Japan Ceramic Tiles Market

Japan Ceramic Tiles Market Size, Share, and COVID-19 Impact Analysis, By Product (Glazed Ceramic Tiles, Porcelain Tiles, Scratch Free Ceramic Tiles, and Others), By End-Use (Residential and Commercial), and Japan Ceramic Tiles Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Ceramic Tiles Market Insights Forecasts to 2035

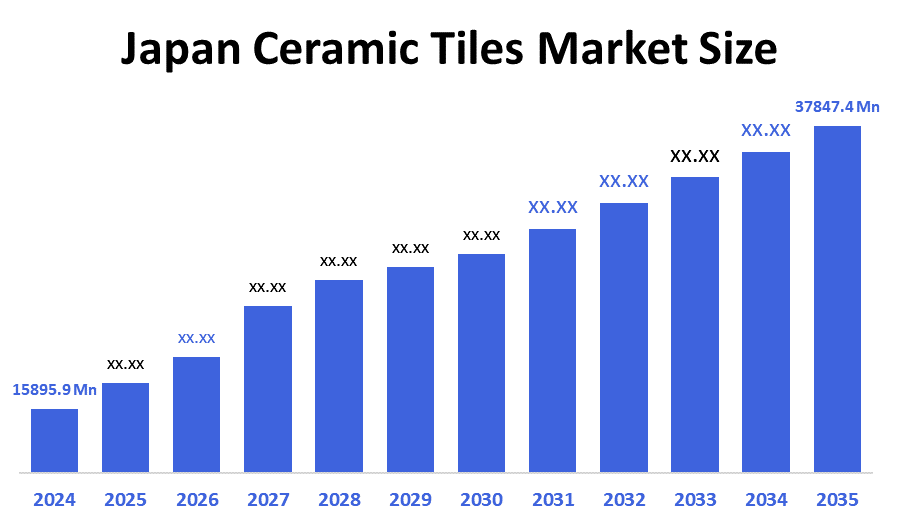

- The Japan Ceramic Tiles Market Size Was Estimated at USD 15895.9 Million in 2024.

- The Market Size is expected to grow at a CAGR of around 8.21% from 2025 to 2035.

- The Japan Ceramic Tiles Market Size is expected to reach USD 37847.4 Million by 2035.

According to a research report published by Decision Advisior & Consulting, the Japan Ceramic Tiles Market size is anticipated to reach USD 37847.4 million by 2035, growing at a CAGR of 8.21% from 2025 to 2035. The ceramic tiles market in Japan is driven due to expanding consumer purchasing power, especially when it comes to building and home renovation initiatives. Customers can invest in these projects because of this financial capability, which is accelerating market expansion.

Market Overview

The Japan ceramic tiles market is a sector within the larger global ceramic tile market that includes the production, distribution, and sale of ceramic tiles for use in flooring, walls, and other architectural applications in Japan. It is characterized by a long heritage, innovation, and a focus on durability and aesthetic appeal, serving residential, commercial, and industrial sectors. Key trends include a growing demand for both high-tech and traditionally inspired tiles, especially those that are earthquake-resistant, anti-slip, or mimic natural materials like wood. Japan's ceramic tile market includes high demand from infrastructure and construction projects, a growing interest in aesthetically pleasing and functional tiles, and a focus on specific applications like healthcare and underfloor heating. Additionally, companies can find opportunities in innovation, particularly with eco-friendly options and customization, and through collaborations that leverage Japanese design and manufacturing expertise. The Japanese ceramic tile market is influenced by the construction industry, residential renovation trends, and a shift toward tiles with hygiene and durability properties. Government support, often through organizations like the Japan Fine Ceramics Association (JFCC), targets research and development in areas like technology infrastructure and promotes international cooperation in the ceramic sector.

Report Coverage

This research report categorizes the market for the Japan Ceramic Tiles market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Ceramic Tiles market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan Ceramic Tiles market.

Driving Factors

The Japanese Ceramic Tiles market is mainly driven by expanding household remodelling projects, the need for long-lasting, low-maintenance flooring, and the rise in the use of high-end, beautiful tiles in business settings. Smart city initiatives, government-backed urban redevelopment, and the growing need for environmentally friendly, moisture-resistant materials all contribute to market expansion.

Restraining Factors

The Japanese Ceramic Tiles market is restrained by high installation and production costs, the availability of less expensive substitute materials, and Japan's stringent environmental laws that have an impact on production methods. Reliance on imported raw materials and a decline in new home development in some areas further restrict market growth.

Market Segmentation

The Japan ceramic tiles market share is classified into product and end-use.

- The porcelain tiles segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan Ceramic Tiles market is segmented by product into glazed ceramic tiles, porcelain tiles, scratch-free ceramic tiles, and others. Among these, the porcelain tiles segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is due to extreme durability because they are burnt at very high temperatures. Furthermore, impermeable porcelain tiles long-term usefulness for usage in flooring applications stems from its resistance to bacteria and mold.

- The commercial segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japanese Ceramic Tiles market is segmented by end-use into residential and commercial. Among these, the commercial segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Ceramic tiles provide a low-cost and environmentally friendly option for many industries, such as education, government, hospitals, businesses, and most other commercial sectors. This is due to their properties, including resistance to fungi, slippery surfaces (anti-slip), and water resistance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Ceramic Tiles market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- INAX Corporation

- TOTO Ltd.

- KANO CORPORATION

- Danto Tile Co. Ltd.

- NITTO Ceramics Co. Ltd.

- Nagoya Mosaic-tile Co. Ltd

- Icot Ryowa Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Japan Ceramic Tiles market based on the below-mentioned segments:

Japan Ceramic Tiles Market, By Product

- Glazed Ceramic Tiles

- Porcelain Tiles

- Scratch Free Ceramic Tiles

- Others

Japan Ceramic Tiles Market, By End-Use

- Residential

- Commercial

FAQ’s

Q: What is the size of the Japan Ceramic Tiles Market in 2024?

A: The Japanese ceramic Tiles Market was valued at USD 15,895.9 million in 2024, supported by rising renovation and construction activities.

Q: What is the expected market size by 2035?

A: The market is projected to reach USD 37,847.4 million by 2035, registering a CAGR of 8.21% during 2025–2035.

Q: What factors are driving the growth of the ceramic tiles market?

A: Growth is driven by increasing household renovation projects, demand for long-lasting and low-maintenance flooring, adoption of premium tile designs, government-backed urban redevelopment, and rising preference for eco-friendly and moisture-resistant materials.

Q: Which product segment dominates the market?

A: Porcelain tiles dominated the market in 2024 due to their strength, high-temperature firing, bacteria resistance, and suitability for high-traffic flooring applications.

Q: Which end-use segment holds the largest share?

A: The commercial segment led the market in 2024, driven by demand from hospitals, offices, schools, government buildings, and other public facilities due to tiles’ anti-slip, durable, and water-resistant properties.

Q: Who are the key players in the Japan Ceramic Tiles Market?

A: Key companies include INAX Corporation, TOTO Ltd., KANO Corporation, Danto Tile, NITTO Ceramics, Nagoya Mosaic-Tile, and Icot Ryowa, along with several regional manufacturers.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 179 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |