Japan Circular Construction Materials Market

Japan Circular Construction Materials Market Size, Share, And COVID-19 Impact Analysis, By Material (Recycled Aggregates, Recycled Metals, Reclaimed Wood, and Recycled Plastics), By End-use (Residential and Non-residential), and Japan Circular Construction Materials Market Insights, Industry Trend, Forecasts To 2035

Report Overview

Table of Contents

Japan Circular Construction Materials Market Size Insights Forecasts to 2035

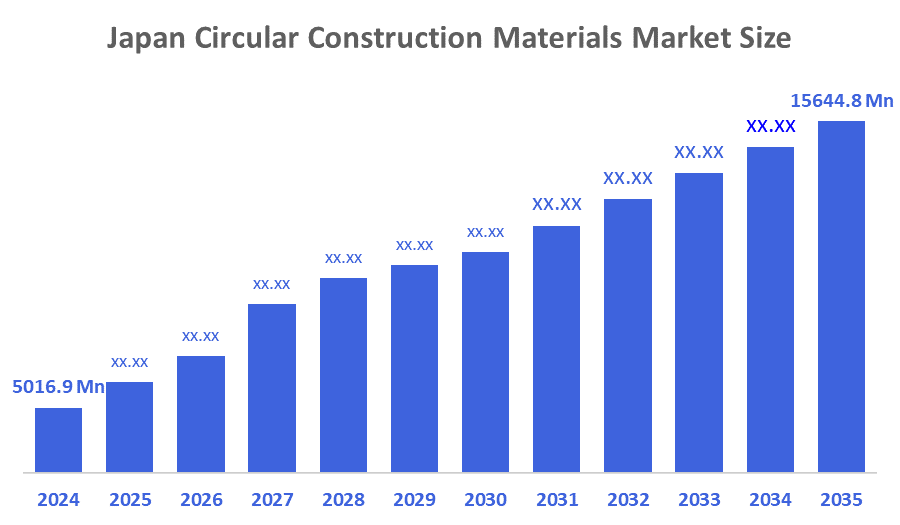

- The Japan Circular Construction Materials Market Size Was Estimated at USD 5016.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 10.89% from 2025 to 2035

- The Japan Circular Construction Materials Market Size is Expected to Reach USD 15644.8 Million by 2035

According to a Research Report Published by Decisions Advisors Consulting, The Japan Circular Construction Materials Market Size is anticipated to Reach USD 15644.8 Million by 2035, Growing at a CAGR of 10.89% from 2025 to 2035. The circular construction materials market in Japan is driven by government initiatives, private sector interest, and a focus on sustainability and seismic resilience. In addition, increasing urbanization and infrastructure expansion have led to significant amounts of construction waste, prompting stakeholders to adopt recyclable and reusable materials.

Market Overview

Construction materials made with circular design exhibit that the objective of circular construction materials is to create new building materials and structures that can be reused, repaired, refurbished, or recycled, to create a circular economy, as opposed to linear take, make, dispose (TMD). Circular construction takes place in the closed loop of material usage, where building materials are intended to be kept in circulation for as long as possible throughout a building's usual life cycle, from the initial building construction until the building is demolished. The market for circular construction materials is growing in Japan due to the development of advanced, resource-efficient construction methods, with a particular focus on framing and other structural components that conform to Japan's rigorous seismic standards. The circular construction materials market adopts digital technologies such as BIM and other digital asset management systems to effectively manage the lifecycle of building materials, to create new business opportunities to recycle and re-manufacture used building materials, and to create leasing opportunities for construction materials. The Japanese government has introduced several policies to encourage the development of circular construction projects by mandating that large-scale projects must sort their materials during demolition and recycle those materials after demolition.

Report Coverage

This research report categorizes the market for the Japan circular construction materials market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan circular construction materials market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan circular construction materials market.

Driving Factors

The Japanese circular construction materials market is driven by increasing urbanization creates demand for new construction, while Japan's aging infrastructure requires significant renovation and replacement. Both these trends generate large amounts of construction waste and a need for circular solutions. Additionally, government initiatives for net-zero emissions, a focus on sustainability and energy efficiency, and the increasing costs of raw materials

Restraining Factors

The circular construction materials market is restrained by high upfront costs, a lack of expertise and awareness, inconsistent regulations, and inadequate secondary material databases. Also, abor shortages and rising material costs, which impact efficiency and profitability, hinder the adoption of circular practices.

Market Segmentation

The Japan circular construction materials market share is classified into material and end-use.

- The recycled aggregates segment held the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan circular construction materials market is segmented by material into recycled aggregates, recycled metals, reclaimed wood, and recycled plastics. Among these, the recycled aggregates segment held the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to extensive application in road construction, foundations, and structural concrete. Recycled aggregates are now an affordable and ecological substitute for natural stone due to the abundance of debris from construction and demolition.

- The residential segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Japan circular construction materials market is segmented by end-use into residential and non-residential. Among these, the residential segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period residential segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to a growing demand for affordable, sustainable housing alternatives and eco-friendly urban infrastructure. Homebuilders are increasingly combining recycled aggregates, repurposed wood, and low-carbon concrete to meet sustainability standards and consumer demand for green living areas.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Circular Construction Materials market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Takenaka Corporation,

- Yoshino Gypsum

- Chiyoda Ute

- Teijin Ltd.

- Asahi Kasei

- Kaneka

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan circular construction materials market based on the below-mentioned segments:

Japan Circular Construction Materials Market, By Material

- Recycled Aggregates

- Recycled Metals

- Reclaimed Wood

- Recycled Plastics

Japan Circular Construction Materials Market, By End-Use

- Residential

- Non-residential

FAQ’s

Q: What is the base year and historical period considered in this market study?

A: The base year is 2024, with historical data from 2020 to 2023.

Q: What is the forecast period for the Japan Circular Construction Materials market?

A: The forecast period for this market is 2025–2035.

Q: What is the expected market size of the Japan Circular Construction Materials market by 2035?

A: The market size is projected to reach USD 15644.8 billion by 2035.

Q: What is the CAGR of the Japan Circular Construction Materials market during 2025–2035?

A: The market is expected to grow at a CAGR of 10.89% during the forecast period.

Q: Which material segment held the largest share in 2024?

A: Recycled aggregates held the largest revenue market share in 2024 due to their use in foundations, roads, and structural concrete.

Q: Which end-use segment dominated the market in 2024?

A: The residential segment dominated in 2024, driven by rising demand for sustainable and affordable housing solutions.

Q: What are the key factors driving the growth of this market?

A: Key drivers include government initiatives for sustainability, urbanization, increasing construction waste, raw material cost pressures, and the push for energy-efficient, low-carbon building materials.

Q: What challenges are restraining market growth?

A: High upfront costs, lack of expertise, inconsistent regulations, labour shortages, and limited secondary material databases are major restraints.

Q: Which companies are key players in the Japan Circular Construction Materials market?

A: Key players include Takenaka Corporation, Yoshino Gypsum, Chiyoda Ute, Teijin Ltd., Asahi Kasei, Kaneka, and others.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 171 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |