Japan Contraceptive Devices Market

Japan Contraceptive Devices Market Size, Share, and Covid-19 Impact Analysis, By Product Type (Condoms, Intrauterine Devices, Hormonal Contraceptives, and Others), By Application (Hospitals, Clinics, Pharmacies, and Other), and Japan Contraceptive Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Contraceptive Devices Market Insights Forecasts to 2035

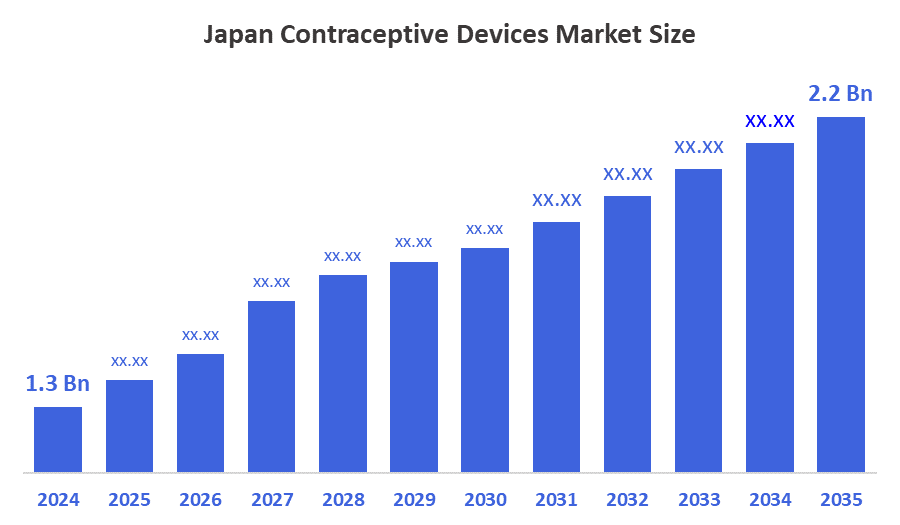

- The Japan Contraceptive Devices Market Size Was Estimated at USD 1.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.9% from 2025 to 2035.

- The Japan Contraceptive Devices Market Size is Expected to Reach USD 2.2 Billion by 2035.

According to a research report published by Decision Advisors, the Japan Contraceptive Devices Market Size is Anticipated to Reach USD 2.2 Billion by 2035, growing at a CAGR of 4.9% from 2025 to 2035. The Japan contraceptive devices market is driven by increasing awareness of family planning and sexual health, rising government initiatives promoting contraceptive use, growing demand for non-hormonal and user-friendly options, and an ageing yet sexually active population seeking safe pregnancy prevention methods.

Market Overview

The Japan contraceptive devices market are essential tools that help individuals and couples prevent unintended pregnancies. They effectively prevent pregnancy by inhibiting the fertilization process. These devices are made using various materials and technologies, depending on the type of device. Barrier methods, such as condoms and diaphragms, prevent sperm from reaching the egg and are typically made of latex, polyurethane, or other materials. Hormonal contraceptives, such as birth control pills, injections, and patches, contain synthetic hormones that regulate the woman's menstrual cycle and prevent ovulation. On the other hand, intrauterine devices are made of either copper or plastic and are inserted into the uterus to prevent pregnancy.

Contraceptive devices offer numerous advantages, such as providing individuals with the autonomy to plan their families and make informed choices about their reproductive health. They can be used by both men and women, offering a wide range of options for contraception. They are generally safe and effective when used correctly, and many devices also provide additional benefits, such as protection against sexually transmitted infections or reduced menstrual bleeding.

Report Coverage

This research report categorizes the market for the Japan contraceptive devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan contraceptive devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan contraceptive devices market.

Driving Factors

The contraceptive devices markets in Japan are driven by increasing awareness of sexual health and family planning, rising government initiatives supporting reproductive health, growing demand for safe and effective contraceptive methods, technological advancements in device design and usability, and the presence of a health-conscious, ageing yet sexually active population.

Restraining Factors

The contraceptive devices market in Japan is restrained by high product costs limiting accessibility, cultural and social stigma around contraceptive use, and preference for traditional or natural family planning methods over modern devices.

Market Segmentation

The Japan contraceptive devices market share is categorized by product type and application.

- The Condoms segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan contraceptive devices market is segmented by product type into condoms, intrauterine devices, hormonal contraceptives and others. Among these, the condoms segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven due to high awareness of sexually transmitted infection prevention, widespread availability in retail and online channels, affordability compared to other contraceptive methods, growing preference for non-hormonal and easy-to-use options, increasing sexual health education and campaigns, and rising focus on safe sexual practices among young and middle-aged populations.

- The pharmacies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan contraceptive devices market is segmented by application into hospitals, clinics, pharmacies and others. Among these, the pharmacies segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to easy accessibility of contraceptive devices, a wide product variety available under one roof, a trusted source for authentic and quality products, growing consumer preference for in-person consultations and guidance, the convenience of purchasing without a prescription for certain products, and the increasing presence of pharmacy chains across urban and semi-urban areas.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan contraceptive devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer Inc

- Bayer AG

- Merck & Co. Inc

- Abbvie inc

- Teva Pharmaceutical Industries Ltd

- Okamoto Industries, Inc

- Fuji Latex Co. Ltd

- Durex (Reckitt Benckiser Group)

- Mayer Laboratories, Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Bayer’s next-generation hormonal IUD was introduced in Japan with an emphasis on decreased adverse effects and increased efficacy.

- In December 2021, Cooper Surgical, Inc. closed on its acquisition of Generate Life Sciences. This acquisition helps Cooper boost their reproductive section.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Japan Contraceptive Devices Market based on the below-mentioned segments:

Japan Contraceptive Devices Market, By Product Type

- Condoms

- Intrauterine Devices

- Hormonal Contraceptives

- Others.

Japan Contraceptive Devices Market, By Application

- Hospital

- Clinics

- Pharmacies

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |