Japan Consumer Packaged Goods Market

Japan Consumer Packaged Goods Market Size, Share, and COVID-19 Impact Analysis, Product (Personal Care, Home Care, Health & Wellness, Food, and Others), By Distribution Channel (Online and Offline), and Japan Consumer Packaged Goods Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Japan Consumer Packaged Goods Market Insights Forecasts to 2035

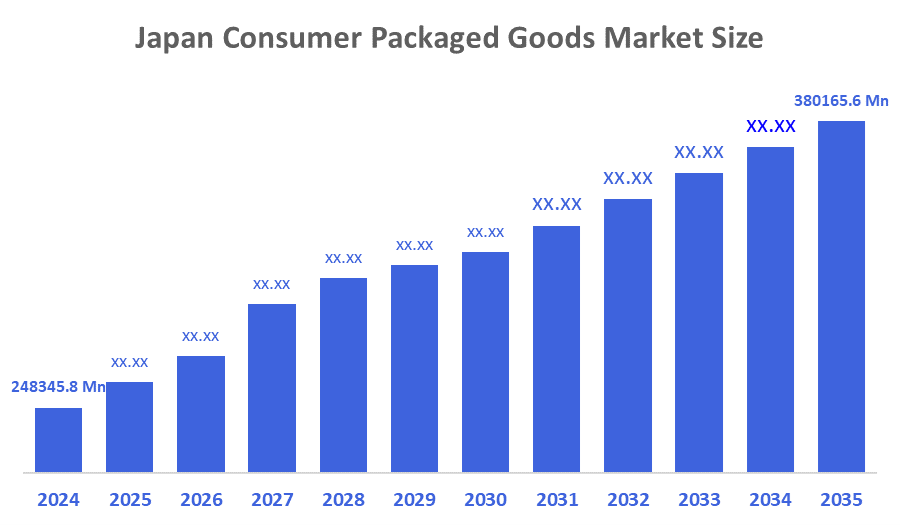

- The Japan Consumer Packaged Goods Market Size Was Estimated at USD 248345.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.95% from 2025 to 2035

- The Japan Consumer Packaged Goods Market Size is Expected to Reach USD 380165.6 Million by 2035

According to a research report published by Decision Advisors & Consulting, the Japan Consumer Packaged Goods market?is anticipated to reach USD 380165.6 million by 2035, growing at a CAGR of 3.95% from 2025 to 2035. The Japanese consumer packaged goods market is driven by consumers who are increasingly seeking items with natural ingredients, low sugar, and eco-friendly packaging. Also, shift is driven by rising awareness about personal well-being and environmental impact, as well as social media influence and transparency from brands

Market Overview

The Japanese consumer packaged goods (CPG) market encompasses the speedy-moving items that people use daily, like pre-packaged food, drink, and household cleaning products. Many different types of containers are available in the CPG market, including flexible and rigid containers, paper/cardboard solutions, metal containers, and biodegradable alternatives. The transformation of lifestyles, rapid urbanization, and an increasing older population all contribute to the strong growth opportunities in this market. Increase in demand for convenience foods, ready-to-eat meals, and single-serve portions has resulted in the increased demand for light, easy-to-open, and resealable containers. The interest in sustainability has created an opportunity for companies to produce lighter-weight, biodegradable, recyclable materials and create less waste by encouraging consumers towards greener choices. The government of Japan is now promoting the recycling, reusing, and decreasing of plastics within the consumer goods packaging space through the enactment of the "Plastic Resource Circulation Act." Companies are making large investments in biodegradable plastics, paper alternative containers, and mono-material packages to enhance recyclability. Top Japanese brands have begun creating minimalistic packaging designs in order to utilize fewer materials and still offer a premium appeal.

Report Coverage

This research report categorizes the Japan consumer packaged goods market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan consumer packaged goods market. Recent market developments and competitive strategies, such as expansion, Protein launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan consumer packaged goods market.

Driving Factor

The Japanese consumer packaged goods market is driven by the rising demand for convenience and ready-to-use products, the growth of e-commerce and home delivery, strong focus on product safety and hygiene. In addition, increasing adoption of sustainable and recyclable packaging, technological advancements in materials and printing, and evolving consumer preferences for premium, functional, and aesthetically appealing packaging solutions.

Restraining Factor

The Japanese consumer packaged goods market is restrained by high production and raw material prices, stringent recycling and environmental laws, and constrained landfill space. Also, difficulties striking a balance between performance and sustainability, and growing compliance costs for producers switching to environmentally friendly packaging materials.

Market Segmentation

The Japan consumer packaged goods market share is classified into product and distribution channel.

- The food segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The Japanese consumer packaged goods market is segmented by product into personal care, home care, health & wellness, food, and others. Among these, the food segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This is due to its continuous demand and vital function in day-to-day existence. Also, high repeat consumption results from the frequent purchasing of staples such as packaged meals, dairy products, and snacks. Convenient and ready-to-eat food options have become even more important due to urbanization and hectic lifestyles.

- The offline segment held the largest share in 2024 and is expected to grow at a substantial CAGR during the predicted period.

The Japanese Consumer Packaged Goods market is segmented by distribution channel into online and offline. Among these, the offline segment held the largest share in 2024 and is expected to grow at a substantial CAGR during the predicted period. Before making a purchase, consumers can view, handle, and compare products at offline channels such as supermarkets, hypermarkets, and neighbourhood food stores. This is especially crucial for perishable goods, domestic goods, and personal care items.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Consumer Packaged Goods market, along with a comparative evaluation primarily based on their Protein offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Protein development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toppan Inc.

- Dai Nippon Printing (DNP) Co., Ltd.

- Toyo Seikan Group Holdings, Ltd.

- Oji Holdings Corporation

- Fujimori Kogyo Co., Ltd.

- Mitsubishi Chemical Group (Packaging Solutions)

- Sumitomo Bakelite Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities?

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Japan Consumer Packaged Goods market based on the below-mentioned segments:

Japan Consumer Packaged Goods Market, By Product

- Personal Care

- Home Care

- Health & Wellness

- Food

- Others

Japan Consumer Packaged Goods Market, By Distribution Channel

- Online

- Offline

FAQ’s

Q: What is the Japan Consumer Packaged Goods Market?

A: The Japan Consumer Packaged Goods (CPG) market includes fast-moving consumer products such as packaged food, beverages, personal care, home care, and health & wellness items that are used daily and distributed through online and offline retail channels.

Q: What is the market size and growth outlook for Japan’s CPG market?

A: The market was valued at USD 248,345.8 million in 2024 and is projected to reach USD 380,165.6 million by 2035, growing at a CAGR of 3.95% during the forecast period 2025–2035.

Q: What are the key factors driving the Japan CPG market?

A: Major drivers include rising demand for convenience and ready-to-use products, growth of e-commerce and home delivery, strong emphasis on hygiene and safety, increasing preference for sustainable packaging, and evolving consumer lifestyles.

Q: Which product segment dominates the Japan Consumer Packaged Goods market?

A: The food segment held the largest market share in 2024 due to high consumption frequency, continuous demand for packaged staples, and increasing preference for ready-to-eat and convenience food options.

Q: Which distribution channel leads the market in Japan?

A: The offline segment dominated the market in 2024, supported by supermarkets, hypermarkets, and neighborhood stores where consumers prefer physical inspection, especially for perishable and daily-use products.

Q: Who are the key players operating in the Japan Consumer Packaged Goods market?

A: Major players include Toppan Inc., Dai Nippon Printing (DNP) Co., Ltd., Toyo Seikan Group Holdings, Ltd., Oji Holdings Corporation, Fujimori Kogyo Co., Ltd., Mitsubishi Chemical Group, and Sumitomo Bakelite Co., Ltd.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 177 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |