Japan Direct Selling Market

Japan Direct Selling Market Size, Share, and COVID-19 Impact Analysis, By Product (Health and Wellness, Cosmetics and Personal Care, Household Goods and Durables), By End User (Individual Customers, Commercial Customers), and Japan Direct Selling Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Direct Selling Market Insights Forecasts to 2035

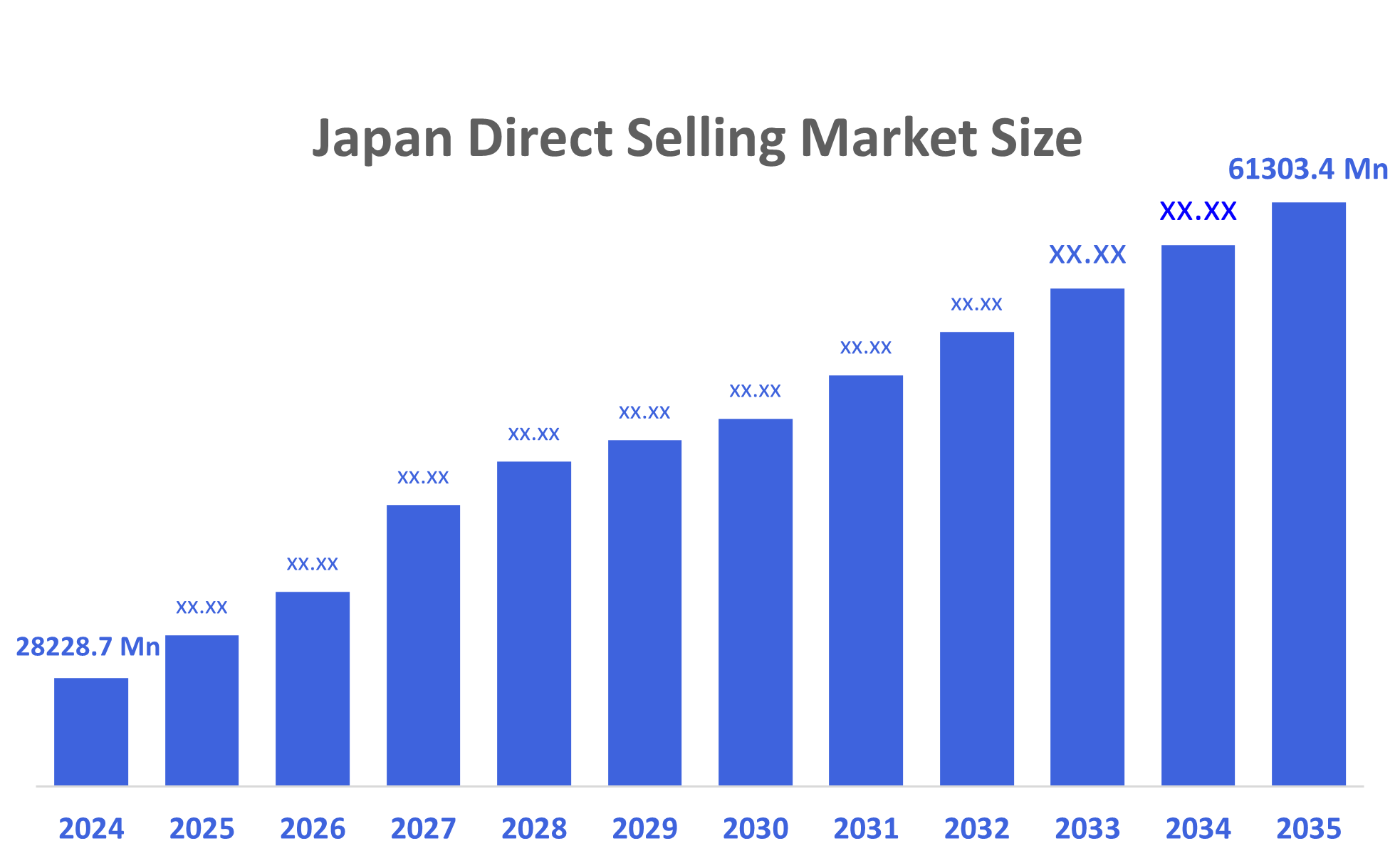

- The Japan Direct Selling Market Size Was Estimated at USD 28228.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.3% from 2025 to 2035

- The Japan Direct Selling Market Size is Expected to Reach USD 61303.4 Million by 2035

According to a research report published by Decisions Advisors, The Japan Direct Selling Market Size is Anticipated to Reach USD 61303.4 Million by 2035, Growing at a CAGR of 7.3% from 2025 to 2035. The Japan direct selling market is driven by growing customer demand to inspect and verify products before buying. Increasing customer need for product inspection and verification before purchase. The popularity of direct-to-consumer (D2C) distribution channels has increased as a result of changing customer needs and new business models fostered by the internet ecosystem.

Market Overview

The direct selling market is an industry where products and services are sold to consumers outside of a fixed retail location, such as at home, work, or online. The market is characterized by a business model that involves a network of independent distributors or consultants who sell directly to customers, often bypassing traditional middlemen like wholesalers. Customers, participants in the business, and the communities in which direct sellers and direct selling enterprises operate all gain from the direct selling sector. Customers by offering high-quality items and informed, in-person personal assistance. As a low-risk stepping stone to entrepreneurship, it also helps individuals who go on to become independent distributors or business owners. Direct selling activity in Japan is governed by individual provinces and territories, as well as by federal legislation. In particular, products such as cosmetics and dietary supplements are governed by regulations overseen by the health ministry. The direct selling market includes personal and professional growth for salespeople, with potential for flexible hours and independent contractor work, as well as opportunities for companies to reach customers through various channels like online platforms, personal demonstrations, and events.

Report Coverage

This research report categorizes the market for the Japan direct selling market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan direct selling market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan direct selling market.

Driving Factors

The direct selling markets in Japan are driven by the growing customer want to check and verify a product before buying it. Direct-to-consumer distribution channels have become more prevalent as a result of changing customer needs and new business models brought about by the internet ecosystem. A vibrant and rapidly expanding distribution method for the promotion of products and services is direct selling.

Restraining Factors

The direct selling market in Japan is restrained by fierce competition in mature markets, making it difficult to acquire new customers due to the market is already saturated. Expanding a network is more difficult when distributor turnover is high. This is a result of their lack of motivation or inadequate compensation, issues with adhering to the regulations, and the fiercely competitive environment.

Market Segmentation

The Japan direct selling market share is categorized by product and end user.

- The health and wellness segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan direct selling market is segmented by product into health and wellness, cosmetics and personal care, household goods, and durables. Among these, the health and wellness segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the numerous illnesses and problems that have been brought on by consumers' busy and sedentary lifestyles. Inappropriate eating habits reduce the intake of essential minerals and nutrients required for the body's active and healthy operation.

- The individual customers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan direct selling market is segmented by end user into individual customers, commercial customers. Among these, the individual customers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by the products for wellness, home care, and personal care are sold directly to individual consumers. Individual customers frequently choose direct selling due to its convenience, tailored suggestions, and alluring pricing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan direct selling market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amway

- Nu Skin Enterprises

- Atomy

- Herbalife Nutrition

- Koyo Sha Co. Ltd.

- Noevir Holdings Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan direct selling market based on the below-mentioned segments:

Japan Direct Selling Market, By Product

- Health and wellness

- Cosmetics and personal care

- Household goods and durables

Japan Direct Selling Market, By End User

- Individual Customers

- Commercial Customers

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |