Japan Confectionery Market

Japan Confectionery Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Hard-boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, and Others) and Japan Confectionery Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Confectionery Market Insights Forecasts to 2035

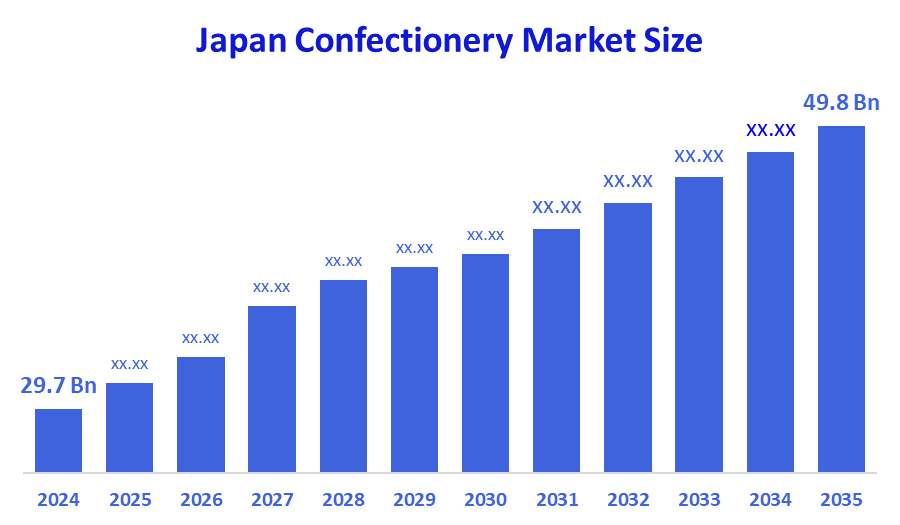

- The Japan Confectionery Market Size Was Estimated at USD 29.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.81% from 2025 to 2035

- The Japan Confectionery Market Size is Expected to Reach USD 49.8 Billion by 2035

According to a research report published by Decision Advisors & Consulting, The Japan Confectionery Market size is anticipated to reach USD 49.8 billion by 2035, growing at a CAGR of 4.81% from 2025 to 2035. The confectionery market in Japan is driven by consumer preferences for upscale products, healthier alternatives, and holiday confections. The industry is boosted by robust retail networks, increasing e-commerce penetration, and a rise in demand for artisan and utilitarian sweets.

Market Overview

Japan has a very diversified confectionery industry, which includes a wide variety of chocolates, sugar confectionery, gum, candy, mints, and traditional products (Wagashi), in addition to baked products and premium handmade confectionery. This is an established but evolving industry that has evolved due to a combination of the long-standing cultural interests of Japan, the tradition of seasonal gifting, and the importance placed on the quality of products and aesthetics of packaging. The Japanese confectionery industry offers significant growth opportunities due to increasing consumer demand for low-sugar, sugar-free, probiotic, collagen-infused, and vitamin-enriched sweets, as well as rapid growth in the luxury chocolate and artisan confectionery sector and seasonal gifting, subscription boxes, personalization in gift packaging, and cross-border online sales. Japan has a main piece of food/agriculture/rural areas law called the Basic Act on Food, Agriculture, and Rural Areas. In 2024, the basic act was updated. It was the first time since the last change in 1999 that an update to this act occurred. The change made by the Basic Act is intended to focus on providing a continuous source of high-quality food at a reasonable cost and providing sustainable, eco-friendly methods for producing those food products, while also providing financial assistance to rural areas. The change made by the Basic Act also has an indirect influence on creating healthy trends in confectionery because of other programs in Japan that focus on decreased sugar intake and the creation of healthier products based on other methods. An example of these programs would be Health Japan 21.

Report Coverage

This research report categorizes the market for the Japan Confectionery Market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan confectionery Market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan Confectionery Market.

Driving Factors

The confectionery markets in Japan are driven by due to shifting customer tastes for high-end goods, healthier substitutes, and a wide range of traditional and contemporary sweets. Additionally, the industry is seeing an increase in demand for wellness-oriented and organic products. rising demand for nutritious, gluten-free, and non-GMO cookies and snacks. Additionally, there is a growing demand for sweets that are produced sustainably and locally as ethical and environmentally conscious consumption behaviors become increasingly important.

Restraining Factors

The confectionery market in Japan is mostly restrained by increased consumer awareness of the negative effects of consuming too much sugar. As worries about diabetes, dental decay, obesity, and other lifestyle-related illnesses have grown, people are eating fewer sweet foods. This results in an overstock or understock being manufactured and sold as sugar and chocolate goods since the average annual price of the raw ingredients swings from low to high.

Market Segmentation

The Japan confectionery market share is classified into product type and distribution channel.

- The chocolate segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan confectionery market is segmented by product type into hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others. Among these, the chocolate segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The industry is being driven by increasing awareness of the health benefits of chocolate, such as its antioxidants and possible cardiovascular benefits. The growing demand for artisanal and premium dark chocolates among affluent consumers seeking pleasure and refinement also contributes to the market's expansion.

- The supermarket and hypermarket segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan confectionery market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others. Among these, the supermarket and hypermarket segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to Stricter safety regulations boosted the market for both local and online shopping, but customers moved their eating habits from food service to supermarkets due to café and restaurant closures and an increase in remote work.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Confectionery Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Meiji Holdings

- Lotte

- Morinaga

- Ezaki Glico

- Mondelez

- Kanro

- Fujiya Co. Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Japan Confectionery Market based on the below-mentioned segments:

Japan Confectionery Market, By Product Type

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

Japan Confectionery Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

FAQ’s

Q: What is the current size of the Japan confectionery market?

A: The Japan confectionery market was valued at USD 29.7 billion in 2024 and is projected to grow steadily due to rising demand for premium and health-oriented confectionery products.

Q: What is the expected growth rate of the market?

A: The market is expected to expand at a CAGR of 4.81% from 2025 to 2035, reaching USD 49.8 billion by 2035.

Q: Which factors are driving the growth of the Japan confectionery market?

A: Key drivers include increasing preference for premium confectionery, healthier alternatives, artisanal sweets, seasonal gifting, and growing e-commerce penetration.

Q: Which segment held the largest share in 2024?

A: The chocolate segment accounted for the largest share in 2024, driven by the rising popularity of premium dark chocolate and increasing awareness of cocoa's health benefits.

Q: Which distribution channel dominates the market?

A: Supermarkets and hypermarkets lead the market due to wide product availability, strict safety standards, and changing consumer buying behavior.

Q: What are the key restraining factors for the market?

A: Growing awareness of health issues associated with sugar consumption and volatile raw material prices (sugar and cocoa) pose significant challenges.

Q: Who are the major players in the Japan confectionery market?

A: Key companies include Meiji Holdings, Lotte, Morinaga, Ezaki Glico, Mondelez, Kanro, and Fujiya Co. Ltd.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 187 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |