Japan Dental Implants Market

Japan Dental Implants Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Endosteal Implants, Subperiosteal Implants, Transosteal Implants, Intramucosal Implants), By Material (Titanium Dental Implants, Zirconium Dental Implants), By End Use (Hospitals, Dental Clinics, Academic and Research Institutes, and Others), and Japan Dental Implants Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Dental Implants Market Insights Forecasts to 2035

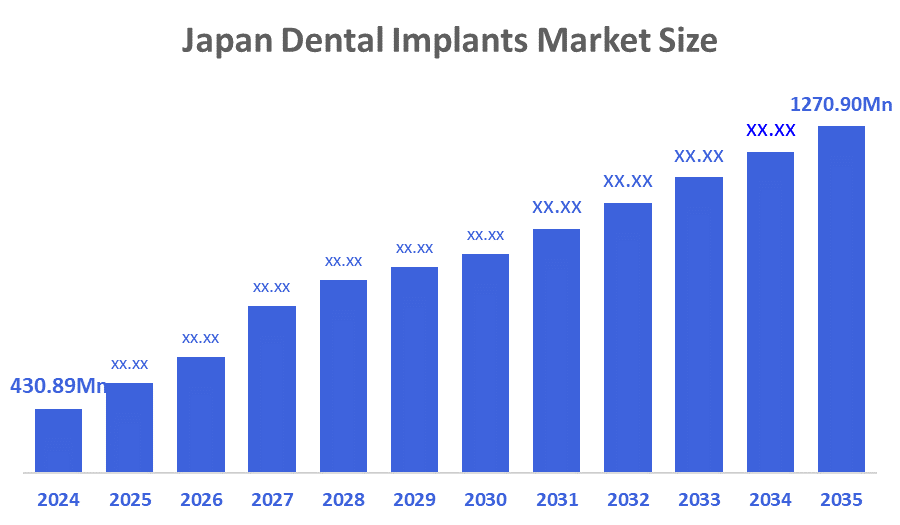

- The Japan Dental Implants Market Size Was Estimated at USD 430.89 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 10.33% from 2025 to 2035

- The Japan Dental Implants Market Size is Expected to Reach 1270.90 Million by 2035

According to a Research Report Published By Decisions Advisors & Consulting, The Japan Dental Implants Market Size is Anticipated To Reach USD 1270.90 Million By 2035, Growing At a CAGR Of 10.33% From 2025 to 2035. The Japan dental implants market is driven by rising demand for aesthetic dentistry, increasing elderly population with tooth loss, technological advancements in implant materials, growing dental tourism, higher disposable incomes, and expanding access to advanced dental care.

Market Overview

The Japan dental implants market refers to the sale of surgically implanted artificial tooth roots that provide a stable base for replacement teeth like crowns, bridges, or dentures. This market includes the sales and procedures related to these implants, which are made from materials like titanium or zirconia and are designed to integrate with the jawbone. The market is driven by technological advancements, an aging population, and a cultural emphasis on aesthetics and quality, with key players including straumann group, dentsply sirona, and zimmer biomet limited.

The introduction of innovative implant designs, materials, and techniques has improved the success rate and overall patient experience. Advanced technologies such as computer-aided design/computer-aided manufacturing (CAD/CAM) systems have enhanced the precision and efficiency of dental implant procedures, leading to better treatment outcomes.

In terms of recent developments, Japan has witnessed a rise in the adoption of digital dentistry, including digital scanning and 3D printing technologies, which have helped the dental implant process. These technologies allow more accurate implant placement and customized prosthetics, resulting in improved patient comfort and aesthetics. Furthermore, Japan has seen an increase in the use of guided implant surgery, which utilizes computer-guided systems to enhance the accuracy and predictability of implant placement.

Report Coverage

This research report categorizes the market for the Japan dental implants market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan dental implants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan dental implants market.

Driving Factors

The dental implants markets in Japan are driven by rise as patients place a greater emphasis on achieving natural-looking and aesthetically pleasing smiles. Aesthetic dental implants offer an ideal solution for those seeking tooth replacement that seamlessly integrates with their natural dentition. Japanese patients, known for their attention to detail and appreciation for beauty, are increasingly opting for dental implants that not only restore function but also enhance their overall facial aesthetics. With advancements in implant design and materials, dental professionals can now offer implants that closely mimic the color, shape, and texture of natural teeth.

Additionally, techniques such as digital smile design and guided implant placement enable precise customization, resulting in optimal aesthetics. As a result, the demand for aesthetic dental implants is expected to continue growing in Japan, driven by the desire for both functional and visually appealing outcomes in dental restorations.

Restraining Factors

The dental implants market in Japan is restrained by high procedure costs, stringent regulatory approvals, limited insurance coverage, lack of awareness among patients, potential surgical complications, and competition from alternative tooth replacement solutions.

Market Segmentation

The Japan dental implants market share is categorized by product type, material and end use.

- The endosteal implants segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dental implants market is segmented by product type into endosteal implants, subperiosteal implants, transosteal implants, intramucosal implants. Among these, the endosteal implants segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by high success rates, wide clinical acceptance, versatility in treating various dental conditions, compatibility with advanced prosthetics, growing dental awareness, and increasing demand for permanent solutions.

- The titanium dental implants segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan dental implants market is segmented by material into titanium dental implants, zirconium dental implants. Among these, the titanium dental implants segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to excellent biocompatibility, high strength, long-term durability, proven clinical success, corrosion resistance, cost-effectiveness, widespread dentist preference, and increasing adoption in restorative dental procedures.

- The dental clinics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan dental implants market is segmented by end use into hospitals, dental clinics, academic and research institutes, and others. Among these, the dental clinics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by increasing number of private dental practices, rising patient preference for specialized care, convenient accessibility, growing awareness of oral health, and adoption of advanced implant technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan dental implants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DENTSPLY Sirona K.K.

- Straumann Japan KK.

- Nobel Biocare Japan K.K.

- Zimmer Biomet G.K.

- OSSTEM JAPAN Co., ltd

- KYOCERA Document Solutions Inc.

- Neo Biotech Co., Ltd.

- Nippon Piston Ring Co., Ltd.

- DIO IMPLANT CO., LTD.

- GC Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2021, Kyocera Corporation has announced a strategic partnership with Osteon Digital Japan Co., Ltd. to foster ongoing advancements in dental implant technology. The partnership aims to expand its capabilities in the dental implant sector and enhance the quality of patient care.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Dental Implants Market based on the below-mentioned segments:

Japan Dental Implants Market, By Product Type

- Endosteal Implants

- Subperiosteal Implants

- Transosteal Implants

- Intramucosal Implants

Japan Dental Implants Market, By Material

- Titanium Dental Implants

- Zirconium Dental Implants

Japan Dental Implants Market, By End Use

- Hospitals

- Dental Clinics

- Academic and Research Institutes

- Others

FAQ’s

Q: What is the size of the Japan dental implants market in 2024?

A: The market size was estimated at USD 430.89 million in 2024.

Q: What is the expected CAGR of the Japan dental implants market?

A: The market is expected to grow at a CAGR of 10.33% from 2025 to 2035.

Q: Which product type dominates the Japan dental implants market?

A: Endosteal implants accounted for the largest revenue market share in 2024.

Q: Which material is most commonly used in dental implants in Japan?

A: Titanium dental implants dominate due to high biocompatibility, strength, and clinical success.

Q: Which end use segment leads the Japan dental implants market?

A: Dental clinics held the largest revenue market share in 2024.

Q: What are the key drivers of the dental implants market in Japan?

A: Drivers include rising demand for aesthetic dentistry, aging population with tooth loss, technological advancements, dental tourism, and higher disposable incomes.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |