Japan Digital Camera Market

Japan Digital Camera Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Single Reflex, Non-Reflex), By Lens Type (Fixed Lens, Interchangeable Lens), By Sensing Technology (Charge-Coupled Device (CCD) and Complementary Metal-Oxide-Semiconductor (CMOS)), and By Application (Personal, Professional), and Japan Digital Camera Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Digital Camera Market Size Insights Forecasts to 2035

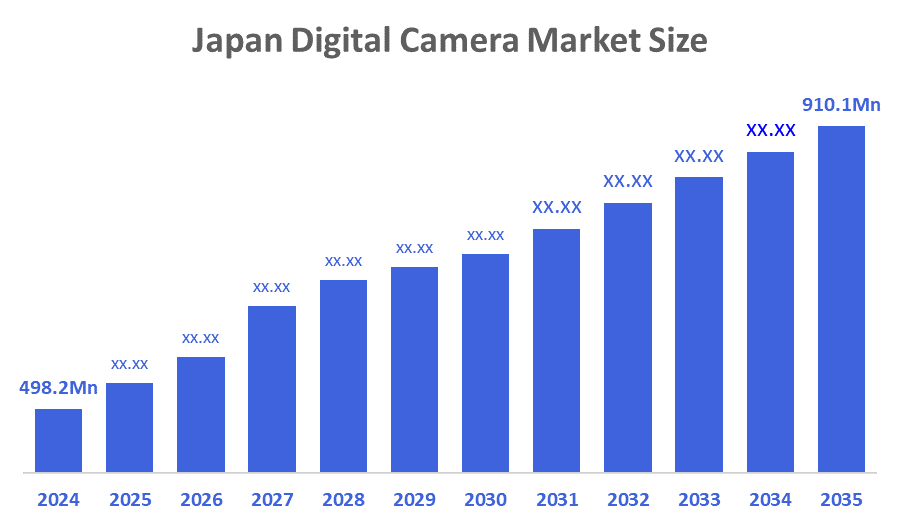

- The Japan Digital Camera Market Size Was Estimated at USD 498.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.63% from 2025 to 2035

- The Japan Digital Camera Market Size is Expected to Reach USD 910.1 Million by 2035

According To a Research Report Published By Decisions Advisors & Consulting, The Japan Digital Camera Market Size Is Anticipated To Reach USD 910.1 Million by 2035, Growing At a CAGR of 5.63% from 2025 to 2035. Japan Digital Camera Market Size is driven by the renewed interest in compact cameras for social media content creation, the continuous advancements in mirrorless technology, and the post-COVID tourism rebound, sales have increased for both compact and high-end camera models.

Market Overview

Japanese digital camera markets are transitioning from an expansive mass-market model to a more specialized one based on consumer preference for value at the expense of features found in compact-style cameras, to greater importance placed on interchangeable lens functionality, i.e., DSLR-style cameras, or mirrorless. A digital camera is a device that takes photos and saves them as digital files on a memory card instead of using film. It uses an electronic sensor, such as a CCD or CMOS, to turn light into signals, which are then processed into a digital picture. Key trends in the market encompass the sustained leadership of mirrorless cameras, growing demand for advanced video capabilities and connectivity features to support content creation, and a robust segment for pre-owned and specialized equipment. Japan's digital camera market is rapidly expanding, motivated by the thriving content creation sector, ongoing technological innovations, and a strong cultural interest in photography as a pastime.

The Camera & Imaging Products Association (CIPA) is a Japan-based organization that publishes widely used industry statistics, formulates standards, and coordinates with government organs on trade and tariff issues.

Report Coverage

This research report categorizes the market for the Japan digital camera market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan digital camera market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan digital camera market.

Driving Factor

The Japanese digital camera market is driven by professional and passionate participants in the photography community, as well as product innovation and customer loyalty are key drivers of the camera market. Leading product drivers include an increased demand for superior image quality compared to smartphones, especially when taking video or photographs in low-light, and an increase in popularity of advanced-featured mirrorless cameras. The expanding number of people creating and sharing digital content, and the rise in disposable income, also positively influence the growth of this market.

Restraining Factor

The Japanese digital camera market is restrained by the ongoing development of new technologies that separate and differentiate camera products from mobile phones, which require continuous investment in research and development. Camera manufacturers must pass the costs onto consumers, leading to higher price points and a possible oversaturation of the marketplace.

Market Segmentation

The Japan Digital Camera Market is segmented by product type, lens type, sensing technology, and application.

- The non-reflex segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japanese digital camera market is segmented by product type into single reflex and non-reflex. Among these, the non-reflex segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by a combination of technological advantages, such as compact size, lighter weight, faster performance, and advanced features, along with a strategic industry shift in which major manufacturers are focusing their innovation and production primarily on mirrorless systems.

- The interchangeable lens segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japanese digital camera market is segmented by lens type into fixed lens and interchangeable lens. Among these, the interchangeable lens segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by a robust local manufacturing ecosystem led by prominent brands such as Canon, Nikon, and Sony, early access to flagship optics, and a culture that prioritizes quality, reliability, and customization favoured by professionals and enthusiasts, the market remains strong.

- The complementary metal-oxide-semiconductor (CMOS) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan Digital Camera Market is segmented by sensing technology into charge-coupled device (CCD) and complementary metal-oxide-semiconductor (CMOS). Among these, the complementary metal-oxide-semiconductor (CMOS) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the sensor of choice due to its lower power requirements, high-speed processing, and ability to enable modern camera features. Enhanced performance was achieved through the combination of lower manufacturing costs are lower, and A new product line would be able to offer highly sophisticated digital features, which would be aligned with the demands of consumers today.

- The personal segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japanese digital camera market is segmented by application into personal and professional. Among these, the personal segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by a combination of cultural factors, technological advancements, and the rising global trend of content creation. Consumers in these demographics are identifying their needs for better image quality and more control over creativity than current smartphone technologies provide them.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan digital camera market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Canon

- Sony

- Nikon

- Fujifilm

- Panasonic

- Ricoh

- OM Digital Solutions

- Sigma

- Casio

- Seiko Epson

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Sony reaffirmed its leadership in Japan’s mirrorless interchangeable-lens camera market, holding a commanding 49.7% sales share according to BCN rankings, which track data from major retailers. Maintaining this strong position throughout 2024, Sony significantly outperformed its nearest competitor, Canon, which captured 20.2% of the market.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Digital Camera Market based on the below-mentioned segments:

Japan Digital Camera Market, By Product Type

- Single Reflex

- Non-Reflex

Japan Digital Camera Market, By Lens Type

- Fixed Lens

- Interchangeable Lens

Japan Digital Camera Market, By Sensing Technology

- Charge-Coupled Device (CCD)

- Complementary Metal-Oxide-Semiconductor (CMOS)

Japan Digital Camera Market, By Application

- Personal

- Professional

Frequently Asked Questions (FAQ’s)

Q: What is the Japanese digital camera market size?

A: Japan Digital Camera Market size is expected to grow from USD 498.2 million in 2024 to USD 910.1 million by 2035, growing at a CAGR of 5.63% during the forecast period 2025-2035.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Q: Who are the key players in the Japanese digital camera market size?

A: Key companies include Canon, Sony, Nikon, Fujifilm, Panasonic, Ricoh, OM Digital Solutions, Sigma, Casio, Seiko Epson, and others.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |