Japan Craft Beer Market

Japan Craft Beer Market Size, Share, and COVID-19 Impact Analysis, By Type (Ale, Lager, Stout & Porter, IPA, and Others), By Distribution Channel (On-Trade and Off-Trade), By Packaging (Bottles, Cans, and Others), and Japan Craft Beer Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Craft Beer Market Size Insights Forecasts to 2035

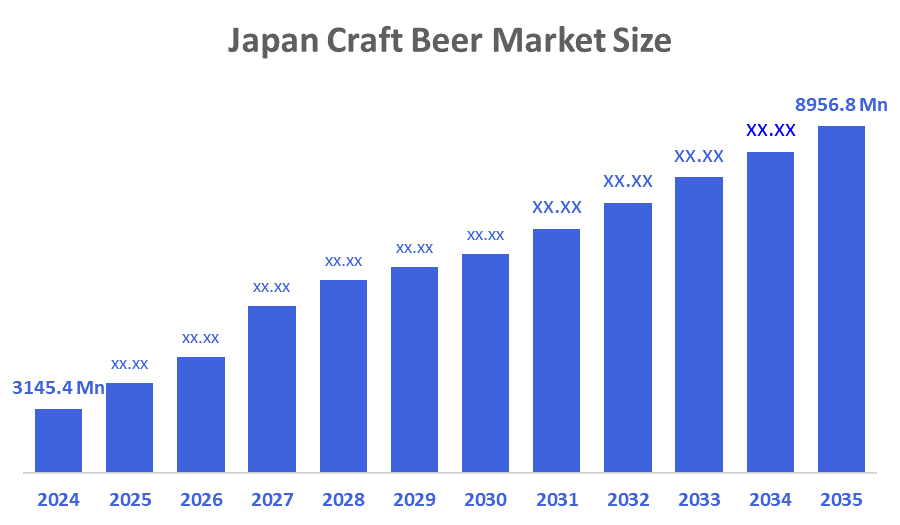

- The Japan Craft Beer Market Size Was Estimated at USD 3145.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of 9.98% from 2025 to 2035

- The Japan Craft Beer Market Size is Expected to Reach USD 8956.8 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Japan Craft Beer Market Size is anticipated to Reach USD 8956.8 Million by 2035, Growing at a CAGR of 9.98% from 2025 to 2035. The Japan craft beer industry is strongly driven by the rising preference for premium, locally brewed beverages, diversification of beer flavors, and increasing popularity of microbreweries and taprooms across urban regions. Consumer interest in artisanal, small-batch, and regionally distinctive beer styles, supported by Japan’s expanding food tourism and a shift away from mass-produced lagers, continues to fuel market growth.

Market Overview

The Japanese craft beer market refers to the production and distribution of independently brewed, small-batch, specialty beers created by microbreweries, regional brewers, and artisanal producers. Craft beer emphasizes unique flavors, quality ingredients, and traditional brewing methods compared to mainstream commercial beer. Market trends include rapid expansion of microbreweries, rising demand for flavored and seasonal beers, increasing consumer experimentation, and premiumization across alcoholic beverages. Key characteristics of the market include a strong focus on artisanal production, rising influence of Western craft beer culture, and product innovations incorporating local Japanese ingredients. Drivers such as the growing young adult population seeking premium beverages, expansion of brewpubs, and increased preferences for high-quality low-volume beer support steady market growth. Increased alcohol tourism, especially in cities like Tokyo, Kyoto, Hokkaido, and Osaka, further strengthens the market.

Government policies supporting SME food & beverage businesses, local manufacturing grants, and initiatives encouraging regional tourism have boosted microbrewery expansion and craft alcohol production across Japan.

Report Coverage

This research report categorizes the market for the Japan craft beer market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan craft beer market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan craft beer market.

Driving Factor

The Japanese craft beer market is driven by rising consumer preference for premium and artisanal beverages, strong growth of microbreweries, and increasing demand for unique, locally inspired flavors. The influence of global craft beer trends, higher disposable incomes, and the expansion of brewpubs across major Japanese cities has also contributed to strong market momentum. Growing alcohol tourism and the popularity of seasonal and limited-edition craft offerings further accelerate market development by attracting both domestic and international consumers.

Restraining Factor

The Japanese craft beer market is restrained by higher production costs for small-batch brewing, limited distribution networks, and strong competition from established mass-production beer companies. Regulatory licensing requirements and the complexity of alcohol tax policies may also hinder the rapid establishment of new microbreweries. Additionally, craft beer is priced higher than commercial beer, which may limit accessibility for price-sensitive consumers.

Market Segmentation

The Japan craft beer market share is categorized by product type, distribution channel and packaging.

- The ale segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japanese craft beer market is segmented by type into Ale, Lager, Stout & Porter, IPA, and Others. Among these, the ale segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by Japanese microbreweries' preference for them for their shorter fermentation period, diverse flavor profiles, and suitability for experimentation with local ingredients like citrus fruits and botanicals. Consumers increasingly gravitate toward pale ales, Belgian-style ales, and amber ales due to their rich aroma, bold taste, and premium positioning.

- The on-trade segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japanese craft beer market is segmented by distribution channel into on-trade and off-trade. Among these, the on-trade segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by revenue for beverages like beer, wine, and spirits because of post-pandemic recovery, rising disposable incomes, urbanization, and a strong consumer shift towards experiential dining, premiumization, and social experiences, especially in fast-growing markets.

- The bottles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japanese craft beer market is segmented by packaging into bottles, cans, and others. Among these, the bottles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by premium, aesthetically appealing, and well-suited for specialty beer shops, gift markets, and restaurants. Additionally, Japan’s culture of packaging aesthetics and gift-giving traditions supports the strong growth of bottled craft beers.

Competitive Analysis

The report offers a comprehensive analysis of the key organizations and companies participating in the Japan craft beer market, including comparisons based on product offerings, business overviews, geographic presence, strategies, segment market share, and SWOT analysis. The competitive landscape includes new product developments, limited-edition craft releases, brewery expansions, tasting room openings, collaborations, mergers, acquisitions, and strategic partnerships across the craft brewing ecosystem. This facilitates a thorough evaluation of the competitive environment in the market.

List of Key Companies

- Yo-Ho Brewing Company

- Craft Beer Market Co. Ltd.

- COEDO Brewery

- Echigo Beer Co. LTD

- Minoh Beer

- Kyoto Brewing Co.

- Hitachino Nest Beer (Kiuchi Brewery)

- Sapporo Craft Division

- Far Yeast Brewing Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In February 2025, COEDO Brewery announced the expansion of its taproom and introduced a new series of seasonal craft beers using Japanese hops grown in Saitama Prefecture.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Craft Beer Market based on the segments below:

Japan Craft Beer Market, By Type

- Ale

- Lager

- Stout & Porter

- IPA

- Others

Japan Craft Beer Market, By Distribution Channel

- On-Trade

- Off-Trade

Japan Craft Beer Market, By Packaging

- Bottles

- Cans

- Others

Frequently Asked Questions (FAQs)

Q: What is the Japan Craft Beer Market size?

A: The Japan Craft Beer Market is expected to grow from USD 3145.4 million in 2024 to USD 8956.8 million by 2035, at a CAGR of 9.98% during 2025 to 2035.

Q: What factors restrain the Japan Craft Beer Market?

A: High production costs, distribution challenges, competition from mass producers, and regulatory complexities.

Q: How is the market segmented by type?

A: The market is segmented into Ale, Lager, Stout & Porter, IPA, and Others.

Q: Who are the key players in the Japan Craft Beer Market?

A: Major players include Yo-Ho Brewing, COEDO, Hitachino Nest, Kyoto Brewing, and others.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 183 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |