Japan Digital Health Market

Japan Digital Health Market Size, Share, and COVID-19 Impact Analysis, By Technology (Tele-healthcare, Healthcare Analytics, mHealth, Digital Health Systems, and Healthcare Analytics), By Application (Obesity, Diabetes, Cardiovascular, Respiratory Diseases, and Others), End-Use (Patients, Providers, Payers, and Others), and Japan Digital Health Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Digital Health Market Insights Forecasts to 2035

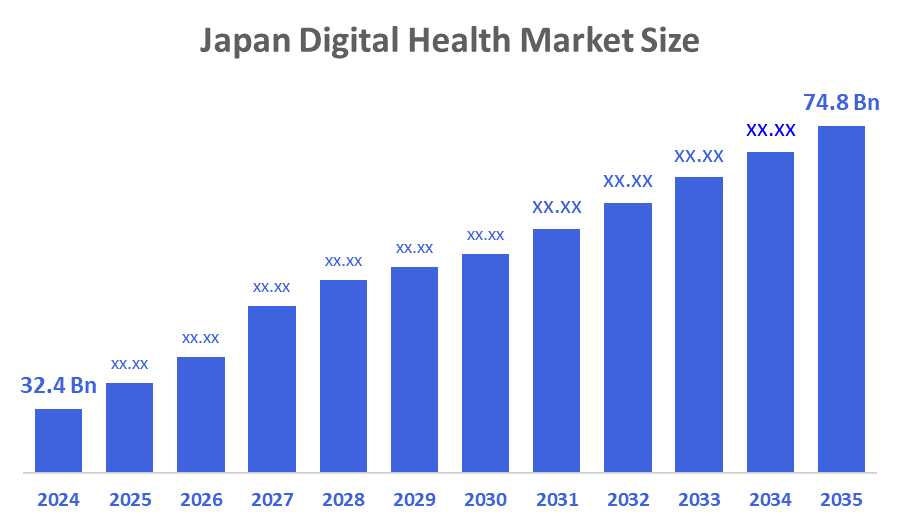

- The Japan Digital Health Market Size Was Estimated at USD 32.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.9% from 2025 to 2035

- The Japan Digital Health Market Size is Expected to Reach USD 74.8 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Japan Digital Health Market Size is anticipated to Reach USD 74.8 Billion by 2035, Growing at a CAGR of 7.9% from 2025 to 2035. The digital health market in Japan is driven by the growing use of eHealth platforms and an increase in regional healthcare spending. Additionally, the growing use of EMRs and EHRs is thought to be a major driver of digital health growth.

Market Overview

The term digital health describes the application of digital technologies to enhance patient outcomes, health care delivery, and overall system efficiency. These technologies include software, mobile applications, linked devices, data analytics, artificial intelligence (AI), cloud computing, and telecommunications equipment. It combines data, technology, and health to provide more intelligent, personalized, and easily available treatments. Digital health has transformed traditional health care, becoming proactive, continuous, and data-driven rather than reactive and episodic. Through digital tools such as wearable technology, patient portals, remote monitoring systems, and mobile health apps, it gives patients are given the ability to actively manage their health. Clinicians can use real-time health data generated by these devices to identify early risks, make better decisions, and optimize treatment regimens. Digital health also includes telehealth and telemedicine, which allow digital care coordination, virtual consultations, and remote diagnosis. These technologies increase access to care, especially in disadvantaged or rural locations. Cloud-based health care systems and electronic health records (EHRs), which ensure that patient data is shared securely between providers, improve continuity of treatment.

Report Coverage

This research report categorizes the market for the Japan digital health market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Digital Health market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan Digital Health market.

Driving Factors

The digital health market in Japan is driven by the growing prevalence of chronic illnesses, the growing need for continuous and remote treatment, and smartphones. Smart diagnosis and individualized care are made possible by developments in AI, cloud computing, and data analytics. Digital health adoption among providers and patients is further accelerated by government measures that support digital transformation, pressure to reduce costs, and increased accessibility to healthcare.

Restraining Factors

The digital health market in Japan is mostly constrained by challenges with platform compatibility, inadequate cybersecurity infrastructure, and data privacy. Adoption is also slowed by limited digital literacy, expensive implementation costs, and complicated regulations. The smooth integration of digital health technologies is further hampered by provider resistance to workflow modifications.

Market Segmentation

The Japan digital health market share is classified into technology, application, and end-use.

- The telehealthcare segment dominated the market in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The Japan digital health market is segmented by technology into tele-healthcare, healthcare analytics, Mhealth, digital health systems, and healthcare analytics. Among these, the telehealthcare segment dominated the market in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This is due to its growing smartphone use, increased internet connectivity, improved technology preparedness, a growing scarcity of healthcare professionals, rising medical costs, the accessibility of telehealth apps, and the increasing use of these technologies by doctors and patients.

- The diabetes segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan digital health market is segmented by application into obesity, diabetes, cardiovascular, respiratory diseases, and others. Among these, the diabetes segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is due to patients can actively manage their diabetes due to digital health solutions, which range from wearable technology that tracks physical activity and provides real-time health data to smartphone apps for glucose monitoring.

- The patient segment held the largest market share in 2024 and is expected to grow at a fastest CAGR during the forecast period.

The Japan digital health market is segmented by end-use into patients, providers, payers, and others. Among these, the patient segment held the largest market share in 2024 and is expected to grow at a fastest CAGR during the forecast period. This dominance is due to its trend toward patient-centered care and increased understanding of personal health management. By giving patients access to health information, self-management tools, and remote monitoring, digital health technologies have completely changed the healthcare industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan digital health market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CureApp, Inc.

- HACARUS Inc.

- Welby, Inc.

- JiMED Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisioins Advisors has segmented the Japan Digital Health market based on the below-mentioned segments:

Japan Digital Health Market, By Technology

- Tele-healthcare

- Healthcare Analytics

- mHealth

- Digital Health Systems

- Healthcare Analytics

Japan Digital Health Market, By Application

- Obesity

- Diabetes

- Cardiovascular

- Respiratory Diseases

- Others

Japan Digital Health Market, By End-Use

- Patients

- Providers

- Payers

- Others

FAQ’s

Q: What is the current size of the Japan digital health market?

A: The market size is estimated at USD 32.4 billion in 2024, with strong growth driven by rising digital adoption across healthcare services.

Q: What is the expected market size of Japan’s digital health industry by 2035?

A: The Japan digital health market is projected to reach USD 74.8 billion by 2035, growing at a CAGR of 7.9% during 2025–2035.

Q: What factors are driving the growth of digital health in Japan?

A: Key drivers include increasing chronic diseases, rising demand for remote care, adoption of smartphones, advancements in AI and cloud computing, and a strong government push for digital healthcare transformation.

Q: What are the major restraints affecting market growth?

A: Data privacy issues, cybersecurity vulnerabilities, interoperability challenges, high implementation costs, and limited digital literacy restrict market expansion.

Q: Which technology segment dominated the market in 2024?

A: Tele-healthcare dominated in 2024 due to increased smartphone use, improved connectivity, shortage of healthcare professionals, and widespread adoption of telehealth apps.

Q: Which end-use segment leads the Japan digital health market?

A: The patient segment held the largest market share in 2024, supported by rising patient-centric care models and growing use of self-management and remote monitoring tools.

Q: What technologies are commonly used in digital health solutions in Japan?

A: Key technologies include telemedicine platforms, mHealth apps, AI-driven analytics, cloud-based EHR systems, wearable devices, and digital therapeutics.

Q: Who are the major players in the Japan digital health market?

A: Leading companies include CureApp, HACARUS, Welby, JiMED, along with several emerging digital health start-ups.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |