subsidies for clinical trials, public-private partnerships that advance iPSC and CAR-T therapy research, tax incentives for biotech R&D, and the creation of national regenerative medicine strategies that will be used to enhance patient access to advanced therapies. Additionally, the regulatory framework in Japan supports the safe clinical translation of cell therapies while fostering innovation through international collaboration programs and funds for translational research.

Report Coverage

This research report categorizes the market for the Japan cell therapy market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan cell therapy market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan cell therapy market.

Driving Factors

The Japanese cell therapy market is driven by the prevalence of oncology, immunology, and rare diseases, along with increased demand for personalized cell-based therapies and increased investment in CAR-T and stem cell technologies, which are fueling the growth of Japan's biotech and recovery sectors. Collaborative efforts between Japanese and global biotech companies, along with government support for regenerative medicine and the development of automated platforms for producing stem cells and CAR-T products, are also contributing to Japan's biotech industry growth.

Restraining Factors

The Japanese cell therapy market is restrained by increasing manufacturing & research & development expenses, increasing total costs associated with cell-based therapy products, stringent regulations, and lengthy approval timelines that delay product commercialization and limit the reimbursement for cell-based therapies, lack of reimbursement coverage, including reimbursement for autologous and allogeneic therapies.

Market Segmentation

The Japan cell therapy market share is categorized by therapy type and application.

- The autologous segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japanese cell therapy market is segmented by therapy type into autologous, allogeneic, and others. Among these, the autologous segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by the increased use of patient-specific CAR-T therapy, and Stem Cell Therapy has been aided by advancements in technology for cell processing, growing numbers of clinical trials, and the increasing awareness of patients regarding different types of personal treatment options available for regenerative purposes. Due to these developments, the demand for patient-specific CAR-T therapies is expected to increase significantly during the next few years.

- The oncology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japanese cell therapy market is segmented by application into oncology, immunology, rare diseases, and other therapeutic areas. Among these, the oncology segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Growth is driven by Factors contributing to an increase in cancer cases, a higher usage of CAR-T (Chimeric Antigen Receptor T cells) and other cell-based therapies for both haematological tumors (blood cancers) and solid tumors, as well as a greater implementation of precision medicine techniques. Moreover, ongoing innovation in the field of immuno-oncology, combined with increasing numbers of clinical trials, supportive reimbursement programmes.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the Japan cell therapy market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Takeda Pharmaceutical Company Limited

- Astellas Pharma Inc.

- Chugai Pharmaceutical Co., Ltd.

- Mitsubishi Tanabe Pharma Corporation

- Kyowa Kirin Co., Ltd.

- Ono Pharmaceutical Co., Ltd.

- Stem Cell Institute Japan

- CellSeed Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, Chugai Pharmaceutical expanded its collaboration with a global biotech firm to advance stem cell therapies for cardiovascular diseases.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Japan Cell Therapy Market based on the below-mentioned segments:

Japan Cell Therapy Market, By Therapy Type

- Autologous

- Allogeneic

- Others

Japan Cell Therapy Market, By Application

- Oncology

- Immunology

- Rare Diseases

- Other Therapeutic Areas

Frequently Asked Questions (FAQ’s)

Q: What is the Japan Cell Therapy Market size?

A: Japan Cell Therapy Market size is expected to grow from USD 199.78 million in 2024 to USD 1754.7 million by 2035, growing at a CAGR of 21.84% during the forecast period 2025–2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the rising prevalence of cancer and chronic diseases, increasing adoption of personalized cell therapies, and government support for regenerative medicine initiatives.

Q: What factors restrain the Japan Cell Therapy Market?

A: High R&D and manufacturing costs, strict regulatory requirements, and reimbursement challenges.

Q: How is the market segmented by therapy type?

A: The market is segmented into autologous, allogeneic, and others.

Q: Who are the key players in the Japan Cell Therapy Market?

A: Key companies include Takeda, Astellas Pharma, Chugai Pharmaceutical, Mitsubishi Tanabe Pharma, Kyowa Kirin, Ono Pharmaceutical, Stem Cell Institute Japan, and CellSeed Inc

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 185 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |