Japan Computed Tomography Market

Japan Computed Tomography Market Size, Share, and COVID-19 Impact Analysis, By Type (Low Slice, Medium Slice, High Slice, and Others), By Application (Oncology, Neurology, Cardiovascular, Musculoskeletal, and Others), By End User (Hospitals, Diagnostic Centres, and Others), and Japan Computed Tomography Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Computed Tomography Market Insights Forecasts to 2035

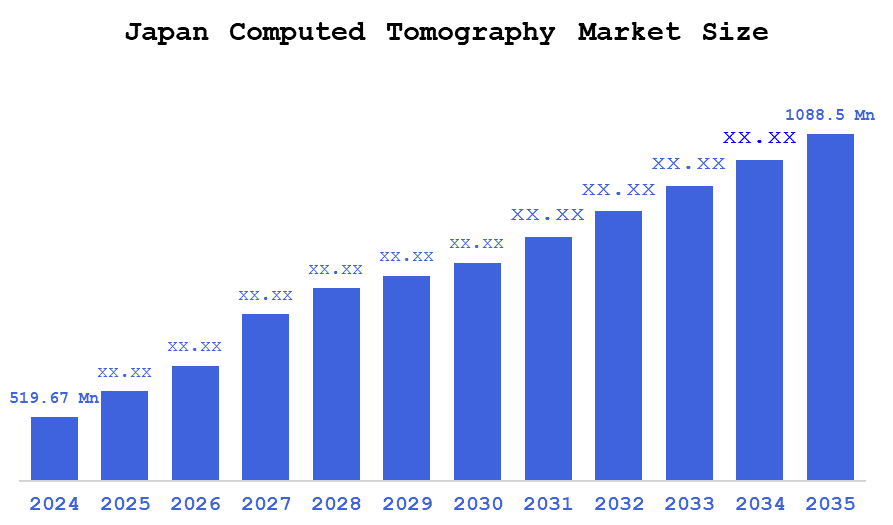

- The Japan Computed Tomography Market Size Was Estimated at USD 519.67 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.95% from 2025 to 2035

- The Japan Computed Tomography Market Size is Expected to Reach USD 1088.5 Million by 2035

According to a Research Report published by Decision Advisiors & Consulting, the Japan Computed Tomography Market size is anticipated to reach USD 1088.5 Million by 2035, growing at a CAGR of 6.95% from 2025 to 2035. Japan Computed Tomography Market is growing due to the demand for CT in Japan is associated with that country's rapidly ageing demographic and the increased incidence of chronic illnesses, which increases the need for advanced diagnostic procedures within that country. The increased use of computer-assisted imaging techniques like AI technology, photon counting cameras, etc. Being deployed in CT is leading to higher-quality imaging results, reduced radiation dosage, and short turnaround times.

Market Overview

Japan's computed tomography (CT) sector is an expanding component of the medical imaging business that utilises state-of-the-art technology for CT imaging. Demand is driven by rising numbers of older individuals within the Japanese population as well as increasing levels of chronic diseases in Japan. Also, the use of new CT scanners with photon counting capabilities and artificial intelligence is increasing the number of CT scans performed in Japan. The number of CT scans performed in Japan is among the highest in the world on a per capita basis. Computed tomography produces cross-sectional images of organs, tissues, bones, and vessels via non-invasive means, using X-ray technology in conjunction with digital technology. Major industry trends include the advancement and adoption of technologies, such as photon-counting computed tomography (CT) and artificial intelligence (AI), which provide increased precision with decreased radiation exposure, and growth in the use of portable computed tomography (CT) systems and mobile fleets. Strong healthcare systems and reimbursement policies support the market. CT scans are used in Japan and globally for diagnostic purposes, including detecting and staging cancer, evaluating cardiovascular diseases, assessing trauma, and guiding biopsies.

In the year 2024, the MHLW will require over-the-counter toothpaste to contain no more than 0.8mg/litre or 800ppm of fluoride. Manufacturers are being forced to reformulate products specifically for sale in Japan, which could increase production costs and create an advantage for companies capable of innovation under these restrictions.

In the 2024 version of the national policy document Basic Policy on Economic and Fiscal Management and Reform 2024, the government explicitly included oral health as a target, calling for life-long dental check-ups for all citizens, also known as universal dental check-ups. That is, systemic, periodic dental examinations across the population are being promoted.

Report Coverage

This research report categorizes the market for the Japan computed tomography market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan computed tomography market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan computed tomography market.

Driving Factor

Japan's computed tomography market, driven by a growing aging population along with corresponding increases in chronic diseases, such as cancers and cardiovascular diseases, will drive the need for more advanced diagnostics. Additionally, factors like Japan's commitment to technological development through artificial intelligence imaging techniques and continued adoption of higher slice CT scanners have also helped to propel the CT market in Japan to an almost unprecedented degree. Demand is also supported by the strong shift toward premium and specialized products, including whitening, high-fluoride, natural, and sensitive-care formulations. Government initiatives such as the promotion of universal dental check-ups and nationwide oral-health campaigns are further encouraging preventive habits and daily toothpaste use.

Restraining Factor

Japan computed tomography market is restrained by increasing rate of elderly people, combined with the growing need for more sophisticated diagnostic tools has allowed this CT market to thrive, yet at the same time, there are barriers in terms of expensive procurement and upkeep costs for these types of machines, as well as the numerous regulatory criteria that will need to be satisfied before being able to deliver these devices.

Market Segmentation

The Japan computed tomography market share is categorized by type, application, and end user.

- The medium slice segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japanese computed tomography market is segmented by type into low slice, medium slice, and high slice. Among these, the medium slice segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segmental growth is driven by the mid-slice scanner's ability to produce very detailed, high-resolution images with much faster acquisition times than those produced by low-slice scanners. Mid-slice scanners are able to provide quality results in a larger number of diagnostic areas, including standard cardiac scans and advanced trauma imaging. At the same time, mid-slice systems are much less costly to acquire than high-slice systems (e.g., 128-slice or greater) and thus represent an overall lower capital investment for a greater range of different types of facilities.

- The oncology segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japanese computed tomography market is segmented by application into oncology, neurology, cardiovascular, musculoskeletal, and others. Among these, the oncology segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segmental growth is driven by cancer is on the rise in Japan due to an aging population. People over 65 make up nearly one quarter of the Japanese population, leading to more individuals developing cancer. The widespread adoption of advanced technologies for diagnosing, staging, and treating cancer will increase demand for CT scans.

- The hospital segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japanese computed tomography market is segmented by end user into hospitals, diagnostic centers, and others. Among these, the hospitals segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segmental growth is driven by increased demand for diagnostic imaging due to an increasingly aged demographic as a result of an increased number of patients being admitted to the hospital through emergency room visits and surgeries, as well as continued investments in new cutting-edge technologies, including those powered by Artificial Intelligence and high-speed CT scanners that improve accuracy and speed of diagnosis.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan computed tomography market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Canon Medical Systems Corporation

- Shimadzu Corporation

- Fujifilm Holdings Corporation

- Hitachi, Ltd. (Healthcare Business Unit)

- EIZO Corporation

- Konica Minolta Inc.

- YOSHIDA DENZAI KOGYO Co., Ltd.

- Siemens Healthineers

- GE HealthCare

- Koninklijke Philips N.V.

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, Shimadzu Corporation announced the launch of its XSeeker 8000, a compact and lightweight X-ray CT system designed to deliver high-quality imaging for a wide range of industrial samples, including aluminium die-cast components and resin-molded parts. The new system expands the company’s product portfolio and supports growing customer demand for more versatile and efficient industrial CT solutions.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the Japan computed tomography market based on the below-mentioned segments:

Japan Computed Tomography Market, By Type

- Low Slice

- Medium Slice

- High Slice

Japan Computed Tomography Market, By Application

- Oncology

- Neurology

- Cardiovascular

- Musculoskeletal

- Others

Japan Computed Tomography Market, By End User

- Hospitals

- Diagnostic Centers

- Others

FAQs

Q. What is the projected size of the Japan Computed Tomography Market by 2035?

A: The market is expected to reach USD 1088.5 million by 2035.

Q: What key factor is driving growth in Japan’s CT market?

A: Growth is driven mainly by Japan’s aging population and rising chronic disease rates, increasing demand for advanced diagnostics.

Q: Which CT type segment held the largest market share in 2024?

A: The medium slice CT segment held the largest revenue share in 2024.

Q: Which application segment dominated the market in 2024?

A: The oncology segment accounted for the largest share due to rising cancer cases.

Q: Which end-user segment led the Japan CT market in 2024?

A: Hospitals held the highest market share thanks to high patient volume and adoption of advanced imaging technologies.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |