Japan Cold Storage Market

Japan Cold Storage Market Size, Share, and COVID-19 Impact Analysis, By Type (Refrigerated Warehouse, Refrigerated Transport), By Application (Dairy and Frozen Desserts, Fish, Meat and Seafood Products, Bakery and Confectionery Products, Fruit Vegetables, and Others), By Temperature Type (Frozen, Chilled), and Japan Cold Storage Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Cold Storage Market Insights Forecasts to 2035

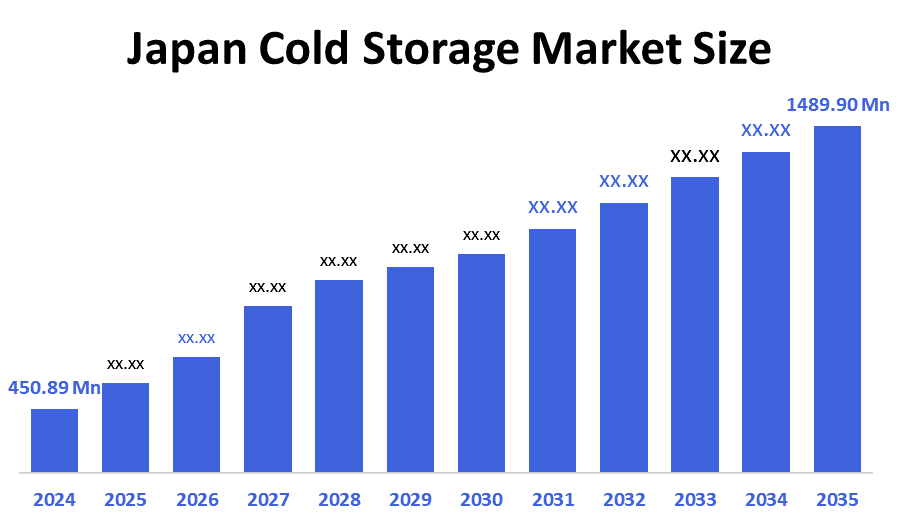

- The Japan Cold Storage Market Size Was Estimated at USD 450.89 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 11.48% from 2025 to 2035

- The Japan Cold Storage Market Size is Expected to Reach USD 1489.90 Million by 2035

According to a research report published by Decision Advisior & Consulting, the Japan Cold Storage Market size is anticipated to reach USD 1489.90 Million by 2035, growing at a CAGR of 11.48% from 2025 to 2035. The Japan cold storage market is driven by rising demand for temperature-controlled logistics, growth in e-commerce food delivery, expanding pharmaceutical needs, stricter food safety regulations, and increasing consumption of frozen and perishable products.

Market Overview

The Japan cold storage market refers to the sector for storing temperature-sensitive products like food, beverages, and pharmaceuticals at controlled temperatures, encompassing refrigerated warehouses and transportation. This market is driven by consumer demand for fresh products, the growth of e-commerce, and the increasing need for efficient pharmaceutical distribution, with a focus on temperature-controlled logistics to ensure product quality and safety. Moreover, Japan’s cold storage market is advancing through automation, IoT-based temperature control, and energy-efficient refrigeration systems. Companies are investing heavily in modern, eco-friendly cold warehouses using natural refrigerants and smart monitoring. Significant capital inflows are driving capacity expansion, improving efficiency, and supporting Japan’s growing demand for high-quality cold chain infrastructure.

Report Coverage

This research report categorizes the market for the Japan cold storage market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan cold storage market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan cold storage market.

Driving Factors

The cold storage markets in Japan are driven by as consumers increasingly prefer the convenience of purchasing groceries online, retailers are expanding their cold storage capabilities to accommodate this shift. Recent data suggests that online grocery sales in Japan are expected to grow by 25% annually, prompting retailers to enhance their cold storage infrastructure. This trend is reshaping the cold storage market, as businesses invest in temperature-controlled logistics to ensure the safe delivery of perishable goods. The growth of e-commerce in the grocery sector not only boosts demand for cold storage facilities but also encourages innovation in last-mile delivery solutions.

Restraining Factors

The cold storage market in Japan is restrained by high construction and energy costs, limited land availability, skilled labour shortages, strict compliance requirements, and challenges integrating advanced automation technologies.

Market Segmentation

The Japan cold storage market share is categorized by type, application and temperature type.

- The refrigerated warehouse segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cold storage market is segmented by type into refrigerated warehouse, refrigerated transport. Among these, the refrigerated warehouse segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by increasing demand for long-term storage of perishable goods, expanding e-commerce food delivery, stringent food safety regulations, rising pharmaceutical cold chain requirements, and investments in modern warehouse infrastructure.

- The dairy and frozen desserts segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan cold storage market is segmented by application into dairy and frozen desserts, fish, meat and seafood products, bakery and confectionery products, fruit vegetables, and others. Among these, the dairy and frozen desserts segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to rising consumption of dairy and frozen desserts, increasing demand for convenience foods, expanding cold chain logistics, strict quality regulations, and growing e-commerce food delivery services.

- The chilled segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The Japan cold storage market is segmented by temperature type into frozen, chilled. Among these, the chilled segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by rising demand for fresh and perishable foods, expanding retail and e-commerce distribution, strict food safety regulations, increasing consumer preference for chilled products, and advancements in temperature-controlled logistics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan cold storage market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nichirei Logistics Group

- Yamato Holdings

- Sagawa Express

- Nippon Express

- Mitsui?Soko Holdings

- AEON Global SCM

- GLP Japan

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2025, Nippon Express (Japan) announced a strategic partnership with a leading technology firm to develop AI-driven inventory management systems. This move is likely to enhance operational efficiency and reduce waste, aligning with the growing trend towards digital transformation in the cold storage sector. The integration of AI technologies may provide Nippon Express with a competitive edge in managing complex supply chains and meeting customer demands more effectively.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Japan Cold Storage Market based on the below-mentioned segments:

Japan Cold Storage Market, By Type

- Refrigerated Warehouse

- Refrigerated Transport

Japan Cold Storage Market, By Application

- Dairy and Frozen Desserts

- Fish

- Meat and Seafood Products

- Bakery and Confectionery Products

- Fruit Vegetables

- Others

Japan Cold Storage Market, By Temperature Type

- Frozen

- Chilled

FAQ’s

Q: What is the size of the Japan cold storage market in 2024?

A: The market was estimated at USD 450.89 million in 2024.

Q: What is the expected market size by 2035?

A: It is expected to reach USD 1,489.90 million by 2035.

Q: What is the CAGR for the forecast period 2025-2035?

A: The market is projected to grow at a CAGR of 11.48% during 2025-2035.

Q: Which segment dominates the market by type?

A: The refrigerated warehouse segment accounted for the largest revenue share in 2024.

Q: Which application segment holds the largest share?

A: Dairy and frozen desserts dominated the market due to growing consumption and e-commerce food delivery.

Q: What drives the growth of the Japan cold storage market?

A: Growth is driven by rising demand for temperature-controlled logistics, e-commerce food delivery, pharmaceutical cold chain needs, and stricter food safety regulations.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 217 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |