Japan Digital Twin Market

Japan Digital Twin Market Size, Share, and COVID-19 Impact Analysis, By Type (Product Digital Twin, Process Digital Twin, System Digital Twin), By Technology (IoT and IIoT, Blockchain, Artificial Intelligence and Machine Learning, Augmented Reality, Virtual Reality and Mixed Reality, Big Data Analytics, 5G, and Others), By End Use (Aerospace and Defense, Automotive and Transportation, Healthcare, Energy and Utilities, Oil and Gas, Agriculture, Residential and Commercial, Retail and Consumer Goods, Telecommunication, and Others), and Japan Digital Twin Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Digital Twin Market Insights Forecasts to 2035

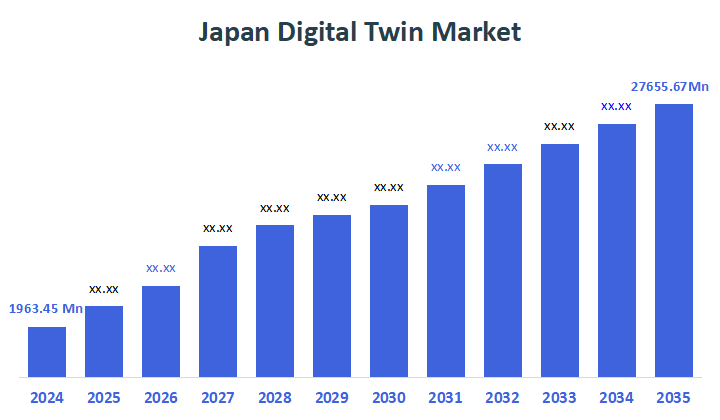

- The Japan Digital Twin Market Size Was Estimated at USD 1963.45 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 27.18% from 2025 to 2035

- The Japan Digital Twin Market Size is Expected to Reach USD 27655.67 Million by 2035

According To a Research Report Published By Decisions Advisors, The Japan Digital Twin Market Size Is Anticipated To Reach USD 27655.67 Million By 2035, Growing At a CAGR Of 27.18% From 2025 To 2035. The Japan digital twin market is driven by ncreasing adoption of IoT, advanced simulation technologies, smart manufacturing, Industry 4.0 initiatives, urban infrastructure modernization, real-time monitoring, predictive maintenance, and enhanced operational efficiency.

Market Overview

The digital twin market development and implementation of virtual replicas of physical assets, systems & processes that allow for real-time monitoring, modeling & optimizing constitutes the digital twin industry in Japan. The high-tech manufacturing sector is a key driver of Japan's economy through its use of smart manufacturing techniques for increased productivity, improved uptime, as well as decreased costs. In particular, predictive maintenance based on digital twin technologies is in high demand because of its potential to decrease equipment failures and increase the lifespan of equipment. In addition to Japan many government programs supporting industry 4.0 and digital transformation, the development of smart cities in Japan is also a primary reason for the accelerated growth of digital twin technology in the nation. digital twins are being used to develop urban areas and streamline the management of infrastructure and other public services and align with the Japan government goals of developing environmentally-safe solutions and Innovation.

For example, as of June 2024, Jfe steel corporation successfully implemented a new radiant tube burner, which they developed in the shortest timeframe possible through the application of digital twin technology within the virtual world, at a cold rolling mill situated in the chiba district of the east Japan works. It has demonstrated consistent and reliable operation for an extended period of time and is expected to have a service life that is approximately six times longer than that of traditional radiant tube burners. In addition, the new design of the burner helps to reduce the amount of Nitrous Oxide produced and it saves energy. Digital twin technology is also being utilized for several renewable energy ventures, including windpower and solar energy, to facilitate the enhancement and optimization of energy generation from the alternative energy sources as well as distribution of the energy through the dedicated utility systems.

Report Coverage

This research report categorizes the market for the Japan digital twin market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan digital twin market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan digital twin market.

Driving Factors

The digital twin markets in Japan are driven by improve productivity and reduce operational costs. With Industry 4.0 initiatives promoting automation and connectivity, digital twins play a critical role in predictive maintenance, process optimization, and supply chain management. They enable manufacturers to simulate and test processes virtually, reducing downtime and enhancing product quality, making them essential in maintaining Japan manufacturing leadership.

For instance, in May 2024, Hitachi Construction Machinery Co., Ltd. developed a real-time digital twin platform that reproduces construction site in a virtual world from data collected in real-time, in cooperation with aptpod, Inc. and Unicast Inc. Utilizing this platform will enable Hitachi Construction Machinery to collect various types of construction-related data and achieve progress management and the operation of autonomous construction machinery from a remote location on the Internet to realize construction sites where people and machinery work in a coordinated manner.

Restraining Factors

The digital twin market in Japan is restrained by high upfront costs and legacy-infrastructure barriers, combined with data-privacy/security concerns, lack of standardized interoperability, and shortage of skilled professionals for deployment and operation.

Market Segmentation

The Japan digital twin market share is categorized by type, technology and end use.

- The system digital twin segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan digital twin market is segmented by type into product digital twin, process digital twin, system digital twin. Among these, the system digital twin segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by increasing demand for virtual models of complex, interconnected infrastructures, enabling real-time monitoring, predictive maintenance and optimization across entire systems rather than individual products or processes.

- The iot and iiot segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan digital twin market is segmented by technology into iot and iiot, blockchain, artificial intelligence and machine learning, augmented reality, virtual reality and mixed reality, big data analytics, 5g, and others. Among these, the iot and iiot segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to Expanding sensor connectivity, real-time data collection, and industrial automation initiatives boosting digital twin adoption nationwide.

- The automotive and transportation twin segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan digital twin market is segmented by end use into aerospace and defense, automotive and transportation, healthcare, energy and utilities, oil and gas, agriculture, residential and commercial, retail and consumer goods, telecommunication, and others. Among these, the automotive and transportation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by rising smart-mobility initiatives, vehicle virtualization needs, and demand for predictive maintenance across Japan’s transportation networks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan digital twin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens AG

- Dassault Systèmes

- General Electric

- IBM Corporation

- Mitsubishi Electric

- Hitachi Ltd

- Autodesk, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2024, Japan's space agency announced it is making an open-source digital copy of its International Space Station (ISS) module, in what it is calling the world's first "Space Digital Twin." The endeavor is taking place through a collaboration with space-related digital application biz SpaceData Inc.

- In May 2024, Japanese maritime leaders announced the successful completion of the early phases of a cross-industry project aimed at creating a secure data-sharing framework between shipyards and shipowners to advance the use of digital twins throughout a ship’s lifecycle. The project, which aims to enable the use of a vessel’s unique design data to optimize efficiency and safety at sea as well as the sharing of operational data to inform new designs, brings together shipowners NYK Group company MTI Co. Ltd. (“MTI”), Mitsui O.S.K. Lines, Ltd. (MOL) and Marubeni Corporation, shipbuilders Imabari Shipbuilding, Japan Marine United Corporation, and Usuki Shipyard, software and data services provider NAPA, and classification society ClassNK.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Digital Twin Market based on the below-mentioned segments:

Japan Digital Twin Market, By Type

- Product Digital Twin

- Process Digital Twin

- System Digital Twin

Japan Digital Twin Market, By Technology

- IoT and IIoT

- Blockchain

- Artificial Intelligence and Machine Learning

- Augmented Reality

- Virtual Reality and Mixed Reality

- Big Data Analytics

- 5G

- Others

Japan Digital Twin Market, By End Use

- Aerospace and Defense

- Automotive and Transportation

- Healthcare

- Energy and Utilities

- Oil and Gas

- Agriculture

- Residential and Commercial

- Retail and Consumer Goods

- Telecommunication

- Others

FAQ’s

Q: What was the size of the Japan digital twin market in 2024?

A: The market size was USD 1963.45 million in 2024, driven by Industry 4.0 initiatives and rising digitalization.

Q: What is the expected market size by 2035?

A: The Japan digital twin market is projected to reach USD 27,655.67 million by 2035.

Q: What is the growth rate of the market during 2025–2035?

A: The market is expected to grow at a CAGR of 27.18% during the forecast period.

Q: Which segment held the largest share by type in 2024?

A: The system digital twin segment held the largest revenue share due to rising demand for complex infrastructure modeling.

Q: Which technology dominated the market in 2024?

A: The IoT and IIoT segment dominated, supported by expanding sensor connectivity and real-time data integration.

Q: What factors are driving market growth in Japan?

A: Key drivers include IoT adoption, smart manufacturing, predictive maintenance, simulation technologies, smart city development, and enhanced operational efficiency.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |