Japan Cyber Insurance Market

Japan Cyber Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage Type (Network Security Liability, Data Breach Response, Business Interruption, Privacy Liability), By Deployment Mode (Cloud-Based, On-Premises), By Application (Financial Services, Healthcare, Retail, Manufacturing), and Japan Cyber Insurance Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Cyber Insurance Market Insights Forecasts to 2035

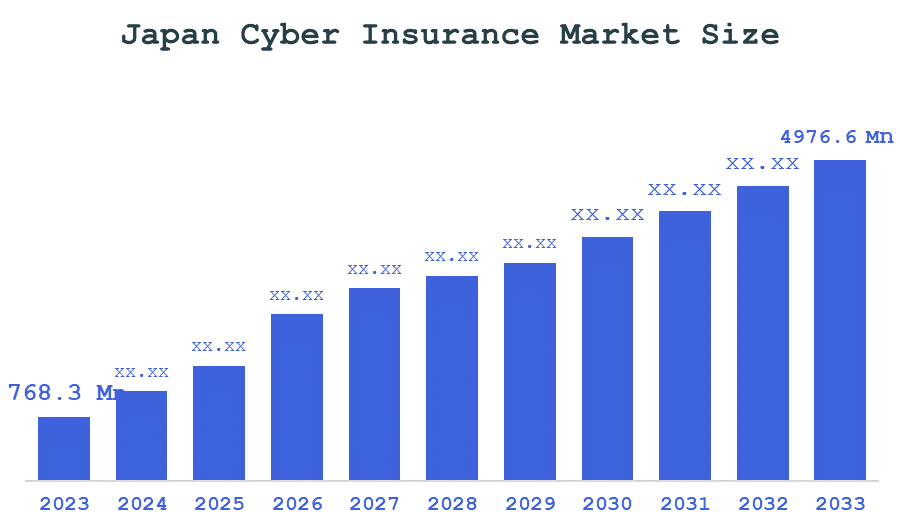

- The Japan Cyber Insurance Market Size Was Estimated at USD 768.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 18.51% from 2025 to 2035

- The Japan Cyber Insurance Market Size is Expected to Reach USD 4,976.6 Million by 2035

According to a Research Report Published by Decision Advisior & Consulting, the Japan Cyber Insurance Market size is projected to reach USD 4,976.6 million by 2035, growing at a CAGR of 18.51% from 2025 to 2035. The market is driven by the rising frequency and sophistication of cyberattacks, growing digital transformation across industries, and increasing regulatory requirements for data protection and cybersecurity compliance.

Market Overview

The Japan cyber insurance market is a sector that develops, sells, and utilises insurance products specifically designed for the protection of businesses, organisations, and individuals from financial loss due to cyber threats, including a cyber attack, data breach, ransomware incidents, and failure of network security systems. Cyber insurance provides coverage for entities, businesses, individuals, and organizations experiencing losses or liability due to cyber incidents such as data breaches, cyberattacks, and disruption of service through the Internet. The landscape of the Japanese cyber insurance market is impacted by an increase in digitization, the growing number of people using cloud services, and the increasing reliance on interconnected networks. The increasing use of cloud based deployment, increased scope of coverage for privacy liabilities, and the increasing integration of cyber liability with enterprise risk management strategies are some of the most important trends in the cyber liability insurance market. Major drivers of this market's growth include the increase in ransomware attacks, rigorous Government regulations regarding data protection, and enterprises becoming more knowledgeable of the cybersecurity risks associated with their operations.

As part of their efforts to increase the use of cyber insurance in Japan, the Ministry of Economy, Trade and Industry (METI) and the Financial Services Agency (FSA) support the development of frameworks for establishing cybersecurity standards, managing corporate risk, and reporting incidents.

Report Coverage

This research report categorizes the market for the Japan cyber insurance market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan cyber insurance market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan cyber insurance market.

Driving Factors

The Japanese cyber insurance market is driven by the rise of cyber attacks against banks, healthcare organizations, and retailers, the financial and reputational losses associated with these attacks have increased. The rapid growth in the use of cloud-based systems and connected devices increases the likelihood that these vulnerabilities will be exploited by cybercriminals. As a result, many organizations are securing cyber insurance policies to protect themselves against these potential vulnerabilities. Additionally, increased awareness of deterrents such as ransomware, phishing, and loss of business continuity has led to many organizations seeking comprehensive cyber insurance to protect their assets and ensure the continued operation of their businesses.

Restraining Factors

The Japanese cyber insurance market is restrained by high premiums, complex policy terms, and dwarfed awareness by SMEs regarding what coverage will do for their respective businesses has limited the adoption of cyber insurance. Likewise, the inability to effectively quantify cyber risk, as well as the inability to quantify exposure, has further contributed to the slow adoption of cyber insurance.

Market Segmentation

The Japan cyber insurance market is segmented by coverage type, deployment mode, and application.

- The network security liability segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cyber insurance market is segmented by coverage type into network security liability, data breach response, business interruption, and privacy liability. Among these, the network security liability segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment is driven by the number and complexity of cybersecurity attacks against corporate networks have increased, and there is a growing demand for corporate compliance with regulatory requirements. Japanese corporations are becoming more aware of the economic consequences and reputation risks associated with a corporate network breach. Consequently, corporations are placing greater emphasis on their coverage of potential financial losses due to hacking, malicious software, and system failure.

- The cloud-based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cyber insurance market is segmented by deployment mode into cloud-based and on-premises. Among these, the cloud-based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment is driven by increasing choice to utilize a cloud infrastructure for their IT services due to the flexibility and scalability of these applications, as well as the increasing requirement for immediate cyber Risk monitoring and management. Furthermore, because cloud deployment provides a lower upfront capital expense than on-premises systems, companies will find that they can have their cyber insurance coverage with less cost associated with managing their cyber insurance policies through a single vendor.

- The financial services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cyber insurance market is segmented by application into financial services, healthcare, retail, and manufacturing. Among these, the financial services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment is driven by the increasing digitization of banking & finance businesses, along with the rise in cyber attacks aimed at sensitive financial information, and the increased importance of regulatory compliance requirements in Japan are driving many financial institutions in Japan to adopt cyber insurance to reduce their financial exposure caused by data breaches, ransomware events, and network interruptions. Cyber insurance helps ensure the continued operation of a financial institution and protects customer trust.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the Japan cyber insurance market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sompo Japan Insurance Inc.

- Tokio Marine & Nichido Fire Insurance Co., Ltd.

- Mitsui Sumitomo Insurance Co., Ltd.

- AIG Japan Holdings KK

- Zurich Insurance Company Ltd.

- Chubb Insurance Japan

- Allianz Global Corporate & Specialty Japan

- Tokio Marine HCC

- Tokio Marine Kiln

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, Sompo Japan Insurance expanded its cyber insurance offerings to include enhanced ransomware response coverage and real-time threat intelligence services for SMEs and large enterprises.

- In July 2024, Tokio Marine & Nichido launched a cloud-focused cyber insurance product, providing specialized coverage for data breaches and business interruptions due to cloud service failures.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Japan Cyber Insurance Market based on the following segments:

Japan Cyber Insurance Market, By Coverage Type

- Network Security Liability

- Data Breach Response

- Business Interruption

- Privacy Liability

Japan Cyber Insurance Market, By Deployment Mode

- Cloud-Based

- On-Premises

Japan Cyber Insurance Market, By Application

- Financial Services

- Healthcare

- Retail

- Manufacturing

Frequently Asked Questions (FAQ’s)

Q: What is the Japan cyber insurance market size?

A: The market is expected to grow from USD 768.3 million in 2024 to USD 4,976.6 million by 2035, at a CAGR of 18.51%.

Q: What are the key growth drivers of the market?

A: Key drivers include rising cyberattacks, adoption of cloud computing and IoT, regulatory compliance, and increasing awareness of cyber risks.

Q: What factors restrain the Japan cyber insurance market?

A: High premiums, complex policy terms, and challenges in quantifying cyber risk restrain market growth.

Q: How is the market segmented?

A: The market is segmented by coverage type, deployment mode, and application.

Q: Who are the key players in the Japan cyber insurance market?

A: Major players include Sompo Japan Insurance, Tokio Marine & Nichido, Mitsui Sumitomo Insurance, AIG Japan Holdings, and Chubb Insurance Japan.

Q: What government initiatives support the market?

A: METI and FSA initiatives promote cybersecurity standards, incident reporting, and corporate risk management, encouraging cyber insurance adoption.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 170 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |