Japan Construction Plastics Market

Japan Construction Plastics Market Size, Share, and COVID-19 Impact Analysis, Type (polyvinyl chloride, Polyurethane, Polypropylene, and Polyethylene), Application (Window, Roofing, Flooring, Insulation, and Piping), and Japan Construction Plastics Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Construction Plastics Market Insights Forecasts to 2035

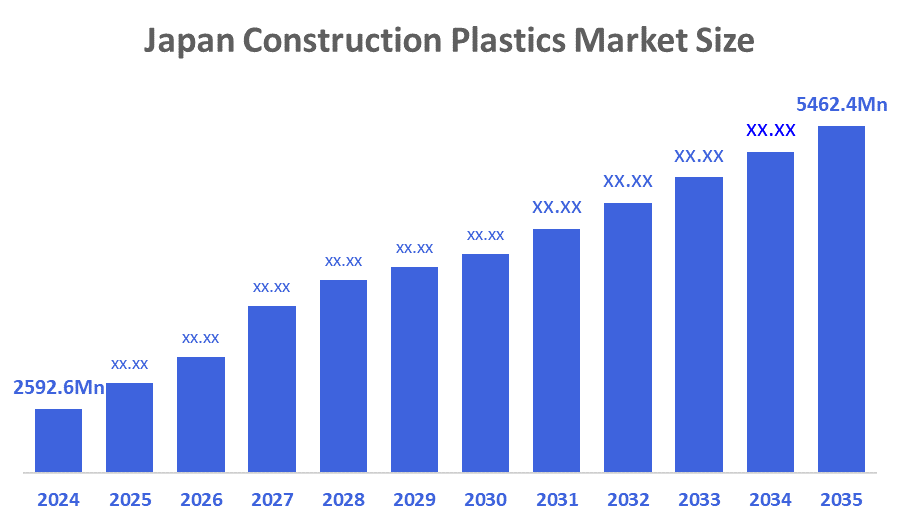

- The Japan Construction Plastics Market Size Was Estimated at USD 2592.6 Million in 2024.

- The Market Size is expected to grow at a CAGR of around 7.01% from 2025 to 2035.

- The Japan Construction Plastics Market Size is expected to reach USD 5462.4 Million by 2035.

According to a Research Report Published By Decisions Advisors & Consulting, The Japan Construction Plastics Market Size Is Anticipated To Reach USD 5462.4 Million By 2035, Growing At a CAGR of 7.01% From 2025 to 2035. The market is driven due to growing infrastructure, urbanization, and the need for affordable, strong, and lightweight materials in both residential and commercial constructions.

Market Overview

The Japan construction plastics sector is part of the building sector, focusing on producing and utilizing many kinds of plastic materials, from structural to non-structural, in residential, industrial, commercial, and infrastructure construction projects. Construction plastics are utilized within the following categories such as polyvinyl chloride (PVC), polyethylene (PE), polypropylene (PP), and Polycarbonate (PC). They are used in pipes, insulation, roofing, window profiles, and cables. The primary factor that drives the Japanese construction plastics industry is consumers’ desire for lightweight, durable, and cost-effective materials, sustainable offerings, and smart building integration. The current Japan construction plastics industry will continue to evolve as it develops high-performance, sustainable, and smart products to meet the government's urban redevelopment, smart city initiative, and seismic resilience needs. The market for advanced plastics will continue to grow due to the emerging energy-efficient building envelopes, resilience infrastructure, and durable, low-maintenance residential and non-residential construction. The government is creating policies to promote resource circulation and a circular plastics economy, such as establishing the Ministerial Council on Circular Economy and approving a "Policy Package for Accelerating the Transition to a Circular Economy".

Report Coverage

This research report categorizes the market for the Japan construction plastics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan construction plastics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan construction plastics market.

Driving Factors

The Japanese construction plastics market is mainly driven by investments in infrastructure, government support for green building, and demand from residential and commercial construction. In addition, lightweight, durable, and easily installed materials, aging infrastructure requiring upgrades, and technological advancements in plastic manufacturing.

Restraining Factors

The Japanese construction plastics market is restrained by fluctuating raw material prices, growing environmental concerns, and strict regulations on plastic use. Limited recycling infrastructure, increasing sustainability pressure, and competition from eco-friendly materials also hinder market growth across residential and commercial construction applications.

Market Segmentation

The Japan construction plastics market share is classified into type and application.

- The polyvinyl chloride (PVC) segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan Construction Plastics market is segmented by type into polyvinyl chloride, Polyurethane, Polypropylene, and Polyethylene. Among these, the polyvinyl chloride segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to extensive use, including flooring, window frames, and pipelines. PVC's robust performance is ascribed to its affordability, robustness, and resilience to environmental influences.

- The piping segment accounted for the largest market revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan Construction Plastics market is segmented by application into window, roofing, flooring, insulation, and piping. Among these, the piping segment accounted for the largest market revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. They are essential for large-scale residential, commercial, and municipal projects because of their lightweight design, corrosion resistance, and ease of installation, which drastically cut project costs and deadlines.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Construction Plastics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Chemical Corporation

- Asahi Kasei

- Polyplastics Co., Ltd.

- Daicel Corporation

- Sumitomo Chemical

- Toray Industries

- Teijin Limited

- Kaneka Corporation

- Kuraray Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan construction plastics market based on the below-mentioned segments:

japan Construction Plastics Market, By Type

- Polyvinyl Chloride

- Polyurethane

- Polypropylene

- Polyethylene

Japan Construction Plastics Market, By Application

- Window

- Roofing

- Flooring

- Insulation

- Piping

FAQ’s

Q: What is the current size of the Japan Construction Plastics Market?

A: The market size was valued at USD 2592.6 million in 2024, driven by rising demand for lightweight and durable materials in construction applications.

Q: What is the market forecast for 2035?

A: The Japan Construction Plastics Market is projected to reach USD 5462.4 million by 2035, growing at a CAGR of 7.01% during 2025–2035.

Q: What factors are driving market growth?

A: Key drivers include expanding infrastructure development, urbanization, government support for green buildings, and increasing demand for affordable, corrosion-resistant, and energy-efficient construction materials.

Q: Which type of construction plastic dominates the market?

A: Polyvinyl Chloride (PVC) held the largest share in 2024, owing to its durability, affordability, weather resistance, and widespread use in pipes, window frames, and flooring.

Q: Which application segment accounts for the largest share?

A: The piping segment dominated in 2024 due to its lightweight design, corrosion resistance, and easy installation, making it essential for residential, commercial, and municipal projects.

Q: Who are the key players in the Japan Construction Plastics Market?

A: Leading companies include Mitsubishi Chemical, Asahi Kasei, Polyplastics, Daicel, Sumitomo Chemical, Toray Industries, Teijin, Kaneka, and Kuraray, among others.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |