Japan Dairy Alternatives Market

Japan Dairy Alternatives Market Size, Share, and COVID-19 Impact Analysis, By Source (Soy, Almond, Coconut, Rice, Oats, and Others), By Product (Milk, Yogurt, Cheese, Ice cream, Creamer, and Others), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online retail, and Others), and Japan Dairy Alternatives Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Dairy Alternatives Market Insights Forecasts to 2035

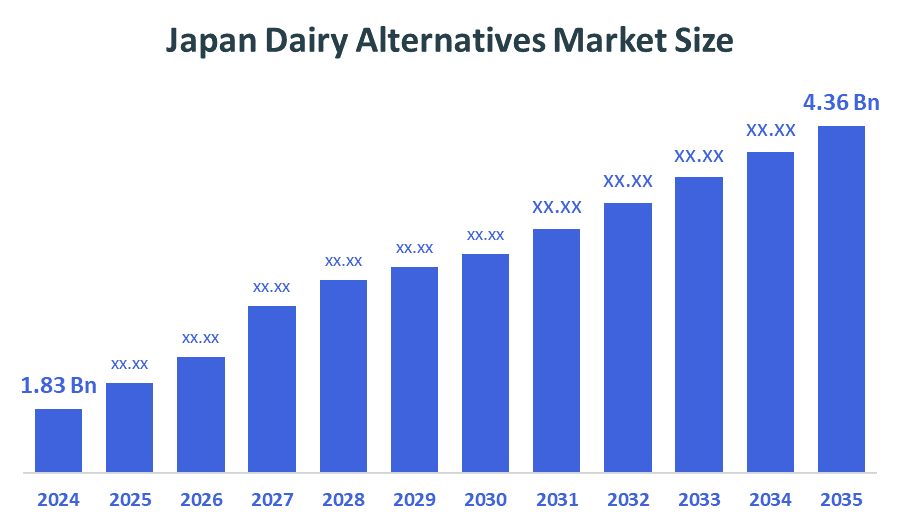

- The Japan Dairy Alternatives Market Size Was Estimated at USD 1.83 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.21% from 2025 to 2035

- The Japan Dairy Alternatives Market Size is Expected to Reach USD 4.36 Billion by 2035

According to a research report published by Spherical Insights & Consulting, The Japan Dairy Alternatives Market Size is anticipated to reach USD 4.36 Billion by 2035, growing at a CAGR of 8.21% from 2025 to 2035. The dairy alternatives market in Japan is receiving support from the accessibility of non-dairy alternatives through organized offline and online channels, as well as a growing consciousness among individuals about their health and wellness. The market is also being supported by an increase in the consciousness of the environment, the high prevalence of lactose intolerance, and growing health concerns.

Market Overview

The Japan Dairy Alternatives Market corresponds to the area of the food and beverage sector involved with producing and selling plant-based alternatives to traditional dairy products like milk, cheese, yogurt, butter, and ice cream. These dairy alternatives are typically made using soy, almonds, oats, rice, coconut, and other plant-derived sources. The Japan dairy alternatives market is experiencing consistent growth, in part owing to an increase in health consciousness, a growing population of vegans, and a greater awareness of lactose intolerance among Japanese consumers. The market is driven by improvements in technology and new products that have enhanced the taste and nutritional quality of dairy alternatives based on plants. In 2024, Yakult Honsha Co., Ltd. made its entry into the plant-based market in Japan with the introduction of its new brand, The Power of Soy Milk. Firstly, the firm launched an original fermented soy milk food product, featuring lactobacilli and bifidobacteria specifically developed to minimize bitter flavor and bean-like odor while maximizing dessert-like smoothness and taste. Secondly, the line also features health claims related to lowering cholesterol, which fits with Japan’s growing trend towards functional plant-based food products. Concerns about the environment and animal welfare are also encouraging both local and international companies to increase their presence in Japan. Leading brands are focused on premium, functional, and culturally relevant dairy-free products to respond to changing consumer preferences.

Report Coverage

This research report categorizes the market for the Japan dairy alternatives market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan dairy alternatives market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan dairy alternatives market.

Driving Factors

The dairy alternatives market in Japan is driven by rising health awareness and the prevalence of lactose intolerance, with both leading consumers to a plant-based product. The growing prevalence of vegetarian and flexitarian diets has stimulated demand for products made from soy, almond, and oat by providing more variety. Increasing product innovation focused on improving taste, texture, nutritional value, and reducing beany flavors are effective strategies that many manufacturers and marketers are focused on. Market growth is further enhanced by supportive government policies directing consumers toward sustainable food systems, which has led to more grocery retail access.

Restraining Factors

The dairy alternatives market in Japan is mostly constrained by traditional dietary preferences, and strong cultural attachment to dairy-based products limits widespread adoption of plant-based alternatives. High production and ingredient costs, particularly for imported nuts and grains, make dairy alternatives more expensive than conventional dairy. Limited awareness in rural areas and among older consumers also slows market growth.

Market Segmentation

The Japan dairy alternatives market share is classified into source, product, and distribution channel.

- The soy segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dairy alternatives market is segmented by source into soy, almond, coconut, rice, oats, and others. Among these, the soy segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Soy milk-based products are offered in a range of flavors and formats. They are the go-to option for shoppers looking for dairy-free products, as they are a staple in supermarkets and convenience stores in Japan.

- The milk segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dairy alternatives market is segmented by product into milk, yogurt, cheese, ice cream, creamer, and others. Among these, the milk segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The milk category dominates the Japanese marketplace due to its versatility, convenience, and compatibility with modern health and lifestyle trends. Consumers appreciate their convenience as a portable beverage, their taste blend of flavors, and ease of consumption in a typical daily routine.

- The supermarkets & hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dairy alternatives market is segmented by distribution channel into supermarkets & hypermarkets, convenience stores, online retail, and others. Among these, the supermarkets & hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Supermarkets respond to health-conscious shoppers by providing soy, almond, oat, and rice-based substitutes with clear labeling, regular promotions, and more shelf space. Supermarkets and hypermarkets continue to propel the widespread use of dairy substitutes in Japan across a range of age groups and lifestyles as the demand for plant-based goods rises.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan dairy alternatives market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kikkoman Corporation

- Yakult Honsha

- Tsukuba Dairy Products Co. Ltd.

- MARUSAN-AI CO. LTD

- Ezaki Glico Co. Ltd

- Marinfood Co. Ltd

- Otsuka Holdings Co. Ltd

- Sapporo Holdings Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In February 2025, Kikkoman Corporation launched the Kikkoman Soymilk Global Site, a dedicated website for promoting its soymilk brand outside Japan, supporting its overseas expansion strategy.

- In 2024, Morinaga Milk Industry Co., Ltd. introduced a new plant-based beverage line called Plants&Me, offered in original and sugar-free variants. The drinks blend oats, coconut, chickpeas, soybeans, and almonds, are vegan-certified by NPO Veggie Project Japan, and fortified with Soy E, fiber, calcium, and folic acid.

- In August 2021, Pokka Sapporo, a subsidiary of Sapporo Holdings Ltd, launched its new line of soy, coconut, and almond-based yogurts in Japan under the brand name Soibio. The launch contributed to the company's evolving range of plant-based products, and the company further provided consumers with various size options to address consumer preferences.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan dairy alternatives market based on the below-mentioned segments:

Japan Dairy Alternatives Market, By Source

- Soy

- Almond

- Coconut

- Rice

- Oats

- Others

Japan Dairy Alternatives Market, By Product

- Milk

- Yogurt

- Cheese

- Ice cream

- Creamer

- Others

Japan Dairy Alternatives Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online retail

- Others

FAQ’s

Q: What is the Japan dairy alternatives market size?

A: Japan Dairy Alternatives market size is expected to grow from USD 1.83 billion in 2024 to USD 4.36 billion by 2035, growing at a CAGR of 8.21% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the rising health awareness and the prevalence of lactose intolerance, with both leading consumers to a plant-based product.

Q: What factors restrain the Japan dairy alternatives market?

A: Constraints include traditional dietary preferences, and a strong cultural attachment to dairy-based products limits widespread adoption of plant-based alternatives.

Q: How is the market segmented by source type?

A: The market is segmented into soy, almond, coconut, rice, oats, and others.

Q: Who are the key players in the Japan dairy alternatives market?

A: Key companies include Kikkoman Corporation, Yakult Honsha, Tsukuba Dairy Products Co. Ltd., MARUSAN-AI CO. LTD, Ezaki Glico Co. Ltd, Marinfood Co. Ltd, Otsuka Holdings Co. Ltd, and Sapporo Holdings Ltd., and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 216 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |