Japan Coffee Market

Japan Coffee Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Instant Coffee, Ground Coffee, Whole Grain, and Others), By Distribution Channel (Supermarket/Hypermarket, Convenience Store, Online Platform, and Others), and Japan Coffee Market Insights, Industry Trend, Forecasts to 2035 Japan Coffee Market Insights Forecasts to 2035

Report Overview

Table of Contents

Japan Coffee Market Insights Forecasts to 2035

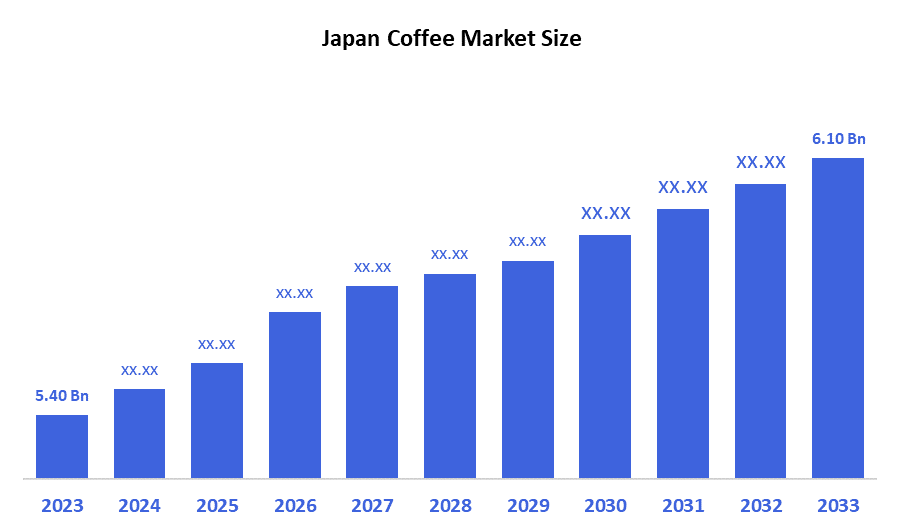

- The Japan Coffee Market Size Was Estimated at USD 5.40 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 1.11% from 2025 to 2035

- The Japan Coffee Market Size is Expected to Reach USD 6.10 Billion by 2035

According to a Research Report published by Decision Advisiors & Consulting, the Japan Coffee Market size is anticipated to reach USD 6.10 Billion by 2035, growing at a CAGR of 1.11% from 2025 to 2035. The Japan coffee market is driven by growing café culture, increasing disposable income, rising demand for specialty and ready-to-drink coffee, urbanization, changing consumer preferences, and the influence of Western coffee trends.

Market Overview

Japan coffee market is a major business with both consumption in the home and away from the home of disposable and reusable coffee products including instant coffees, ground coffees, whole bean coffees, and coffee pods/capsules. Japan coffee industry is characterized by convenience, superior quality, and emerging trends like third wave coffee and advancements in innovation of the ready to drink (RTD) single serve type of product.

In Japan, coffee consumption has long been connected to traditional methods of preparing and drinking coffee, but also incorporates an ever-increasing variety of modern methods. Coffee was introduced to Japan in its present form, during the last decade of the 19th Century: during this period and continuing into the 20th Century, coffee quickly gained a great deal of popularity in Japan. Today, coffee is sold at numerous outlets, including traditional Japan tea houses as well as contemporary coffee houses (specialty shops). In the Japan coffee market, there continues to exist an emphasis on both the quality of the coffee being sold, and the innovative ways that coffee can be enjoyed. Coffee consumed by Japan consumers will include: high quality blended coffees, single-origin coffees, espresso/caffeinated beverages, pre-packaged beverages, etc. In addition, the growing popularity of seasonal flavours of coffee, coupled with an increased awareness of the environmental, social, and ethical issues surrounding the production of coffee, are shaping coffee drinking patterns within Japan.

Report Coverage

This research report categorizes the market for the Japan coffee market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan coffee market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan coffee market.

Driving Factors

The coffee markets in Japan are driven by the demand from consumers in Japan for specialty coffee Products, and their changing tastes, have driven the development of quality driven specialty coffee Shops that use different types of brewing techniques and single origin coffee doughs to make premium espresso beverages. The interest and excitement for higher quality coffee has been growing rapidly, through increased awareness at events such as Coffee Competitions and Coffee Festivals.

As the interest in premium quality coffee products increase, there has been an increase in demand from consumers for customized coffee experiences, resulting in more specialty coffee cafes and more high-end home brew equipment. By Sept 2024, Armani Cafe has established operations in Japan.

Restraining Factors

The coffee market in Japan is restrained by including high production costs, intense competition from both local and international coffees, and changing consumer preferences toward other types of beverages that are being introduced into the market.

Market Segmentation

The Japan coffee market share is categorized by product type and distribution channel.

- The instant coffee segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan coffee market is segmented by product type into instant coffee, ground coffee, whole grain, and others. Among these, the instant coffee segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by convenience, long shelf life, affordability, busy lifestyles, strong retail availability, innovations in flavour and quality, expanding ready-to-drink culture, and increasing consumer preference for quick, consistent coffee experiences across diverse demographics.

- The supermarket/hypermarket segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan coffee market is segmented by distribution channel into supermarket/hypermarket, convenience store, online platform, and others. Among these, the supermarket/hypermarket segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to wide product variety, strong brand visibility, competitive pricing, frequent promotions, convenient one-stop shopping, high foot traffic, expanding retail chains, and increasing consumer preference for purchasing coffee alongside other household essentials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan coffee market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Starbucks Corporation

- Asahi Group Holdings Ltd.

- Coca-Cola Company

- Lotte Chilsung Beverage Co.

- Unilever

- Pokka Group

- Suntory Holdings Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, Japan-based Ueshima Coffee Company, for the first time in the UK market, introduced two new ready-to-drink (RTD) canned coffees.

- In Nov 2024, Nestlé Japan Ltd. announced the release of “Nescafé Gold Blend Caffeine Half,” a regular soluble coffee with 50% less caffeine compared to typical coffee extracts.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the Japan Coffee Market based on the below-mentioned segments:

apan Coffee Market, By Product Type

- Instant Coffee

- Ground Coffee

- Whole Grain

- Others

Japan Coffee Market, By Distribution Channel

- Supermarket/Hypermarket

- Convenience Store

- Online Platform

- Others

FAQ’s

Q: What was the size of the Japan coffee market in 2024?

A: The market size was USD 5.40 billion in 2024, driven by growing coffee consumption and evolving consumer preferences.

Q: What is the expected market size of the Japan coffee market by 2035?

A: It is projected to reach USD 6.10 billion by 2035, supported by steady demand for specialty and RTD coffee.

Q: What is the CAGR of the Japan coffee market from 2025 to 2035?

A: The market is expected to grow at a CAGR of 1.11% during the forecast period.

Q: Which product type segment held the largest market share in 2024?

A: The instant coffee segment held the largest revenue share due to its convenience, affordability, long shelf life, and strong retail presence.

Q: Which distribution channel dominated the Japan coffee market in 2024?

A: The supermarket/hypermarket segment dominated the market, supported by wide product variety, competitive pricing, and high customer footfall.

Q: What factors are driving the growth of the Japan coffee market?

A: Growth is driven by rising café culture, increasing disposable income, demand for specialty coffee, urbanization, RTD innovations, and Western lifestyle influences.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 169 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |